Texas Manufacturing Comes Back

The Dallas Fed updated the final of the regional Fed manufacturing indices this morning. Business Activity remains in contraction but improved versus July. The headline index came in at -12.9, slightly worse than expectations of a reading of -12.7. Expectations saw a similar move with a large bounce off of the worst levels of the post-pandemic period.

Although the headline reading was higher, breadth was disappointing with only five other categories rising month over month. With broad declines across other categories, three indices—Unfilled Orders, Capacity Utilization, and Delivery Times—fell from expansion and into contraction. As has been the case with other regional Fed indices, expectations are generally far more pessimistic with ten of the sixteen indices in the bottom decile of their historical ranges and two others only half of one percentage point away. For comparison, there is not a single current conditions index at that low of a reading.

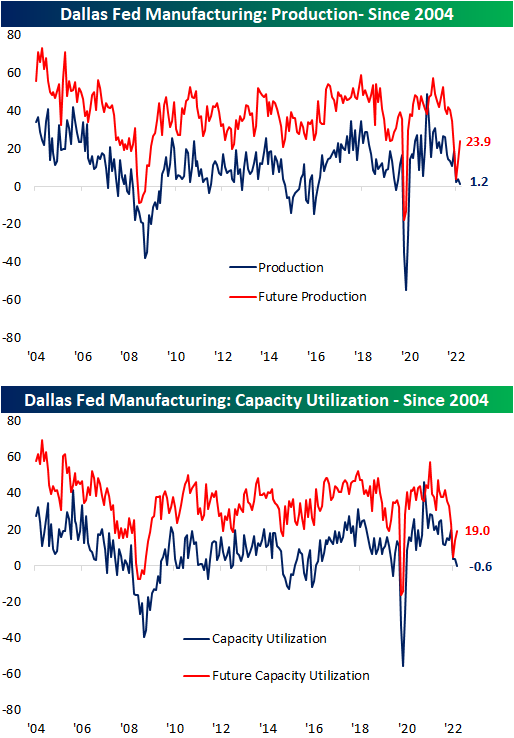

As demand has pulled back with New Orders seeing the third straight monthly contractionary reading, Production and Capacity Utilization are two of the most depressed indices of the report. These indices are in the 18th and 17th percentiles of their historical ranges, respectively. After this month’s declines, those two indices have reached the lowest levels since May 2020. In other words, consistently weak demand in recent months has resulted in production to go little changed. Ironically, the region’s firms reported much healthier expectations with significant increases in those indices. For Production, the 10.3 point month-over-month increase ranks in the top 7% of all monthly readings.

Likely another result of weakened demand, both Prices Paid and Received have continued their sharp declines across both current conditions and expectations. Prices Paid fell for the third month in a row and is now at the lowest level since October 2020 whereas Prices Received has fallen five months in a row and is down to the lowest level since February 2021. Not only are firms seeing a deceleration in price increases, but Delivery Times actually fell into contraction for the first time since June 2020. Paired with that, Inventories are also signaling improvements in supply chains as this month marked the fourth consecutive expansionary reading; the longest such streak since a six-month streak ending in January 2019. Expectations, however, are now calling for that dynamic to remain for much longer as the drop to -9.7 is the lowest reading since April 2020. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Morning Lineup – 8/29/22 – No Doldrums Here

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The greatest education in the world is watching the masters at work.” – Michael Jackson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If you planned on a quiet week of trading ahead of the unofficial last week of summer, you might want to adjust your plans. After plunging Friday, the only ones seemingly on vacation this morning are the dip buyers. Equity futures are down nearly 1% while US Treasury yields are moving higher. The 10-year yield has moved back above 3.1% which is still below the highs from June, but the 2-year yield briefly took out those June highs, so the upward direction in rates has resumed following Powell’s hawkish speech on Friday. The economic calendar is quiet today with the Dallas Fed Manufacturing report coming out at 10:30 Eastern. Economists are expecting a negative print but an improvement from July’s level of 22.6.

In many ways, last week was a normal one for the stock market- at least in terms of 2022 performance. To put it succinctly, Energy was up and everything else stunk. As shown in the graphic below from our Trend Analyzer, Energy was up over 4% taking its YTD gain back above 50%, while every other sector fell at least 1% and, in most cases, much more than that. Leading the way to the downside, Technology, Consumer Discretionary, Communications Services, and Health Care all fell more than 4%.

Despite the sharp declines last week, most sectors remain above their 50-day moving averages (DMA) with the only two exceptions being Communications Services and Health Care. It remains to be seen whether last week was a pause in the sharp rally off the June lows or a resumption of the bear market, but if the majority of sectors can stay above their 50-DMAs, the bulls still have some hope to cling to.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 8/28/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Utilities

America’s trash flow isn’t signaling a recession, CEO explains by Luke Carberry Mogan (Yahoo! Finance)

The CEO of a large trash hauler is reporting very strong demand from consumers, industrial customers, and commercial customers. Typically trash production leads or is at least coincident with weaker economic data that comes with a recession. [Link; auto-playing video]

A ‘Tsunami of Shutoffs’: 20 Million US Homes Are Behind on Energy Bills by Will Wage and Mark Chediak (Bloomberg)

Roughly one in six homes has fallen behind on utility bills, with unpaid utility balances rising through the pandemic and continuing to move upwards this summer. [Link; soft paywall]

National Defense

The Family That Mined the Pentagon’s Data for Profit by Mark Harris (Wired)

How to build a family business based on national secrets? Step one is an aggressive use of the Freedom of Information Act to fill your inventories. [Link; soft paywall]

How China Could Choke Taiwan by Chris Buckley, Pablo Robles, Marco Hernandez and Amy Chang Chien (NYT)

A detailed analysis of how the geography of Taiwan leaves it vulnerable to blockade by China…should China take that step as part of an effort to bring the island back under its control. [Link; soft paywall]

EVs

The Only Electric Car Worth Buying Right Now Is Used by Kyle Stock (Bloomberg)

As the EV supply chain ramps up, high prices and lack of availability may mean the best way to get your hands on a battery-powered car is via the used market. [Link; soft paywall]

California Approves Rules to Ban Gasoline-Powered Cars by 2035 by Mike Colias and Christine Mai-Duc (WSJ)

Wit the support of automakers, California’s Air Resources Board will phase out internal combustion engines over the next decade and a half as the nation’s largest auto market does away with engines. [Link; paywall]

Food At Scale

The Mysterious, Stubborn Appeal of Mass-Produced Fried Chicken by Adam Clair (Vice)

An investigation into the mysteries of industrially manufactured fried chicken and why it beats more artisanal approaches to deep fried bird. [Link]

There’s a Carbon Dioxide Shortage, and Food and Drink Makers are Scrambling by Jesse Newman (WSJ)

Carbon dioxide is a byproduct of ethanol and fertilizer manufacturing, which have both been disrupted by supply chain issues. The result has been a scramble for supplies across the food and beverage industry. [Link; paywall]

Real Estate

The Sellers Strike and Housing Inventory by Bill McBride (Calculated Risk)

The flow of new listings on to the market is slowing as potential sellers decide to hold supply back from housing markets where inventories have soared amidst weak demand; it remains to be seen how long the “seller’s strike” can continue. [Link]

Home Sellers Are Slashing Prices in Pandemic Boomtowns by Paulina Cachero (Bloomberg)

Almost three-quarters of homes on sales in Boise had price cuts in July as the soaring prices of the pandemic era Zoom town boom start to roll over and even reverse. [Link; soft paywall, auto-playing video]

Great White North

The best places to live in North America (The Economist)

A ranking of major cities across 30 different metrics for education, culture, the environment, health care, infrastructure, and stability suggests Canadian cities are the most livable in North America. [Link]

Hurricane Season

Hurricane season on the verge of rarely seen August without a named storm by Chris Perkins (South Florida Sun Sentinel/ArcaMax)

Hurricane season is off to a slow start; it’s on track to be only the third August since 1961 without a named hurricane in the Atlantic. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 8/26/22 – Don’t Fight The Fed, Hawk or Dove

This week’s Bespoke Report newsletter is now available for members.

The Federal Reserve is trying to engineer tighter financial conditions, and investors that don’t heed the commitment to avoiding an early pivot laid down by Chair Powell today will be on the wrong side of the aggressive Fed. We talk about the hawkish tilt in Fed speakers, underperformance of both stocks and bonds this year, commodity markets and how they impact the dollar, euro parity, stock exposure to the buck, European power markets, technical readings from major equity markets around the world, recent sentiment analysis, a full recap of US economic data released this week as well as global indicators, analysis of the rapidly shifting political backdrop ahead of US midterms, and much more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Quotes From August Earnings

Heading into a weekend when everyone is focused on commentary out of Jackson Hole, we decided to go a different direction. Today we are highlighting some of the most interesting quotes from earnings releases and conference calls during the month of August. We picked out the quotes from our Conference Call Recaps that provide insight into either the broader economy or specific industries. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

Overall, company commentary suggests that the consumer is generally strong, but purchasing patterns have changed due to higher gas prices, inflation, and shifting consumer activities. On the corporate side, a number of tech companies have made note of the fact that business has softened as the economy is now on the backend of the COVID demand pull forward.

August ’22 Earnings Quotes:

Uber (UBER) CEO Dara Khosrowshahi noted: “Driver engagement reached another post-pandemic high in Q2, and we saw an acceleration in both active and new driver growth in the quarter. Against the backdrop of elevated gas prices globally, this is a resounding endorsement of the value drivers continue to see in Uber.” This might be due to the higher cost of living brought forth by the inflationary environment.

UBER’s management team saw “Delivery demonstrated stable consumer, merchant, and courier metrics against tough YoY comps as COVID-19 restrictions continued to ease around the world.”

Starbucks (SBUX) is still seeing “strength in customer demand globally,” according to CEO Howard Shultz.

“We are not currently seeing any measurable reduction in customer spending or any evidence of customers trading down, reflecting the strength of the Starbucks brand, deep customer engagement and loyalty, pricing power, and the premium nature of our beverage and food offerings.” – Shultz

Tyson Foods (TSN) CEO Donnie King noted that “increasing consumer demand for protein remains relatively steady.” However, consumer demand is being impacted by “a challenging macroeconomic environment.”

Walmart (WMT) CEO Doug McMillon noted: “We expect inflation to continue to influence the choices that families make, and we’re adjusting to that reality so we can help them more.”

CFO David Rainey is seeing consumers trade down “in terms of quality and quantity… Clearly, they’re stressed from higher gas prices, higher food prices, and even housing.” Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

Target (TGT) Chief Growth Officer Christina Hennington commented that, although consumer spending power appears to remain strong, “confidence in their personal finances continues to wane.” Hennington also added that “difficult news headlines, COVID surges, and continued political volatility” had a negative impact on consumer confidence as well.

Home Depot (HD) CEO Ted Decker noted “continued strength in demand for home improvement projects,” which is likely supplementing a decline in new home activity.

PayPal (PYPL) CFO Gabrielle Rabinovitch commented: “we’re closely monitoring the impact of high inflation on economic growth, consumer demand, and sentiment, as well as broader global macroeconomic indicators. The backdrop continues to be complex, and we’re taking an appropriately prudent approach to managing our business.”

Alibaba (BABA) still sees “supply chain and logistics disruptions” due to China’s COVID-zero policy. However, the company did see improvement towards the end of the quarter. CEO Daniel Zhang saw “signs of recovery since June as logistics and the supply chain situation gradually improved after COVID restrictions eased.”

Coinbase (COIN) CEO Brian Armstrong said, “you have to really remember that crypto is not linear. Any given quarter could be up or down or even any given year. But if you evaluate the business across price cycles, it tells a much different story.”

“The future of all media is digital and programmatic, eventually all media will be digital, and it will be transacted by machines,” according to The Trade Desk’s (TTD) press release.

Zoom (ZM) lowered guidance due to FX headwinds, weak online sales, and “to a lesser extent backend linearity,” as per CFO Kelly Steckelberg.

Cisco (CSCO) CEO Chuck Robbins commented: “While we anticipated some moderation from the unprecedented product order growth of last year, demand signals remain solid.”

Advanced Micro Devices (AMD) CEO Lisa Su noted that “there has been additional softness in the PC market in recent months.”

NVIDIA (NVDA) CFO Colette Kress added: “we have likely under-shipped gaming to our end demand significantly… we do have gaming growth drivers to consider for the future.” Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

“The next wave of computing is coming. With AI and 3D graphic advances, developers will extend the internet with virtual world overlays that connect to the physical world,” as per CEO Jensen Huang.

Salesforce (CRM) Co-CEO Bret Taylor noted that the company is “seeing [gross merchandise value] decelerate in line with the rest of the e-commerce industry as consumers settle back down to pre-pandemic norms.”

To gain access to our full Conference Call Recaps in real time, start a 14-day trial to our Institutional package.

Bespoke’s Morning Lineup – 8/26/22 – Going Back to the (Po) Well

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no risk-free path for monetary policy.” – Jerome Powell

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures have been digging out of their hole all morning, but still remain in negative territory ahead of Powell’s speech in Jackson Hole at 10 AM. Crude oil is modestly higher this morning while US Treasury yields are modestly lower. Outside of the Fed, one big story crossing the wires right now is from Bloomberg which is reporting that the US and China have reached a preliminary deal regarding audits that could avoid delistings of Chinese companies from US exchanges.

It’s also a busy morning for economic data, and for the 8:30 batch, Personal Income and Spending were both weaker than expected, but PCE inflation data came in weaker than expected. At 10 AM, we’ll get the Michigan Confidence report which will be interesting to watch as it will come out just as Powell starts speaking.

Ahead of Powell’s widely anticipated speech today, the equity market is following the technical playbook to a tee. After stalling out just short of its 200-DMA last week, the pullback that followed found support right at the June highs and the brief period of consolidation that occurred right before the August rally run to the 200-DMA. While not necessarily a technical term, the saying, “if at first, you don’t succeed, try again”, seems applicable to where the market is today relative to its 200-DMA. Now, we just have to wait to see if Powell’s speech will provide some fuel for that attempt or put on the brakes. We’ll know within the next couple of hours.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Sentiment Slide

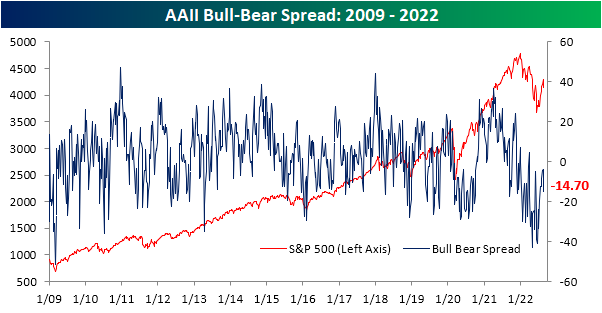

With the S&P 500 pivoting lower in the past week, sentiment has reflected the move as the AAII sentiment survey showed bullish sentiment drop from 33.3% last week down to 27.7%. That marked the first time bullish sentiment fell in three weeks, and it was the largest single-week decline since an eleven percentage point drop the week of June 9th.

Bearish sentiment picked up the bulk of that decline as the reading topped 40% for the first time since the last week of July. At 42.4%, it is at the highest level since July 14th. Although that marks a shift toward more pessimistic sentiment, reversing a trend of improvement from the past few weeks, the current reading on bearish sentiment is well below the highs from throughout the spring and early summer.

Nonetheless, after coming within only a few points of a positive reading in the past month, the bull-bear spread took a sharp turn lower as a result of this week’s results. The spread fell to -14.7 which is the lowest reading since July 14th. That was also the first double-digit week-over-week drop in the reading since June. Additionally, with a move deeper into negative territory, the spread is a week away from becoming tied for the second-longest streak of negative readings on record. Click here to learn more about Bespoke’s premium stock market research service.

Claims’ Seasonal Low Draws Near

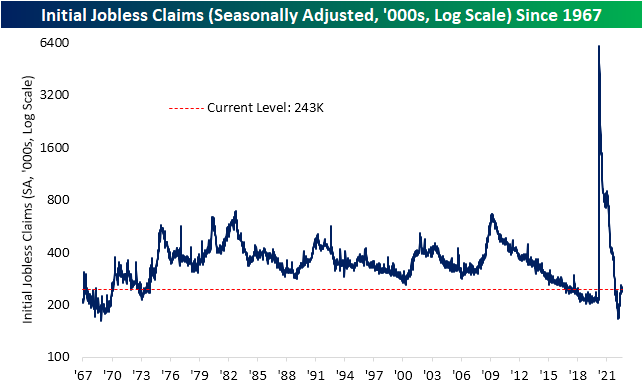

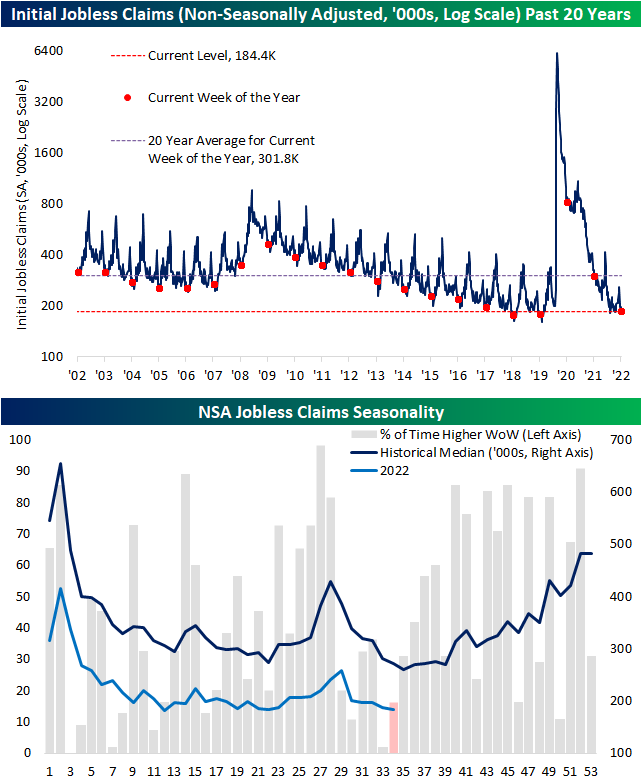

Initial jobless claims have come well off of the historic lows from earlier this year, but the past couple of weeks have also seen modest improvements. We’ve now seen back-to-back weeks of declines in claims for a total drop of 9K, leaving seasonally adjusted initial claims at 243K. That is the lowest reading since the week of July 22nd. However, that is still above the range from the two years prior to the pandemic.

Non-seasonally adjusted claims are nearing what is typically an annual low. The past couple of weeks have historically been two that have seen the most consistent declines on a week-over-week basis throughout the year. That has dropped NSA claims to 184.4K which is only slightly above the post-pandemic low of 183.6K from the final week of May.

Continuing claims came in lower than expectations this week dropping to 1.415 million versus forecasts for an increase to 1.441 million. Overall, continuing claims remain much stronger and less elevated off the lows than initial claims. Whereas initial claims are above their pre-pandemic range, current levels of continuing claims continue to come in at some of the lowest levels since the first few years of the data.

Given this, the ratio of initial to continuing claims continues to hover at levels that are well above the norm of the past few decades even after peaking last month. That would imply healthy turnover as those who are filing for unemployment are not remaining unemployed for long given the small amount of follow-through of initial claims into continuing claims. Click here to learn more about Bespoke’s premium stock market research service.

LIKS Report: 8/25/22

Bespoke’s Little Known Stocks (LIKS) report highlights a company that may not be on the traditional radar of most investors. In this report, we provide an in-depth analysis of the little known stock, including industry insights, growth lever analysis, insights to the competitive landscape, equity performance, relative valuation, operational efficiency, pros & cons, and more. Today’s report is about a company that helps governments and enterprises defend their cyber assets.

As always, this report is for informational purposes only and is not a recommendation to buy or sell any specific securities. Investors should do their own research and/or work with a professional when making investment decisions. Highlighting a stock doesn’t mean we are bullish or bearish on it. Our goal is simply to provide readers with facts to help them make informed decisions rather than just opinions.

Bespoke’s LIKS reports are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our LIKS reports. To sign up, choose either the monthly or annual checkout link below: