The Closer: End of Week Charts — 11/1/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Next Week’s Economic Indicators – 11/1/19

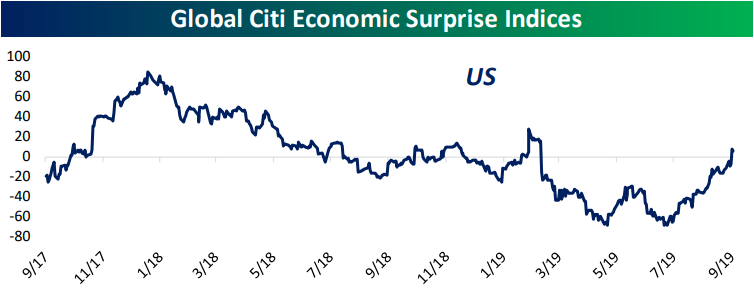

It was an extremely busy week for economic data with over 40 releases on the calendar. A vast majority came in either inline or worse relative to expectations or the previous period, while only 27% of releases came in stronger than expected or above the prior reading.

The Chicago Fed’s National Activity Index was the first release of the week, turning back into negative territory in September. The Dallas Fed’s Manufacturing Activity index was also released on Monday and also missed estimates while shifting negative. The Conference Board’s reading on consumer confidence also softened unexpectedly as the spread between present conditions and expectations widened further. Housing data was somewhat mixed as prices slowed slightly, but pending home sales was much better than expected. Wednesday’s GDP release also came in stronger than expected with solid personal consumption. Core PCE and other inflation indicators like the Employment Cost Index were inline with expectations. Finally, Wednesday also saw the FOMC rate decision which resulted in rated cut another 25 bps, as expected. ADP’s stronger than expected employment data, preceded a solid NFP Report on Friday. Nonfarm Payrolls were expected to show 85K added jobs in the month of October which would have been a substantially weaker number than the 136K increase the prior month. Instead, actual results showed 128K added jobs, which was better than all but the highest of estimates (140K). Another focus on Friday was the Markit and ISM readings on manufacturing. Both were expected to improve from the prior month which they in fact did but by less than estimates were calling for. Markit’s preliminary PMI was originally showing a stronger reading of 51.5. Instead, the final reading came in at 51.3 which was still the highest reading since April so the report wasn’t entirely bad. Meanwhile, the ISM index ticked up off of last month’s reading of 47.8, its lowest levels since June of 2009. This was in part thanks to the readings on new orders and employment improving. Aside from these improvements, ISM’s indices—unlike Markit—are still showing contraction in the manufacturing space.

The economic calendar slows down next week with around half as many releases as this week. Final durable and capital goods data and factory orders will take up the entirety of Monday’s reports. Durable goods orders are not expected to show any change from the preliminary readings, but factory orders are expected to show moderation in September. On Tuesday, we will get the services counterparts to today’s ISM and Markit manufacturing gauges. While both manufacturing readings missed, ISM’s Non-Manufacturing index is anticipated to rise to 53.5. Quarterly mortgage delinquencies and foreclose data will also be out on Tuesday. Wednesday will see more quarterly data with the Q3 preliminary releases of Nonfarm Productivity and Unit Labor costs. Following this week’s weaker Confidence report from the Conference Board, next Friday we will get further clarification on sentiment with the University of Michigan’s preliminary November data. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke Market Calendar — November 2019

Please click the image below to view our November 2019 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three premium research levels.

Flipping “Burgers”, Flopping IPOs

It has been roughly six months since Beyond Meat (BYND) made its initial public offering. Although the stock was sitting on nearly an 840% gain from its IPO price at its highs back in July, BYND has come back down to Earth especially after Tuesday’s 22% decline on earnings. Currently, the stock is “only” up 257% since its IPO having pared a large portion of its gains from the first few months after the IPO.

BYND has joined a number of stocks, such as Twilio (TWLO), GoPro (GPRO), Shake Shack (SHAK), and Acacia (ACIA), that have IPO’ed in the past few years, doubling or more in the first few months only to fall considerably in the times ahead. Of these, TWLO was the only one to have considerably recovered within the first 500 trading days while GoPro (GPRO) is the only one to fall below its IPO price.

Turning to some of the largest of this year’s class of IPOs, while not to the same extent as BYND, Zoom Video (ZM) and Crowdstrike (CRWD) saw a similar dynamic as both more than doubled in the first 50 days but fell in the following months. On the other hand, the ride sharing giants, Lyft (LYFT) and Uber (UBER), have yet to move back above the IPO price. Although BYND has not had immunity from the classic spike and tank pattern, the stock still has dramatically outperformed other IPOs. Start a two-week free trial to Bespoke Institutional to unlock access to our actionable research and interactive tools.

Bespoke’s Morning Lineup – 11/1/19

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Spooky Price Action, Scary Savings, Wicked Wages – 10/31/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we go over the technical picture of US stocks following today’s declines. We then show how earnings expectations have shifted recently for both small and large caps. Next, we review today’s economic data beginning with Core PCE which was weaker. We also show the rise in household savings rates and the mixed bag that was today’s Employment Cost index.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke Matrix of Economic Indicators – 10/31/19

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke’s Consumer Pulse Report — November 2019

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Long List of Today’s Triple Plays

Today is one of the busiest days of earnings season, and with these reports, we have also gotten a massive number of earnings triple plays over the past 24 hours. Since last night’s close, 22 companies have reported better than expected sales and EPS while also raising guidance. For reference, heading into today there were a total of only 35 triple plays this entire earnings season!

Charles River Associates (CRAI), a consulting firm, is up the most since last night’s close having risen more than 20%. Other stocks that have risen double-digits include Universal Display (OLED), ManTech (MANT), Ultra Clean Holdings (UCTT), and Teledoc (TDOC). Of all these triple plays, Inovalon (INOV) saw the largest gap up at the open, rising 13.94%. Despite that gap up, INOV has fallen since the open. On the other hand, only three companies, Generac (GNRC), YETI (YETI), and ACADIA Pharma (ACAD) gapped down today. While overall performance so far for this group of stocks has been strong with an average gain of over 4.7%, intraday performance has been somewhat weak. Just under half of them have sold off since the open. The worst of these is recent IPO Lyft (LYFT) which, as of this writing, has fallen almost 7% since the open, erasing all of its gap higher. Cigna (CI), Masimo (MASI) and FormFactor (FORM) have also more than erased this morning’s gap higher.

Using data from our Earnings Explorer, other stocks that have reported triple plays this earnings season have risen an average of 0.83% from open to close and have averaged a full-day gain of 4.86%. Looking at all triple plays throughout history since our data begins in 2001, those averages are 0.26% and 5.4%, respectively. In other words, this season’s triple plays including today have been doing better than average on an intraday basis, but have been slightly weaker in regards to the full-day stock price reaction. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much more.

Sentiment Little Changed

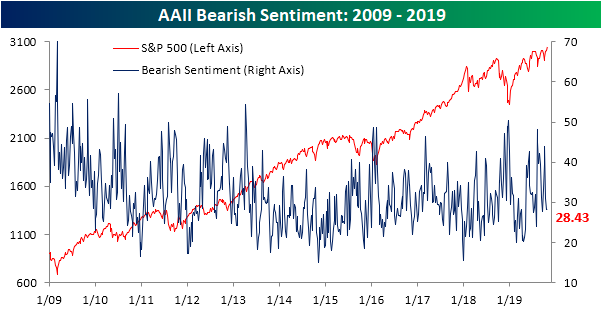

Last week, we noted the sharp rebound in sentiment over the past few weeks. In the wake of those large moves, the AAII survey of investor sentiment took a breather this week despite the market’s successful efforts to reach new highs. The S&P 500’s new all-time highs have done little to garner optimism, though, as bullish sentiment declined 1.6 percentage points to just a hair under 34%. While lower than last week, it is still at the higher end of where sentiment has been over the past few months and in the middle of the past couple of years’ range.

Bearish sentiment took some of that loss from the bullish camp as it rose 0.16 percentage points. That is the smallest one week change in bearish sentiment since the last week of June when it fell 0.08 percentage points. Additionally, this was only the 20th time in the past decade that bearish sentiment changed less than 0.2 percentage points.

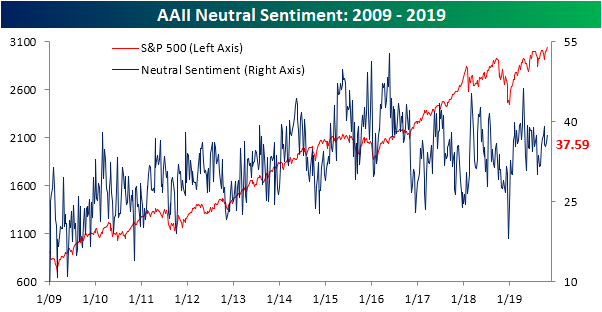

Neutral sentiment took the larger share of the losses from bulls as it rose to 37.59% and is now at the highest level since the beginning of the month when it reached 39.19%. Neutral sentiment is also still the predominant sentiment reading for the third week in a row, outweighing bearish, and to a lesser extent, bullish sentiment readings. In other words, investors do not seem to have fully bought into the new highs for the S&P 500, but are at least slightly more optimistic than pessimistic. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.