Daily Sector Snapshot — 7/27/21

Home Prices Soar to New Heights

May 2021 S&P CoreLogic Case-Shiller home price numbers were released today, and they showed a continued surge in home prices all around the country. The month-over-month gains of 2-3% are similar to what we used to see on a year-over-year basis prior to COVID, but now the year-over-year gains all stand in the teens and twenties. At the top of the list is Phoenix which saw home prices rise 3.75% from April to May and 25.86% from May 2020 to May 2021. Below is a table showing MoM and YoY gains for the twenty cities and the composite indices tracked by S&P CoreLogic Case-Shiller.

Home prices have surged nearly uniformly across the country since COVID first hit. As shown below, since February 2020, the composite indices are up 18-19%, while most cities are up between 14% and 21%. Chicago and New York have seen a slightly smaller jump in prices than the rest of the country. Miami, LA, Portland, Charlotte, Dallas, Tampa, Denver, San Francisco, and Boston are all up between 19-21% since COVID. Three cities stand out for even bigger price jumps. As shown, Phoenix, Seattle, and San Diego are up quite a bit more than the rest of the group with gains between 28-30%.

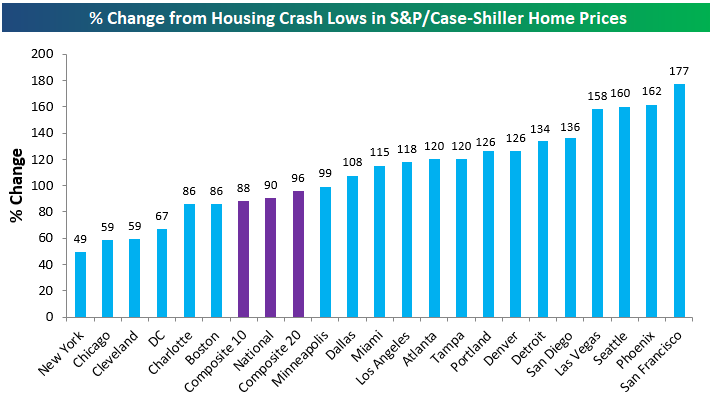

Below we show where home price levels are now versus their low-points after the mid-2000s housing bubble burst. Most lows for home prices were seen sometime between 2010 and 2012. As shown, the composite indices are now up 88-96% from their lows, while 13 of 20 cities are up more than 100% off of their lows. San Francisco is up the most at +177%, followed by Phoenix, Seattle, and Las Vegas (all up 150%+). At the other end of the spectrum, New York is up the least off its lows at +49%.

Notably, the post-COVID surge in home prices has left all but two cities above their prior all-time highs made during the mid-2000s housing bubble. Las Vegas and Chicago are the only two cities that have yet to eclipse their prior highs, but they’re now very close at just -1% and -3%, respectively. Miami, New York, and Washington DC are the three cities that have most recently made new highs.

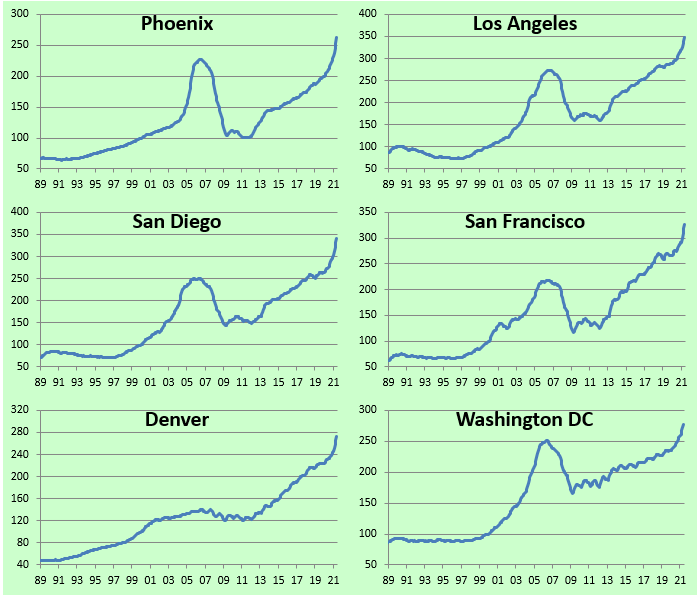

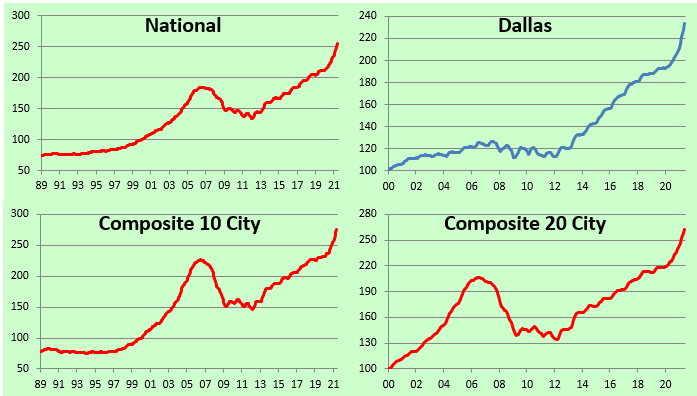

Below are charts showing historical levels of home prices across the S&P CoreLogic Case-Shiller indices. These really show how much prices have spiked post-COVID. Prices were already trending higher coming into the pandemic, but over the past 17 months, they look more like a rocket does at take-off than a passenger jet! Click here to view Bespoke’s premium membership options.

Bespoke Stock Scores — 7/27/21

Fifth District Manufacturing Flying

As we noted in our update of our Five Fed Manufacturing Composite featured in last night’s Closer, July regional Fed manufacturing indices have been showing broadly strong readings. The fifth and final Fed bank’s index released today out of, coincidentally enough, the fifth district added some fuel to the fire. The Richmond Fed’s composite reading was anticipating a 2 point decline from 22 last month. Instead, last month’s reading was revised higher by 4 points, and July saw another uptick to 27. That is the second-highest reading on record behind March 2008 when the composite came in a single point higher.

While the composite index as well as multiple other sub-indices like those for employment, prices, and inventories were at or just off of records, breadth in terms of the month-over-month changes was more mixed. Of the 17 sub-indices, 9 were higher, 1 was unchanged, and 6 were lower.

The area of the report to have seen the most significant deterioration in July was New Orders. The index fell 11 points to 25. Granted, that is coming off of a record high, and the July reading remained in the top 5% of all months. Order Backlogs also fell m/m although the decline was much smaller at only a single point. One interesting dynamic of the readings on Backlog of Orders is the difference between current conditions and expectations. Whereas the current conditions index is in the top 2% of all readings, the expectations component saw an 8 point decline and is now in the bottom decile of readings. Overall, while order growth decelerated, it is still running at a very strong clip.

As such, shipments were higher with that index rising 6 points to 21; the highest level since March. While shipments rose, there still appear to be significant disruptions to supply chains. Vendor Lead Times were unchanged in July just off of the record high from two months ago. While that reading has yet to see much improvement, the region’s businesses do seem optimistic that the lead times will improve but not necessarily return to normal down the road as expectations plummeted 12 points.

Given those supply chain disruptions, inventories continue to decline at record rates. The indices for both raw materials and finished goods fell to fresh record lows.

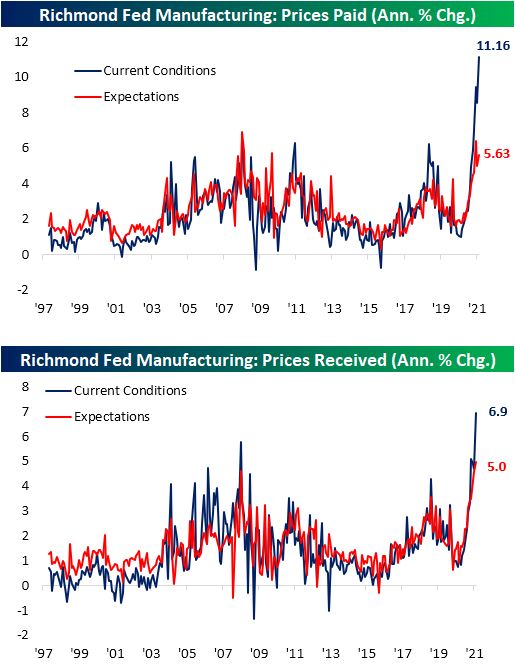

Meanwhile, unlike other regional Fed reports, prices paid have gotten little relief accelerating to an 11.16% annualized rate. Prices Received also rose to a record high of 6.9%.

In addition to input and final good prices, wages also came in at a record high alongside the index for Number of Employees. Forward-looking indicators point to continued strong labor demand going forward too as expectations for the Number of Employees also set a new record. Granted, that did not coincide with a record in the reading on wage expectations. In other words, higher pay has appeared to have enticed more workers but we are potentially hitting a limit on firms’ willingness (or ability) to pay higher wages. Additionally, alongside the higher wages and an increase in employment, there was an improvement in the Availability of Skills index which has been around record lows of late (meaning there has been a lack of candidates with necessary skills). Click here to view Bespoke’s premium membership options.

Chart of the Day: Hang Seng Two-Day Rout

Bespoke’s Morning Lineup – 7/27/21 – Now the Fun Starts

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Learn everyday, but especially from the experiences of others. It’s cheaper!” – John Bogle

Futures are indicated lower this morning as Chinese equities sink on continued fears of government crackdowns on that country’s tech sector. We’ve seen a bit of a bounce off the lows, though, as we get closer to the opening bell in the US. If that sounds familiar, it should since it was the exact same setup we had yesterday. While the issues in China are troubling for investments based in China, it should make US assets more attractive as capital flees that area of the world and looks for a safer home.

The week may have started off quietly yesterday, but the real fun begins today as there are not only a number of economic reports but some of the largest companies in the world will start releasing results. In the case of economic data, Durable Goods came in weaker than expected, but last month’s release was revised higher which somewhat netted this month’s weakness out. Later on today, we’ll get releases on Home Prices, Consumer Confidence, and the Richmond Fed Manufacturing sector.

On the earnings front, after the close, we’ll get reports from Alphabet (GOOGL), Apple (AAPL), and Microsoft (MSFT). On a combined basis, these three companies alone are expected to report combined revenues of about $175 billion! As if these three companies weren’t enough, we’ll also hear from Advanced Micro (AMD), Chubb (CB), Mondelez (MDLZ), Starbucks (SBUX), and Visa (V).

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

Yesterday was a big day for the crypto-currency markets, but Amazon’s denial that it would accept bitcoin payments by year-end has resulted in a giveback of some of those gains. Bitcoin’s rally yesterday also coincidentally (or not) stalled out right at the same levels it stalled out at in mid-June, so for people to feel more comfortable going forward, they’ll likely want to see prices trade and stay above $40,000.

In the case of ethereum it’s a similar story as the rally in ether stalled out right near $2,400 which is right where it stalled out earlier this month. The only difference between now and then is that while the last rally also failed at the 50-DMA, this time around, ether has still been able to hold above that level.

Daily Sector Snapshot — 7/26/21

Chart of the Day – FAAMG Stocks Erupt into Earnings

Dallas Manufacturing Slows With Some Silver Linings

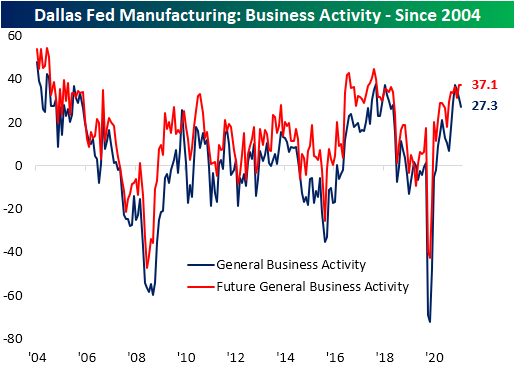

Manufacturing activity in the Dallas Fed’s region continued to expand at a strong clip in July albeit with some slowing. The index for General Business Activity came in at 27.3 rather than the expected increase from 31.1 to 31.6. That decline marked the third month in a row that the index has fallen since the multi-year high of 37.3 in April. While current conditions deteriorated, expectations have held up better with a modest decline of 0.2 points this month.

Most of the individual areas of the report saw a decline month over month in July with 12 of the 16 indices falling. Although most were lower, current levels remain broadly healthy with many in the top decile of their historic ranges. Expectations saw more broad declines with the only index to move higher month over month being Delivery Times. There were some particularly large double-digit declines in expectations for Shipments, Capacity Utilization, Inventories, and Prices Received.

One of the few areas of the report to see a move higher in July concerned new orders. The indices for New Orders and New Order Growth rate rose 0.1 and 2.4 points, respectively. Granted, those upticks still left both indices below their highs from earlier in the sping and expectations saw significant turns lower. While that could imply some slowing in demand, historic backlogs still exist. As shown in the bottom left chart below, outside of the spike in September 2005 and the past few months, the index for Unfilled Orders has never been higher even taking into account the declines over the past few months. Shipments also saw a small turn lower in July while the bigger move was in regards to expectations. Last month, expectations for shipments surged to the highest level since February 2006. This month, that reading reversed by 12.4 points; a month-over-month decline that ranks in the bottom 3% of all monthly moves.

Ironically, even though the reading on shipments worsened, supply chains appeared to have improved to some degree. Higher readings in the Delivery Time index indicate that products are facing longer lead times. Earlier this year the index surged to unprecedented levels, and while it still has a ways to go until it is back to normal, it did fall 7.2 points in July following a 3.2 point decline in June.

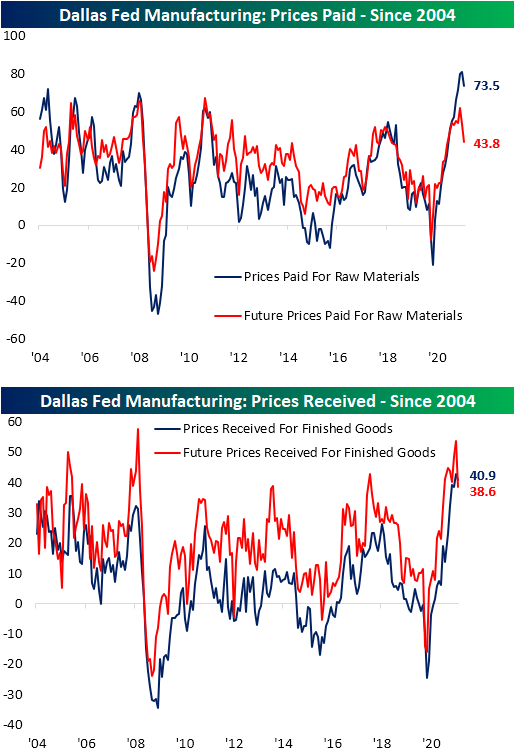

As with Delivery Times, prices have also found some respite after flying higher over the past several months. Prices Paid fell from a record high to 73.5 which is still the third-highest level of any month to date. Expectations also saw a sharp pivot lower falling 9.8 points to 43.8. That is at a similar level to three years ago. Prices Received are a similar picture pulling back from a record high to 40.9. Again even though this reading shows some slowing in price increases, there is no historical precedent for as high of a reading in the index. Additionally, expectations saw an even more dramatic decline as the index fell 15 points. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 7/26/21 – Big Week for Earnings

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“When the facts change, I change my mind.” – John Maynard Keynes

Futures are lower to kick off the week, but it’s nothing like last Monday and we’re also well off the lows from earlier. It’s a slow start, but we have a busy week of economic data ahead as well as a ton of earnings reports, and don’t forget about the FOMC meeting on Wednesday.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

There’s an old sketch from Saturday Night Live called “Mr. Short Term Memory” where Tom Hanks plays a character with a disorder where he has a limited short-term memory. As you might expect, the segment made for a few laughs when the character was in various situations like visiting a friend in the hospital or as a contestant on a game show. Looking at the market last week, it appears as though Mr. Short Term Memory is a guiding force in the market. Just a week ago, Dow futures were already down more than 500 points and the yield on the 10-year US Treasury was plummeting on concerns of rising COVID cases from the Delta variant. By Tuesday, though, those concerns were all water under the bridge as all of the major US averages not only finished in the green for the week, but they were all up over 1% as well.

Leading the way higher, the Nasdaq 100 (QQQ) rallied nearly 3% putting the index nearly 7% above its 50-day moving average. Even the Russell 2000 (IWM), which at one point on Monday was down over 10% from its record high, managed to finish the week up by more than 2%. Despite the rally, though, most small and mid-cap indices remain below their 50-day moving averages. However, despite all the commentary regarding the underperformance of small caps recently, they are still comfortably positive on the year, and besides IWM, there is a fairly strong degree of uniformity in YTD performance across the various market cap ranges.