Bespoke’s Weekly Sector Snapshot — 10/20/22

The Bespoke 50 Growth Stocks — 10/20/22

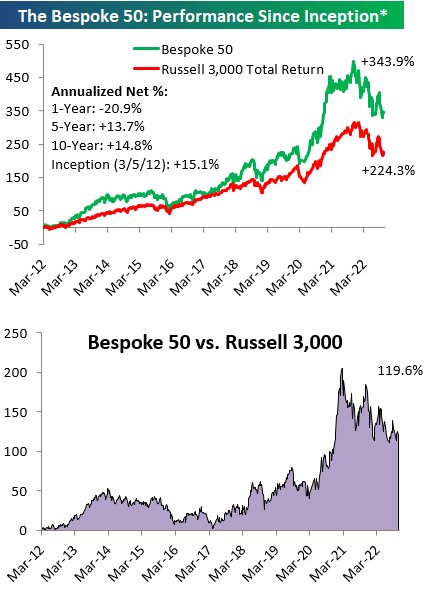

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Options Volumes Shift

Sentiment Streaks Press On

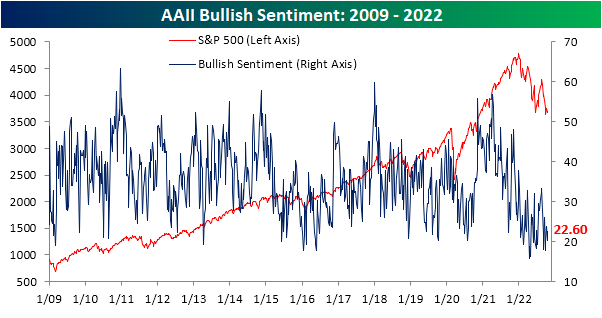

A small equity market bounce over the last week didn’t cause any major changes in investor sentiment, at least based on the weekly AAII numbers released this morning. The latest data from AAII showed 22.6% of survey respondents reported as bullish versus 20.4% the week before.

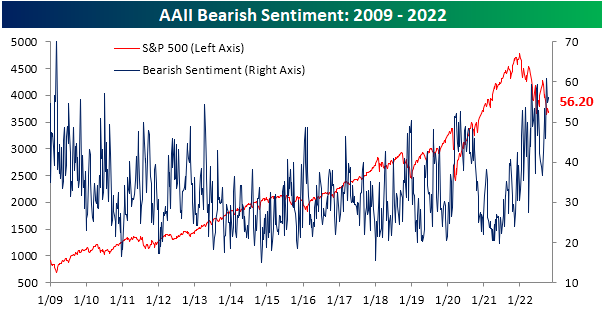

Bearish sentiment also rose slightly to 56.2% for the highest reading since the end of September when there were back to back weeks of readings above 60%.

There is little precedent in the history of the AAII survey for over half of respondents to report as bearish for this many weeks in a row. As shown below, this week marked the fifth in a row that bearish sentiment came in above 50%. That is now the second longest such streak on record behind the seven week long streak in the fall of 1990.

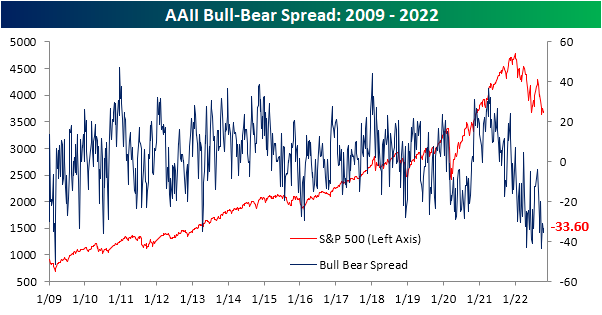

Given more than half of responses to the survey have reported bearish sentiment, the bull bear spread continues to show negative readings (meaning bears outnumber bulls). The reading remains at the low end of the past decade’s range at -33.6.

Similar to five straight weeks of 50%+ bearish sentiment, the streak of weeks with a negative bull-bear spread has grown to become the second longest on record at 29 weeks.

Turning to another reading on sentiment—the NAAIM Exposure Index—another notable streak has continued to press on this week. This index measures investment manager exposure to equities with readings ranging from -200 (leveraged short) to +200 (leveraged long) and readings of +/-100 representing responding managers are full long or short. The index has remained below 50 for eight weeks in a row now. That has tied the streak of sub-50 readings in the spring of 2020. Going back through the history of the index dating back to 2006, there have only been seven other periods in which equity exposure by active managers has been as muted for as long of a span as now. In other words, the AAII survey is not alone in showing persistent pessimism. Click here to learn more about Bespoke’s premium stock market research service.

Claims Take A Seasonal Dip

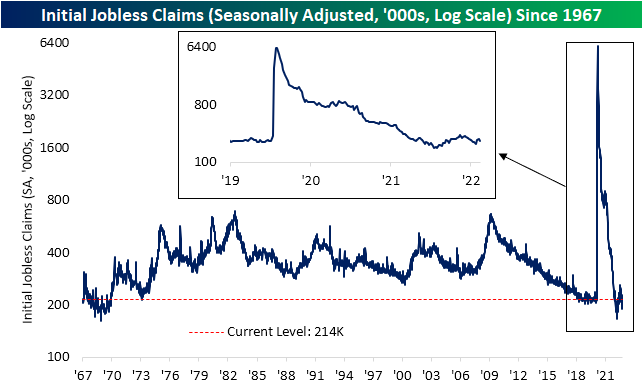

It was a good week for jobless claims as the seasonally adjusted number fell 12K to 214K versus last week’s downward revision to 226K. That compares to forecasts that were expecting claims to rise further to 233K. At current levels, claims remain healthy and within similar levels to the pre-pandemic range.

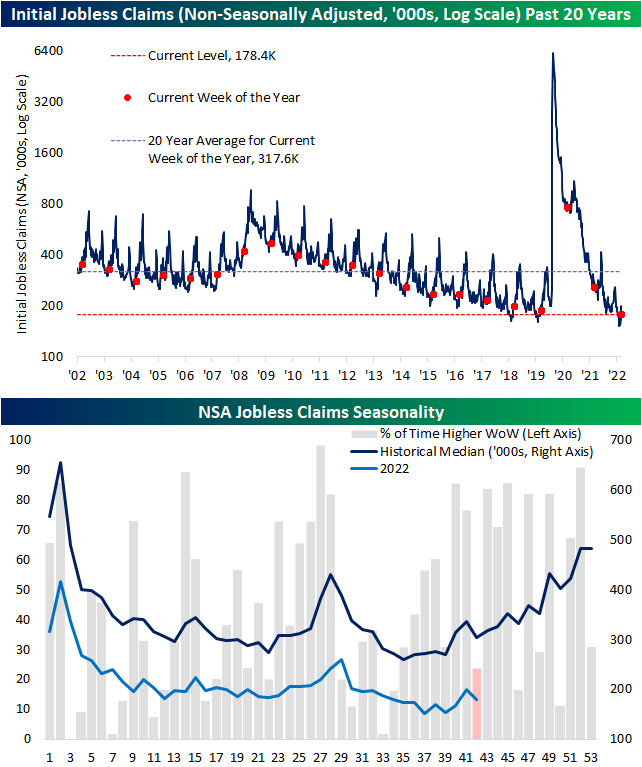

On a non-seasonally adjusted basis, claims were also lower as might be expected for the current week of the year. Historically, the current week of the year has consistently seen a brief break in the Q4 seasonal uptrend in claims. With that occurring again this year, claims are impressively strong. The only two years in which the comparable week has seen a lower reading in the non-adjusted number were 1969 (155K) and 1968 (151K).

As we highlighted last week, roughly a third of the rise in national claims last week was thanks to Florida which was recently impacted by Hurricane Ian. One week later, claims in that state improved albeit they remain elevated and account for a disproportionally large drag on the national claims number. We would note, that the current hurricane-related spike is similar in size to the fall of 2017 when there was a historically damaging hurricane season (the year of Hurricanes: Harvey, Irma, and Maria).

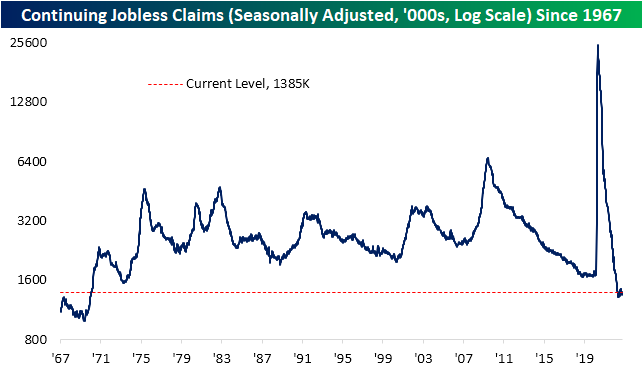

Turning to continuing claims, which are lagged an additional week to the initial claims number, the picture remains unchanged versus recent months. Claims are historically strong at 1.385 million and much lower than initial claims. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/20/22 – Opposite Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It is clearly now the will of the parliamentary Conservative Party that there should be… a new prime minister.” – Boris Johnson 7/7/22

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Just over three months ago, Boris Johnson resigned as UK PM, and now this morning, his successor, Liz Truss, just announced she will be stepping down as PM. Do you think she had enough time even to unpack her bags? After trading lower throughout most of the night, S&P 500 futures had flipped modestly into positive territory this morning, but in the immediate aftermath of the resignation announcement, they pulled back closer to unchanged while Nasdaq futures are lower. Treasury yields have been behaving with nothing more than modest moves higher in yields across the curve. Crude, however, is rallying an additional 2%+ and back above $87 per barrel while copper is also up over 2%. Over in China, there was some positive news that the country is considering a reduction of the required quarantine time required for travelers in the country.

Here in the US, the general trend in earnings remains primarily positive, but there have been some duds. Tesla (TSLA) is trading lower after reporting weaker-than-expected sales raising concerns over demand, and Allstate (ALL) dropped over 10% after announcing Q3 catastrophe losses of $673 million. Lastly, Alcoa also reported weaker-than-expected EPS and sales and lowered forecasts for shipments, but anyone following the company over the years knows that it is hardly a bellwether.

In economic data this morning, Initial Jobless Claims came in lower than expected (214K vs 233K) while Continuing Claims were only slightly higher than forecasts (1.385 million vs 1.378 million). Also, the Philly Fed Manufacturing report for October improved less than expected rising from -9.9 to -8.7 versus forecasts for a reading of negative five.

This week’s equity market performance has been the opposite of the pattern we have seen this year. Heading into the week, the S&P 500 has averaged negative returns on every weekday this year except Wednesday when the average gain has been 0.20%. This week, the only down day (so far) was Wednesday, and on Monday and Tuesday, the S&P 500 was up well over 1%. While it’s still early, equity futures are once again modestly positive heading into Thursday’s trading. There’s still plenty of time left in the week but wouldn’t that be a welcome trend?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Baskets Update — October 2022

Daily Sector Snapshot — 10/19/22

Chart of the Day: S&P 500 Drawdowns vs. Forward Performance

Housing Continues to Roll…Over

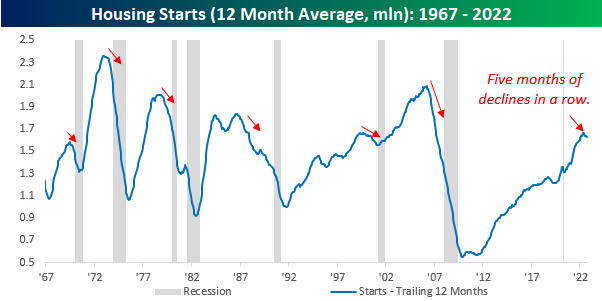

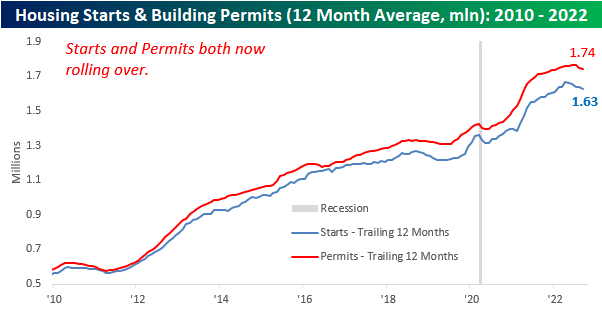

The latest update on Housing Starts and Building Permits from the Census Bureau was released this morning, and the results continue to reflect a significant slowdown in the sector. On a y/y basis, both starts and permits saw declines of 7.7% and 3.2%. respectively. The real weakness, however, has been in single-family units where starts are down 18.5% and permits fell 17.3% even as multi-family units were both up by double-digit percentages y/y. On a regional basis, the west was the only region to register a m/m uptick (4.5%) while the northeast was the only region registering an increase relative to last year. For permits, every region except the northeast was up m/m while it was the only region to register an increase on a y/y basis.

Housing Starts have historically done a good job predicting turns in the business cycle, so the fact that we have now seen five straight months of declines in this reading is just another indication of the risk of a recession on the horizon. We would note, however, that while recessions usually follow peaks in the 12-month average, they weren’t always imminent.

Looking more closely at the last few years, in addition to the decline in Housing Starts, the 12-month average of Building Permits has also started to roll over.

Single-family starts and permits have been even weaker. and both have now declined for five straight months. Also, the magnitude of the recent decline has been steeper than anything seen since the period from 2010 through 2012. Click here to learn more about Bespoke’s premium stock market research service.