Bespoke’s Morning Lineup – 5/12/74 – INFLATION

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Inflation is not all bad. After all, it has allowed every American to live in a more expensive neighborhood without moving.” – Alan Cransto

Inflation has its name in lights this morning as gas prices surge across the country as the Colonial Pipeline outage threatens energy supplies on the East Coast of the United States. April CPI was just released, and while economists’ forecasts called for a m/m increase of 0.2% at the headline level and 0.3% on a core basis, the actual readings came in at 0.8% and 0.9%, respectively. The headline reading was the biggest gain since 2009, while the core reading hasn’t been this high since the early 1980s. On a y/y basis, headline CPI was 4.2% (highest since 2008) and core CPI was 3.0% (highest since 1996). While the high levels were expected, not many were expecting them to be this high.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight earnings reports and economic data, a look at some key market charts from Asia and Europe, EZ Industrial Production, as well as the latest US and international COVID trends including our vaccination trackers, and much more.

Technology may have received the most attention for this week’s declines, but it has been far from alone. The chart below summarizes the week-to-date performance of the S&P 500 and each of the eleven sectors through Tuesday’s close. Over the last two days, Technology isn’t even the worst performer. That title belongs to Consumer Discretionary which is down 2.86%. Not far behind, Technology is down 2.77%, while Energy is down 2.61%. The only other sector down more than the S&P 500 is Communication Services (-2.43%). On the upside, or more accurately, the less bad side, Materials, Consumer Staples, and Utilities are all down less than 0.20%. It’s interesting to see that the two commodity-related sectors – Energy and Materials both have vastly different returns WTD.

Daily Sector Snapshot — 5/11/21

Small Businesses Growingly Concerned About Inflation

In today’s Morning Lineup, we covered some of the details of this morning’s release of the NFIB’s monthly survey on small business sentiment. The survey showed rising prices, tight labor market conditions, and overall improving demand.

The NFIB also surveys businesses on what they consider to be their single most important issues. For the majority of businesses, cost or quality of labor and government requirements or taxes are the most prevalent. In total, 64% of businesses reported one of these as the biggest problem. Meanwhile, the percentage of businesses reporting weak sales as the most pressing issue continues to fall which is indicative of a further recovery in demand. One other interesting decline was in the issue of competition from ‘big business’. Only 7% of businesses reported this as their biggest problem which is the lowest reading since October 2017. While up 1 percentage point in April, cost or availability of insurance is also still around some of the lowest levels of the past decade. While that mention of costs has ticked only slightly higher similar to the cost of labor which rose 1 percentage point in April, inflation more broadly is increasingly on the minds of small businesses. 6% of businesses reported higher prices as the biggest issue which is triple the reading from February and is the highest level since August 2013.Click here to view Bespoke’s premium membership options for our best research available.

“Druck” vs the Fed

Futures were already weak Tuesday morning but then took another leg lower following a CNBC appearance by Stanley Druckenmiller where he discussed his WSJ op-ed outlining his views of Fed Policy titled “The Fed is Playing With Fire”. Some of the excerpts of the column give a little more detail as to Druckenmiller’s opinions of Fed policy.

Yet the Fed regularly distorts the most important price of all—long-term interest rates. This behavior is risky, for both the economy at large and the Fed itself.”

America’s deep divisions also make the central bank’s independence crucial. Fighting inequality and climate change are very far from the Fed’s central mission. There’s a reason central bankers are supposed to be unpopular.

Fed policy has enabled financial-market excesses. Today’s high stock-market valuations, the crypto craze, and the frenzy over special-purpose acquisition companies, or SPACs, are just a few examples of the response to the Fed’s aggressive policies.

What made the timing of Druckenmiller’s op-ed interesting is the fact that it came on a day that numerous FOMC officials were already scheduled to speak. Despite Druckenmiller’s criticism, though, FOMC officials were unfazed. Below are just a sampling of the headline comments made throughout the day.

Mester: Want to see more, broader progress in recovery.

Brainard: Uncertainty remains; jobs, inflation far from goals.

Daly: Hopeful economy will climb out of virus hole by next year.

Bostic: Long way to go…appropriate to stay in accommodative mode.

Harker: Let’s see how the job market heals before talking taper.

Kashkari: Long way from maximum employment.

Bullard: Too early to talk taper.

Over the last several months, there’s been an interesting divergence between Fed officials and market expectations for Fed policy. While the Fed says one thing (‘steady as she goes), the market is having trust issues and keeps thinking that the Fed will start to remove accommodation sooner than expected. Whether or not you agree with their policies, you have to ask yourself, do the excerpts above sound like the type of comments you’d hear from a Fed that was losing confidence in the current state of monetary policy? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Stock Scores — 5/11/21

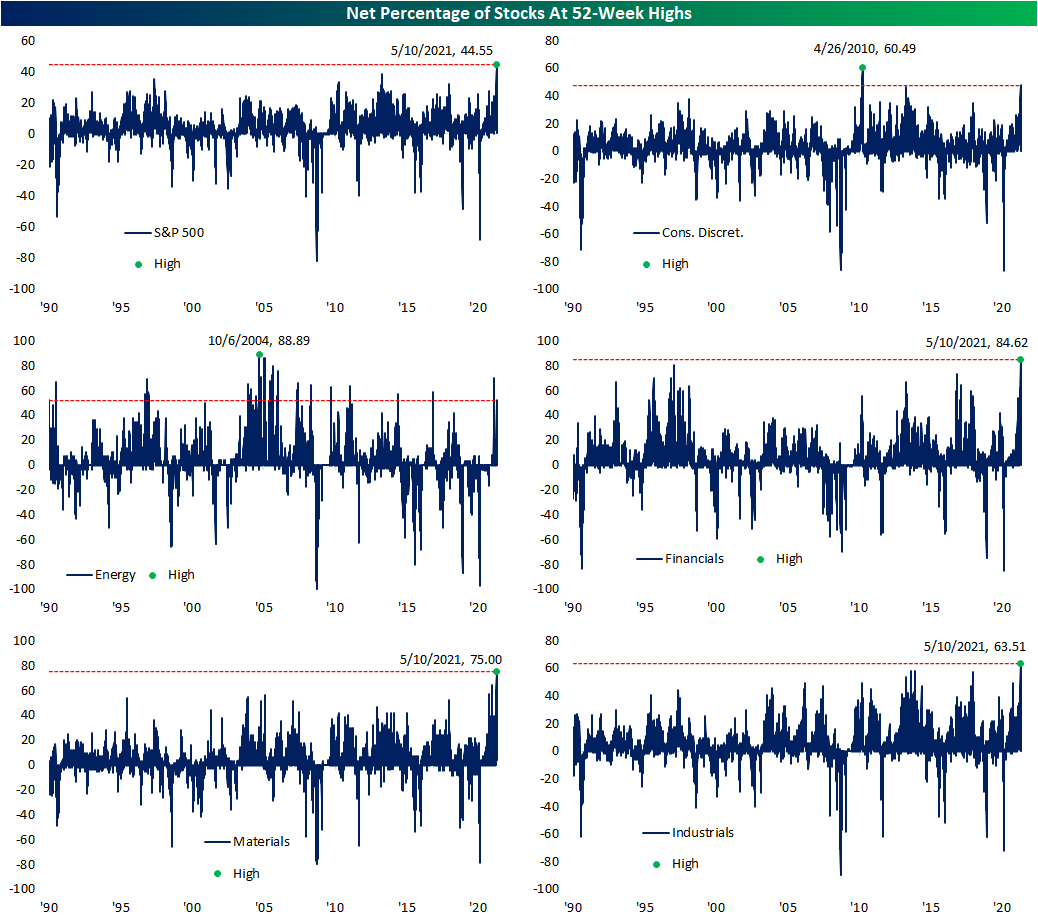

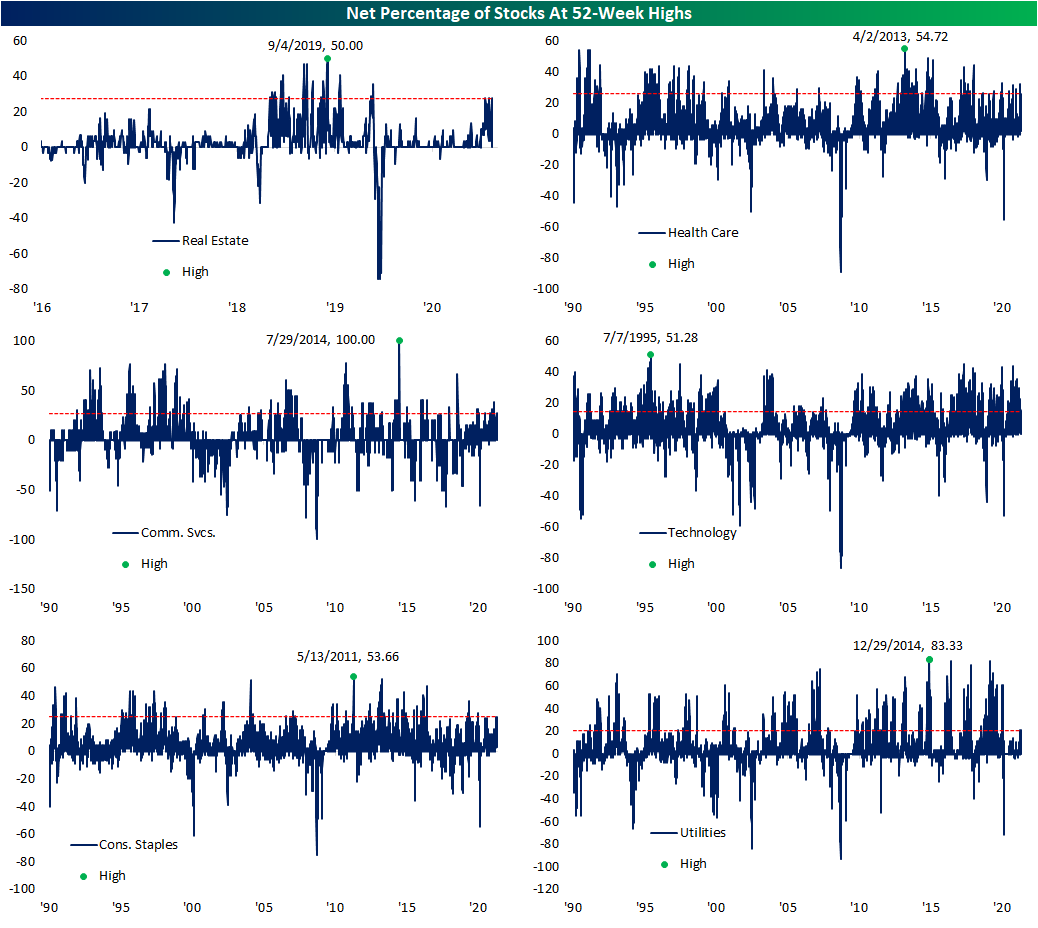

Record Highs in 52-Week Highs

Although equities are lower today, for a large portion of stocks these declines represent reversals from 52-week highs. In the charts below, we show the daily readings in the net percentage of stocks reaching 52-week highs across the S&P 500 and multiple sectors since 1990. While not even 1% of S&P 500 stocks have reached a 52-week high today, yesterday a net of 44.55% of stocks did so. Going back to at least 1990, that is the strongest reading in net new highs on record. The same could be said for Materials, Industrials, and Financials. The latter saw the strongest reading of these as 84.62% of the sector hit a 52-week high. Materials were also strong with three-quarters of the sector at a new high while the Industrials sector reading was lower but also at an impressive 63.51%.

While they did not hit a record high, Consumer Discretionary and Energy both also saw elevated readings of 47.62% and 52.17%, respectively. For Consumer Discretionary, the only higher readings came in April of 2010 with some similar but slightly lower readings also in the fall of 2013. Meanwhile, just over half of Energy stocks were at a 52-week high, and although the reading as recently as March was higher almost hitting 70%, yesterday still managed to land itself in the 99th percentile of all days since 1990.

As for other sectors, the readings yesterday were not as close to record highs but were still impressive. Just about every other sector saw a reading in the top 5% of all periods with a single major exception: Technology. Only 14.67% of stocks in the sector traded at a new high yesterday. While that is still indicative of solid breadth in the 88th percentile of all periods, it pales in comparison to the rest of the S&P 500. Click here to view Bespoke’s premium membership options for our best research available.

Russell 3000 50/50 Club

If the performance of GameStop (GME) this year has shown us anything, it is that it’s been a crazy year for the stock market.

GME is not the only example either. Within the Russell 3000, there are actually 100 stocks that have dropped 50% or more from their 52-week highs but are still up over 50% from their respective 52-week lows. That’s quite a rollercoaster!

The table below shows the 19 stocks in the Russell 3000 that have market caps in excess of $4 billion that fit the criteria mentioned above. While some of these stocks are biotech names that you may not have heard of, many of them are familiar sounding and even household names. Topping the list is Zoom Video (ZM). Despite falling more than 50% from its 52-week high, the stock is still up over 80% from its 52-week low and has a market cap of just under $85 billion. Right behind ZM, Peloton (PTON) is still up over 100% despite falling just over 50%. Next on the list are two Archegos stocks – ViacomCBS (CBS) and Discovery (DISCA). Other names you’ve likely heard of include Novavax (NVAX), GME, Plug Power (PLUG), Microstrategy (MSTR), AMC, and Stitch Fix (SFIX). Click here to view Bespoke’s premium membership options for our best analysis available.

Bad Starts to May for the Nasdaq and Russell 2000

One week ago in our Chart of the Day, we noted how the Nasdaq 100 was having a rough start to May. One week later that has continued to be the case as the declines keep coming. Looking at the Nasdaq Composite (which has a longer history than the Nasdaq 100) the index is down again today as of this writing which leaves it down nearly 5% month-to-date. From a seasonal perspective, early May is not exactly the best time of year, but even with that in mind, since the index began in 1971, that ranks as the second-worst performance through the first seven trading days of May on record. Only 2000 saw weaker performance in the same time span, but it was much larger at nearly twice the magnitude of this month’s drop. Additionally, while the decline MTD is steep, 2000 saw a much larger decline that was an entire 4.5 percentage points larger than this year.

So far this month, other major US indices are also lower with the exception of the Dow which is still up 0.72% MTD even after the past couple of days of declines. That is the best start to any May since 2018 and is roughly twice as strong as the average performance through the first seven trading days of all Mays since 1971. The S&P 500, on the other hand, is lower month to date but that 1.33% decline does not really stand out compared to past years as it does for the Nasdaq or the small-cap Russell 2000. The Russell 2000 more closely resembles the Nasdaq. It is on pace for a 3.64% decline MTD which like the Nasdaq is the worst start to the month of May since 2000. The only other years that come close to as weak in terms of performance were declines of over 3% in both 2012 and 1979. Click here to view Bespoke’s premium membership options for our best research available.