Jobless Claims Weaker Under The Surface

After a small uptick last week, initial jobless claims have resumed their move lower coming in at 712K this week and 13K below expectations. The 42K decline from last week’s upwardly revised reading (745K previously to 754K) entirely erased the prior week’s 18K increase as claims now stand just 1K above the pandemic low of 711K reached in the first week of November. While that is still a historically elevated reading, it is only within 17K of the pre-pandemic record of 695K.

While the adjusted number is just off the pandemic low, on a non-seasonally adjusted basis claims did reach a new low. At 709.5K, claims have taken out the previous 716.6K low from two weeks ago. From a seasonal perspective, declines during the current week of the year are the norm. Historically, the current week of the year (10th) has seen claims fall two-thirds of the time.

Adding in Pandemic Unemployment Assistance (PUA), the improvement in claims data was less impressive. PUA claims were actually higher by 41.86K on a week over week basis bringing total claims between that program and regular state claims to 1.188 million from 1.193 million last week. That is still roughly 181K above the pandemic low from early November and little changed from the past few weeks’ readings.

On a state-level basis, while a majority of states continue to report lower initial claims for both programs, the single biggest contributor to national claims continues to be Ohio. Ohio reported 126.9K regular state claims which is 20K more than the next biggest contributor, California (105.9K). For PUA claims, Ohio’s 261.7K claims in the most recent week are over 45K more than the combined total PUA claims for all other states and territories. For continuing claims, things are a bit less extreme with Ohio only accounting for 4.13% of all regular state continuing claims and 8.67% of total PUA continuing claims.

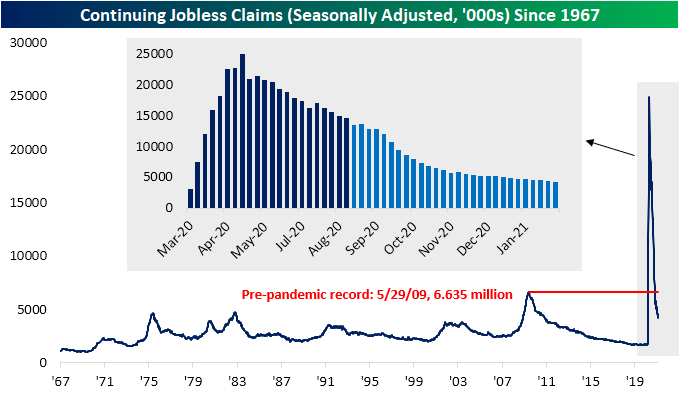

Like initial claims, continuing claims have also continued to improve, coming in below expectations (4.144 million vs. 4.2 million expected) which was also a new low for the pandemic. The 193K decline was the eighth weekly decline in a row as claims have fallen every week except for three in the past half-year.

Including all programs adds an extra week’s delay to the data. For the data as of the week of February 19th, total claims were an entirely different story as they rose by over 2 million rising back above 20 million for the first time since early December. That week saw an uptick across programs, but the biggest factors were PUA claims and Pandemic Emergency Unemployment Compensation (PEUC) which rose by 1.058 million and 986.35K, respectively. For PUA claims, that was the largest increase since January 8th when there was some catch-up following the signing of the spending bill. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Tech Exposure To Rates At A Record

Bespoke’s Morning Lineup – 3/11/21 – Five in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

The Dow is looking to make it five in a row today as equity futures are higher across the board. Weekly jobless claims came in lower than expected on both an initial and continuing basis, and are also both at or near their lowest levels of the pandemic. Futures were already higher this morning, but dovish comments from ECB President Lagarde have boosted the mood even further.

Trends related to COVID continue to show improvement on both a national and international basis, as vaccine doses continue to pile up across the country. Also, news from Pfizer (PFE) suggesting strong (94%+) real-world effectiveness of its vaccine based on a study in Israel only makes the outlook for once those doses are administered more broadly even more optimistic.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of Asian and European markets, the latest ECB rate decision, Japanese bond flows, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Looking at the chart of QQQ, it’s in a bit of limbo heading into today. Last week, the index appears to have successfully tested support at its peak from last September. Despite the bounce, QQQ still remains below its 50-DMA, and even after what is on pace to be a 2% gap at the open, it will still be trading below its 50-DMA. Large-cap tech still has some catching up to do!

Daily Sector Snapshot — 3/10/21

Chart of the Day – Large Cap Value Trounces Growth

Short Interest Update

Short interest numbers as of the end of February were released yesterday. In aggregate across all Russell 3,000 stocks, short interest as a percent of float came in at 3.21%, down from 3.6% at the start of the year. In the table below, we show the 25 stocks in the Russell 3,000 that currently have the highest short interest as a percent of float. Topping the list is Academy Sports and Outdoors (ASO) with 40.6% of shares shorted; unchanged in its ranking from the last report for the period ending February 12th. While it is still the most heavily shorted name in the index, ASO did see short interest as a percent of float fall 1.25 percentage points since the last report, and it is down even more considerably since the start of the year given its over 20% rally in that time. Including ASO, 13 of the top 25 most shorted stocks have lower short interest than they did in the last report. Of these, GameStop (GME) has seen the largest decline. GME has been on another massive rally over the past couple of weeks which has left the stock within 16.5% of its January closing highs. With that rally likely causing some shorts to close out their positions, the stock has seen a 6.36 percentage point drop in short interest as a percent of float in the most recent period, though, it remains one of the most heavily shorted stocks. Conversely, GEO Group (GEO) and Solid Biosciences (SLDB) are the two stocks in the top 25 that have seen short interest rise the most since the last report and YTD. For SLDB, the increase in short interest comes on what have been big gains year to date (+39.84%) while GEO has actually fallen double digits this year.

Not only has SLDB seen the biggest uptick in short interest among the most heavily shorted stocks, but it is also the stock that has seen the biggest increase of the entire index. In the table below, we show the Russell 3,000 stocks that have seen the biggest increase/decrease in short interest as a percent of float since the last report in mid-February. Other than SLDB, no other name saw a double-digit increase from the previous report with the next largest increase coming from Workhorse Group (WKHS) which saw short interest as a percent of float rise 8.4 percentage points. While WKHS saw higher short interest from the last report, the stock is still less heavily bet against than it was at the start of the year. Of the 20 stocks to see the biggest increases, WKHS is the only one that this applies to.

As for the stocks that have seen the biggest declines in short interest, there are three that fell by more than 10 percentage points: Corbus Pharma (BRBP), Dillard’s (DDS), and Kymera Therapeutics (KYMR). It should come as no surprise that once again, GME is not much further down this list with its 6.36 percentage point drop in short interest. On a year-to-date basis, GME is also the stock that has seen the biggest decline in short interest. Dillard’s (DDS), BigCommerce (BIGC), and Ligand Pharma (LGND)—all of which saw some of the biggest declines since the last report—are the runners-up in terms of YTD declines each having seen short interest fall by over 50 percentage points.

Looking across the names in the tables above, one industry group pops up more than any other: the Pharmaceuticals, Biotechnology, and Life Sciences industry. Of the 25 most heavily shorted names, 7 stocks are part of this industry. Meanwhile, of the 20 stocks that have seen short interest increase the most since the last report, 11 are from this industry, though, even 8 of the 20 biggest decliners also belong to the Pharma, Biotech, & Life Sciences industry.

Given this, on an aggregate basis, this industry has the highest short interest as a percent of float; up 6 bps from the last report to 5.46%. That replaces Retailing in the number one spot of the most heavily shorted industry groups. Further, the massive amount of short interest in retail names has appeared to have normalized. Whereas the industry came into the year with over 8% of float shorted, the current reading has fallen down to 5.36%. Similarly, Energy and Transportation stocks have seen aggregate short interest as a percent of float fall by more than 1 percentage point since the start of the year. Not everything has seen short interest decline though. Food, Beverage, & Tobacco, Household & Personal Products, Banks, and Insurance have all seen short interest rise since the start of the year. Since the last report, Food & Staples Retailing, Commercial & Professional Services, and Insurance all have seen the biggest upticks in short interest. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Chart We’re Watching – 3/10/21

Bespoke’s Morning Lineup – 3/10/21 – Inflation Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.” – Ernest Hemingway

Nothing like a quote on the perils of inflation for a day when inflation is on everyone’s mind in the wake of recent market performance and today’s release of the February CPI. Equity futures were modestly higher heading into the release, treasury yields are higher, and bitcoin is above $55K. With the report coming in right in line with expectations at the headline level and slightly weaker than expected ex-food and energy, the positive tone looks to be continuing. We would stress, though, that this is only the initial reaction. There’s lots of time left in the day and even to the opening bell!

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of Asian and European markets, French manufacturing output, credit growth and inflation in China, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

After Tuesday’s surge in the Nasdaq and strong rally in the S&P 500, US equities are back in the black for the week, but in many ways, the stocks that led the rally on Tuesday were the exact opposite of the ones that outperformed on Monday. For starters, within the entire Russell 1000, there were only 36 stocks that outperformed the index by more than 1% on both days.

The decile performance of stocks in the Russell 1000 on Tuesday based on their performance Monday also illustrates this trend. As shown in the chart below, the five deciles of top performers Monday all averaged declines on Tuesday, while the five deciles comprising the worst-performing stocks from Monday all saw positive returns on Tuesday. Outside of decile one which was only down slightly less than decile two, the performance rankings of the ten deciles on Monday versus Tuesday was a complete reversal. As noted in the Bible, “the last shall be first, and the first last:”

Daily Sector Snapshot — 3/9/21

Small Business Sentiment Slow to Come Back

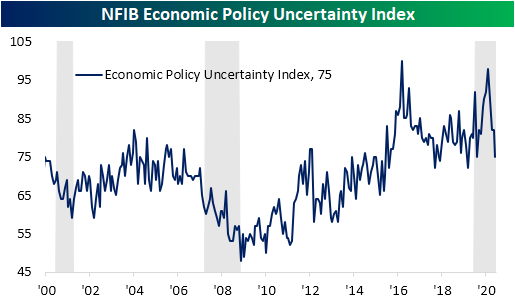

After crashing following the election, optimism on the part of small businesses remains pretty beaten down, though there was finally an improvement in February. The NFIB’s Small Business Optimism Index was expected to see a 2 point rebound in the month of February, but the increase was even smaller as the index rose from 95 to just 95.8.

While small business sentiment is far from recovered, uncertainty has improved. After spiking to a near-record high of 98 headed around the election last fall, the index for Economic Policy Uncertainty has continued to fall dropping to 75 in February. That 7 point month-over-month decline stands in the bottom 5% of all monthly changes which brings the index to the lowest level since last April.

Breadth in the report was mostly positive with 10 of the 18 categories higher in February while another 3 went unchanged and the remaining 5 were lower. Although most categories saw an improvement, several readings remain at historically low levels. For example, the indices for Expect Economy to Improve and Expect Real Sales Higher were both in the 3rd percentile of all readings. Other indices also remain at the low end of their historical ranges such as Plans for Capital Outlays and Now is a Good Time to Expand.

Sales metrics generally improved although firms reported as less optimistic for the future. While sales expectations fell deeper into negative territory, small businesses reported higher nominal sales as that index rose 9 points from -7 to 2. That was in the top 5% of all monthly moves and the first positive reading since November. Additionally, the index for Actual Earnings Changes also improved rising 5 points to -11. Due to the strong pace of sales, a higher share of companies reported higher prices. That index rose 8 points to 25. That is the strongest reading for the index since August 2008.

In addition to stronger sales, lower inventory levels also played into those higher prices. The index of Inventory Satisfaction which measures how many firms report current inventory levels as “too low” was flat on the month in the top 1% of all readings. Despite this, fewer firms report plans to increase inventories. The index for Inventory Accumulation actually fell 2 points to the lowest level since May.

While small businesses do not appear to be making plans to increase inventories, they are investing in employment. The index for Hiring Plans rose slightly from 17 in January to 18 in February. Although that is off higher levels from earlier in the pandemic, it is well within the range of the past several years. Compensation Plans were also higher with the index gaining 2 points to 19. Even though firms appear to want to increase employment, they have yet to follow through with hiring. The index for Actual Employment Changes remains negative falling further to -3 in February. Meanwhile, the Compensation index went unchanged. The lack of actual increases to employment is not a demand problem but instead appears to be a labor supply problem. A record number reported job openings as hard to fill while 33% report either cost or quality of labor as the single most important problem for the business; up 5 percentage points from the prior month. That borrowed from firms reporting things like Taxes, Inflation, and “Other” as their biggest issues. Click here to view Bespoke’s premium membership options for our best research available.