Chart of the Day: Highest Mortgage Rates In Two Decades

Hurricane Claims Come In

Last week’s jobless claims number went unrevised whereas the latest week’s data rose by 9K up to 228K. That brings the seasonally adjusted number back up to the highest level since the end of August and was the first back-to-back increase since the first week of August.

On a non-seasonally adjusted basis, claims remain a hair below 200K and in line with the readings from the comparable weeks of the year in the few years before the pandemic. We would also note that the increase in claims at this point of the year is very much a regular occurrence.

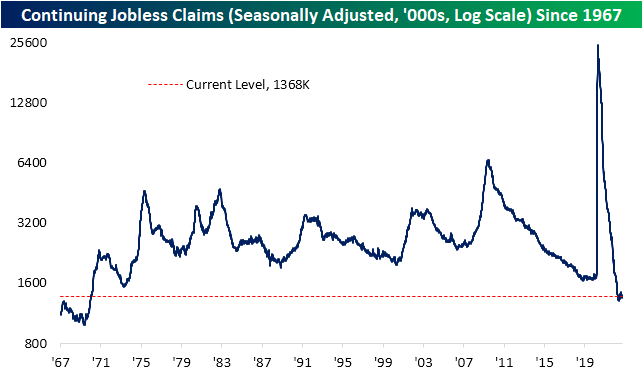

Turning to continuing claims, the latest print for data through the end of September saw a modest 3K increase to 1.368 million. That is only the highest level in three weeks as the indicator remains well below pre-pandemic levels, unlike initial claims.

On a national level, claims are moving higher but it is perhaps too early to say we are in a new trend as opposed to things like seasonality and one-off events like the weather. While 80% of states and territories saw claims move higher this week, a large share of the national move was concentrated in the Southeast likely as a result of Hurricane Ian. In the table below, we show the state-level readings for initial and continuing claims (NSA). Roughly a third of the national move in claims was thanks to claims in Florida more than tripling week over week. Now, initial claims in that state are at the highest level since May of last year. That was matched with a significant pickup in continuing claims as well. Although they have a smaller impact on national claims, other hurricane-impacted areas like Puerto Rico also saw a significant uptick in initial claims. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/13/22 – Pre Inflation Strength

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Inflation is the crabgrass in your savings.” – Robert Orben

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were higher most of the night but really picked up steam in the last hour following reports out of the UK that the Truss government was looking to reverse some of its recent tax proposals. In reaction, gilt prices are rallying, the pound is surging, and equity futures around the world have rallied. Now, if only the CPI report would cooperate. The pace of earnings is starting to pick up and this morning we got better-than-expected reports from Blackrock (BLK) and Taiwan Semi (TSM), while Delta (DAL) and Domino’s (DPZ) missed on the bottom line.

Weaker-than-expected CPI reports have become endangered over the last several months as economists just haven’t been able to keep up with the rapid increase in prices. Heading into today’s report for September, there have only been three reports in the last two years where headline CPI came in lower than expected and just one in the last year. In both cases, the 12- and 24-month totals have been at or near record lows. The average 12 and 24-month totals of weaker-than-expected reports have been 8 and 4, respectively, indicating that two-thirds of the time consensus forecasts are either at or below the actual reading. Simply put, economists have historically underestimated inflation, but the recent degree of underestimating price increases has been unprecedented to the point where betting on a higher-than-expected report has been nearly as bankable as it used to be taking the over in the NBA all-star game.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/12/22

Semis Set to Turn?

In last night’s Closer, we highlighted the diverging performance of two industries that have often been considered leading groups for the broader market: the Philadelphia Semiconductor index (SOX) and the Dow Jones Transportation Average. As of this writing, that divergence has continued today with the Transports gaining another 1% while the more new age semiconductors are down 0.7%. As a result, the ratio of the transports to the semis has continued to rally off its recent lows.

In fact, the five-day rate of change of that ratio has now risen into the double digits as it sits 12.23% above last week’s levels. Surges in the ratio like we have seen over the last week have historical precedence, but very little following the dot com era. The only recent increases that were as large or larger than the current run were in March of last year (2021) and December 2017.

In the table below, we show each time since 1994 (when the Philly Semiconductor Index begins) that the ratio mentioned above has risen by at least 10% in a one-week span without another occurrence in the prior 3 months. The current run higher in the ratio has been on the larger side of those prior instances.

However, that outperformance has not necessarily carried forward. The next week has consistently seen the Dow Transports turn lower whereas the semis have consistently posted solid gains. Looking at performance in the medium to longer term, again the semis tend to outperform with more consistently positive moves that are also much better than the norm. For example, three and six-month performances for the semis have, on average, been around three times larger than the norm for all periods. Transports, meanwhile, have seen performance that is more in line with the historical norm. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Extremes in Materials and Industrials

Bespoke’s Morning Lineup – 10/12/22 – Is That Green on the Screen?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is well that war is so terrible, or we should grow too fond of it.” – Robert E. Lee

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The big news item of the day will be the September PPI which is being released as we type this, and the results were not all that good. Headline PPI came in at 0.4% versus forecasts for an increase of 0.2%. Core PPI was in line with forecasts at 0.3%. On a y/y basis, the headline reading came in at 8.5% versus forecasts for an increase of 8.4%. Y/Y Core PPI was actually slightly weaker than expected at 7.2% versus forecasts for 7.3%. Futures were higher heading into the print along with US Treasury yields as the 10-year trades back up near 4%, but equities have now given up nearly all of their gains in the immediate aftermath of the report.

Pepsi (PEP) reported better-than-expected earnings and sales and also raised guidance this morning, and the stock is trading 2.5% higher in response. Today is really just the warmup for tomorrow, though, when we’ll get the release of CPI and banks will kick off the Q3 earnings season. In the meantime, keep an eye on the UK as officials there can’t seem to make up their minds on how long they intend to support the gilt market.

With the S&P 500 down five days in a row, the number of down days this year continues to pile up. Through Tuesday’s close, the S&P 500 has traded down on 56.9% of all trading days. That may not sound all that extreme, but since the five-trading day week began in late 1952, this year is currently on pace to have the second-highest percentage of down days in a given calendar year. The only one with a higher percentage of down days was 1974 (58.3%) when the S&P 500 was down 29.7% for the calendar year. Barring a major reversal in Fed policy, which is only taking on an increasingly hawkish stance even as economic activity shows signs of weakness, 2022 could end up in the record books.

Not only has the S&P 500 experienced a large number of down days, but the frequency of big down days has also been at historical extremes. 2022 just took out 1974 for third place in terms of the percentage of down 1% days, trailing only 2008 (29.6%) and 2002 (28.6%). Just as the S&P 500 was down nearly 30% in 1974, 2008 and 2002 were horrible years as well with declines of 38.5% and 23.4%, respectively. If it Ever Went Up, They Wouldn’t Call it Losing

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/11/22

B.I.G Tips – Apprehension Ahead of Earnings Season

We’re on the cusp of another earnings season as Thursday will unofficially kick off the Q3 reporting period when the major banks and brokers start to report their results. Once again this quarter, there’s no shortage of concerns for investors and analysts to factor into their models, so the upcoming period promises to be volatile. For a more detailed rundown of the earnings schedule for the upcoming season, please see our Earnings Explorer Tool (available to all Institutional clients) on the Tools section of our website, and to see our quarterly preview of the upcoming earnings season with respect to analyst sentiment heading into it, start a two-week free trial to either Bespoke Premium or Bespoke Institutional.