Daily Sector Snapshot — 6/22/21

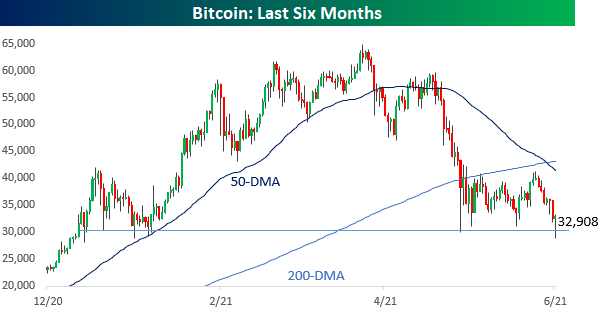

Bitcoin Hangs on to 30K

It has been a roller-coaster ride for bitcoin today. After breaking below $32K, then $31K, $30K, and $29K all within a matter of hours, buyers stepped in and prices rebounded back above $32K. Over the course of the day, bitcoin prices were down over 11% versus the prior day’s close but have rebounded more than 14% off the intraday lows. A 10% intraday decline coupled with a 10% intraday bounce is practically unheard of in the equity markets, but for bitcoin, it has become increasingly common. This year alone, today’s reversal marks the fifth such intraday rebound of 10%+ following a 10%+ intraday decline, although it only happened twice in 2020 and three times in 2018.

As far as bitcoin’s price chart is concerned, today’s bounce represents another in what is becoming a long list of testing the $30K level. It happened twice back in January before bitcoin rocketed above $60K and has now happened four times since prices started to fall in early May. When it comes to technicals, the more often a security tests support or resistance, the weaker it is considered to become. If that holds true with bitcoin, a few more tests of that level in the short term could open the floodgates to the downside.

Even after today’s bounce in bitcoin, its price is still over 48% below its all-time high reached just over two months ago in mid-April. While 48% sounds pretty steep, it looks like a walk in the park compared to prior drawdowns. Following peaks back in early 2011, early 2013, late 2013, and late 2017, bitcoin’s price fell anywhere from 70% to 93% each time. Even more surprising is the fact that since the start of 2011, bitcoin’s average percentage spread between its closing price on a given day and the all-time high as of that date was 48% – which is right where it is now. Click here to view all of Bespoke’s premium membership options and sign up for a trial.

Bespoke Stock Scores — 6/22/21

New Orders Support Richmond Fed Manufacturing

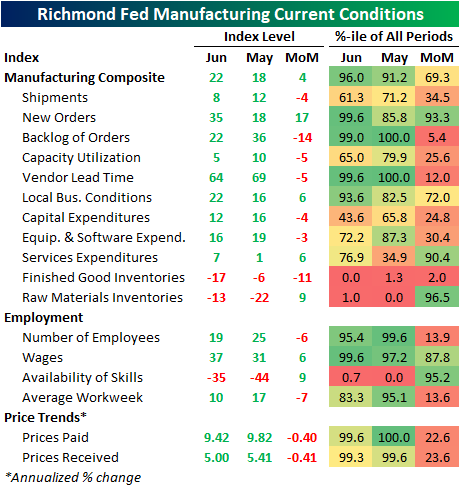

After disappointing readings from the Empire and Philly Fed releases last week, the Richmond Fed provided a sigh of relief for US manufacturing as this morning’s release moved up to 22 versus estimates for an unchanged reading of 18. The four-point increase month over month brings the index into the top 5% of all readings since the survey began in 1993. That indicates the region’s manufacturing sector continued to grow at a historically rapid rate in the month of June.

In spite of the strong headline reading, breadth in the report was actually negative with almost twice as many sub-indices falling month over month versus making a move higher. A huge 17 point jump in New Orders was to thank for the stronger reading in the headline number making up for the broad declines across categories. Although many indices fell versus May, the vast majority remain in expansionary territory. Even those in which that was not the case, like those for Inventories and Availability of Skills, the negative readings are not necessarily signs of weakness either.

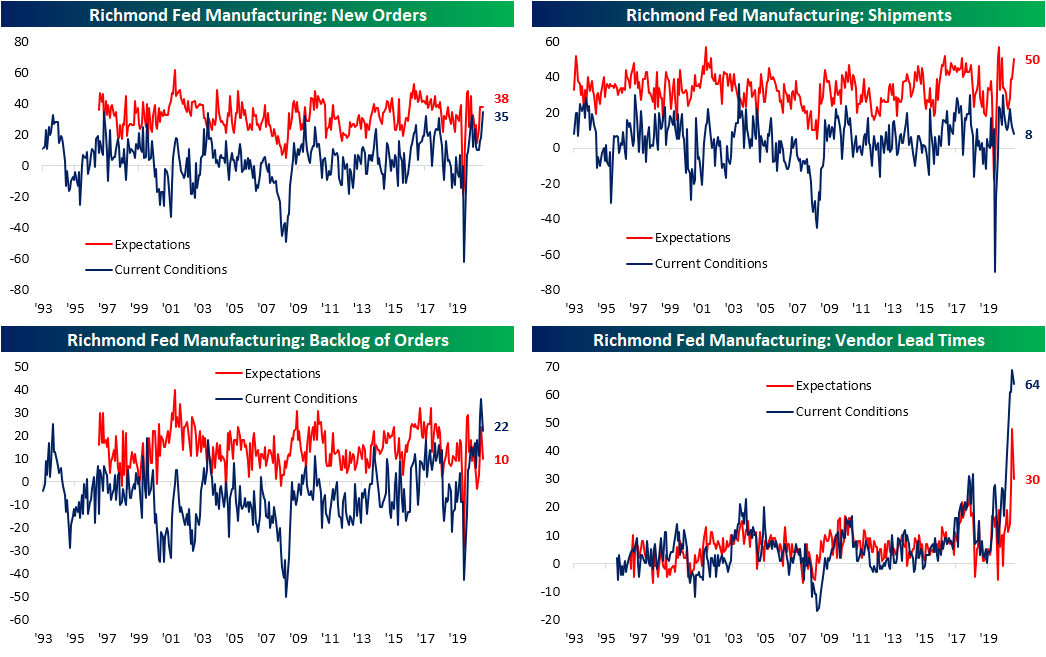

As previously mentioned, New Orders ripped higher rising 17 points to 35, the joint highest reading on record alongside the September 1997 reading. As the component with the largest weight (40%), that bolstered the composite reading in a big way more than making up for the declines in Shipments and Number of Employees. Even though New Orders accelerated considerably, Order Backlogs saw a massive deceleration as that index dropped 14 points. Even with that decline, the index is still in the 99th percentile of all months. Although backlogs are growing at a historic pace, shipments have yet to pick up as that index fell 4 points to the lowest level in a year.

As for why shipments are not growing at the same pace as orders, supply chain issues seem to be part of the problem. The Vendor Lead Times index (higher readings indicate longer lead times and vice versa) has backed off of the record high but is still far above any level with historical precedence. In addition to the improvement in current conditions for this category, expectations also saw a massive 18 point decline; ranking as the second-largest month-over-month decline on record behind a 23 point drop last June. That optimism in the improvement in supply chains was also likely the reason for the improvement in optimism for shipments. Diverging from the current conditions index, that optimism reading rose 11 points to the top 2.5% of all readings.

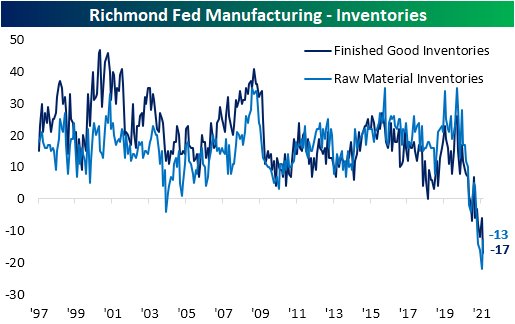

Those long lead times are also impacting inventories which in turn is impacting shipments. Finished Good Inventories are at a record low after falling 11 points MoM while the Raw Material Inventories index bounced, but is also contracting at a rate unparalleled with any other period in the survey’s history. Putting aside the supply chain headwinds, the need to rebuild those inventories should be a positive for growth going forward.

Long lead times, low inventories, and strong demand can only mean one thing: higher prices. Input prices pulled back slightly but are still rising at an unprecedented 9.42% annualized rate. Those higher prices have been passed onto consumers with prices received growing at 5% annualized, though, that is lower than the 5.41% rate last month.

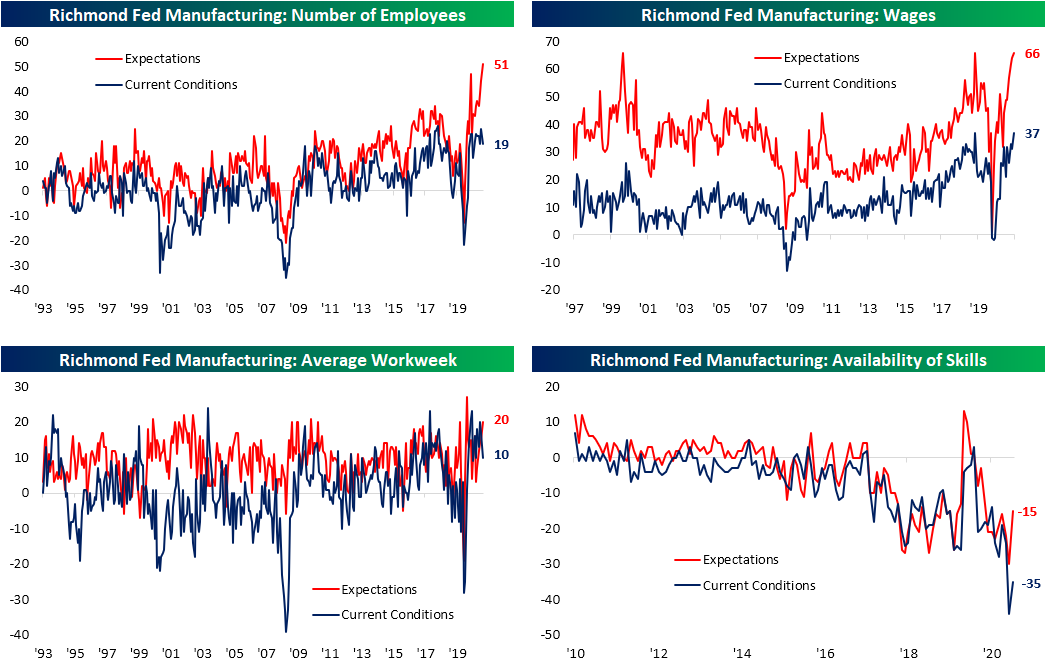

Perhaps the most optimistic area of the report was in regards to employment. While the current conditions index fell, expectations for the Number of Employees index hit a record high in June. That disconnect between actual increases in employment and the desire to hire has to do with a lack of needed workers. The index for Availability of Skills rose 15 points month over month, one of the biggest one-month upticks to date, but that leaves the index well below the past eleven years’ range when the Richmond Fed first began to survey on the topic. Taking action on that lack of labor supply, businesses are raising wages at one of the fastest clips on record, and expectations are not pointing to any slowdown in that trend. Click here to view all of Bespoke’s premium membership options.

Japanese Equities Swing Big

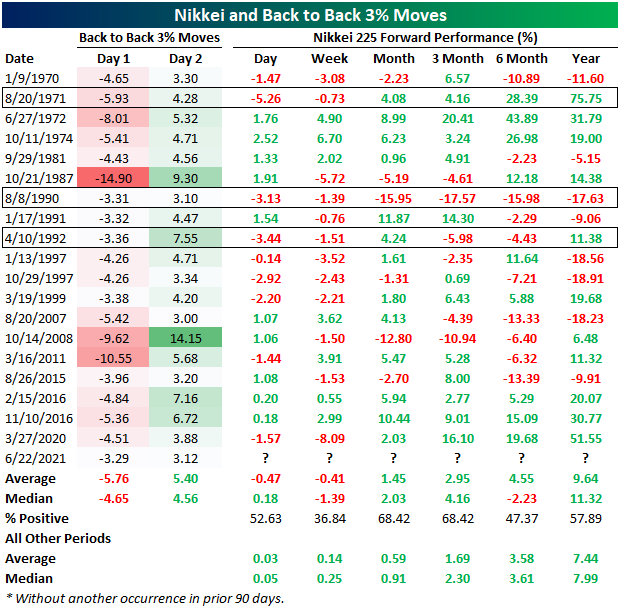

In today’s Chart of the Day, we detailed how the S&P 500 has swung down then up by over 1% in back-to-back sessions as the index sits just off of record highs. Over in Japan, the Nikkei has seen even more wild swings with a 3.29% decline yesterday followed by a 3.12% gain overnight. In terms of that decline yesterday, there was an even larger single-day drop as recently as February, but the bounce overnight marked the biggest single-day gain in a year and one week. The past couple of days also marked the first time since June of last year that Japanese equities fell at least 3% in one session and then rallied 3% or more in the following session.

In the chart below, we show the Nikkei going back to 1970 with every other time the index has experienced a similar-sized move. Such moves of a 3% decline one day and a 3% rally the next have been relatively uncommon. In total (including this week), there have been only 30 days with these types of back-to-back moves. Again, the most recent occurrences were on June 15/16th and March 26/27th of last year. Prior to that, there was not another occurrence since November 2016 in the wake of the US Presidential Election. While there have not been many of these instances in the grander scheme of things, they have occurred with some regularity with an instance every few years or so with the biggest gap between occurrences being in the early 2000s.

Given it has been over a year since we have seen such a move, in the table below we show each of the 19 past times in which the Nikkei fell at least 3% followed by a 3% or larger rally without another instance in the prior 3 months. For each occurrence, we show the Nikkei’s move over the next day, week, month, 3 months, 6 months, and year.

Only three of these instances—in 1971, 1990, and 1992—saw a similarly volatile session (defined as at least a 3% move) on the third day, and each of those saw a move lower. While it has not necessarily been common for that volatility to continue for a third consecutive day, in aggregate the next day has pretty much been a toss-up averaging a 47 bps decline (median 18 bps gain) with a positive move only slightly better than half the time. Weakness has most consistently been seen one week out as the Nikkei has experienced a median decline of 1.39%. The last occurrence in March of last year, in fact, saw the biggest decline one week out when the Nikkei fell over 8%. While there is again some underperformance six months after such moves, one, three, and twelve months later all have seen the Nikkei outperform the norm and make a move higher more often than not. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – It’s Flip Flop Season

Bespoke’s Morning Lineup – 6/22/21 – Some Positive Follow Through

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If you’re feeling good, don’t worry. You’ll get over it.” – Yogi Berra

Bulls look like they have a little more gas in the tank after yesterday’s big rally as futures are modestly higher. Crypto assets are another story, though, as bitcoin just broke through $31,000 and went tight through $30,000 after that. Treasury yields are modestly higher, but the 10-year yield still remains below 1.50%. There’s a decent amount of Fedspeak today with Mester, Daly, and Powell all on the calendar to speak between now and the end of the day. In terms of economic data, the only two indicators on the schedule are Existing Home Sales and Richmond Fed.

Read today’s Morning Lineup for a recap of all the major market news and events, an update on the decline in crypto assets, overnight economic data, and the latest US and international COVID trends including our vaccination trackers, and much more.

Yesterday’s rally in the S&P 500 saw the strongest breadth in terms of the advance/decline line (+459) since April 2020. Noth only was breadth notably strong, but it followed a Friday where breadth was notably weak (-401). With the net A/D reading on both days coming in above +400 or below -400, they both qualified as ‘all or nothing days’. All or nothing days in the market are uncommon enough, but it’s not often that you see a negative all or nothing day immediately followed by a positive one. The last time it happened was in early March 2020 just as the market was in the middle of the COVID crash, and there have only been 36 occurrences since 1990.

For the entire year so far, yesterday’s all-or-nothing day was just the sixth such occurrence so far this year putting 2021 on pace for 13. That’s a far cry from last year’s total of 43, and if the pace keeps up, it would go down as the second-lowest number of all or nothing days for a given year since 2007. The only other year during that span with fewer was 2017. One thing to remember, though, is that while the pace so far this year has been slow, as the last two trading days have shown, all or nothing days often tend to show up in bunches.

Daily Sector Snapshot — 6/21/21

Chart of the Day: Extremely Oversold Dow and Overbought NASDAQ 100

Memory Lane: The Best and Worst Days of This Week Through History

With a 500-point decline in the Dow last Friday and a 500-point gain today, volatility in the markets has picked up, but days like the last two pale in comparison to the most extreme up and down days of the upcoming week in market history. For these two extremes, we have to go all the way back to 1950 and 1931.

The worst market day of the current week in the history of the S&P took place on 6/26/1950 when the S&P fell 5.4%. Stocks jolted downward that day on the uncertainty surrounding the Communist invasion in Korea with North Korean tanks crossing over the 38th parallel and invading the South Korean capital of Seoul. President Truman condemned the ‘latest aggression in Korea in defiance of the Charter of the United Nations’ and pledged his full support of U.N. efforts to end the fighting. The nature of the support and whether American troops would be sent to Korea if the U.N. requested them, however, was left unanswered.

The fact that the Soviets were considered responsible for this aggressiveness brought into focus the fact that like Korea, Germany was a split country with a lack of military force in place to prevent a Soviet-sponsored proxy invasion. The worrying implications of the invasion resulted in heavy price action reminiscent of the fall of France on 5/21/1940 (-9.14%) as volume surged to the highest levels since that day.

The S&P’s decline on June 26th, 1950 had been preceded by a year-long bull run marked by a resurgence of public participation in markets. At the market open, imbalances were so wide between bids and offers that it took certain issues upwards of an hour to open for trading, and once they opened for trading, selling was exacerbated by stop-loss orders. Liquidations continued to come through the market in waves, with trading periodically coming to a standstill only to be interrupted by larger volumes of even more aggressive selling, with the low of the day being the close. How bad was the selling? For the entire day, only 59 of the 1,256 (4.7%) issues traded were up on the day. Radio Corporation was the heaviest traded issue of the day on 124,000 shares, slipping 2 1/4 points to a price of 19 5/8, Chrysler lost 7 to 73, and General Motors fell 6 3/8 to 90 1/8.

Selling in June 1950 continued right up through mid-July and the S&P dropped about 14% from its peak to trough. As bad as the day was, the market would erase this loss by 9/15, less than two months later, and it kept rallying from there. Click here to view Bespoke’s premium membership options.

The best market day of the current week in the history of the S&P took place on 6/22/1931 when the S&P rallied 10.5%. Over the weekend of 6/21/1931, President Hoover unveiled a proposal to put a one-year moratorium on upwards of a quarter billion dollars of World War I reparations and war debts owed to the United States. Hoover noted that “The purpose of this action is to give the forthcoming year to the economic recovery of the world and to help free the recuperative forces already in motion in the United States from retarding influences from abroad.” Wall Street initially loved Hoover’s plan to help alleviate the Great Depression in Europe, and investors, previously starved for good news, cheered the plan. Those Wall Street firms with international connections reported a surge in foreign demand for equities, and professional traders sought out the most shorted stocks and caught the shorts flat-footed squeezing them out of their positions. The brighter economic outlook also provided a lift to commodity prices.

Unfortunately, the bullish party ended early, and just as the losses from 6/26/1950 were erased within two months, the gains from 6/22/31 were gone by early September. Hoover’s moratorium, which didn’t have anywhere close to universal support in the US and Europe, didn’t pass in Congress until that December. In that ensuing period, though, Germany would have not just a currency crisis but a banking collapse as well, and then soon after Great Britain abandoned the gold standard. As optimistic as Wall Street was on 6/22/1931, all of the gains were erased by 9/8 of that year, and the market continued its slide right up through mid-1932 when it made the final Great Depression lows – 70% below where it closed on 6/22/31! Click here to view Bespoke’s premium membership options.