B.I.G. Tips – Large Drops in Bullish Sentiment

The S&P 500 is down under 2% from its record closing high on September 2nd and has been hovering right above its 50-DMA this week. While neither of those may sound dramatic, it seems to have sent shivers down the spines of individual investors given the results of this week’s sentiment survey from AAII. Bullish sentiment has made a turn lower since its high of 43.4% two weeks ago, but this week, the reading plummeted down to 22.4%. That is the lowest level in bullish sentiment since the last week of July 2020 and is in the bottom 5% of readings since the start of the survey in 1987. The 16.5 percentage point drop is even more notable ranking in the 1.9th percentile of all week over week moves. It was the largest decline since August 2019 when bullish sentiment dropped 16.78 percentage points in a single week.

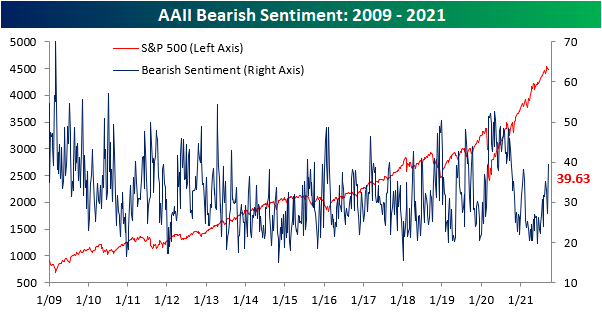

Given that massive decline in bullish sentiment, bearish sentiment obviously picked up substantially. The percentage of respondents reporting as bearish spiked 12.1 percentage points to 39.3%. That is the highest reading on pessimism since early October of last year, and it was the largest one-week uptick in bearish sentiment since the 24.14 percentage point spike in August 2019.

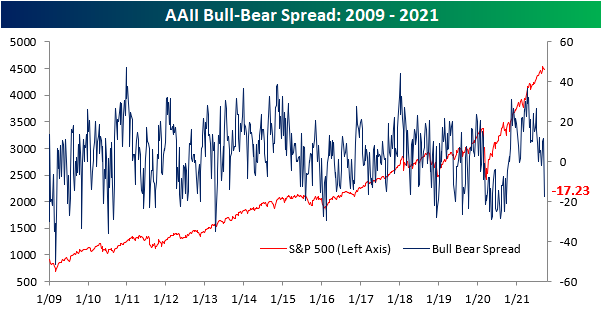

As a result of those big inverse moves in bulls and bears, the spread between the two crashed back into negative territory meaning bears now outnumber bulls for the first time since the week of August 19th. While it has not been too long since bears outnumbered bulls, the degree to which that is the case is significant. The last time that the bull-bear spread was as negative as it is now was in August 2019.

That is not to say all the losses to bullish sentiment went to the bearish camp. Neutral sentiment rose for a second week in a row adding over 15 percentage points in that time. Currently, 38.3% of respondents are neutral. That is an elevated reading but only the highest since the end of July.

To see how the S&P 500 has performed following similar types of sentiment readings, make sure to log in. If you aren’t currently a subscriber, sign up for a two-week trial to Bespoke Premium to view the rest of this report.

S&P Dividend and Treasury Yields Are Nearly Identical

On February 25th of this year, the 10-Year Treasury yield surpassed the dividend yield of the S&P 500 for the first time since January 17th, 2020. Currently, the S&P 500’s dividend yield stands at 1.33% vs. the 10-Year’s yield of 1.31%, so they’re essentially right inline with each other at the moment.

Since 1971, the 10-Year yield has been higher than that of the S&P 90.7% of the time, and the median spread between the 10-Year yield and the S&P’s dividend yield has been +3.5 percentage points. Both yields are much lower than their typical level since 1970. The S&P’s dividend yield has been higher than its current level 94.62% of the time. As for the 10-Year Treasury, its yield has been higher 97.55% of the time.

The spread between these two yields generally narrowed between the ’90’s and the mid 2000’s. The first time the S&P’s dividend yield crossed above the 10-Year yield was in November 2008 in the midst of the Financial Crisis. Since then, the spread has never been more than 2 percentage points in either direction, with a range from -1.99 to 1.67. The spread was the largest in September of 1981, when the 10-Year Treasury yield was 10.23 ppts higher than that of the S&P 500’s dividend yield.

The 10-Year yield has also historically been more sensitive to economic change. The average rate of change over a one month period for the yield of the 10 year has been 4.82% to the upside and -4.95% to the downside. The S&P 500 dividend yield’s average rate of change over the same time period has been 3.64% to the upside and -3.23% to the downside. The correlative coefficient between the two yields is .80, signifying that the two figures are strongly correlated. This makes sense, as the two are alternative forms of income. When one yield increases, it becomes more attractive to investors, who will sell off the alternative, thus raising the yield of the alternative as the price decreases.

B.I.G. Tips – Retail Sales Top Expectations

Chart of the Day: Tech Spending Outlook vs. Tech Sector Returns

Bespoke’s Morning Lineup – 9/16/21 – Busy Day of Data, Sentiment Plunges

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s not like the CIA. We don’t have private, secret data on the economy.” – Jerome Powell

We’ve seen a fair amount of weaker than expected economic data over the last several weeks, and today will be a test for the strength of the recovery as a number of key reports are on the calendar. Retail Sales, Jobless Claims, and the Philly Fed will all be released at 8:30, while Business Inventories will hit the tape at 10 AM.

Yesterday was a nice relief from the recent selling, but it has been surprising to see just how quickly investors have reversed course in terms of sentiment. According to the weekly sentiment survey from AAII, bullish sentiment plunged from 38.9% down to 22.4% this week (lowest level since June 2020) while bearish sentiment surged from 27.2% up to 39.3% (highest level since last October). That was quick!

This morning, there’s been little movement in different asset classes as equity futures are just slightly lower, the 10-year yield is modestly higher, and oil is lower. Even in the crypto space, there’s little life as bitcoin is trading down just … 77 cents!

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

When it comes to seasonal patterns in the market, one less widely known trend is related to the Jewish calendar regarding Rosh Hashanah (the Jewish New Year) and Yom Kippur (Judaism’s most solemn day of the year). The old saying says to “Sell Rosh Hashanah and buy Yom Kippur” as the period between these days tends to be a weak time of year for the market. We’ll leave it to others to try and explain the reasons behind the axiom, but the actual results don’t refute the pattern.

The table below shows the performance of the S&P 500 from the close before the start of Rosh Hashanah to the closing price on the day Yom Kippur ends from 2000 through 2020 (2021’s performance is through Wednesday’s close). During that span, the S&P 500’s median performance during this period has been a decline of 0.50% (average: -0.92%) with positive returns less than half of the time.

While equity market returns have been weak during the period between these two days on the Jewish calendar, Yom Kippur ends tonight at sundown, so what are market trends from after Yom Kippur ends through year-end? Overall, the broad market trend has been positive. In the twenty-one prior years shown, the S&P 500’s median rest of year performance has been a gain of 6.07% with gains 71% of the time. In the table, we have also shaded those years where the S&P 500 bucked the market headwinds and posted positive returns during this period, but it tended to have no impact on performance for the remainder of the year.

While we have seen all sorts of theories over the years as to why the equity market has been weak in the period between Rosh Hashanah and Yom Kippur, it is also important to remember that both of these days occur at a time of year that is already seasonally weak to begin with.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke Baskets Update – September 2021

Daily Sector Snapshot — 9/15/21

Strong Start to September Manufacturing Data

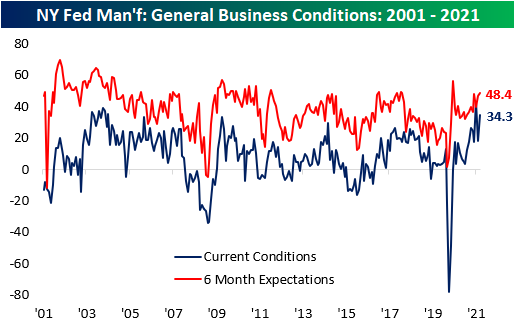

Last month saw a broad pivot lower across the regional Federal Reserve Bank manufacturing surveys. With the release of the Empire Fed’s survey this morning, we now have the first reading for the month of September. Rather than the more dour results of August, today’s results showed a broad acceleration in activity across categories in the New York region. The headline index was expected to show an ever so modest decline to 18.0 from 18.3 last month. Instead, it popped 16 points to 34.3 which is actually the seventh-highest level on record.

Just about everything drove the uptick in the headline number as only one index for current conditions was lower on a month-over-month basis: Prices Paid. Not only did almost every category show acceleration, but current levels across the board are in the top decile of historical readings. While elevated and higher readings are perhaps not positives, Delivery Times and Prices Received both came in at record highs.

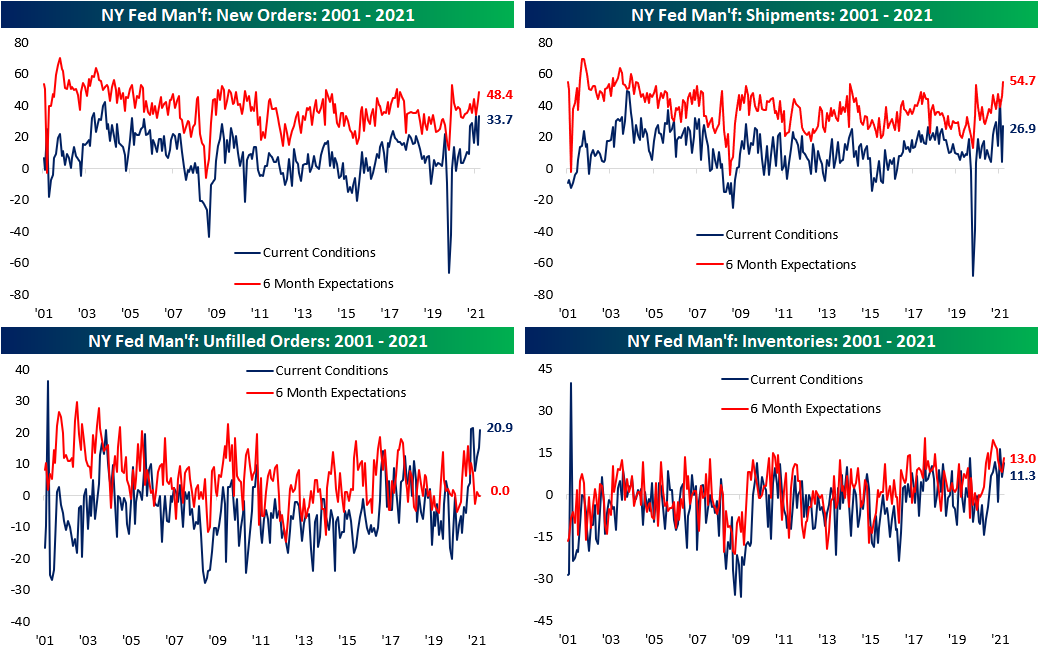

Some of the categories to have seen the most notable upticks this month were related to demand. Both New Orders and Shipments saw increases in the top few percentiles of their respective historical ranges. In fact, New Orders surpassed the July high to reach the highest level since July 2004. The reading on Shipments has been particularly volatile over the past few months, and the September reading was still below the high from July. That being said, it still came in at a very healthy level in the 90th percentile versus the 21st percentile reading in August. Additionally, expectations were far stronger. Coming in at 54.7, that index was at a seventeen-year high.

One area that expectations have gone the other way of current conditions is unfilled orders. While the growth in demand meant the current conditions index is right below the spring highs, six-month expectations came in at zero for the second month in a row. In other words, reporting businesses expect backlogs to remain at current levels six months out even as inventories are being built up at one of the fastest clips on record.

For the past few months, the index for Delivery Times had been showing some relief, but over the past two months, there has been increasing evidence once again of worsening supply chains. The past two months have both seen the index increase over 8 points which brings it to yet another record high of 36.5. While time will tell if the prediction is right, on the bright side, expectations are much more modest for future delivery times.

Prices are a somewhat similar story. Current levels are unlike anything seen through the history of the survey, but Prices Paid have now fallen for four months in a row. That lower does not mean prices are falling but are instead growing at a slower rate. As such, price increases are continuing to be passed on to customers as prices received increased for the third month in a row to a new record high of 47.8.

Employment-related indices also had a strong showing this month. The region’s businesses continued to take on more workers with the index rising to 20.5 which is just below the pandemic high of 20.6 set back in June. Granted, there are also signs that demand for labor is not being met. In spite of that uptick in employment, the average workweek surged. That index leaped 15.4 points to come in at the second-highest level on record.

Perhaps because the demand for labor cannot be filled, responding firms appear to be turning to the other side of the production function. Readings on plans for Capital Expenditure and Technology Spending also shot higher this month with the latter rising to record levels. In fact, the month-over-month increase in Technology Spending was the second-largest monthly gain on record behind a 19.1 point leap in April 2009. Click here to view Bespoke’s premium membership options.

B.I.G. Tips – Years Like 2021 – September Edition

Natural Gas Prices Explode Higher

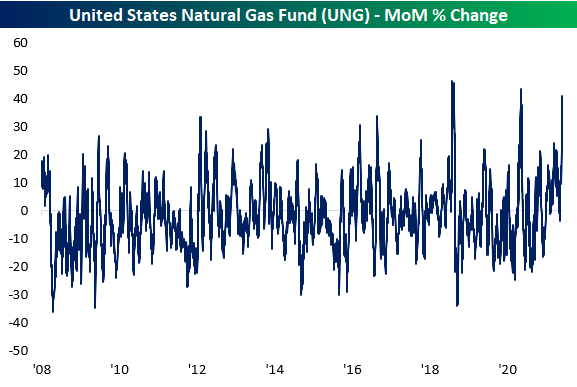

Energy commodities have been on an impressive run in 2021. Natural gas has basically gone into orbit recently on supply concerns. The US Natural Gas Fund (UNG) is now up over 100% on the year and 15.65% over the past five days alone. Since its recent closing low on August 18th when UNG was testing its 50-DMA, UNG has rallied 44.88%. Take a look at the one-year price chart for UNG:

With regards to this particular ETF tracking the commodity, UNG’s one month rate of change is now approaching one of the highest levels on record. As shown in the chart below, UNG’s 40.9% rally over the past month is second only to the 43.6% gain in August of last year and a 46.3% rally in November 2018. As for a slower year-over-year rate of change, things are equally as impressive. Again, only two periods have seen UNG experience larger gains on a rolling 1 year basis. The smaller and more recent of the two was when UNG posted a 66% rally in early December 2018 while the record 68% rally occurred in April 2013.

As could be expected with the explosive moves in natural gas prices, price has become extremely overbought. Today, UNG has moved over 3 standard deviations above its 50-DMA for the first time since June. Prior to that occurrence earlier this spring, there were only a handful of other times that UNG was as elevated above its 50-DMA. Two of those were in the fall of 2018 while the others were in June 2016, January 2014, and June 2010.

Turning to a look at speculator positioning, Friday’s release of the CFTC’s Commitment of Traders report showed the recent rally in natural gas appears to have resulted in shorts closing out their positions. As shown below, open interest has consistently been net short since the early spring. But from the second to last week of August to the most recent update last week, the percent of open interest has gone from 11.97% net short to only 8.18% net short. March 2020 was the last time to have seen positioning jump by as much in a two-week span. Click here to view Bespoke’s premium membership options.