Bespoke’s Morning Lineup – 2/24/21 – Asia Down, Europe Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Nothing is so exhausting as indecision, and nothing is so futile.” – Bertrand Russell

With Asia down overnight and Europe higher, the US is looking to break the tie in favor of the bulls as futures extend the rebound from Tuesday morning’s lows. As one might expect given the positive tone in equities, treasury yields are a bit higher. The economic calendar is light today as New Home Sales are the only report scheduled, but Fed Chair Powell will resume his semi-annual monetary report to Congress and a number of other FOMC officials are also scheduled to speak.

Powell is unlikely to say anything new this morning relative to yesterday, but with investors on edge regarding the direction of interest rates, uncertainty remains high as investors weigh the pros and cons of valuations, economic growth, a receding of the winter COVID wave, the potential for less accommodative monetary policy, and many other factors. With all these cross-currents, days like yesterday are likely to be more common.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, a discussion of fund flows from the ARKK funds, economic data out of Europe, an update on the latest national and international COVID trends, and much more.

Seasonal trends have been a tailwind for the market over the last several months, but the winds may be starting to shift. As shown in the snapshot from our Seasonality Tool, while the S&P 500’s historical returns from the last ten years over the following week, month, and three months are all positive, relative to all prior periods of similar duration, they rank below the 50th percentile.

More Than Meets the Eye to Fifth District Manufacturing

The fourth of the five regional Fed manufacturing surveys was released this morning from the Richmond Fed. The Manufacturing Composite held firm at 14 in February, unchanged from January but worse than the expected 1 point uptick that was penciled in by economists. Even though it did not live up to forecasts, that reading is still healthy and indicative of continued growth in the region’s manufacturing economy.

Although there was no change in the headline number, under the hood, there were some more interesting moves. Breadth in this month’s report was generally positive with only the indices for New Orders, Local Business Conditions, Raw Materials Inventories, and Availability of Skills lower month over month. The latter two categories not only are in contraction after the past month’s decline but are also now at record lows; neither of which is necessarily a bad thing. The only indices in contraction are for Services Expenditures and Inventories for both Finished Goods and Raw Materials.

While the New Orders index was lower, it remains at a healthy level consistent with growth. While new demand slowed down slightly, Shipments, Vendor Lead Times, and Order Backlogs were all higher. For the index of Backlog Orders, the 12 point increase was the highest month-over-month increase since June and July when the index rose 19 points two months in a row. Now at 18, the index is also tied with November of 2017 and March of 2004 for the third-highest reading on record. Only May 2000 and June 1994 have seen higher readings of 19 and 25, respectively.

Vendor Lead Times are at an even more notable high. Higher readings in this index mean products from vendors/suppliers are taking more time to reach their destination while lower readings mean shorter lead times. The index rose another 7 points to 46 this month. The only higher readings in this index came in the early days of the survey back in January 1996 and December 1994 when those readings were 75 and 282, respectively. Putting all of this together, new orders continue to grow leading to further growth in backlogs, and although businesses are shipping their products, some supply chain issues are constraining things.

With demand still growing and only slowing slightly, the long lead times are playing a role in dwindling inventories. Both indices for Raw Material Inventories and Finished Good Inventories sit in contraction. With regards to inputs, the Raw Material Inventories index’s reading of -8 was a record low. In spite of the index for Finished Good Inventories rising 3 points this month, it still sits in the bottom 1% of all readings.

In turn, prices are on the rise. Prices paid were up 4.47% annualized while prices received were up a more modest 2.83%. For prices paid, that is the most prices have accelerated since April 2019 when they were up 5.3% annualized. Higher readings in the expectations indices for both of these indicate that the region’s manufacturers are expecting these price increases to continue in the future.

The report painted a pretty positive picture concerning employment as well. While employment growth slowed a bit with the index for Number of Employees falling one point to 22, the index remains in the top 3% of all readings while the index for expectations for Number of Employees is in the top 1% of all months. Additionally, one potential reason for the decline in February’s reading of current conditions appears to be a lack of labor. The index for the Availability of Skills reached a record low of -28 in February. Given this, wages were higher back up to the same level as December. Click here to view Bespoke’s premium membership options for our best research available.

Daily Sector Snapshot — 2/23/21

Chart of the Day – S&P 500 Up, While Energy Leads and Tech Lags

Bespoke Stock Scores — 2/23/21

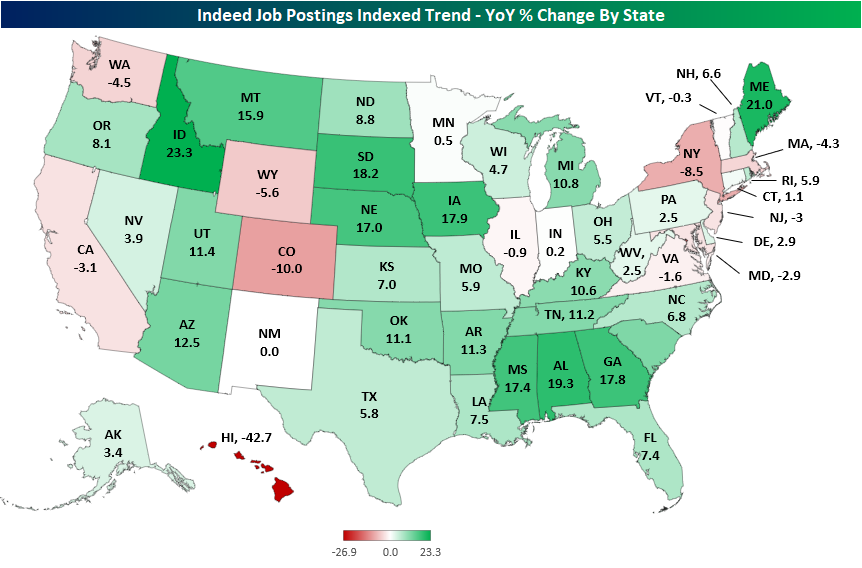

Where the Jobs Are and Aren’t

In last night’s Closer, we reviewed data from job listings website Indeed.com made available through the St. Louis Fed. While somewhat convoluted, Indeed’s indices show the year-over-year change in the seven-day moving average of the seasonally adjusted number of job postings on their website indexed to February 1st of 2020. For the most recent data updated through February 12th, job listings in the US have continued to trend higher up 3.9% year over year. Indeed also breaks down this data on a state-by-state basis. As shown in the heatmap below, most states in the Midwest and South currently have postings up year over year, but some coastal states like New York and California as well as some Southwestern states are lagging in their recoveries. By far the worst state continues to be Hawaii which is likely a result of a crippled travel industry.

Getting even more granular, Indeed also provides the data broken down by metro areas with populations larger than 500,000 people of which there are 110. Below we show the 20 metros that have the strongest and weakest job posting readings as of February 12th. Unsurprising given the state-level reading, Honolulu, Hawaii has the weakest reading followed by San Jose and San Francisco, California. Taking a look at the other weakest metro areas, there are a number of massive areas like New York City, LA, Boston, Chicago, DC, Seattle, and Denver to name a few. On the other hand, smaller metro areas dominate the list of those that have job postings most improved from a year ago.

Further quantifying this, in the chart below we show the average reading of metro areas grouped by their respective populations. As shown, metros with smaller populations (those under 1 million people) have seen the strongest growth in job postings, up over 11% year over year. As you move up the ladder of higher and higher populations, the job postings readings get weaker. Metros with populations between 2 and 3 million people only have postings up 0.56% year over year. The worst of these groups are the largest metros with populations over 4 million. On average, this group’s job postings are only up 0.35%. Click here to view Bespoke’s premium membership options for our best research available.

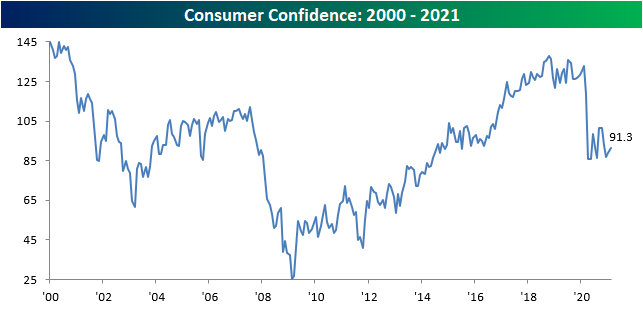

Consumers Still Stuck in a Rut

The stock market and economy have both exhibited different degrees of v-shaped patterns over the last year, but one area where the v-shaped pattern has been noticeably missing involves Consumer Confidence. The latest read on consumer sentiment for the month of February showed a modest improvement from January’s downwardly revised reading of 88.9. While economists were forecasting the headline reading to come in at a level of 90.0, the actual reading showed a modestly larger increase coming in at 91.3. Even as financial conditions and the economy improve and vaccines roll out, though, consumers remain stuck in a rut.

Breaking out confidence by Present Conditions and Expectations shows the same trend. While sentiment towards the present has seen a bigger bounce off the lows, expectations continue to trend lower. At first glance, this seems strange given the improved trends regarding COVID case counts and the rollout of the vaccines, but then again, if you told most Americans a year ago that we’d still be at the current level of restrictions and closures, they wouldn’t have believed you. Maybe the fact that expectations remain so muted is just consumers taking the attitude of, “I’ll believe it when I see it.”

Another reason for the muted sentiment is the fact that jobs simply aren’t there yet. Like overall confidence, the ‘Jobs Plentiful’ index has barely bounced off its lows. As long as jobs remain hard to find, don’t expect consumer sentiment to improve much.

One surprising aspect of this month’s report concerned sentiment towards the stock market. While there’s an overall abundance of bullish sentiment, the percentage of consumers in this survey expecting higher stock prices is barely higher than the percentage expecting lower stock prices. Normally, when the stock market makes record highs, consumers are bullish towards the market. This month, though, the lack of consumer enthusiasm has even made its way into sentiment towards the stock market. Click here to view Bespoke’s premium membership options for our best research available.

Travel Stocks Red Hot

The past year has been rough for the travel industry, but more recently these companies’ stocks have been red hot. As shown in the snapshot of our Trend Analyzer below, there are several S&P 500 travel stocks (those in the airlines, cruise, and hotel industries) that are off the chart overbought. Only two names, Las Vegas Sands (LVS) and Wyndham Worldwide (WYND), did not close yesterday at least 2 standard deviations above their 50-DMAs, but even though they did not technically do so, they were very close to joining the rest of their cohorts in extreme overbought territory. Another remarkable aspect of these readings is that just last week some of these stocks were oversold. After more than 20% rallies in the past five days, cruise lines Royal Caribbean (RCL) and Norwegian (NCLH) have gone from oversold levels to deep into overbought territory.

From a charting perspective, in spite of the very overbought conditions, many of these stocks have now broken out above their highs from a few months ago thanks to these recent gains. As shown in the snapshot of our Chart Scanner below, within the past couple of days stocks like Booking Holdings (BKNG), Carnival (CCL), Southwest Airlines (LUV), and Las Vegas Sands (LVS) to name a few have now broken out. Not only have they broken out, but some are even reaching 52-week highs as pre-pandemic levels roll off the chart. In fact, just yesterday, Alaska Air (ALK), Booking Holdings (BKNG), Expedia (EXPE), Hilton (HLT), Southwest (LUV), Las Vegas Sands (LVS), Marriott (MAR), MGM Resorts (MGM), and Wynn Resorts (WYNN) all reached 52-week highs. Click here to view Bespoke’s premium membership options for our best research available.

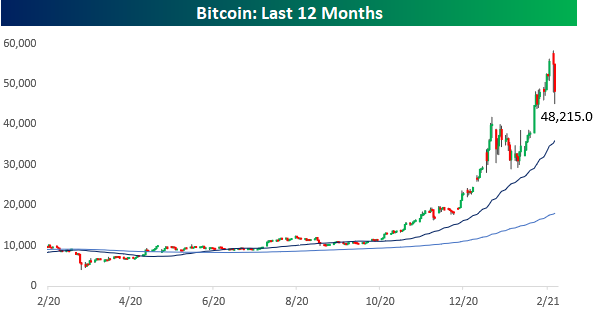

Bitcoin’s Largest Drawdown Since Last Month

Bitcoin hit record highs over the weekend, but it’s having a week to forget. After topping $58,000 on Sunday, bitcoin’s price barely held $45,000 this morning, and at current levels is still down over 17.4% from its record high three days ago. As sharp as bitcoin’s decline seems now, we’d note that it is still 34% above its 50-day moving average (DMA) and more than 167% above its 200-DMA. Those spreads show just how strong the recent rally in bitcoin has been.

While bitcoin is down over 17% from its recent highs, at this point it has been a relatively modest pullback for the leading crypto-currency. The chart below shows the history of bitcoin’s daily price relative to its prior all-time high going back to 2015. During the last six years, bitcoin’s average drawdown from its all-time high has been 35%, or double the current level of 17.4%. While the pullback this week has been swift, you don’t even have to go back a month to find a larger drawdown from a record high. Back on 1/27, bitcoin was down over 26% from its prior record high of 41,981. That prior record high is 12% below current levels. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/23/21 – More Pain in Tech

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If your only goal is to become rich, you will never achieve it.” – John D. Rockefeller

What goes up must come down. After a rough day for tech and bitcoin yesterday, we’re seeing more of the same again today, as Nasdaq futures are down over 1% and bitcoin, while well off its lows, is still down 10%. There’s not a lot of economic news on the calendar today, but we will get updates on Consumer Confidence and economic activity in the Richmond Fed district at 10 AM. Also at 10, Fed Chair Powell will give his semi-annual monetary report.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, inflation data out of Europe, an update on the latest national and international COVID trends, and much more.

Days like yesterday don’t happen very often. Even as the DJIA was up marginally, the Nasdaq finished down more than 2%. The charts below show both indices going back to the start of 1986. Before yesterday, there was only one other day since 2001 that saw a similar setup and that was last July. In the period from early 1999 through May 2001, there were 33 occurrences, and then before that, the only two other occurrences were right after the 1987 crash. Let’s just say that prior divergences like yesterday didn’t exactly occur during periods of low volatility.

While days like yesterday are rare, the way futures are positioned right now, we could see the same thing happen again today. While Nasdaq futures aren’t down quite 2% yet, they’re still down over 1.5%. Needless to say, back-to-back days where the DJIA was up and the Nasdaq was down 2% are extremely uncommon. The only four other times it has occurred since 1986 were in 2000 (4/10-4/11, 9/5-9/6, 10/2-10/3, and 12/12-12/13).