Shipments Drive the Richmond Fed Higher

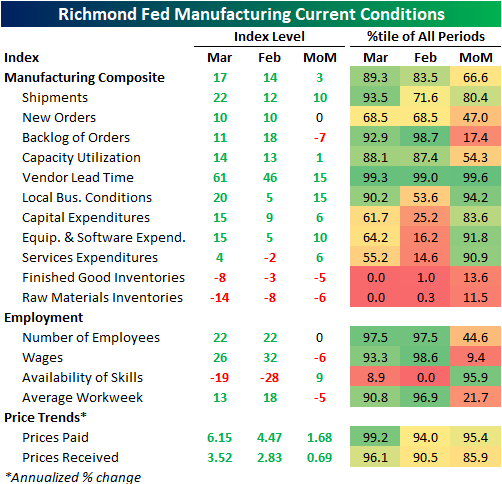

The Richmond Fed’s Manufacturing Activity Index rose to 17 in March after readings of 14 over the prior two months which had been the weakest readings since last July. At 17, this month’s reading was the strongest since December pointing not only to further growth but also an acceleration in the region’s manufacturing activity.

Across sub-indices, almost everything continues to show expansionary readings although there are a few exceptions for things like inventories and availability of skills; neither of which are necessarily bad signs for activity. As for the month-over-month changes, things were perhaps a bit more mixed with five of the eighteen categories lower and another two unchanged. Expectations also generally improved across categories though the actual levels of most of these indices are generally at the lower end of their historic range. In all, the report showed orders continue to grow with inventories being drawn upon at a record pace. Prices (including wages given labor market tightness) are also increasing at a historic rate.

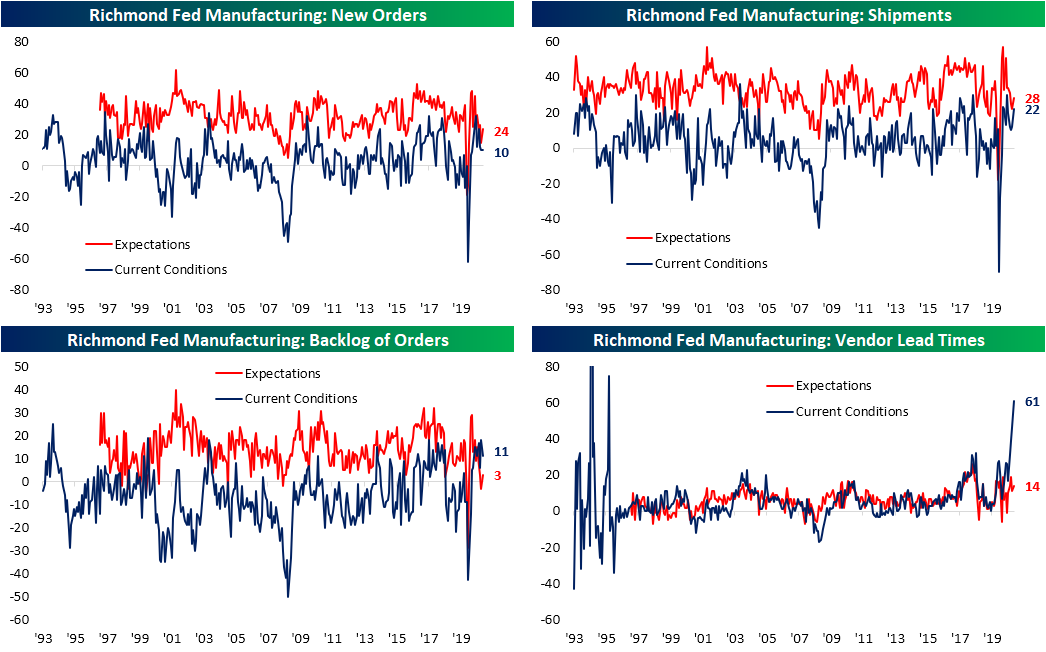

The main driver of the uptick in the headline number (which is a composite of Shipments, New Orders, and Employment) was the increase in Shipments which offset the unchanged readings in the other two components. That index gained 10 points to 22 in March. That was both the biggest one-month gain and the highest level for this index since October and leaves it in the top decile of readings throughout the index’s history. Although Shipments were higher, New Orders remain off their highs from a few months ago going unchanged in March. With Shipments on the rise and new demand steady, the Backlog of Orders decelerated as the index fell 7 points. But even with that decline, the current reading still stands in the top 10% of readings. One surprising point about the uptick in Shipments was that it also coincided with a historically high reading in Vendor Lead Times. Higher readings in this index indicate that it takes longer for products from suppliers to reach their destination. In other words, supplier delays have not yet appeared to slow down manufacturers getting products out the door.

While supplier delays aren’t slowing things down yet, inventories are being drawn upon at a record rate. Both indices for final good and input inventories fell to record lows in March.

Meanwhile, prices for both inputs and receivables continue to accelerate. Prices Paid rose at a 6.15% annualized pace. That is the third-highest reading on record behind October 2018 and June 2008. Expectations for Prices Paid are at the highest point in over a decade and the seventh-highest level on record. Prices Received are rising at a slower clip, 3.52% annualized, but this too is around one of the highest levels in recent years.

As for another input, Wages, there was a six-point decline in the current conditions index in March. Even though that is in the bottom 10% of monthly moves, the index is still at a historically strong level. As the report also continues to show a lack of skilled workers, expectations for Wages were much higher. That index rose to 57 which is the highest level since May 2019. Prior to that, you would need to go back to March and February of 2000 to find as high of a reading. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Historically Bad Quarter for Long-Term Treasuries

Bespoke’s Morning Lineup – 3/23/21 – Nasdaq Outperforming Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“In a wicked world, relying upon experience from a single domain is not only limiting, it can be disastrous.” – David Epstein – Range

US equity futures are shaping up a lot like Monday where the Nasdaq is leading the way, although unlike yesterday where all three major averages were higher on the day, so far it’s just the Nasdaq. Treasury yields and crude oil are both trading lower to start the day as rising COVID cases in Europe have dampened risk appetite.

In Fed news, Dallas Fed President Robert Kaplan was on CNBC earlier and said he sees inflation for 2021 coming in at a rate of 2.25% to 2.50% but sees the rate of price increases declining again in 2022. Kaplan is only the first of many Fed officials, including Powell, scheduled to speak today, so expect a lot of headlines on that front.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of the recent moves in rates, equity performance in Asian benchmark indices, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

The Philadelphia Semiconductor Index (SOX) has been in a relatively steady downtrend since its high in early February. Last week the SOX briefly traded and closed above that downtrend but quickly reversed back below. Yesterday, the SOX’s rally to kick off the week not only brought the index back above its 50-DMA and downtrend line, but it was also the first time that the index opened and traded above that downtrend line for the entire trading session. The SOX has still underperformed the broader market by a relatively wide margin over the last month, but if it’s going to get back on track, it has to start somewhere.

Daily Sector Snapshot — 3/22/21

Chart of the Day: What A Year It’s Been

February: Short But Weak

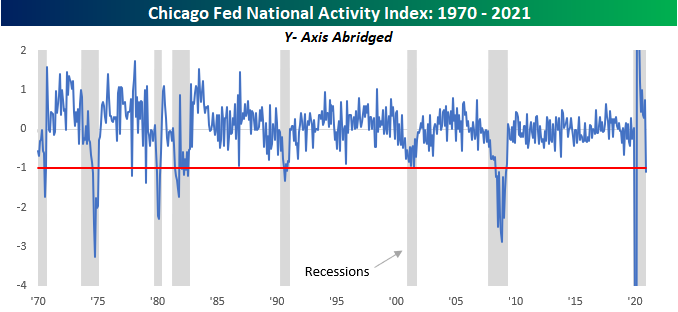

With elevated COVID cases and a major winter storm that paralyzed much of the south, February was a speed bump for the US economy. The latest example comes from this morning’s release of the Chicago Fed National Activity Index (CFNAI). From the website of the Chicago Fed, “The CFNAI is a weighted average of 85 existing monthly indicators of national economic activity. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend and a negative index reading corresponds to growth below trend.”

The release for February showed considerable weakness falling from a strong reading of 0.75 in January to -1.09 in February. The chart below shows historical readings of the CFNAI index dating back to 1970 with recessions highlighted in gray and a red line indicating the current reading for February. Because of the major swings we saw in this index around the COVID outbreak last year, this chart is pretty useless in terms of looking at the current data to see how it compares to prior periods.

In order to get a better view, in the chart below we have cut off the y-axis to leave out the extreme readings from 2020. Looking at it this way shows just how weak February was. Looking back, just about every prior occurrence where the CFNAI was below -1 the US economy was in a recession. Besides the period in 2020, the last times this index was at similar levels was during the Financial Crisis, during the dot-com recession, the 1990 recession, and then the double-dip recession of the 1980s. Noticing a trend?

The table below shows every month where the CFNAI was less than negative one (-1). Since 1970, out of 612 monthly readings, there have only been 37 months that the index was below -1. Of those 37 months, there have only been two (Jan 1978 and April 1979) that occurred when the US economy wasn’t in a recession. Technically, since the NBER has yet to confirm an end date, the US economy remains in the COVID recession, but most would agree that when the time comes, the recession will likely have ended in the second or third quarter of 2020 which would make February just the third month since 1970 that the CFNAI was below -1 outside of a recession. In other words, in just about any other time but now, an overheating economy would be the last thing people would be worried about right now given a negative reading of this magnitude in the CFNAI. Click here to view Bespoke’s premium membership options for our best research available.

Canada on Top

As shown below, there is not a single BRIC or G7 country that has a total return of less than 50% since the March 23rd, 2020 COVID low through today. Of all of these, India (PIN) boasts the best return having more than doubled and leading the pack throughout basically all parts of the past year. There were only a couple of points in time early on in the recovery that PIN was not the leader. That was when Brazil (EWZ) was up the most, but since the end of 2020, the country’s equities have significantly underperformed. The same applies to China (ASHR). Meanwhile, Russia (RSX) and the US (SPY) have more steadily continued higher alongside PIN.

As for the developed world, things have been more stable. There has not been a G7 country that has fallen sharply recently in the same way as Brazil or China. As a result, China (ASHR) actually has the worst return over the past year out of all G7 and BRIC countries and Brazil would rank as the second-worst. Earlier in the pandemic, Canada (EWC) and Germany (EWG) had been vying for the best-performing G7 country, but since the fall, EWC has put some distance between itself and the rest. The US has the next best returns with a 78.46% total return over the past year.

Click here to view Bespoke’s premium membership options for our best research available.

Historic Year for the S&P 500

Tomorrow will mark the one-year anniversary of the S&P 500’s closing low from the COVID crash, and for most stocks in the index, it has been a historic year. Within the S&P 500, stocks in the index are up an average of 104.22% through Friday’s close, and just three stocks – all from the Health Care sector – are actually lower. Leading the losers, Gilead (GILD) has declined over 10%. Recall that GILD performed well during the initial stages of the pandemic on the promising results of its drug Remdesivir in treating COVID patients, but once the market started to rally, it was left behind.

The table below lists the top 25 performing stocks in the S&P 500 since the closing low on 3/23/20. Topping the list with a gargantuan gain of 763% is ViacomCBS (VIAC). After trading below $12 per share last March, the stock is close to triple-digits today. Behind VIAC, Tesla (TSLA), L Brands (LB), Etsy (ETSY), and Freeport-McMoRan (FCX) round out the top five, and all have gained in excess of 500%. Interestingly enough, despite the strength of the sector for what seems like years now, the only stock on the list from the Technology sector is Enphase Energy (ENPH). In fact, after ENPH, you have to go all the way down to the 53rd spot to find the next stock from the Technology sector (Applied Materials – AMAT, +186%).

Leading the way higher, stocks in the Consumer Discretionary and Energy sectors are both up an average of over 150%, while Consumer Staples and Utilities are the only two sectors where each one’s components are up an average of less than 50%. Just to the right of the S&P 500 in the chart below is the Technology sector which is one of five sectors where the average performance of its components is less than 100%. A gain of 96.1% in a year is nothing to sneeze at in any market environment, but just the fact that the average performance of stocks in the Technology sector since the March lows is now lower than the average of the S&P 500 illustrates the shift we have seen since the sector’s peak relative strength last fall. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/22/21 – Nasdaq Leading a Mixed Bag

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The road to success and the road to failure are almost exactly the same.” – Colin R. Davis

It’s been a while since we’ve had a “vaccine Monday” but today’s supplier of positive headlines is AstraZeneca (AZN). The company announced earlier that its vaccine was 79% effective against symptomatic COVID-19 and 100% effective against severe disease. More importantly, AZN also reported no safety concerns such as the blood clotting issues that had been reported in the EU last week. Unlike prior vaccine Mondays where equity futures have typically surged in reaction to the news led by the DJIA and S&P 500 while the Nasdaq lagged, this morning’s picture is the complete opposite. DJIA futures are actually lower heading into the opening bell, the S&P 500 is flat, Nasdaq futures are up half of one percent, and the 10-year yield is actually lower. With AZN likely to now enter the fray, it’s only a matter of weeks before vaccine shortages in the US turn to gluts.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of the chaos in Turkey after its Central Bank chief was fired for raising rates last week, data on Korean Exports, Eurozone Current Account, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Also, if you weren’t able to catch it earlier this morning, make sure to check out our interview on CNBC’s Squawk Box.

Tomorrow marks the one-year anniversary of the S&P 500’s COVID low and what an impressive run it has been. The chart below shows the performance of each of the S&P 500’s components since the close on 3/23/20. Of the 500 names shown, the average gain through Friday’s close has been just over 100%! Even more amazing is the fact that only three stocks in the entire index are down during this span. The worst of the three has been Gilead (GILD). With a decline of just over 10%, the maker of Remdesivir, which originally rallied on the promising prospects of its potential COVID treatment, has been a dog ever since.

On the other end of the spectrum, the top-performing stock has been ViacomCBS (VIAC). Since the close on 3/23. VIAC has rallied nearly 800%. Behind VIAC, four other stocks are up 500% (TSLA, LB, ETSY, and FCX). Notably absent from the list of top performers is the Technology sector. Of the top 50 performing stocks in the S&P 500 since 3/23, only one stock from the Technology sector (Enphase- ENPH) made the cut.

Bespoke Brunch Reads: 3/21/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

3 Ways the Pandemic Has Made the World Better by Zeynep Tufecki (The Atlantic)

Custom-designed vaccines, deeper use of digital infrastructure, and open science are three critical benefits of the COVID-19 pandemic that will be with us for a long time to come. [Link; soft paywall]

America’s Covid Swab Supply Depends on Two Cousins Who Hate Each Other by Olivia Carville (Bloomberg)

Swabs that are critical for testing were only manufactured by two companies globally at the advent of the COVID pandemic. The American one was rife with disfunction, making it a very poor candidate to ramp production to meet impossibly high demand. [Link; soft paywall]

Why Black Parents Aren’t Joining the Push to Reopen Schools by Melinda D. Anderson (Mother Jones)

A deep dive into why there’s a racial divide between black and white parents over the question of school reopenings. [Link]

Changing Preferences

Boat sales took off during the pandemic and now dealers can’t keep up with demand by Katie Tsai (CNBC)

Boat sales are at decade-plus highs, with first-time buyers by far the biggest segment of new buyers and sustaining their enthusiasm despite the waning of the COVID pandemic. [Link]

Roughly 4 in 5 Manhattan Office Workers Will Not Return Full-Time, Survey Says (NBC New York)

A Partnership for New York City survey showed that just 22% of the large employers on the island of Manhattan plan to bring their workforces back to the office full time. Two-thirds reported planning on a hybrid model. [Link]

Speculation Is Our Middle Name

Tapping Day-Trader Cash, ETF Launches Go From Risky to Roaring by Claire Ballentine (MSN/Bloomberg)

Betting and iGaming, SPAC-Derived, Social Sentiment, and Equity Sentiment ETFs have proliferated, fueled by a huge class of day traders and novice investors who have arrived in stock markets during the pandemic. [Link]

ARKK Copycat Is Beating Cathie Wood’s Original by 10-Fold by Claire Ballentine (Bloomberg)

A small ETF that goes by the memorable ticker MOON is aiming to take on the ARK Invest empire via a focus on innovation. Unlike ARK products, MOON is index-based. [Link; soft paywall]

Morgan Stanley becomes the first big U.S. bank to offer its wealthy clients access to bitcoin funds by Hugh Son (CNBC)

Clients with more than $2mm in assets at Morgan Stanley and an “aggressive risk tolerance” are now eligible to buy funds that offer bitcoin exposure via the MS platform. [Link]

Bonds

Investing in bonds has ‘become stupid,’ Ray Dalio says. Here’s what he recommends instead by Mike Murphy (MarketWatch)

Somewhat hilariously given the fact that the largest hedge fund in the world owns massive exposure to government bonds, its founder has argued that owning bonds is “stupid”. [Link]

Economic Research

The ‘China Shock’ revisited: insights from value added trade flows by Adam Jakubik and Victor Stolzenburg (Journal of Economic Geography)

The authors decompose imports and exports to identify the US component of gross value added in trade flows and the output that stems from them in order to illustrate a very different impact on US labor markets than previously estimated from the “China Shock”. [Link]

Autos

‘No one focuses on the pain here’: Inside Oakland’s abandoned car epidemic by Ariana Bindman (SFGate)

Thousands of abandoned vehicles have piled up in Oakland, often after they’ve been stolen and stripped for valuable parts. The city has under-budgeted a response that requires large resources to properly deal with the scale of the problem. [Link]

Beer

Why Did Women Stop Dominating the Beer Industry? by Laken Brooks (Smithsonian Magazine)

During the Middle Ages, women were the ones that brewed beer. But the advent of scalable quasi-industrial brewing meant that men had an incentive to force them off their turf. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!