See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You always hear the phenomenon that people are trading down, that’s not happening in our space.” – Marvin Ellison, CEO Lowe’s (LOW)

“Based on softening sales and profit trends that emerged late in the third quarter and persisted into November” Target (TGT) Earnings Release (11/16/22)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After some geo-political tensions yesterday afternoon following reports of a Russian missile strike on Poland, markets are breathing a sigh of relief this morning after NATO said that the missile likely did not come from Russia and wasn’t an act of aggression. Despite the eased tensions, futures are modestly lower this morning following a mixed batch of earnings reports. Treasury yields are lower on continued optimism that inflation pressures in the US are easing (we’ll see what Fed officials think throughout the day as a number of speakers are on the calendar), but over in the UK, CPI rose by a 40+ year high of 11.1% y/y.

It looks like it’s a morning of the haves and have-nots in retail. Target (TGT) noted in its earnings release that sales trends are softening after reporting weaker-than-expected EPS and sales. Lowe’s (LOW) seems to be operating on a whole different landscape, though, as the company reported better-than-expected EPS and sales while raising guidance. In an interview on CNBC, CEO Marvin Ellison noted that he has seen no signs of a consumer slowdown and no sign of trading down. Two large American retailers with two entirely different viewpoints on the consumer. It will be interesting to see which comments today’s Fed speakers decide to place more weight on. Getting back to the Lowe’s report, while Ellison noted that consumer trends remain strong, he also added that input prices are starting to trend down, so even from the strong report, there were some positive signs on the inflation front… but it’s just ‘one data point‘.

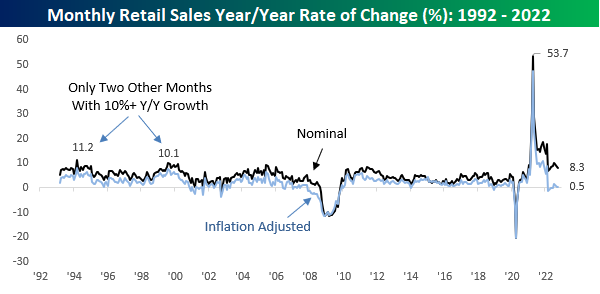

It’s only fitting that right in the thick of retail earnings season, we’re also getting the monthly update on Retail Sales for October this morning. The report came in stronger than expected with headline Retail Sales rising 8.3% on a y/y basis. While that’s strong at the surface, keep in mind that Retail Sales are a nominal reading. After adjusting for inflation, the y/y reading was up 0.5%.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.