Bespoke’s Morning Lineup – 11/17/22 – Euro Test

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If the euro fails, Europe fails.” – Angela Merkel

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It was a pretty uneventful evening for global equities, that is, until Europe opened. After opening slightly higher, European equities have been grinding lower all morning, and that has dragged US futures along for the ride. Making matters worse, hawkish commentary hitting the tape in the last half hour from Jim Bullard and Esther George has only added to the negative tone. On deck, we have Housing Starts, Building Permits, Philly Fed, and Initial Jobless Claims at 8:30. Then, at 11 AM, we’ll get a November update on manufacturing from the KC Fed.

The first three quarters of 2022 were a time to forget for the euro as the common currency plunged over 16% YTD at its intraday low on 9/28 and well below the psychologically important parity level versus the dollar. Since that intraday low, the euro has rallied over 8%, and in the process of that rally, it has broken the steady downtrend that had been in place all year. This week, the euro has encountered another level of resistance at the 200-day moving average (DMA). On Tuesday and Wednesday, the euro tried and failed both days to stay above its 200-DMA, and today it is once again off its intraday highs but this time it never even made it to the 200-DMA. Rallies failing at their 200-DMA are a classic trait of bear markets, and it’s a trend we’ve seen across financial markets all year, so it will be interesting to see if this level acts as similar resistance for the euro as well.

In some ways, you could say that the euro is wearing out its welcome below the 200-DMA. The current streak of 372 trading days closing below its 200-DMA ranks as the longest since the common currency’s launch in 1999. Over the last 22 years, this current streak marks only the fourth time that the currency has traded below its 200-DMA for more than an entire year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Closer – Waller Rules, IP Miss, Issuance Ramps, EIA, 20y Auction Amazes – 11/16/22

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out tonight with some commentary on today’s Fedspeak followed by a look at the latest dose of semis earnings (page 1). We then dive into some details of today’s economic data including various retail sales categories and industrial production (page 2). Afterward, we take a look at corporate issuance, FX, real yields, and crude term structure (page 3). Then we provide a recap of the latest EIA data (page 4) before finishing with an overview of today’s very strong 20 year bond auction (Page 5)

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke Baskets Update — November 2022

Daily Sector Snapshot — 11/16/22

Chart of the Day – Majority Rules?

Consumer Discretionary’s Muddled Relative Strength

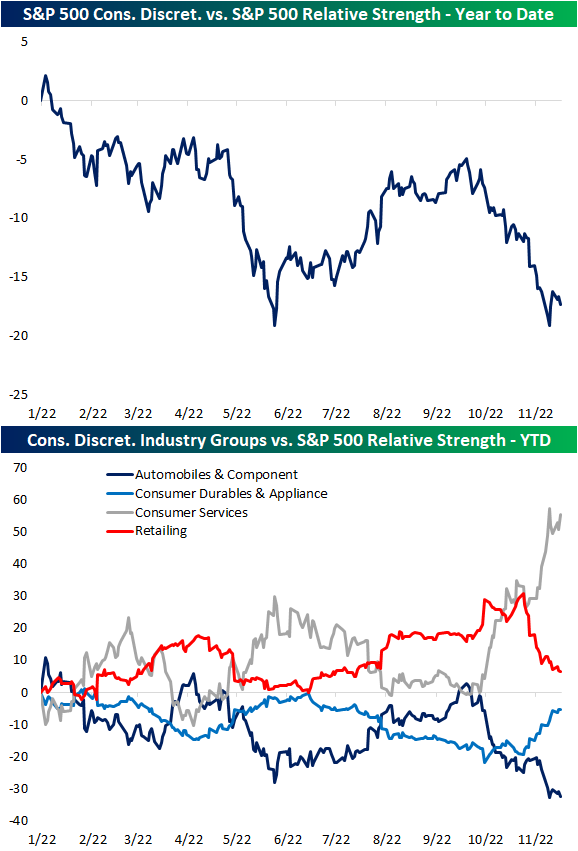

Ranging from today’s retail sales report to homebuilder sentiment to the earnings of some of the largest retailers like Target (TGT) and Lowe’s (LOW), the economic and earnings calendar this week has given Consumer Discretionary stocks plenty of news to digest. Outside of the spring to late summer, the sector has generally been on the decline relative to the S&P 500 in 2022. Last week, that relative strength line bounced right as it reached the late May low. However, over the past few days, it has been resuming its move lower, meaning it is back to underperforming.

While on a sector level the relative strength line has been falling, drilling down to the industry group level, there has been more variation. For example, even with some positive responses to earnings from the likes of Home Depot (HD) or Lowe’s (LOW), the retailing industry has seen a sharp grind lower in its relative strength line versus the S&P 500. Similarly, autos have seen a turn lower although it has been underperforming the S&P for a longer period of time since the early fall. Meanwhile, Consumer Durables and Appliances (which includes stocks like the homebuilders and home appliance makers) has been moving higher. That move has paled in comparison to the relative strength of Consumer Services stocks (restaurants, cruise lines, hotels and resorts), though, as that group’s line has surged over the past couple of months.

As mentioned above, retailers in the Consumer Discretionary sector have been underperforming the S&P 500 lately but there is another group of retailers in which performance has been more solid. The Food & Staples Retail industry is a component of the Consumer Staples sector, and its relative strength line has been trending higher since the spring lows. In fact, after the past week’s move higher thanks in part to a strong response to Walmart (WMT) earnings, its relative strength line is approaching some of the highest levels of the past year, entirely recovering the massive drop from May in the wake of another, much more negatively received, WMT earnings report. Click here to learn more about Bespoke’s premium stock market research service.

B.I.G. Tips – Earnings Season Recap and Triple Plays

Today we published our newest Earnings Triple Plays report. This season there were a total of 133 earnings triple plays out of just under 2,000 individual quarterly earnings reports from US-listed stocks.

What is a triple play? When a stock reports quarterly earnings, it registers a “triple play” when it beats analyst EPS estimates, beats analyst revenue estimates, and raises forward guidance. We coined the term back in the mid-2000s, and you can read more about it at Investopedia.com. We consider triple plays to be the cream of the crop of earnings season, and we’re constantly finding new long-term opportunities from this basket of names each quarter. You can track the newest earnings triple plays on a daily basis at our Triple Plays page if you’re a Bespoke Premium or Bespoke Institutional member. To read our newest report and see some of the triple plays with intriguing charts at the moment, start a two-week trial to Bespoke Premium!

Homebuilder Hopes Demolished

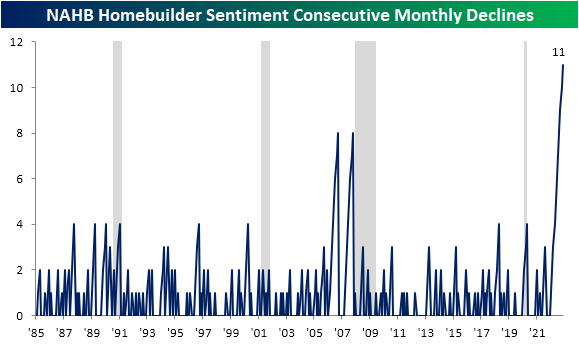

The national average on a 30-year fixed rate mortgage has come back below 7%, but it remains elevated versus recent history as housing data still can’t catch a break. This morning, the NAHB released their latest reading on homebuilder sentiment and for the eleventh month in a row, the headline index fell month over month. As shown below, the current streak of nearly a year straight of declines is far and away a record, surpassing two eight-month long streaks leading up to the Financial Crisis.

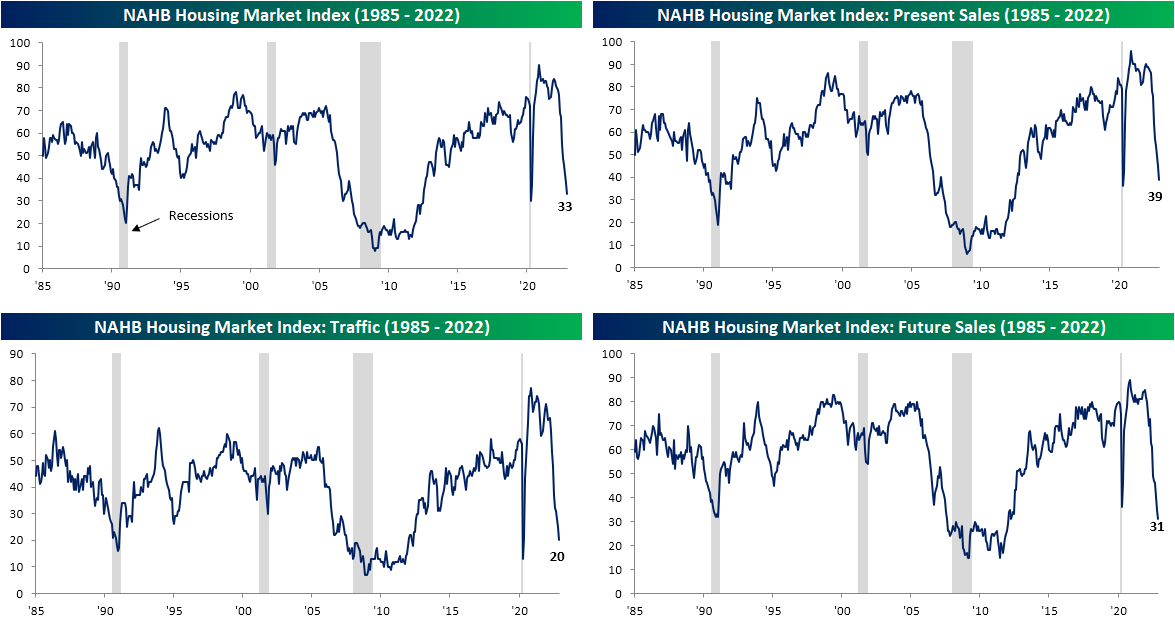

This month, homebuilder sentiment dropped another 5 points down to 33. That is not the largest drop of the current streak of declines, with bigger drops of 8 points last month or 12 points in July, but it still ranks in the bottom 4% of all months on record. In other words, not only is homebuilder sentiment falling consistently, but it’s falling fairly fast. The other components have also seen bottom decile declines with the only sub-index avoiding declines being in the West.

After the November decline, the headline homebuilder sentiment reading sits 3 points above the spring 2020 low. Similarly, Present Sales and Traffic are down to the lowest level since April 2020 while Future Sales have actually surpassed those levels to now sit at the weakest reading in over a decade.

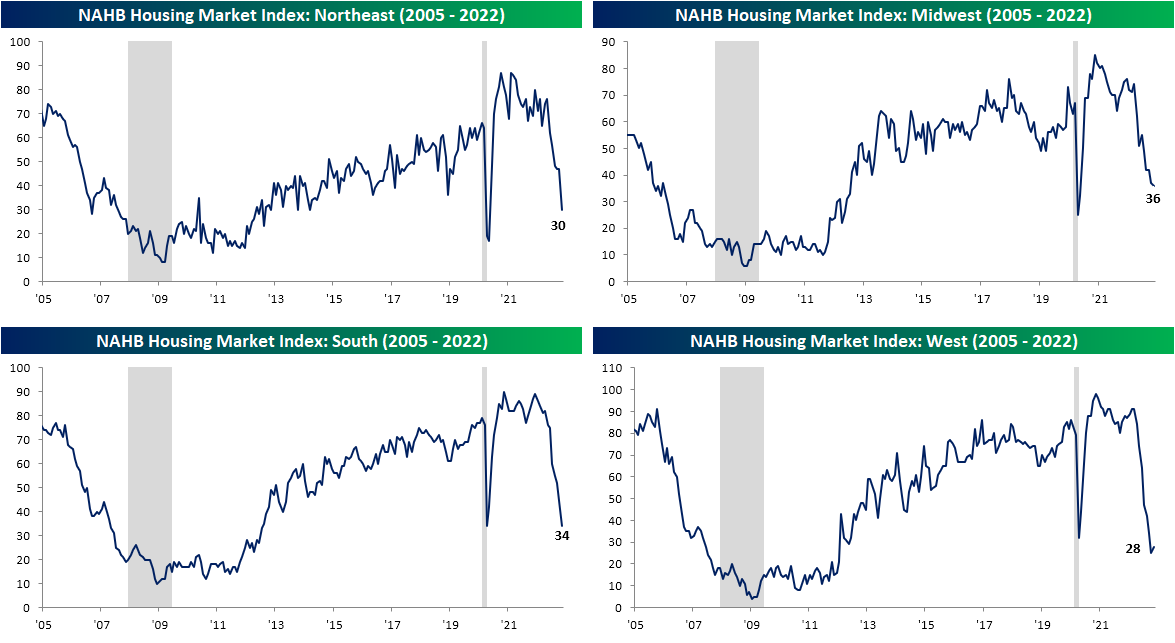

Last month, we highlighted how the geographic breakdown of sentiment was showing homebuilders in the Northeast being much more optimistic than their counter parts in the rest of the country. In November, that region joined the rest of the pack with a massive 17 point decline. That ranks as the third largest monthly decline on record behind a 19 point drop in June 2010 and the 45 point decline at the onset of the pandemic in April 2020. While that has not been enough to result in a new low, similar to sentiment in the Midwest, sentiment in the South is down to the lowest level in a decade. The same could be said for the West although it rose marginally month over month.

As for the reaction of homebuilder stocks, the iShares US Home Construction ETF (ITB) is trading 1.1% lower as of this writing. As shown below, after last week’s equity market surge on CPI in which the group moved not only above its 50-DMA but also its 200-DMA, ITB has continued to hold above its moving averages for now. Without much follow through on the post-CPI surge, any move above last week’s highs would be a welcome bullish sign, whereas the 200-DMA is looking to be the critical level of support for the time being. Click here to learn more about Bespoke’s premium stock market research service.

B.I.G. Tips – Strong Retail Sales

Bespoke’s Morning Lineup – 11/16/22 – Retail Divide

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You always hear the phenomenon that people are trading down, that’s not happening in our space.” – Marvin Ellison, CEO Lowe’s (LOW)

“Based on softening sales and profit trends that emerged late in the third quarter and persisted into November” Target (TGT) Earnings Release (11/16/22)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After some geo-political tensions yesterday afternoon following reports of a Russian missile strike on Poland, markets are breathing a sigh of relief this morning after NATO said that the missile likely did not come from Russia and wasn’t an act of aggression. Despite the eased tensions, futures are modestly lower this morning following a mixed batch of earnings reports. Treasury yields are lower on continued optimism that inflation pressures in the US are easing (we’ll see what Fed officials think throughout the day as a number of speakers are on the calendar), but over in the UK, CPI rose by a 40+ year high of 11.1% y/y.

It looks like it’s a morning of the haves and have-nots in retail. Target (TGT) noted in its earnings release that sales trends are softening after reporting weaker-than-expected EPS and sales. Lowe’s (LOW) seems to be operating on a whole different landscape, though, as the company reported better-than-expected EPS and sales while raising guidance. In an interview on CNBC, CEO Marvin Ellison noted that he has seen no signs of a consumer slowdown and no sign of trading down. Two large American retailers with two entirely different viewpoints on the consumer. It will be interesting to see which comments today’s Fed speakers decide to place more weight on. Getting back to the Lowe’s report, while Ellison noted that consumer trends remain strong, he also added that input prices are starting to trend down, so even from the strong report, there were some positive signs on the inflation front… but it’s just ‘one data point‘.

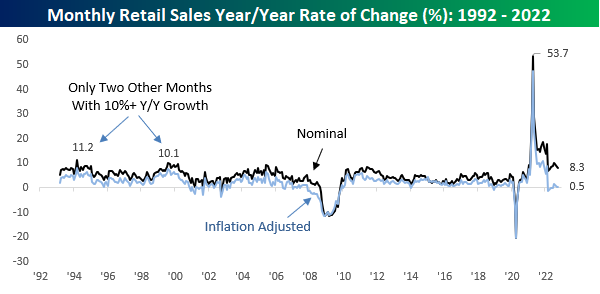

It’s only fitting that right in the thick of retail earnings season, we’re also getting the monthly update on Retail Sales for October this morning. The report came in stronger than expected with headline Retail Sales rising 8.3% on a y/y basis. While that’s strong at the surface, keep in mind that Retail Sales are a nominal reading. After adjusting for inflation, the y/y reading was up 0.5%.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.