The Bespoke Report Newsletter — 10/1/21

This week’s Bespoke Report newsletter is now available for members.

September 2021 ended with a thud this week with the S&P 500 falling 1.2% on the last trading day of the month. The turn of the calendar to October marked a turning point for the market as well, as the S&P rose 1.15% on the first day of the month to close out the trading week. This week’s Bespoke Report looks closely at the recent action in leading groups and sectors like the semiconductors and the transports. We also check in on the economy as the Delta wave recedes. There are a ton of insights on both markets and the economy in this week’s newsletter, and you can read it now with a two-week trial to our subscription service — Bespoke Premium. Click here to learn more about Bespoke Premium and start a two-week trial if you’re interested.

Mega Caps Underperforming as Energy Explodes

In November of last year, we took a look at the performance spread between the equal and market cap weighted versions of the S&P 500. The chart below provides an update through the end of September where positive readings indicate outperformance of the equal-weight S&P 500 and negative readings indicate outperformance of the market cap weighted index. In March 2020, as the market was plunging from the February peak and bottoming towards the end of the month, mega-caps such as Apple (APPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Facebook (FB) significantly outperformed the broader market, resulting in a 5.68 percentage point spread between the return of the equally weighted and market cap weighted S&P 500. Whereas the equal-weighted index declined 18.19% in March 2020, the market cap weighted index dropped ‘just’ 12.51%. In a reversal of these trends, the equal-weighted index outperformed between the months of September 2020 and March 2021, rallying 30.84% while its market cap weighted counterpart gained 18.14%. Over these months, there was a maximum monthly spread of 3.37 percentage points in favor of the equal-weighted index, which occurred last December. In recent months, mega-caps briefly took back the reins before the trend reversed in September when the equal-weighted index outperformed by 0.82 percentage points.

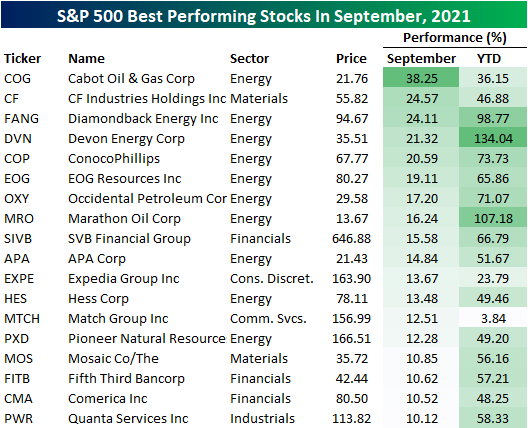

With the month of September behind us, the table below lists the 18 stocks in the S&P 500 that finished the month up over 10%, and less than a quarter of the stocks in the index (22%) finished the month higher. Overall, the average performance of stocks in the index was a decline of 3.7 percentage points. While short-term performance has been weak, on a YTD basis, 81.42% of S&P 500 stocks are up on the year, and the overall average gain is 18.90%. Of the stocks that have rallied 10%+ in September, more than half are from the Energy sector and another three come from the Financials sector. Click here to view Bespoke’s premium membership options.

Q3 Asset Class Performance

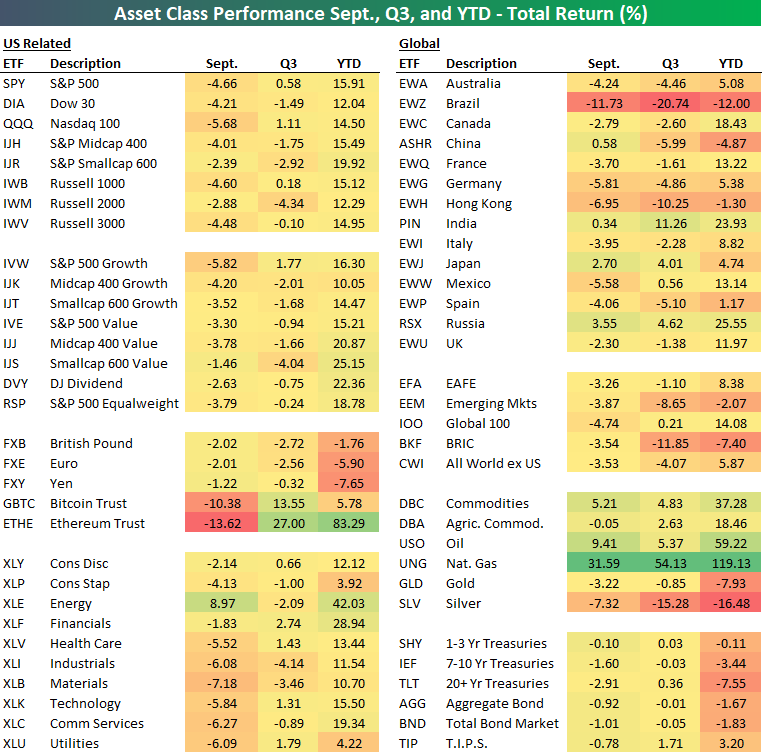

Q3 and the month of September are now in the books, and it was not a great period for US equities. As shown in our asset class performance matrix below, the sole portion of the US equity market that was higher in September was Energy stocks. Every other sector, theme, and major index was lower on the month. As for global equities, performance was more mixed with declines ranging from 11.73% for Brazil (EWZ) to a 3.55% gain for Russia, though, most country ETFs were lower on the month.

Commodities had a good month particularly in the energy space with crude oil (USO) gaining 9.41% and Natural Gas (UNG) rising an astounding 31.59%. That lifted the total gain in Q3 to 54.13% while it has returned almost 120% year to date; the best performer for both time periods. Precious metals, namely silver (SLV), on the other hand, was hit particularly hard. As for cryptos, Ethereum (ETHE) was another top performer YTD and in Q3, but September pared those gains. ETHE fell 13.62% in September while Bitcoin (GBTC) also fell by double-digit percentages. Click here to view Bespoke’s premium membership options.

Daily Sector Snapshot — 10/1/21

Bespoke Matrix of Economic Indicators – 10/1/21

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

B.I.G. Tips – October Intra-Month Seasonality

Bespoke’s Morning Lineup – 10/1/21 – Merck Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“As an investor, my job is to figure out what will happen rather than what should happen.” – David Einhorn

It wasn’t looking like a positive start to October earlier this morning as futures were significantly lower, but beginning at 6 AM we started to see a turnaround following positive trial results from Merck (MRK) regarding its oral anti-viral COVID treatment. The thought of being able to simply pop a pill to significantly reduce the chances of an adverse reaction to COVID would be a big step in returning back to normal.

Given the volatility and sell-offs we’ve seen during the regular trading session this week, there’s still a real possibility that these early gains don’t hold, but at least this morning we’ve seen futures strengthening from low levels throughout the morning rather than the opposite of weakness from higher levels.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

As far as closing acts go for a quarter, Q3’s exit was one to forget. Over the last week of the month, the S&P 500 dropped 3.18% for its worst final week of September since 2003 when it dropped by a similar amount. In the S&P’s history, there have been thirteen prior years where the index dropped more than 2.5% in the final week of September, and we have highlighted each of those years below.

Looking ahead to today and the first week of October, weak finishes to September have historically been followed by a weak first day of October. In the thirteen prior years shown, the S&P 500 dropped by an average of 0.19% (median: -0.60%) on the first trading day of October with positive returns just under a third of the time. Based on the turnaround we have seen in futures this morning, we may be on pace to buck that trend today.

While the first trading day of the month has been weak, the first week of October has been positive with an average gain of 0.30% (median: 0.93%) and positive returns just over two-thirds of the time. Relative to the long-term average, returns on the first trading day of October have been below average while performance in the first week of October has been pretty much right in line with the historical average of all first weeks of October.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 9/30/21

Bearish Sentiment Back Above 40%

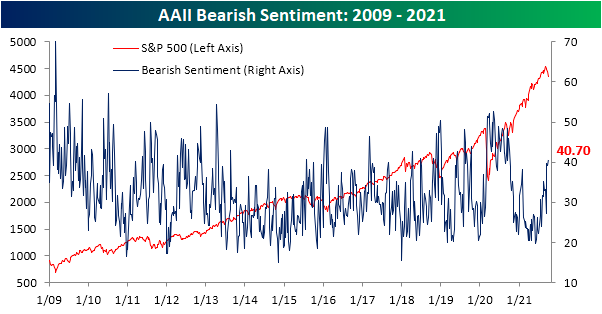

As the S&P 500 continued to decline over the past week, survey results from the American Association of Individual Investors have shown investor sentiment has taken a more negative tone. 28.1% of respondents this week reported as bullish versus 29.9% last week. While lower, that is still several percentage points above the recent low of 22.4% from a couple of weeks ago.

Bearish sentiment picked up the bulk of those losses to bullish sentiment as 40.7% reported pessimistic sentiment this week. That is the highest reading in exactly a year. With bearish sentiment having risen by 13.5 percentage points since the low of 27.2% in the week of September 9th, it is now a full standard deviation above its historical average of 30.55%.

Even though bearish sentiment came in at a new high, the bull-bear spread was only slightly lower at -12.6. That is still above the low of -16.9 from two weeks ago.

Bearish sentiment did not pick up all of the losses to bullish sentiment either. Neutral sentiment was also slightly higher this week gaining 0.2 percentage points.

Other readings on sentiment are also echoing the decline in optimism. One other sentiment indicator, the National Association of Active Investment Mangers’ Exposure Index, has also seen a significant drop this week. This index shows how exposed managers are to equities with a reading of 200 being the max and meaning respondents are leveraged long whereas -200 would be leveraged short. A reading of +100 (-100) would indicate managers are full long (short), and a reading of zero would indicate they are market neutral. The index has fallen in back-to-back weeks now with this week seeing a 22.68 point drop to the lowest level since May. That week over week change also ranks in the bottom 5% of weekly moves going back to the start of the data in 2006, although there have been a handful of similar if not larger drops in the past year like a 26.98 point decline in mid-August and a 40.93 point drop back in May. Now at 55.02, the index indicates managers have stepped back and are far less exposed to equities than they have been for most of the past year. Click here to view Bespoke’s premium membership options.

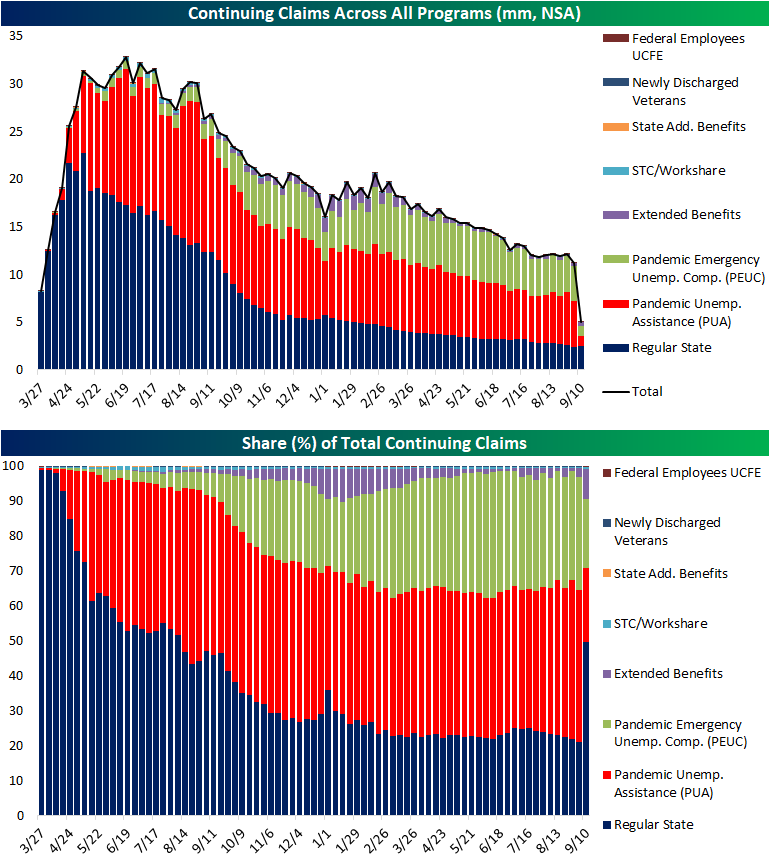

Pandemic Claims Evaporate

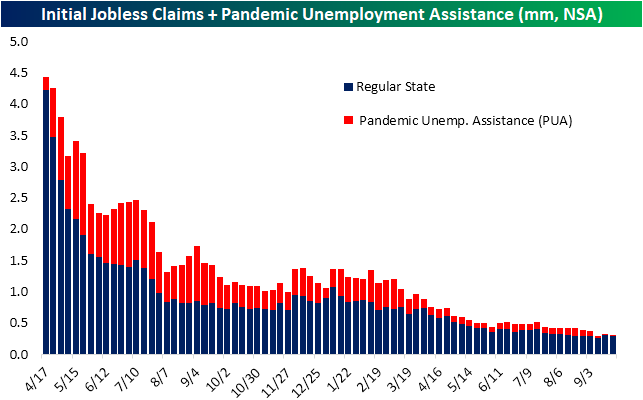

This week’s initial jobless claims number disappointed with a surprise increase to 362K rather than the anticipated 21K decline to 330K. After that increase, claims are at the highest level since the first week of August when total adjusted claims were 15K higher at 377K.

While seasonally adjusted claims were disappointing, the unadjusted number actually improved week over week falling back below 300K. Albeit lower, claims are still off their low of 265.9K from two weeks ago which could be expected given the seasonal tendency for claims to rise at this time of year. With the program’s official end date now a few weeks in the rearview, PUA claims remain muted, but there was actually an increase of early 2K this week.

Seasonally adjusted continuing claims fell this week to 2.802 million. Although lower, that was not as large of a decline as expected. That makes for the second-lowest reading of the pandemic outside of the first week of September when continuing claims came in at 2.715 million.

On a non-seasonally adjusted basis and including all auxiliary programs creates a couple of weeks of lag to the data making the most recent reading through September 10th. That was the first week of data to encapsulate the end of pandemic programs, and the drop was significant. Total claims across all programs were more than cut in half falling 6.22 million to 5.03 million. As could be expected, declines in PUA and PEUC claims drove that decline with the two programs shedding a combined 6.49 million claims. That being said, these two programs still have a total of over 2 million claims left on the table and likely to fall off over the coming weeks. Click here to view Bespoke’s premium membership options.