Dividend Stock Spotlight: Johnson & Johnson (JNJ) and UnitedHealth (UNH)

Earnings season kicked off this morning with a number of big banks’ third-quarter results such as JPMorgan (JPM) and Goldman Sachs (GS). Two other Dow components, both Health Care stocks, also had notable reports: Johnson and Johnson (JNJ) and UnitedHealth (UNH). These two were the first triple plays of this earnings season. A triple play is when EPS and revenues are above analyst estimates while the company also raises forward guidance.

Despite some recent legal headwinds, Johnson and Johnson (JNJ) showed a strong quarter with EPS coming in 11 cents above estimates along with revenues that also topped estimates. JNJ also raised guidance making it the first triple play for the stock in two years (the last being in October of 2017) and only the ninth since 2000 (as highlighted in the table from our Earnings Explorer snapshot below). In terms of the stock price reaction, normally JNJ has generally not been very volatile with an average full-day gain of just 17 bps in reaction to earnings across all quarters. In quarters when the company has reported a triple play, though, the stock has performed even better with an average full-day gain of 1.2%. Today, JNJ is on pace to do even better having already gained 2.2%.

From a technical standpoint, the stock remains stuck in its recent range even after today’s rally. At current levels, though, JNJ yields 2.85% which is more than the S&P 500’s 1.9% yield and the average for other Health Care stocks (1.68%). Furthermore, of all 61 S&P 500 Health Care stocks, JNJ has the seventh-highest yield. Johnson & Johnson is also a dividend aristocrat with a long history of paying and growing its dividend, something it has no done for 58 consecutive years. Given the payout ratio is still relatively low at 44.9%, the company should be able to keep that streak going even if earnings growth stalled out.

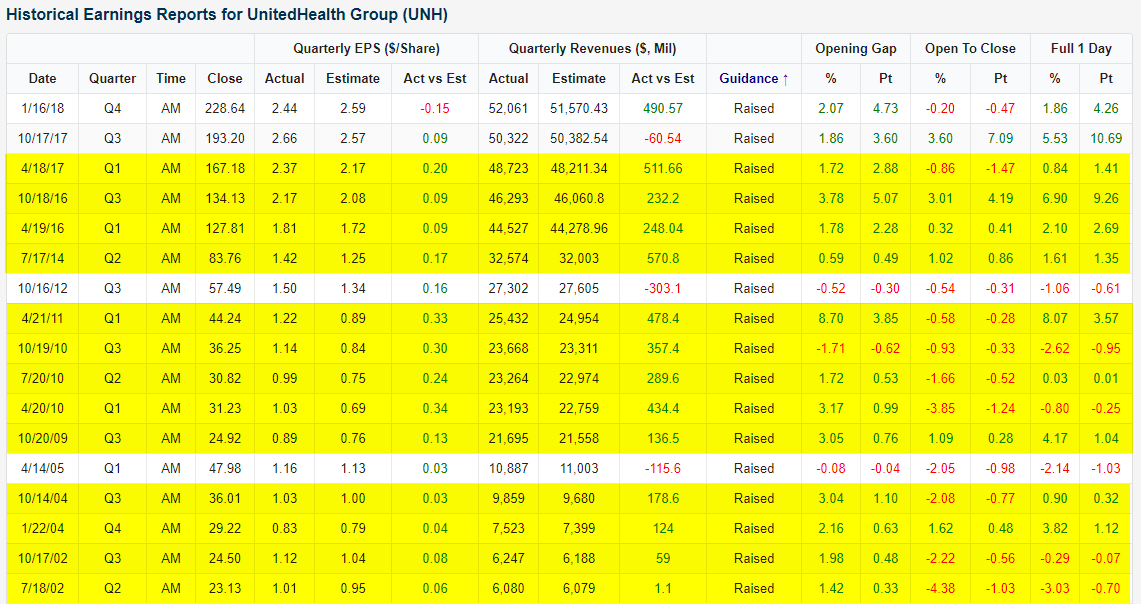

UnitedHealth’s (UNH) price action has been a bit more exciting than JNJ as it has ripped higher in today’s session. The stock is up over 7.5% after exceeding EPS estimates by 12 cents, topping revenues by over $500 million, and raising guidance. This is the company’s fourth-best reaction to any quarter’s earnings since 2001 and is the 14th triple play in that time. The only one of these past triple plays that saw a stronger stock price reaction to earnings was the first quarter of 2011 when UNH finished the day 8.07% higher.

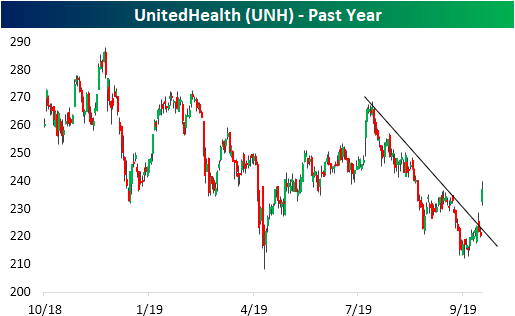

While JNJ is still within its uptrend, this strong response for UNH has actually broken the past few months’ downtrend line. UNH is now back to where it was in mid-August. From a dividend perspective, UNH is not as attractive as JNJ as it only yields 1.83%, slightly below that of the S&P 500. The company also does not have as long of a track record (only 9 consecutive years) of increasing its dividend. Granted, UNH does have a slightly lower valuation with a P/E of 14.6 compared to JNJ’s 14.8. Both of these are also below the 19x average for all S&P 500 Health Care stocks. Start a two-week free trial to Bespoke Premium to sample our actionable research. If you use this checkout link, you’ll receive a 10% discount on an annual membership if you stick with it past your trial period.

Chart of the Day: Volume. Where is It?

Today’s Chart of the Day is now available for members.

As stocks have rallied off their recent lows from October, we’ve heard a number of comments from investors regarding the lack of volume accompanying the move. These critics aren’t wrong. In the four trading days since the 10/8 closing low, volume in SPY has come in below its 50-day moving average by an average of 18%, and there has only been one day of those four where volume was actually above average. The day isn’t over yet, but volume so far is tracking below average again even as the S&P 500 is up over 1%.

Does low volume matter, and if so how much should we be worried? In today’s Chart of the Day, we look to shed some light on that question. To read this report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to Bespoke Premium. You won’t be disappointed!

Bespoke CNBC Appearance (10/14)

Bespoke co-founder Paul Hickey appeared on CNBC’s Closing Bell yesterday (10/14) to discuss the upcoming earnings season. To view the segment click on the image below. Stay on top of everything earnings-related this earnings season, and start a two-week free trial to Bespoke Premium to sample our actionable research. If you use this checkout link, you’ll receive a 10% discount on an annual membership if you stick with it past your trial period.

Energy Sector Depleted

With the bond market closed for the Columbus Day holiday, it was a very quiet day in the equity market yesterday. As we noted in last night’s Closer report, it was the lowest volume full day of trading since December 2017. With the lack of any big moves, the lists of new highs and new lows were very small as well. In the S&P 1500, which includes large-cap (S&P 500), mid-cap (S&P 400), and small-cap (S&P 600) stocks, there were just eight 52-week highs and 18 new lows. One standout sector on the list of new lows, though, was Energy. As shown in the table below, eleven of the eighteen stocks on the list of new lows were from the Energy sector. Also, it’s not as though Energy is a big sector within the index as it accounts for less than 6% of the index’s constituents.

The fact that so many stocks from the Energy sector make up the list of new lows shouldn’t come as too much of a surprise after looking at a chart of the sector over the last year. While the S&P 500 is within 2% of new highs, Energy is within 10% of a 52-week low. While the Energy sector remains mired in a long-term downtrend, it is interesting to note that it is showing some early signs of a double-bottom following its recent sell-off. With the sector so close to 52-week lows and sentiment being so negative, any positive news would provide a big boost. An example of that negative sentiment is the latest release of the BofA Merrill Fund Manager Survey which showed that overall asset allocation towards the Energy sector is further below its historical average than any other sector/asset class. Start a two-week free trial to Bespoke Premium to sample our most actionable investment research. If you use this checkout link, you’ll receive a 10% discount on an annual membership if you stick with it past your trial period.

Bespoke Morning Lineup – 10/15/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Turkey Drop, Volume Stop, Energy Stocks, Transport Indices, Empire – 10/14/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the markets’ reaction to geopolitical tensions in Turkey. Next, we show just how low volumes were in today’s session followed by the breakdown in correlation between the energy sector and crude oil. We finish with a bit of macroeconomic data including Cass Transportation’s freight volumes and the Empire State manufacturing report.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Apple (AAPL) Back on Top

When Apple (AAPL) overtook Microsoft (MSFT) in size back in 2010, a lot of people thought Microsoft’s best days were behind it. By late 2012, Apple’s market cap had eclipsed $600 billion while Microsoft was still trending lower and lower towards the $200 billion level.

The tide for MSFT finally started to turn in 2013, and since current CEO Satya Nadella took over in February 2014, the company has seen its market cap increase by 2.5x from $300 billion up to its current size of $1.068 trillion.

During the fourth quarter rout for US equities in 2018, Apple (AAPL) shares tumbled much more than Microsoft (MSFT), which allowed MSFT to slip ahead of AAPL in terms of size. While the two battled it out during the first quarter recovery this year, Apple shares got hit extra hard in May when the US/China trade war really heated up, allowing MSFT to take a commanding lead in market cap.

Recently, though, it has been Apple that has been surging as Microsoft has traded more sideways. Apple hit a new all-time high again last week, and on Friday the company managed to close the week with a market cap that was just under $1 billion higher than that of Microsoft. Today we’re seeing the gap widen a little more as Apple’s market cap trades at $1.072 trillion versus MSFT’s cap of $1.068 trillion. When you’re talking in the trillions, though, what’s four billion between friends.

With levels that are so close, one up day for MSFT and down day for AAPL could give MSFT the lead again, but for now, Apple has regained its title as the world’s largest company. Start a two-week free trial to Bespoke Premium to sample our most actionable investment research. If you use this checkout link, you’ll receive a 10% discount on an annual membership if you stick with it past your trial period.

Columbus Day Markets

While our friends in the bond market are all enjoying the third day of a three-day weekend, US equities are operating on a typical schedule for Columbus Day. Given the bank holiday and the fact that most schools are closed in the NYC region, this is often a day where liquidity is a bit more scarce than normal. A perfect example of that lack of liquidity causing major outsized moves was in 2008 when the S&P 500 rallied more than 11% on Columbus Day. Granted, that was a period of historic volatility, but there have only been a handful of such large one-day moves in market history, so even for the financial crisis, an 11.6% one-day move was a big deal. As good (or bad if you were short) as that move felt in 2008, the gains were fleeting and were more than erased within just seven trading days!

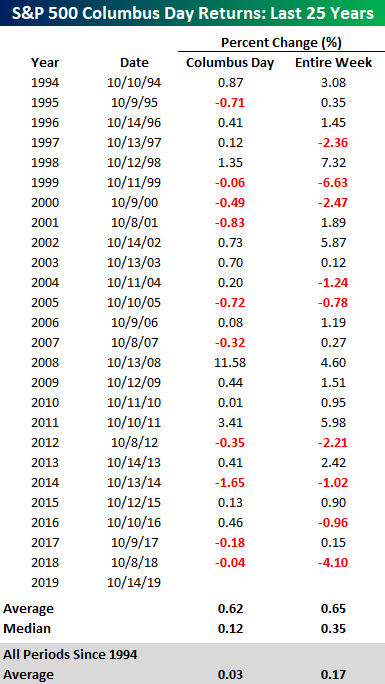

The table below shows the S&P 500’s performance on Columbus Day and during the entire week over the last 25 years. On an average basis, the S&P 500 has rallied 0.62% on Columbus Day with positive returns 60% of the time. That average is skewed big time, though, by the 2008 rally. On a median basis, the S&P 500’s Columbus Day return over the last 25 years has been much lower at +0.12%, which is still actually better than the S&P 500’s average one-day return of 0.03% over the last 25 years.

For the entire Columbus Day week, the S&P 500’s average return has been a gain of 0.65% (median: 0.35%) with gains 64% of the time. Those figures are also better than the long-term average weekly change of 0.17% for all periods since 1994. More recently, though, it has been a bit of a coin flip in terms of market returns as the S&P 500 has alternated between positive and negative returns for the week since 2011. Last year, the S&P 500 was down 4.1% during the week, so if the back and forth pattern continues, bulls will catch a break this year. Start a two-week free trial to Bespoke Institutional to access all of our interactive tools, including our popular Seasonality tool.

Bespoke’s Morning Lineup – 10/14/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 10/13/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Taxes

Trump’s Tax Bill Has Cost Homeowners a Trillion Dollars by Allan Sloan (Fortune)

One consequence of the 2017 TCJA is to remove subsidies for homeowners, which reduced state and local real estate tax deductions and some mortgage rate deductions. [Link]

The Rich Really Do Pay Lower Taxes Than You by David Leonhardt (NYT)

A times analysis of 2018 income tax filing data suggests that the 400 households with the most wealth paid the lowest tax rate of any bracket across federal, state, and local taxes. [Link; soft paywall]

Batteries

California’s power outage means problems for electric cars. Tesla says charge up, quick. by Faiz Siddiqui (WaPo)

With rolling blackouts in California designed to prevent fires sparked under PG&E infrastructure, the automaker warned customers of the need to charge up before blackouts. There’s always an angle for Tesla bears! [Link; soft paywall]

Chemistry Nobel Hails Work on Batteries That Changed Society by Elisabeth Behrmann and Veronic Elk (Bloomberg)

The latest Nobel prize has gone to the three scientists who were key to the development of the modern lithium-ion battery technology, which fuels everything from cell phones to cars. [Link; soft paywall]

Grifter Nation

All the “wellness” products Americans love to buy are sold on both Infowars and Goop by Nikhil Sonnad (QZ)

It’s hard to imagine two brands with a more different message than Gwyneth Paltrow’s West Coast wellness shop “Goop” and conspiracy theorist Alex Jones’ Infowars, but many of the products they hawk are the same snake oil in a different package. [Link]

The Cheating Scandal Rocking the Poker World by David Hill (The Ringer)

While nothing has been proven – yet – evidence and speculation has swirled that a popular, exciting player has been winning a bit too much in tight spots. [Link]

WeWork chases new financing as cash crunch looms by James Fontanella-Khan and Andrew Edgecliffe-Johnson (FT)

While the company looked to have enough cash on hand to make it well in to next year, new reports suggest that it’s burning cash faster than anticipated and may run out before December. [Link; paywall]

We pit the Uber Copter vs. public transit in a race to JFK — here’s who won by Elizabeth Rosner, Olivia Bensimon and David Meyer (NY Post)

While taking a helicopter to JFK sounds pretty amazing, if you’re leaving from Midtown you’re probably better off underground than up in the air. [Link; auto-playing video]

Tech Travails

Is Amazon Unstoppable? by Charles Duhigg (The New Yorker)

The country’s second-largest employer and seller of one-third of all goods bought or sold online is facing regulatory scrutiny and public outrage. Can Bezos carry the firm on ego alone? [Link; soft paywall]

Facebook Can Be Forced to Delete Content Worldwide, E.U.’s Top Court Rules by Adam Satariano (NYT)

In a state of affairs that is foreign to Americans but plenty familiar elsewhere, a foreign court has ruled that countries have extra-territorial powers that will open companies up to consequences if they are not respected. [Link; soft paywall]

OECD takes aim at tech giants with plan to shake up global tax by Chris Giles (FT)

The OECD has developed a new proposal designed to push back against tech firms’ tax dodging as a result of profit shifting to low tax jurisdictions. [Link; paywall]

Markets

Why Oct. 9 is a day that lives in infamy among stock investors by Mark Hulbert (MarketWatch)

In both 2002 and 2007, there were two different big shifts in equity markets, both falling on the exact same calendar day: October 9th. [Link]

Home Work

How remote work is quietly remaking our lives by Rani Molla (Recode)

Jobs in high cost cities are increasingly being done by remote workers who are able to buy higher standards of living in rural areas or simply other regions of the country. [Link]

Keeping the Heirloom House by Amy Gamerman (WSJ)

As homes get passed down across multiple generations, shares of time – and decisions related to the house – can get very complicated. [Link; paywall]

Bitcoin

Order Disapproving a Proposed Rule Change,as Modified by Amendment No. 1, Relating to the Listing and Trading of Shares of the Bitwise Bitcoin ETF Trust Under NYSE Arca Rule 8.201-E (SEC)

The SEC has disallowed the last remaining application for a bitcoin ETF, based primarily on the fact that they find the entire market to be ripe for manipulation and fraud. [Link; 112 page PDF]

Crop Report

Despite Extreme Weather, 2019 Is a “Perfect Storm” Vintage for Wine by Elin McCoy (Bloomberg)

Vinophiles take note: harvests were “near perfect” in California, while French grape growing areas have gotten a weather combination that has hurt yields but concentrated flavors, making 2019 a year of bottles to look forward to. [Link; soft paywall]

Credit Markets

SG pull-back poses questions for CDS market by Christopher Whittall (IFR)

With Societe Generale pulling back from its role in the CDS market, a key regulatory body composed of end investors and dealers is without the minimum number of participants. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!