B.I.G. Tips – June 2021 Seasonality

Bespoke’s Morning Lineup – 5/28/21 – Salesforce.com Drives the Dow

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Focus on the 20 percent that makes 80 percent of the difference.” – Marc Benioff

It seems weird to say that a 5% rally in Salesforce.com (CRM) is driving the Dow higher today, but since it was added to the index late last August, Marc Benioff’s company is on pace for one of its largest one-day gains accounting for about half of the Dow’s pre-market gains this morning.

In economic data, it’s been a busy morning but so far there hasn’t been much in the way of surprises. The only other releases on the calendar are Chicago PMI at 9:45 and Michigan Confidence at 10 AM. With the holiday weekend on the horizon, look for this afternoon’s trading to be on the quiet side.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of some notable earnings reports, major economic data out of Asia and Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

Although equity futures are higher this morning, the crypto space is under pressure heading into the long weekend following some cautionary comments from BoJ Governor Kuroda (who says crypto isn’t uncorrelated?). It’s been an interesting week for bitcoin and ether. Throughout the week, they made multiple attempts to break above short-term resistance, but each one was met with selling. In bitcoin’s case, the resistance level was right around $40,000 while for ether it was $2,900. After several unsuccessful attempts at sealing the deal, it looks like traders in both crypto assets have given up heading into the weekend.

More and More Investors Are Looking For A Correction

The S&P 500 has been hovering around 0.5% below its record highs this week, but without a true test of those highs, sentiment has not moved very far. The American Association of Individual Investors‘ weekly reading on bullish sentiment fell from 37% last week down to 36.4%. While that is the second week in a row with an absolute move less than a full percentage point in size, the marginally lower reading does leave bullish sentiment at the lowest level since the end of October.

Bearish sentiment moved by even less, only rising 0.1 percentage points. At 26.4%, it still is below the reading of 27% from the first week of the month. Outside of that reading, that is the highest level since February.

This week’s moves left the bull-bear spread little changed at 10. That’s down 0.7 points from last week but still above the 9.5 reading from two weeks ago.

Once again, the highest percentage of investors are in the neutral camp at 37.1%. As was the case last week, that makes for the highest level in neutral sentiment since the first week of 2020 when it stood north of 40%.

Pivoting over to sentiment for equity newsletter writers measured in the Investors Intelligence survey, there were some more interesting moves. Bullish and bearish sentiments were not necessarily anything to gawk at similar to the AAII survey. Bullish sentiment has been on the decline with this week’s survey showing a 3 percentage point drop to 51.5%, the lowest level since March 10th. Meanwhile, bearish sentiment moderated from 17.2 to 16.8%. That was the same level as the start of the month.

The percentage of respondents “looking for a correction” was more notable. Rather than simply asking whether or not respondents foresee a correction in the technical sense on the horizon (a 10% decline from a high), Investors Intelligence defines a newsletter writer as “looking for a correction” when they are bullish on a list of stocks but at a lower price point. Coming in at 31.7%, the reading is a few percentage points above the historical average of 27.6% and is in the top quartile of the historical range. In other words, it is an elevated reading albeit far from without precedence. What is more significant is that it has been over a year since this part of the survey has seen these levels.

In the history of the survey dating back to 1963, there have only been eight other times that the percentage of newsletter writers looking for a correction has crossed above 30% for the first time in at least a year. The most recent of these was in April 2009. In the table below we show the S&P 500’s performance in the year following those occurrences. As shown, performance has been generally positive across those past instances with average gains over the following weeks and months and moves higher at least 75% of the time one month, three months, and one year out. Additionally, while there were two times, 1982 and 2009, in which the S&P 500 rallied over the following year without looking back, there were another two times, 2001 and 2007, that at the following years’ lows, the S&P 500 would end up lower by double-digit percentage points. Click here to view Bespoke’s premium membership options for our best research available.

The Bespoke 50 Top Growth Stocks — 5/27/21

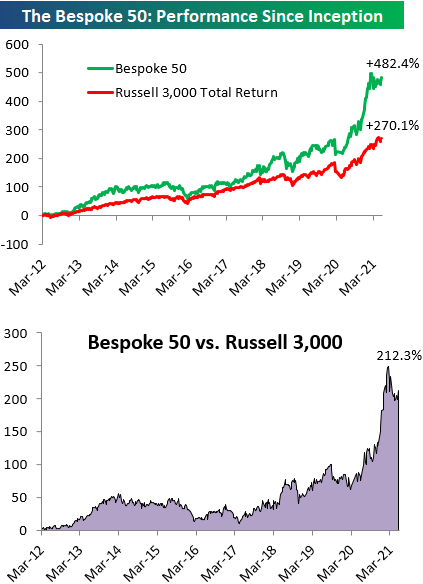

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” list is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 482.4% excluding dividends, commissions, or fees. Over the same period, the Russell 3,000’s total return has been +270.1%. Always remember, though, that past performance is no guarantee of future returns. (Please read below for more info.) To view our “Bespoke 50” list of top growth stocks, please start a two-week trial to either Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, fees, or dividends are not included in the performance calculation. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities.

Bespoke’s Weekly Sector Snapshot — 5/27/21

Bespoke’s Top Earnings Triple Plays

Here at Bespoke, our job is to identify winners and losers, and one of the ways we try to find earnings-season winners is through our list of “triple plays.”

Long-term Bespoke subscribers know how much we like triple plays, but for those that haven’t heard of the term, we came up with it back in the mid-2000s for companies that beat analyst EPS estimates, beat analyst revenue estimates and also raise guidance. Investopedia.com is one of the best online resources for financial markets education, and they’ve given us credit for coining the “triple play” term on their website. We consider triple play stocks to be the cream of the crop of earnings season, and we are constantly finding new long-term buy opportunities from this basket of names each quarter.

We’ve been covering epic earnings strength versus estimates for a couple of quarters now, but it’s worth mentioning again that companies are reporting triple plays at the highest rates we’ve seen since we began tracking this data in the early 2000s. Since the Q1 2021 earnings season began on 4/12/21, we’ve seen 272 earnings triple plays. Prior to COVID, a normal earnings season would see 50-100 triple plays. Given their high numbers, triple play stocks are not seeing the same type of upside price reaction that they used to see. We view this as an opportunity to find the triple plays that may still offer upside but haven’t seen it yet due to broader market trends.

In this regards, we’ve gone through the price charts of all 272 triple plays to find the ones that look the best either from a short-term or long-term technical perspective. In all, we identified 49 triple play stocks that we cover in our just-published “Top Triple Plays” report. This report is not meant to be a “buy list” but rather an idea generator that you can use as a starting point for further research into the names we’ve identified.

Learn how to see the 49 stocks in this quarter’s Top Triple Plays report below!

See our Top Earnings Season Triple Plays by signing up for a Bespoke Premium membership now. Click this link for a 14-day trial!

Chart of the Day: Manufacturing Hard Data Slows

Initial Jobless Claims Only 150K Above Pre-Pandemic Levels

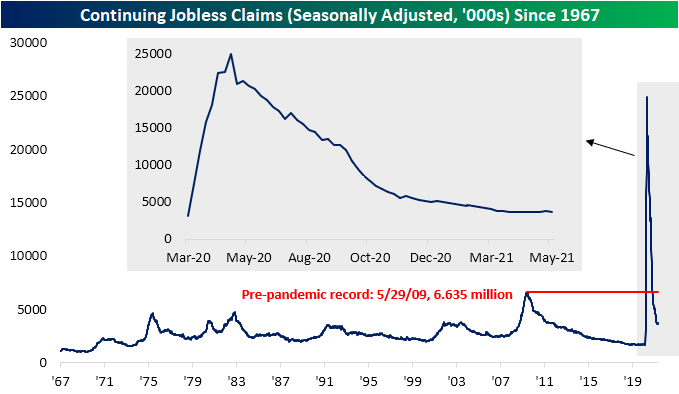

For the fourth week in a row, initial jobless claims have made a move lower coming in at 406K. That is down 38K from last week’s unrevised level of 444K. That brings claims to the lowest level of the pandemic, and just 150K above the last sub-one million print in March of last year.

On a non-seasonally adjusted basis, the picture is equally as positive. Claims through the regular state program fell to 420.5K which is again the lowest level since the start of the pandemic. Including other programs no longer significantly increases the total claims count either. PUA claims came in below 100K for the second time in a row this week as they printed at 93.5K. As we noted last week, some states have announced plans to do away with programs like PUA, so this number will become more and more negligible.

Relative to initial claims, seasonally adjusted continuing claims (which are lagged an additional week) have not been trending as positively over the past few months as the series has been moving sideways to even slightly higher. This week saw some respite in this trend as seasonally adjusted regular state continuing claims fell by 96K to 3.642 million. That is still 2K above the low from 2 weeks ago, but the week over week improvement was the largest since the week of March 12th when continuing claims had fallen 282K.

Before seasonal adjustment, the picture is much better. Regular state claims through May 14th have fallen for 12 weeks in a row with the 150K drop this week the largest week-over-week decline since March 12th. Factoring in other programs for a more complete picture delays the data yet another week, but it does paint an even more optimistic picture. After rising at the start of the year, total claims across all programs peaked during the week of February 19th at 20.7 million. In the roughly three months since then, claims have generally ground lower having fallen by 4.9 million. While regular state claims have dropped by 1.18 million in that time, PUA claims have been a bigger contributor to the total decline having erased 1.87 million claims. Pandemic Unemployment Assistance and Extended Benefits programs have also been significant contributors to the overall decline in claims. Combined, these two programs have seen a 1.8 million drop. In other words, while it may not be apparent from the headline seasonally adjusted number, continuing claims are improving alongside initial claims. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/27/21 – Jobless Claims at Pandemic Low

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I have thought it my duty to exhibit things as they are, not as they ought to be.” – Alexander Hamilton

We’ve just received a slug of economic data, and it was a mixed bag. Durable Goods Orders saw a pretty big miss at the headline level (-1.3% vs 0.85) but were slightly better than expected after stripping out Transportation (1.0% vs 0.7%). Jobless claims came in better than expected on both an initial (406K vs 425K) and continuing basis (3,642K vs 3,680K). The second look at Q1 GDP was unchanged at 6.4%, but the Price Index and Core PCE both came in higher than expected.

Despite the stronger than expected inflation data, futures have actually seen a modest bounce following the data.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of some notable earnings reports, major economic data out of Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

The charts below come from page seven of our Morning Lineup and show the daily COVID case trends for various regions around the world. The country that stood out more than any others in recent weeks has been India, but the daily number of new cases has nearly been cut in half as the surge part of the recent wave burns itself out. Looking at other major countries/regions, most have been on the decline, but there has been a modest uptick in cases in both Brazil and Chile although neither country is close to its highs from the Spring. Meanwhile, here at home the daily number of new cases continues to shrink and is now below 100 new daily cases per million.