Ohio Drives Claims Nationally

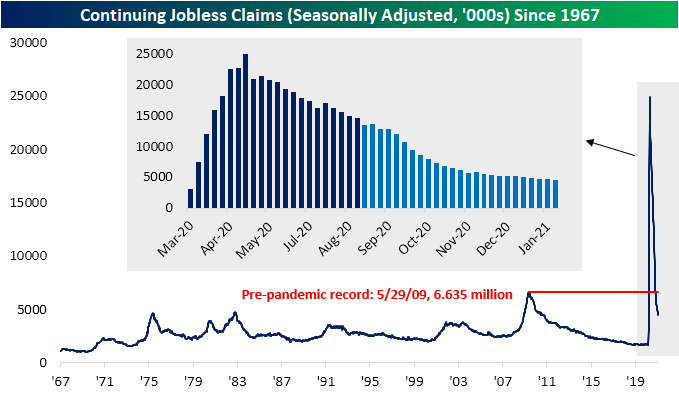

Jobless claims disappointed this week as both initial and continuing claims came in above expectations. In addition to an upward revision of 55K to 848K last week, initial jobless claims were higher at 861K this week. That brought claims to the highest level since the week of January 15th when they were 14K higher at 875K. This week also marked the third week in a row without an improvement in jobless claims.

Although the seasonally adjusted number was higher, on an unadjusted basis claims were a bit better. Only 862.4K claims were filed this week compared to 868.1K the prior week. We would note that seasonality is very much on the side of claims for the current week of the year though. In the history of the data going back to 1967, there has only been one year, 1978, that the seventh week of the year has seen the unadjusted number move higher week over week.

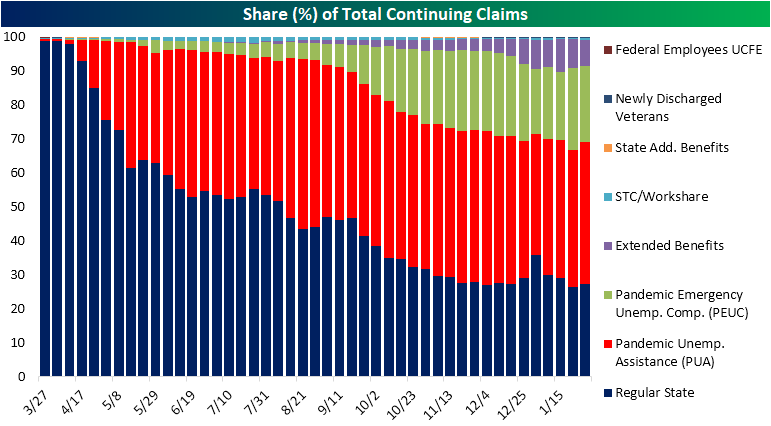

While unadjusted regular state claims were slightly better, factoring in Pandemic Unemployment Assistance (PUA) claims, the picture once again worsens. PUA claims saw a significant increase of 174.43K from last week rising to 516.3K. That is the highest level of PUA claims since the week of September 18th and the biggest one-week increase since mid-May.

On a state level, though, there are some added quirks. Ohio was the single biggest contributor to that increase in PUA claims as the state reported 232,016 claims (or 44.9% of all national claims) compared to only 10,156 in the prior week. That’s 2% of the state’s entire population The next biggest contributor to PUA claims was California with only 38,052 claims. Even for just regular state claims, Ohio has led the pack with the highest level of claims of any state second to only California. Over the past two weeks, Ohio has reported regular state claims above 140K. That compares to an average for the state of 49.7K from March through the last week of January. When looking at these numbers, we would urge some caution taking them purely at face value given news of large-scale fraudulent claims.

As for continuing claims, the same trends are still very much in place. Seasonally adjusted continuing claims which are lagged one week to initial claims fell for a fifth consecutive week and made another low for the pandemic period. At 4.494 million in the first week of February, regular state continuing claims were at the lowest levels since March 20th.

Factoring in other programs adds an additional weeks’ lag to continuing claims, and here too continuing claims improved. Total claims across all programs fell from 19.7 million for the week of January 22nd to 18.376 million in the last week of January. While sequentially better, total continuing claims have still hit a bit of a plateau for the time being. Additionally, extension programs like Extended Benefits and Pandemic Emergency Unemployment Compensation (PEUC) saw some of their most significant declines since the start of the pandemic; to a degree reversing what has been a trend of a growing prevalence of these types of claims. PEUC continuing claims fell by 718K on a week over week basis which was the second-largest drop behind the drop of over 1 million at the end of 2020 due to the expiration of benefits before being renewed shortly after. For the Extended Benefits program, the 196.9K decline was the biggest single-week decline of the pandemic.Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

B.I.G. Tips — Charts We’re Watching — 2/18/21

Bespoke’s Morning Lineup – 2/18/21 – Earnings Season Ends on a Down Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“High expectations are the key to everything.” – Sam Walton

With Walmart’s (WMT) earnings crossing the tape this morning, we have finally reached the unofficial end to earnings season. Despite high investor expectations, it was generally a positive period for the equity market, although initial stock reactions to earnings reports haven’t been particularly positive. The key to the tepid initial reactions of stocks reporting, as Sam Walton once said, is high expectations. When investors and analysts are expecting good news, it sets the bar high. The key to the market’s ability to post positive returns during earnings season was the fact that the economy has been hanging in just fine, COVID trends are moving in a more favorable direction, and the FOMC continues to prime the pump.

WMT’s reported weaker than expected headline EPS this morning, and the stock is trading down over 4% on the news. While 4% may not sound like much for the typical stock reporting earnings, for WMT, it represents a pretty significant move. Historically, the stock has only moved up or down 2.6% on the day it reports earnings, and going back to 2001 there have only been two other times where the stock saw a larger downside gap – 2/20/18 (-7.4%) and 8/17/07 (-4.6%).

Futures are indicating a lower open today as the trend has been lower all night. A ton of economic data was just released, though, so we’ll see how the market digests them. Below, we provide a summary of how these reports came out relative to expectations. Overall, it was a mixed bag, and the initial reaction from futures has been muted.

Housing Starts – 1,580K vs 1,660K estimate

Building Permits – 1,851K vs 1,679K estimate

Initial Claims – 861K vs 770K estimate

Continuing Claims – 4,494K vs 4,450K estimate

Import Prices – 1.4% vs 1.0% estimate

Philly Fed – 23.1 vs 20.0 estimate

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, economic data out Asia and Europe, an update on the latest national and international COVID trends, and much more.

Concerns over rising interest rates crept into the market yesterday as the 10-year yield briefly topped 1.30% hitting its highest level since last March. Heading into the opening bell, the 10-year yield is currently sitting right at 1.30%, but that is still well below levels seen a year ago right before the pre-COVID peak in rates and also 20 basis points below the dividend yield on the S&P 500. Which would you rather have? All else equal, higher rates are worse for equity prices than lower rates, but when you’re coming from record low levels of rates due to a complete shutdown of the US economy, some increase in rates can certainly be tolerated.

Daily Sector Snapshot — 2/17/21

Tech Leading in New Highs

The S&P 500 has been reversing from its record highs over the past couple of sessions, but on an individual stock basis there are still a large number of names that have reached new 52-week highs. As shown in the charts from our Daily Sector Snapshot below, through yesterday’s close, a net percentage of just over 15% of the S&P 500 reached new 52-week highs. That is the strongest reading in new highs since January 12th. Outside of several days at the start of 2021, the only other days of the pandemic era with as high if not higher readings were September 2nd, October 9th, and November 9th. Most of the sectors are also seeing their number of new highs rise to strong levels. In addition to the S&P 500, yesterday’s reading for Communication Services, Financials, Materials, and Tech all were in the top decile of all days since at least 1990. In the case of Materials, while new highs have been trending higher and yesterday’s reading was historically strong, it was still well off the record highs from earlier this year.

On the other hand, perhaps the most impressive sector in terms of net new highs has been Technology. Yesterday, 35.53% of the sector’s stocks reached a new 52-week high. Not only is that the highest reading with respect to the other sectors, but that high reading also stands in the top 0.5% of all days for the sector since at least 1990. In other words, there have only been 38 other days since 1990 that the Tech sector saw as strong of a reading in net new highs as yesterday. The most recent of those was November 9th when 43.84% of the sector touched a new 52-week high. Overall, in the context of more broadly positive breadth with strong readings in new highs for other sectors, Tech’s large number of new highs is an added plus for the broader market given the massive 28.08% weight of the sector. Try Bespoke Premium to receive these charts on a daily basis in our Sector Snapshot report.

Homebuilders Hot While Purchases Decline

The housing sector remains on fire and as such, homebuilder sentiment remains historically elevated. After falling for the past two months, the NAHB’s Housing Market Index experienced a small bounce in February. The index rose from 83 to 84 compared to expectations of no change. At 84, it is still 6 points below the November record high of 90, but that is also above any other reading in the history of the data prior to October.

The improvement in the headline number this month was driven entirely by higher traffic. That index was up 4 points month over month and now sits 5 points below November’s record high of 77. Meanwhile, of the other components, Present Sales went unchanged at 90 while optimism for the future was dented with that index dropping to a six-month low of 80. Again, although those readings have not improved, they remain historically strong.

As with the different categories of the report, the readings across the various regions’ indices were mixed. The West was the only region where homebuilder sentiment declined. Granted, that drop was only 1 point and at 91, the index still ties the pre-pandemic record high. Meanwhile, the South went unchanged and the Midwest experienced a small rebound.

One of the more notable changes of the whole report was sentiment in the Northeast. Even though it too has been at some of the strongest levels on record, over the past few months the region’s reading on homebuilder sentiment has been a significant laggard compared to the rest of the nation. From its high of 87 in October, the index for the Northeast fell 19 points through January. For comparison, in that same span, the Midwest index fell only 4 points while the South and West were up 1 and 3 points, respectively. In February, though, whereas other regions remain several points off their highs, the Northeast put in a new record high after lurching 21 points higher. The only times that this index has risen by more in a single month was in June (31 points) and July (22 points) of last year.

As for other housing data released this morning, the MBA’s weekly reading on mortgage purchase applications has continued to fall. Since the peak in mid-January, mortgage purchase applications have fallen nearly 14%, and the index now sits at the lowest level since the first week of November. Granted, that is still well above pre-pandemic levels, so it’s hardly a weak reading.

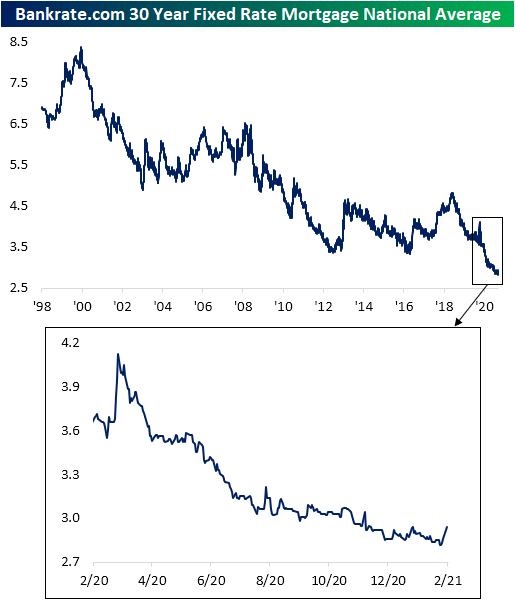

Higher mortgage rates likely in part played a role in that lower reading in mortgage applications. As shown below, with a broader rise in rates recently, the national average for a 30 year fixed rate mortgage has gone from a low of 2.82% just over a week ago to 2.94% yesterday; tied with January 12th for the highest rate since the end of November. That has also been the biggest one-week rise in the average mortgage rate since August.

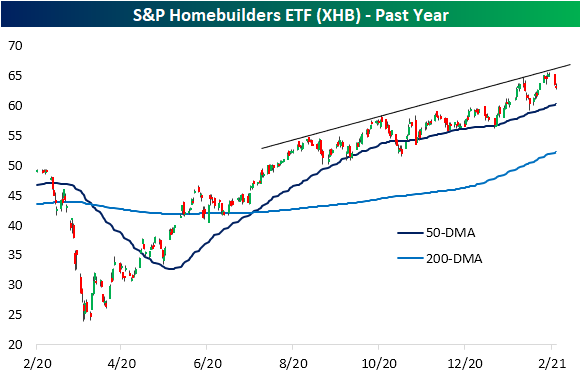

Like the macro data released today, homebuilder stocks are in turn off their highs. After reaching extreme overbought levels last week at the top of its uptrend channel that has been in place over the past few months, the S&P Homebuilders ETF (XHB) has been mean-reverting over the past couple of days. With the downward move, the 50-DMA will be a support area to watch as it consistently has been since the summer. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: S&P 500 YTD Decile Analysis

B.I.G. Tips – Retail Sales Surge

Based on the latest Retail Sales report for January, it looks like the $600 stimulus checks that were sent out to both struggling (and non-struggling) Americans in later December and early January achieved their purpose. After three straight weaker than expected reports, Retail Sales for the month of January blew the doors off estimates, surging by 5.3% compared to expectations for an increase of 1.1%. After stripping out Autos and Gas, the increase was even more at close to 6%.

To put this spread versus expectations into perspective, since the late 1990s, the only other times that Retail Sales topped expectations by more than four percentage points were last June coming out of the lockdowns and back in November 2001 after the 9/11 attacks. While December’s report was revised down, it did little to dent the positive impact of the January numbers.

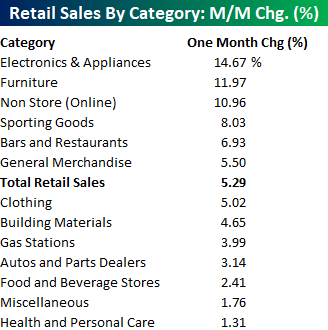

Not surprisingly, breadth in this month’s report was perfect. Of the thirteen sectors that comprise the total pie, all of them were higher on a m/m basis led by Electronics & Appliances, Furniture, and Online, which all spiked more than 10%. If the distortions resulting from the COVID lockdowns weren’t so fresh in our collective memories, we’d be calling these types of moves historic. On the downside, Health and Personal Care was the weakest sector, and it still increased over 1%!

The characteristics behind the total level of sales have changed markedly in the post-COVID world. In our just-released B.I.G. Tips report, we looked at these changing dynamics to highlight the groups that have been the biggest winners and losers from the shifts. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke’s Morning Lineup – 2/17/21 – Trends Come and Go

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Big market price changes happen when lots of people are forced to reevaluate their prejudices, not necessarily when the world actually changes – Colm O’Shea

Futures are little changed this morning, but that could change over the next 90 minutes as there’s a big slug of economic data on the calendar. Its starts with PPI and Retail Sales, which were just released. Both of these reports were gargantuan. Headline PPI came in at 1.3%, which was more than three times consensus expectations and the largest m/m increase in over ten years. Retail Sales were also much stronger than expectations. While economists were expecting the headline reading to rebound to 1.1% after three weaker than expected readings, the actual reading came in at 5.3%. Consumers were clearly ready to spend to start the year. When it comes to economic data, that’s not all either. At 9:15 eastern, we’ll get the latest updates on Industrial Production and Capacity Utilization, followed by Homebuilder sentiment at 10 AM.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, economic data out Asia and Europe, an update on the latest national and international COVID trends, and much more.

It may have just seemed like a late summer day at the time, but September 2, 2020 was a notable day for the market as it represented the beginning of the longest period of consolidation for the current bull market so far. After a solid and steady rally off the March lows, the S&P 500 traded in a sideways pattern for the next several weeks and didn’t make a new high for more than two months. While the market ultimately resumed its winning ways, as we all know now, the character of the rally changed considerably. The chart below shows the performance of S&P 500 stocks from the close on 2/19/20 through 9/2/20. The x-axis of the chart is sorted by market cap with the largest stocks as of 2/19/20 all the way to the left, and as you move to the right, market caps get progressively smaller.

During the 6.5 month stretch from 2/19/20 through 9/2 it was the mega-cap stocks that led the rally. While the ‘average’ stock was down 2.5% during that span, the five largest stocks in the S&P 500 (red bars) were among the best performers averaging a gain of 40.1% and ranking an average of 48 out of 500 in terms of performance.

Since 9/2, though, performance has changed considerably. While the ‘average’ stock is up 20.2% during this period, the same five stocks that led the market from 2/19 through 9/2 are barely higher, averaging a gain of 3.1% and ranking an average of 353 out of 500 in terms of performance.

Another way to illustrate the changing characteristics of performance since 9/2/20 based on market cap, the chart below shows the rolling 50-stock average performance based on market cap from 2/19/20 through 9/2/20 (red line) while the blue line shows the performance of these same stocks from 9/2 through 2/16. In each line, the left-most point shows the average performance of the 50 largest stocks in the S&P 500 (a/o 2/19/20) while the next point represents the average of stocks 2 through 51 and then all the way down the line.

Looking at the period from 2/19 through 9/2 (red line), the fifty largest stocks in the S&P 500 were among the best performing group of 50 stocks in the S&P 500 while the smallest stocks were among the worst performers. Since then (blue line), we’ve seen the complete opposite pattern play out as the 50 largest stocks in the S&P 500 have been the worst performers relative to every other rolling 50-stock group while the 50 smallest stocks have practically been the best performers.

At the time, September 2nd didn’t seem like an especially remarkable day in the market, but it represented a long-term shift in the performance of mega-caps relative to the rest of the market.