Grub-Dud

While there were eight companies that reported triple plays since yesterday’s close by beating EPS estimates, beating sales estimates, and raising guidance, GrubHub (GRUB) posted a reverse triple play. A reverse triple play is a company that misses EPS estimates, misses sales estimates, and lowers guidance. It doesn’t get any worse than that.

GrubHub (GRUB) shares are reacting accordingly to the reverse triple play. The stock just opened down 33% from yesterday’s closing price, which is by far the biggest gap down on earnings that the stock has experienced since its first quarterly report back in May 2014. Below is a snapshot of all of GRUB’s historical reports pulled from our Earnings Explorer tool. We’ve sorted the list by opening gaps from worst to best. Heading into this report, the biggest gap down that GRUB had experienced was a 28.58% lower open on October 27th, 2015. That day at least, the stock managed to recover by 6.85% from the open to the close, but it still resulted in a full-day decline of 23.68%. While it’s not much consolation given that shares are giving up a third of their value this morning, the four times the stock has gapped down at least 10% on earnings in the past, shares have at least traded up from the open to the close by 5% or more. Start a two-week free trial to Bespoke Institutional for full access to some of the most sought after research on the street, including our Earnings Explorer tool.

Today’s Earnings Triple Plays; Beyond Bombs

Guidance numbers have been pretty atrocious this earnings season, with companies lowering guidance about twice as much as companies are raising guidance. Even still, there have been plenty of earnings triple plays this season, with another 8 registered since the close yesterday.

An earnings triple play is when a company raises guidance, beats EPS estimates, and beats sales estimates. Long-time Bespoke readers know that we’ve been following triple plays since our inception back in the mid-2000s. Investopedia.com has even given the triple play its own entry, providing credit to Bespoke for coming up with the term.

Below is a list of the triple plays registered either after hours yesterday or in the pre-market this morning. While four of them are trading nicely higher — Leidos (LDOS), Merck (MRK), NeoGenomics (NEO), Xerox (XRX) — the biggest bust on the list by far is Beyond Meat (BYND). Even with an earnings and sales beat and increased forward revenue guidance, BYND is set to open down nearly 20% this morning supposedly due to concerns about pricing and increased competition and the end of the employee lock-up period.

Things couldn’t get any better for Beyond Meat (BYND) in the early days following its IPO. You probably remember that shares pretty much couldn’t go down during the summer months, and they were seemingly closing higher by 10-20% every day for a few weeks! After pricing at $25/share at its IPO on May 1st, BYND shares reached their peak of $234.90 on July 26th — a ridiculous gain of 840% in less than three months!

Since peaking just over three months ago, though, it has been straight downhill. Based on where shares are trading in the pre-market, BYND will be down 63.7% from its high and only up 29.7% from where it opened on its first day of trading on the secondary market. Start a two-week free trial to Bespoke Institutional for full access to some of the most sought after research on the street.

Bespoke Morning Lineup – 10/29/19 – Taking a Breather

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Change in Tone, Economic Data Deluge – 10/28/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the market’s change in tone regarding risk. We then look at how the United States’ share of global market cap has declined. Next, we review all of today’s economic data including the Chicago Fed’s National Activity Index, the Dallas Fed’s manufacturing results, monthly data on the federal government’s budget, and finally, retail and wholesale inventories.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

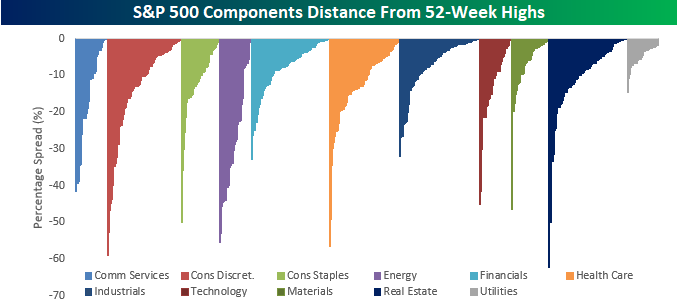

New Highs MIA

Earlier today, we noted in a tweet that despite the record highs for the S&P 500, the number of stocks hitting 52-week highs was extremely weak at 38. While that number improved slightly this afternoon, at 40 it’s still very low for a day when the index itself is hitting a new all-time high. While the overall number of stocks hitting new highs is very low, we can take some consolation in the fact that more than one-third of the index is within 5% of a new high, so if we see a few more days like Monday, the list of new highs should start to meaningfully expand.

The table below summarizes the percentage of stocks in each sector that are within 5% of a new high. Topping the list is Utilities where more than half of the sector’s components are less than 5% from a new high. Behind Utilities, nearly half of stocks in the Industrials sector are also on the verge of a new high. At the other end of the list, Energy has the fewest components within 5% of a 52-week high at just 7%, and then three other sectors have a quarter or fewer of their components at new highs (Health Care, Consumer Staples, and Materials).

The chart below is the same as the one above, but instead of sorting the components by the distance from their respective 52-week highs, we sorted it first by sector and then by the distance from a 52-week high. Five sectors currently have at least one component that is down over 50% from a 52-week high (Consumer Discretionary – Macy’s and L Brands, Consumer Staples – Kraft Heinz, Energy – Concho Resources and Cimarex, Health Care – ABIOMED, and Technology – DXC Technology and Alliance Data Systems). On the other end of the spectrum, if you look closely at the chart, you can see that for both the Financials and Industrials sectors, a number of stocks are very close to 52-week highs. For the Financials, 12 components are within 2% of a new high while 20 members of the Industrials sector are just within the 2% threshold as well. Start a two-week free trial to Bespoke Institutional for full access to some of the most sought after research on the street.

Dividend Stock Spotlight: Tiffany & Co. (TIF)

This morning, LVMH, the owner of famous brands like Louis Vuitton, Sephora, Dom Perignon, and TAG Heuer, confirmed a bid to acquire yet another world-renown luxury brand: Tiffany & Co. (TIF). With the news of this bid, TIF’s stock is up over 30% for the largest one-day gain in the stock’s history. TIF has been no stranger to big price moves lately. Previously, its best single-day performance was on May 23rd of last year in response to an earnings triple play when the stock rallied 23.3%. Today’s rally brings the stock to levels not seen that massive rally last year and within 5% away from its all-time high that was put in place in July of 2018.

Given the surge in TIF, the dividend yield has been brought down quite a bit. On Friday, the stock yielded 2.35% which was above the yields of the S&P 500, Consumer Discretionary sector, and Retailing industry group. With the stock now yielding 1.83%, it’s payout is now less than all of these and even 2 basis points less than the yield of the ten-year US Treasury. With that said, the company has boosted its yield for 15 straight years, and the payout ratio of 51.5% is not a concern. Start a two-week free trial to Bespoke Institutional to access our Earnings Explorer, Security Analysis tool, and more.

Bull Market Extends to 3,885 Days; 2x Longer and Stronger Than Average

It has been just over three months since the S&P 500 made its last all-time closing high on July 26th. If we get a close above 3,025.86 today, the current bull market will extend to 3,885 days using the standard bull market definition of a 20%+ rally that was preceded by a 20%+ decline on a closing basis. As shown in the table of post-WW2 bull markets below, this one easily ranks as the second longest and second strongest on record. We’re now more than 1,000 days longer than the 1949-1956 and 1974-1980 bulls, and we’re nearly 2,000 days longer than the 2002-2007 bull. We’re also more than double the average bull market in terms of both length and gain. The average bull sees a gain of 154.4% over 1,700 days versus this bull’s gain of 349.5% over 3,885 days.

While this bull has certainly been a long one, the S&P would have to continue rallying for nearly two more years before it can take over the trophy for the longest bull market on record. From December 1987 to March 2000 (4,494 days), the index gained 582.1% without experiencing a single 20% decline on a closing basis. Start a two-week free trial to Bespoke Premium to unlock access to our research, including our Morning Lineup, Chart of the Day, and weekly Bespoke Report.

Bespoke Morning Lineup – 10/28/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 10/27/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Changes And Stasis

Apple Pay Overtakes Starbucks as Top Mobile Payment App in the US (eMarketer)

Mobile payments leader Starbucks has been surpassed by Apple Pay, which now was more than 30mm US users accounting for 47% of total users who use proximity payment services. [Link]

‘Death by Amazon’ Was a False Alarm for Walmart and Some Other Retailers by Daren Fonda (Barron’s)

Bespoke’s own Death By Amazon index shows that traditional retailers have been having a great year despite the rise of the e-commerce giant. [Link]

Why the Gasoline Car to the EV is Like the Horse to the Car by Vitaliy Katsenelson (Contrarian Edge)

Part of an 11-part series on Tesla and related topics, this essay argues that internal combustion engines’ decline is a critical shift akin to the end of horses and rise of the automobile. [Link]

Hollywood

The Latest in Security for Hollywood Homeowners: “Laser Systems in Every Single Project” by Alexandria Abramian (The Hollywood Reporter)

Higher incidence of robberies and burglaries have the stars of the silver screen thinking more about their security and some of the results live up to the same over-the-top approach that celebrities bring to other kinds of consumption. [Link]

The One Where Apple Tried to Buy Its Way Into Hollywood by Lucas Shaw and Mark Gurman (Bloomberg)

A detailed look at the story of Apple’s entry into the world of streaming, powered by an ocean of cash and a need to bolster services revenues, a risky play given the history of what makes winners in Hollywood. [Link; soft paywall]

Food

An Undeserved Gift by Shane Mitchell (The Bitter Southerner)

The delicious oral history of okra, a key ingredient in the cuisine of the south that was part of the massive Columbian Exchange; the vegetable goes back so far into that history that nobody can when or how specifically it made its way from Africa to the Gulf Coast. [Link]

Popeyes Will Hire More Staff to Deal With Return of Hit Sandwich by Leslie Patton (Bloomberg)

In early November, the chicken joint will resume its offering of chicken sandwiches which proved so staggeringly popular over the course of the summer, and it’s hiring extra workers to do so. [Link; soft paywall, auto-playing video]

Online ordering boom gives rise to virtual restaurants by Alexandra Olson (AP)

Commercial kitchens are sharing space and workers in order to offer precisely tailored menus designed for takeout that appeals to users of Grubhub, DoorDash, and Uber Eats. [Link]

Politics

The Student Vote Is Surging. So Are Efforts to Suppress It. by Michael Wines (NYT)

College student voting rates doubled from 2014 to 2018, as young people increasingly turn out in opposition to the GOP; the response has been to restrict voting by students. [Link]

A multi-millionaire set out to counter Dominion. Now he’s the state’s biggest campaign donor. by Ned Oliver (Virginia Mercury)

When a Charlottesville-based hedge fund manager Michael Bills ran the numbers, he realized he could buy more influence with state lawmakers than the local utility, so he did. This is both an amusing and slightly horrifying story about how basically (and legally) corrupt many lawmakers have become. [Link]

Democrats Seek Insider Trading Probe After ‘Trump Chaos’ Article by Ben Bain and Matt Robinson (Yahoo!/Bloomberg)

Bespoke’s Macro Strategist George Pearkes gave a convincing debunking of the conspiracy theory that insiders were moving around S&P 500 futures ahead of Presidential tirades (link), but apparently that wasn’t enough for some Democratic lawmakers who want more details; those details will inevitably disappoint the tinfoil hat crowd. [Link]

Baseball

A century after Black Sox, baseball cheating goes high-tech by Ben Nuckols (San Diego Union-Tribune)

While nobody can accuse modern players or whole teams of throwing the World Series, there’s still plenty of evidence that more modest acts of cheating are commonplace. [Link]

Why Baseball in D.C. Finally Worked by Brian Costa and Jared Diamond (WSJ)

A story of how the Washington Nationals finally broke through after spending years in purgatory north of the border in Montreal. [Link; paywall]

Romanophilia

Mark Zuckerberg’s fascination with Augustus Caesar might explain the Facebook CEO’s haircut by Mary Mesenzahl (Business Insider)

Facebook CEO Mark Zuckerberg is a fan of Augustus Caesar, the princeps (“first citizen”) who helped transition Rome from a semi-republic to a full empire, and his weird haircut is one example of that appreciation. [Link]

Aerospace

How Boeing’s 737 MAX Troubles Are Affecting the Economy by Matthew C. Klein (Barron’s)

Boeing’s manufacturing operations are so large that the halt in sales (and orders) for just one of their models (the infamous 737-MAX) is having a very measurable impact on government economic statistics. [Link; paywall]

Executive Efforts

How to retire by 40 by Jamie Powell (FTAV)

An amusing set of tips for those who want to cut their working lives in half. [Link; registration required]

Inside Ken Fisher’s Private Kingdom, Where Hardball Culture Reels in Billions by Sabrina Willmer (Bloomberg)

Cold calls by the hundreds, more than $100bn in AUM, and direct mail in industrial quantities: inside the sprawling empire that is Fisher Investments. [Link; soft paywall, auto-playing video]

Halloween Horrors

Scariest haunted house in U.S. requires 40-page waiver, doctor’s note, safe word (WGN9)

If you’re willing to get a physical, sign a book-length waiver, and watch a two hour training video you are allowed to try the scariest attraction in America. If you can get through it without using your safe word, you’ll get a $20,000 reward. [Link]

The Times Square Sbarro Is Closed by Chris Crowley (Grub Street)

An iconic – and somewhat laughable – figure in Times Square, the Sbarro pizza is being closed after opening 23 years ago. [Link]

Social Media

Online Influencers Tell You What to Buy, Advertisers Wonder Who’s Listening by Suzanne Kapner and Sharon Terlep (WSJ)

Quantifying the benefit of advertising spending that is funneled through “influencers” gets complicated, leading to significant questions about how much value they provide. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 10/25/19

This week’s Bespoke Report newsletter is now available for members.

Global equity markets are breaking out. The S&P 500 has poked above resistance that has held since mid-year, while 52-week closing highs were logged to close the week in Sweden, Switzerland, and the broad European Stoxx 600. We run through earnings results in the US and Europe, technical patterns in specific European sectors, the breadth of the US market, and give a complete rundown on economic data published this week both here in the US and impacting the broader global economy. We cover everything else you need to know related to trends in financial markets in our weekly Bespoke Report. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!