The Closer – Thursday Thrashing: Fifth-Worst Day for Stocks of All-Time – 3/12/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, after the S&P 500 experienced one of its worst days on record we take a look at some of the other extremes in markets both in the US and abroad. Next, we show some broken aspects of fixed income markets including airline bonds and mortgages. We finish with a look at the declines in Brazil and Canada.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Sentiment Sours

With equities entering bear market territory this week, current sentiment understandably holds a significant bearish bias. Bullish sentiment fell 9 percentage points to 29.74%. While low, sentiment was actually lower as recently as October, August, and the spring of last year.

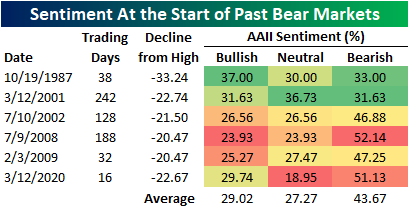

While that means there is precedent for bullish sentiment to fall even further, the current level is pretty much right in line with what could be expected at the start of an S&P 500 bear market. In the table below, we show the AAII sentiment readings at the start of all bear markets (20% drawdown from a prior high where the rally was at least 20%) since the survey began in 1987 as well as the degree of those declines and the time it took to reach that 20% threshold. The current reading on bullish sentiment is pretty much right in line with the average of past bear markets. Meanwhile, bearish sentiment is at 51.13% which is its highest level for when the S&P 500 reached the threshold for a bear market behind only July of 2008. Neutral sentiment (18.95%) is now at its lowest level since December of 2018 at 18.95% and of the past bear markets, this is the lowest reading.

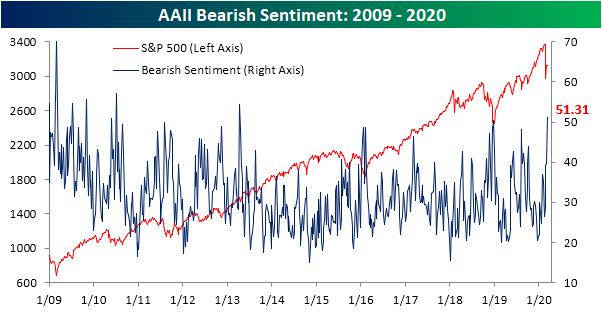

For just the 56th time since the beginning of the survey in 1987, over half of the respondents reported as pessimistic. Bearish sentiment rose 11.49 percentage points from 39.64% to 51.13%. That 11.49 percentage point jump is in fact large, in the 96th percentile of the past decade’s readings, but as recently as the end of January there was a bigger one week increase of 12.09 percentage points. This leaves bearish sentiment at its highest level since April of 2013 when bearish sentiment reached 54.48%

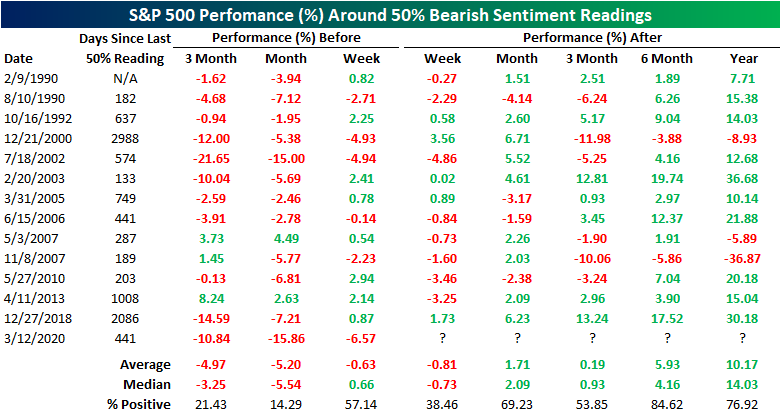

Readings above 50 have been few and far between with only 56 other prior instances in the history of AAII’s survey. The last time we saw a reading this high was was 441 calendar days ago in December of 2018. The table below shows all of the prior times that bearish sentiment tipped above 50% without having done so in the previous 6 months and the S&P 500’s performance around these times. As could be expected, the S&P 500 was typically heading lower in the weeks and months leading up to these elevated bearish readings. Going forward, performance has tended to remain weak over the following week, but begins to improve over the course of the next year. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Selloff Erases All of US Market Cap Gains Since Election Day 2016

With the US stock market down nearly 7% yet again today, the total market cap of US companies as measured by the Russell 3,000 has fallen $11.5 trillion in less than a month. On February 19th, total US market cap was just over $35 trillion. It’s at $23.8 trillion as of this morning.

What makes this drop even more noteworthy is that $23.8 trillion was the market cap of US companies on Election Day 2016. At this point in time, all of the market cap gains seen since President Trump’s election victory have been wiped out. Visit our membership options page to learn more about Bespoke’s research.

Covid-19 Still Not Showing in Claims

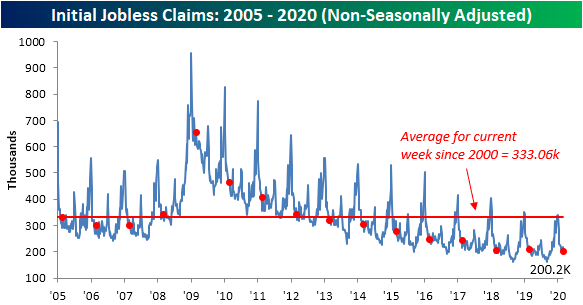

Given its more backward-looking nature, economic data has taken a backseat over the past few weeks, but this also makes more timely data like weekly jobless claims ever more important. While risk assets continue to get hammered, weekly jobless claims have still yet to show any major layoffs as a result of the coronavirus. In fact, claims were lower this week, falling to 211K compared to estimates of an increase to 220K. Last week’s number was also revised lower by 1K (from 216K to 215K). While there still has not been any new low, that leaves jobless claims basically in the middle of the past year’s range which historically is still a healthy level.

Although claims were lower this week, the four-week moving average has risen for a third consecutive week to 214K. While at face value that may sound bad, there have been seven other such streaks, some of which ran for longer, in the past year alone. Now at 214K, the moving average is not at any new high either, only at its highest level since late January. In other words, the move higher in the moving average over the past few weeks has been far from dramatic and still is too early to call it a change in trend.

Non-seasonally adjusted numbers also remain at historically low levels with this week’s 200.2K print being the lowest of the current week of the year of this cycle. That is also over 100K below the 333.06K average for the current week of the year since 2000. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Boeing Down

Yesterday, we showed a table of how much each component of the DJIA has impacted the index since its peak on 2/12. Given the continued decline in the market today, we wanted to provide an update showing the stocks with the largest negative impact on the index over the last month. Of the roughly 7,700 points that the DJIA has dropped over the last month, Boeing’s 53% has accounted for more than 1,250 of those points. Cut in half in just a month! Boeing was close to a $200 billion company in February, and now it’s less than $100 billion!

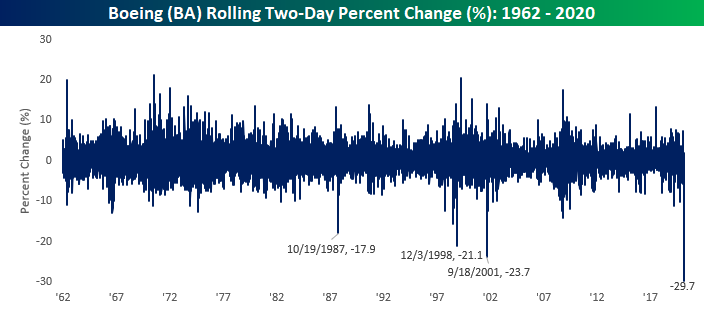

The decline in Boeing (BA) over the last two days is literally unlike anything the stock has ever seen before. The chart below shows the rolling two-day performance for BA going all the way back to 1962. If this morning’s levels remain in place (and prices have been moving wildly), it will be the largest two-day decline (-29.7%) for the stock on record. While the stock saw declines of over 20% in 1998 and after 9/11, those declines were nowhere close to what we are seeing today. Looking to make some sort of sense of all these crazy market moves? Start a two-week free trial to Bespoke Institutional for full access to all of our research and tools.

Bespoke’s Morning Lineup – 3/12/20 – All News is Bad News

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The old saying goes that no news is good news, but the variation of that phrase today is that no news is good. No matter where you look today, there is literally no good news. Actually, jobless claims were just released and came in at 211K versus estimates for 220K, so the layoffs haven’t started yet. Futures are limit down as they have been for most of the night, but the S&P 500 ETF (SPY) is down moderately more at about 6%. The only question now is what time will the Fed act?

Read today’s Bespoke Morning Lineup for a discussion of the carnage in financial markets overnight, the latest tallies on Covid-19 cases, and a historical look at bear markets.

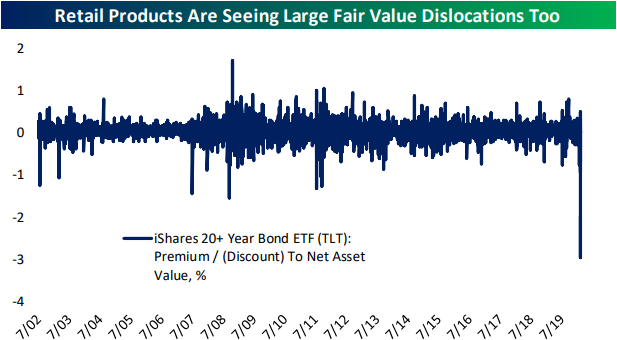

We touched on it in the Morning Lineup, but the volatility in the fixed income market has been cataclysmic. In the three trading day period from 3/6 through 3/10, the long-term US Treasury ETF (TLT) has experienced the best and worst days in its history.

The Closer – Weary Wednesday: New Lows As Markets Start Breaking – 3/11/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by showing just how steep the past three week’s declines have been and what it means for the US Dollar. Next, we delve into the substantial moves in credit markets and Treasury markets. Then we turn to today’s economic data including CPI for Feburary and EIA petroleum stockpile data. We finish with a look at the deteriorating technical setups of crude oil and small caps.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Fixed Income Weekly – 3/11/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review the massive surge in interest rate volatility.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Low Rates Send Mortgage Applications Surging

Coronavirus fears have broadly sent rates lower over the past month. Currently, the national average for a 30-year fixed-rate mortgage stands at 3.68%; just off the low of 3.55% from earlier in the month. With mortgage rates now basically at their lowest levels since late 2016, homeowners have been quickly enticed to jump on these lower rates.

Last week, weekly mortgage applications from the Mortgage Bankers Association showed a roughly 15% surge as rates were reaching record lows. In the time since then, the Fed’s 50 bps cut came into effect and yields fell even further which led mortgage applications this week to surge 55.4%. That is the highest week over week increase in mortgage applications since November of 2008 when they had risen 112.1%. Outside of that period, we’ve only seen larger weekly increases a few other times since 1990.

The spike was driven largely by refinancing applications which rose 78.6% week-over-week. As with the composite, that was the biggest weekly jump in refi applications since the housing bubble. Prior to that, once again you would need to go back to 2001 or the 1990s to find larger weekly increases in mortgage refinance applications. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

The Dow Can Thank Boeing for Its Nosedive

It’s been a tumultuous month for the Dow Jones Industrial Average since its closing high on February 12th as the index has declined over 5,500 points or 18.8%. Below we have provided a breakdown of which stocks have had the largest and smallest impact on the decline. For each stock listed below, we have included its performance since the close on 2/12 in both percentage and price terms. The reason, of course, for including price changes is because the index is price-weighted. Therefore, a stock with a low share price but a large percentage decline may not have as large an impact on a stock with a larger share price but a smaller percentage decline. Because of this, the table is sorted by stocks with the largest weighting in the index (highest share price) at the top.

Remember the days when Boeing (BA) was the most heavily weighted stock in the DJIA? Well, it was only a month ago! Back on 2/12 when the DJIA last peaked, BA was the most heavily weighted stock. But after a decline of nearly 40% since then, it’s now the fourth most heavily weighted behind UnitedHealth (UNH), Apple (AAPL), and Home Depot (HD). Since 2/12, BA’s decline has accounted for almost 17% of the DJIA’s decline, or more than 900 points! Not only has BA been the largest contributor to the DJIA’s downside, but the next closest drag on the index (Goldman Sachs – GS) has had less than half the impact to the downside. Other relatively large contributors to the downside have been Apple (AAPL), United Technologies (UTX), and JPMorgan Chase (JPM). On the upside, there hasn’t been much. Since the DJIA’s closing high on 2/12, the only stock that is up is Walmart (WMT), but with a gain of 0.1%, its impact on the DJIA’s level has been less than a point. I guess we’ll take what we can get! Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.