Mortgage Purchases and Refinancing Go In Opposite Directions

This morning, the Mortgage Bankers Association (MBA) released their weekly reading on mortgage purchase and refinance applications. Although the composite index was up 1.2%, purchases of homes have been a bit lackluster likely on account of the short supply of existing homes and rising costs to build new homes which we discussed yesterday. This week, the seasonally adjusted purchases index fell 4.2% and currently sits just above the recent low from the week of February 19th.

We would also note that seasonal tailwinds of mortgage purchases have now likely come and passed. As shown through the blue dots in the chart below, the annual peak in non-seasonally adjusted mortgage purchases typically comes at some point in March through May. The only exceptions of the past decade were last year and 2015.

While purchases have continued to decline, refinances have picked up a bit recently. That index rose over 4% this week as it is now back to the highest levels since the first half of March.

That uptick in refinances comes as the national average of a 30-year fixed rate mortgage has been on the decline after the surge in February and March. As of yesterday, the national average sat at 3.09% which is around similar levels to last fall. Again, while refinances have benefited from that decline in mortgage rates, it hasn’t appeared to have impacted purchases as supply is likely the bigger issue at play. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Bitcoin Drawdowns Versus Mega Cap Tech

Bespoke’s Morning Lineup – 5/19/21 – Splat

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Age doesn’t matter, unless you’re cheese.” – John Paul Getty

There’s not a lot of economic or earnings data to speak of this morning, but that hasn’t stopped traders from selling. Equity futures are down sharply this morning with tech leading the way lower. Nowhere is the severity of today’s weakness more pronounced than in the crypto markets.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic and earnings data, a graphical summary of the current decline in bitcoin, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

It’s looking like an especially painful day in the cryptocurrency markets today. While the sector has been under pressure for the last couple of weeks now, reports overnight regarding a crackdown by Chinese authorities have given traders another excuse to sell. While bitcoin is down over 10% this morning, other more speculative areas of the sector are down far more.

In the case of bitcoin, today’s decline takes the drawdown from its recent record highs to just over 40%. That’s steep no matter how you look at it, but would you believe that over the last ten years, bitcoin’s average drawdown from a record high on any given day is close to 50%, and on 69% of all trading days during this span bitcoin has been down more than 40% from its record high? One caveat here, though, is that while bitcoin isn’t even trading at its ‘average’ drawdown levels, given the market value, the amount of money ‘lost’ during this sell-off has been much steeper than any prior pullback. Make sure to check out page six of our Morning Lineup for additional charts summarizing the decline.

Daily Sector Snapshot — 5/18/21

China ASHR ETF Trending Higher

After surging to 52-week highs at the very end of 2020 and into the new year, the Xtrackers CSI 300 ETF (ASHR) tracking China A-Shares collapsed back below its 50-DMA. The decline not only left the ETF in between its 50 and 200-DMA but also brought it back within the range between roughly $37 and $40 that traces back to the ETF’s range from November and December of last year. On Friday, that ended. ASHR popped almost 3% to not only move out of that range but also to finally move back above its 50-DMA for the first time since late April when there was a false breakout only lasting for a day. This time around, that breakout appears to be much less of a pump fake with a decent follow-through. Friday’s rally has continued into this week with ASHR up another 0.38% today following a 1.1% rally yesterday. The ETF now trades 3.86% above its 50-DMA which is now trending sideways rather than downward as it has for the past few months. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Stock Scores — 5/18/21

Still A Lot of Triple Plays

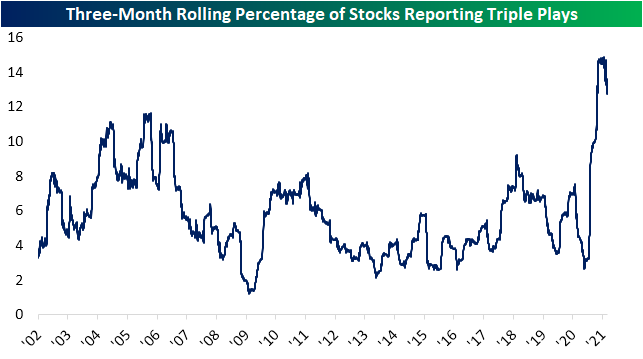

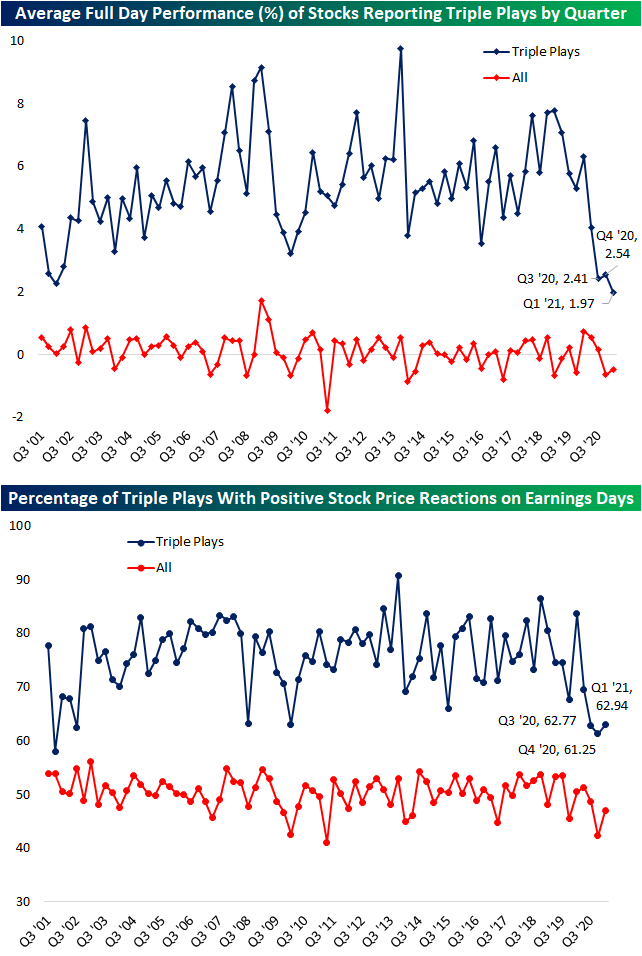

Although there are still a decent number of reports scheduled to come out over the next few weeks especially from major retailers, the pace of earnings slows significantly as Walmart’s (WMT) results out this morning marked the unofficial end of earnings season. With earnings season now more or less in the rearview, taking a look back at this past season, triple plays continued to come in at historically strong levels. A triple play is when a company reports EPS and sales above analyst forecasts while also raising guidance, which indicates a strong fundamental background for a company. In the chart below, we show the 3-month rolling percentage of stocks that are reporting triple plays. The past year has seen this reading skyrocket whether it be on account of dour forecasts and/or business quickly bouncing back from the pandemic. Even though the rate of triple plays did peak earlier in the year, currently, it sits around 14% which is still well above any reading prior to the past year.

In aggregate, elevated beat rates this earnings season have been met with a yawn in terms of stock price reactions, and that has especially been true of the gold standard of beats: triple plays. As shown below, the average full-day performance on the earnings reaction day of those stocks that reported triple plays this season was only a 1.97% gain. While positive and much better than the 48 bps average decline for all stocks reporting this season, it does set a record for the worst collective reaction to triple plays of any earnings season going back to 2001 when our Earnings Explorer data begins. The past two quarters have similarly been met with historically weak reactions, but this past quarter has blown those out of the water. On the bright side, the percentage of triple plays that rose on their earnings reaction day did rise to 62.94% from 61.25%. That is the highest reading of the past few quarters, but again, is a historically muted reaction.

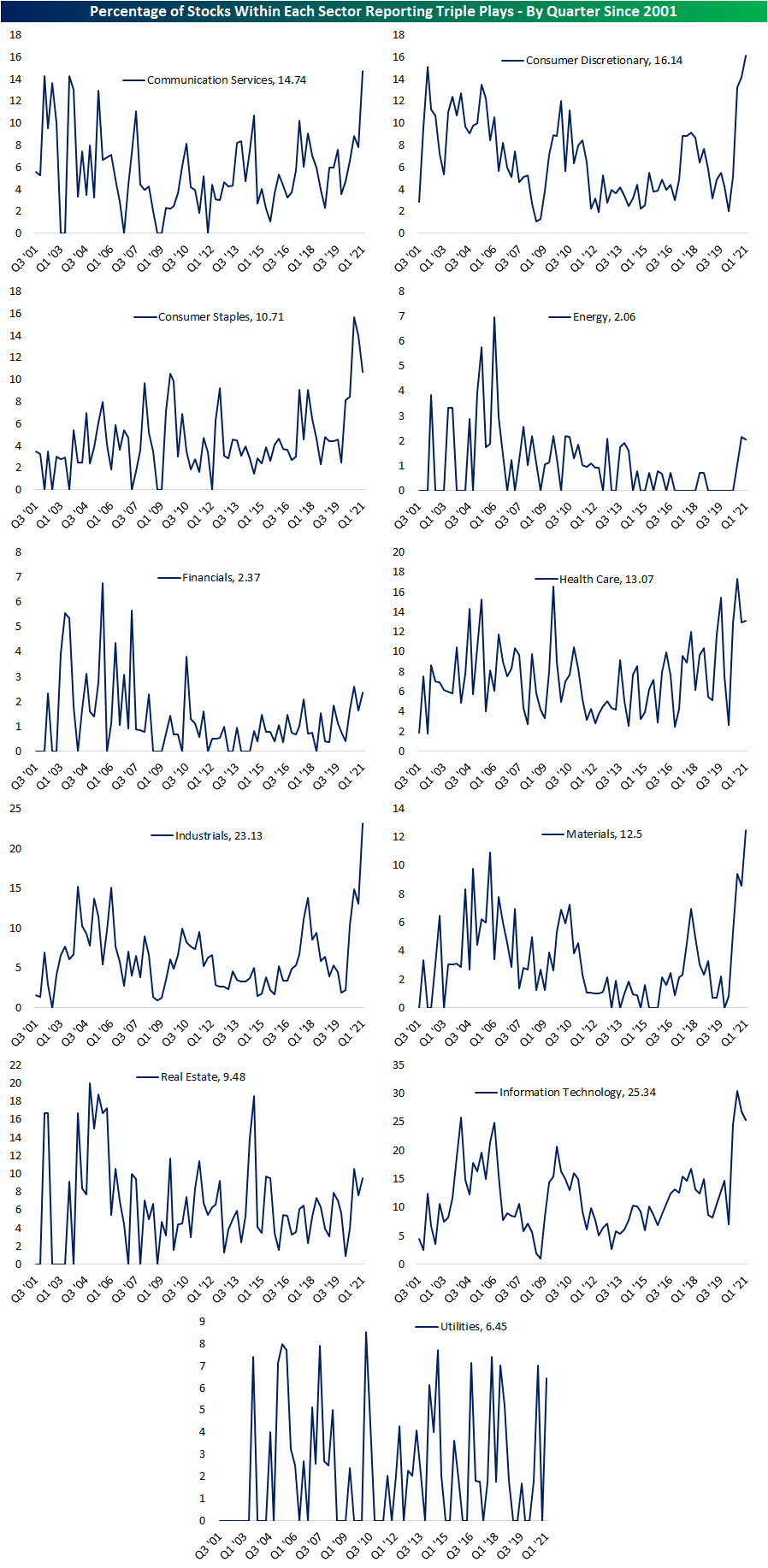

In the earlier days of this past earnings season, we had highlighted one other interesting trend regarding recent triple plays: it hasn’t been just one sector or group with strong beat rates, rather a high percentage of stocks are reporting triple plays regardless of their sector. Even with the aggregate percentage of stocks reporting a triple play having peaked, that strong breadth was still evident through the end of the current earnings season. The percentage of stocks reporting triple plays within the Communication Services, Consumer Discretionary, Consumer Staples, Industrials, Materials, and Tech sectors were all at a record high or had pulled back but were still above any reading prior to the past year. Some of the more remarkable readings came from Consumer Discretionary, Industrials, and Materials which have been well above any historical precedent. Even for sectors that did not necessarily see a large share of their stocks report triple plays compared to times in the past, like Energy or Financials, this quarter’s readings were still some of the strongest of the past several years. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – The Supply Side of Housing: Lumber, Labor, & Land

Chart of the Day – Still Room For Improvement in Housing Starts

Bespoke’s Morning Lineup – 5/18/21 – The Taxman Goeth

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“You don’t pay taxes; they take taxes.” – Chris Rock

After inflation was the theme last week, this week housing takes center stage. Yesterday it was NAHB sentiment and today we get reports on Housing Starts and Building Permits. Levels for the month of April are expected to come in roughly the same as in March, but we’ll be watching for any signs of a slowdown due to the rising costs of inputs. Outside of these two reports, there is no other data on the docket.

In earnings news, Walmart (WMT) marked the unofficial end to earnings season with a stellar report, and unlike a lot of other companies that have reported positive results and sold off, so far WMT is actually trading higher.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic and earnings data, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

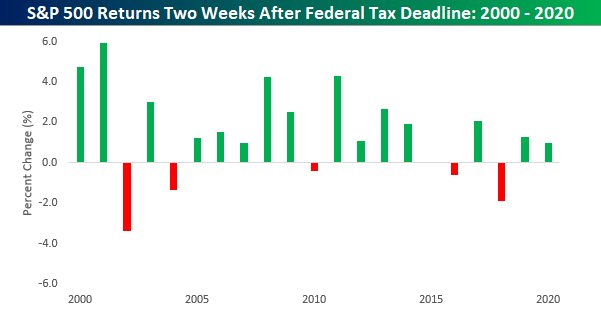

The saying goes, ‘better late than never”, but when it comes to taxes and the delayed deadline for Federal payments most would prefer “better never than late”. Due to the one-month delay and the fact that the 15th of May fell on a Saturday, yesterday (5/17) was the Federal Tax deadline, so if you haven’t filed your return or an extension yet, you are now officially late. You may not be aware, but when it comes to the Federal tax deadline, the last two decades have seen a relatively clear trend of short-term weakness in equities leading up to the tax deadline and strength after.

The chart below shows the S&P 500’s performance in the two after the Federal tax deadline for every year since 2000. In the 21 years before 2021, the S&P 500 has only been down in the two weeks after the tax deadlines five times.