Russell 2000’s Third Largest Drawdown on Record

While US large cap stocks are right around 30% from their record highs a month ago, the carnage in small caps has been even more severe. While the Russell 2000 never quite made a new high this year along with the broader market, it got pretty close. Like the rest of the market, though, it has been crushed. As of yesterday’s close, the Russell 2000 was 43.1% below its all-time high which ranks as the third-largest decline from a record high. The only two periods where the Russell saw a larger decline were in October 2002 when the drawdown reached 46.1% and then in March 2009 when the selling finally stopped at 59.9% on March 9, 2009. Now, if the Russell 2000 were to match either of those prior two periods in terms of magnitude, it would have to fall an additional 4.3% to match the decline of October 2002 or 28.9% to match the decline of March 2009. Start a two-week free trial to Bespoke Institutional for full access to our market and economic analysis.

Claims Spike

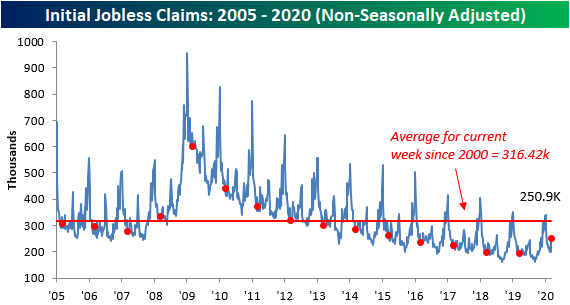

As could be expected and as we have been warning this week (see here and here), shutdowns aimed to thwart the spread of the coronavirus have begun to impact weekly jobless claims. Claims exploded higher by 70K to 281K this week. That is the largest weekly increase in the seasonally adjusted number since November of 2012 when they had risen 81K. Going all the way back to the beginning of the data in 1967, there have only been 13 total times (including the two aforementioned instances) that jobless claims have risen by 70K or more in a single week. The largest of these was a 172K spike in July of 1992. While this week’s increase may have been large, just wait for next week’s explosion.

With the massive surge in claims this week, the indicator now sits at its highest level since the spike up to 299K in September 2017. Other than that, the last time claims consistently came in around these levels was back in mid-2015. Given the fact that shutdowns across the country have ramped up over the past week, claims are likely to continue to experience large moves, and it is likely that we will see this number rise even further in the coming weeks.

The moving average has also risen but is not yet at as notable of levels as the seasonally adjusted number. Now at 231.5K, the moving average is only at its highest level since the final week of 2019 when it was 233.5K. But the 16.5K increase versus last week is the largest spike in one week since October of 2013 when the moving average rose by 17K. Additionally, of all weeks since 2000, it is the 14th largest week over week increase.

The non-seasonally adjusted number rose by 50.5K this week to 250.9K. For the current week of the year (12th week), that is the highest level since 2015 when it was 260.2K.Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke Morning Lineup – 3/19/20 – Searching For Stability

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Down again. What else is new? Futures are indicated lower this morning, but with losses of less than 2% at this point, that seems like a win these days! Jobless Claims were just released and came in at 281K, or 61K above consensus expectations. In any other week over the last few years, that type of miss would have been a major concern, but given what economists are expecting to come in the next few weeks, we’ll be wishing for numbers like this.

Read today’s Bespoke Morning Lineup for a discussion of the latest salvos from both the ECB and US Federal Reserve to help stem the carnage in credit markets, as well as a recap of the latest case counts of the coronavirus.

Futures may be indicated lower this morning, but with the S&P 500 indicated to open down about 2%, we could actually end the streak of consecutive 4% daily moves which currently stands at eight. In the entire history of the S&P, there has never been a longer stretch of daily 4% moves, and the longest prior such streak was just six days way back in the late 1920s. In order for the market to find any sort of bottom, we’re going to need some signs of stability first.

The Closer – Minute Reasons For Optimism – 3/18/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a couple points of optimism and the more concerning outlook for unemployment claims. Next, we review today’s housing starts data before turning to today’s EIA data and crude oil’s historic session.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Fixed Income Weekly – 3/18/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss the carnage in carry instruments designed to create big passive income.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

The Buck’s Bounce

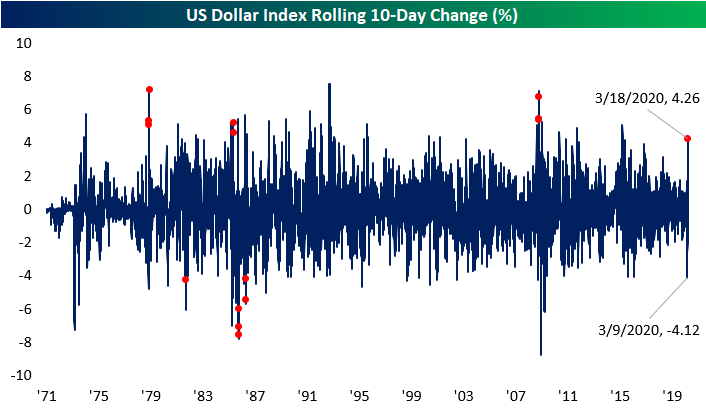

In the currency space, the US dollar has certainly not been immune from recent market volatility. The dollar index peaked on February 20th, just one day after the S&P 500 had reached its all time highs. That was the dollar’s highest level since April of 2017. Over the following days, the dollar would go on to fall roughly 5% to its low on March 9th. In the time since then, it has more than recovered those losses, rising over 6% and is once again back up to its highest levels since 2017.

This string of volatility for the greenback is rare. As of today, the dollar is up 4.26% over the past ten days. But just back on the ninth (the recent low) it had been lower by 4.12% over the prior ten days. The last time that there was both a 10-day change up and down of at least 4% in the span of just ten days was back in October of 2008. Going back through the index’s history since the early 1970s, there have been a total of 15 days (including that 2008 and current instances) in which such swings can be observed; shown by the red dots in the chart below. Prior to 2008, the only other times the dollar was as volatile by this measure was in the 1980s and late 1970s. So with regards to more recent history, it is even more unprecedented.

In terms of daily changes, the dollar has also been very volatile. Over the past ten days, the currency has averaged a daily change (positive or negative) of just over 1% which is rare going back through history. Again this is the most volatile the dollar has been since the financial crisis, though at that time, the daily swings were larger on average; reaching 1.35% at the high. Prior to 2008, the only other times the average daily change was over 1% was in the early 1990s, mid-1980s, and late 1970s. As with 2008, those past times were slightly more volatile than the current moment. Start a two-week free trial to Bespoke Institutional to access all of our interactive tools and research.

Volume Surge

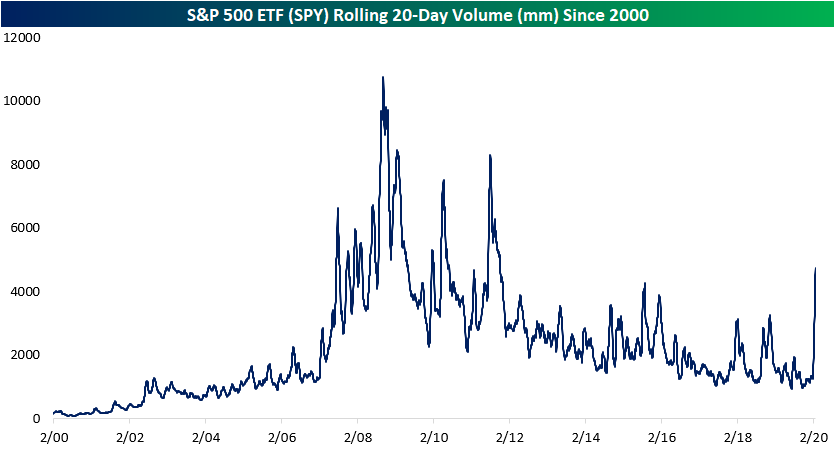

Given the massive swings across assets, it should come as no surprise that volumes have been elevated. For the S&P 500 ETF (SPY), over 3.25 billion shares have already exchanged hands in March through yesterday’s close. That is the highest monthly volume for SPY since January of 2016, and keep in mind, we still have two weeks left in the month!

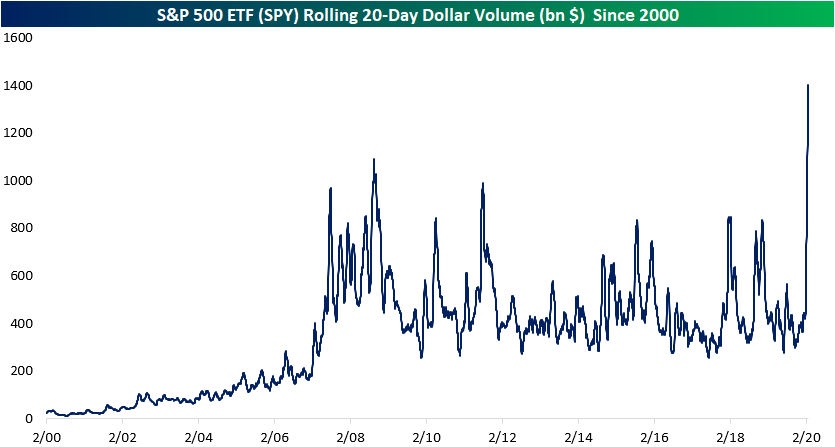

Considering that does not fully capture the Covid-19 saga which began to affect markets about a month ago now, we also looked at volumes over the last 20 days. The volume of SPY traded in that time frame totals 4.7 billion shares. As shown below, that is the highest volume since November of 2011. One interesting thing to note, while volumes are certainly elevated, they still are not even close to levels in the years leading up, during, and shortly after the financial crisis.

While the number of shares trading hands has not eclipsed financial crisis highs, volumes in dollar terms have. As of yesterday’s close, volumes reached a record of $1.4 trillion over the past 20 trading days. The only other time that the dollar volume of SPY was over $1 trillion was briefly in 2008. Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.

Bespoke’s Global Macro Dashboard — 3/18/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

The COVID Crash of 2020

Below is a snapshot of month-to-date and year-to-date returns for 72 country stock markets around the world (in local currency). As of this morning, the average country was down 20% month-to-date and 26% year-to-date. And this doesn’t even include the levels that North and South American equity markets are set to open at this morning, which looks to be 5-7% lower from yesterday’s close.

The country that has been hit the hardest in terms of equity market price destruction is Russia, which we haven’t heard from much regarding the COVID-19 virus. Month-to-date, Russia is down 34.67%, and it’s down 45.18% year-to-date. Seven other countries are down more than 30% month-to-date, including Italy, Greece, Austria, and Ireland. France and Germany are both down close to 30%, while BRIC countries like Brazil and India are down more than 24%.

Notably on the other side of the spectrum is China, where markets are down only 5% month-to-date and 10% year-to-date. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – 3/18/20 – Limit Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Well, the St Patrick’s Day rally lasted long. Futures are once again trading limit down and poised to erase all of yesterday’s gains. On the bright side, despite the fact that futures are limit down, the major US index ETFs are only down about 6%, which isn’t much more than the futures. Imagine that. Only 6%!

Conditions remain dire, but we do have to stress the recent moves by the Fed should help to stabilize the credit markets and stem an even bigger disaster. That certainly doesn’t help with slowing down the pandemic and its spread, but it’s better than the alternative.

Read today’s Bespoke Morning Lineup for a discussion of the Fed’s latest moves to stabilize the credit markets, trading in Europe and Asia, as well as a recap of the latest case counts of the coronavirus.

The market’s volatility right now is truly unprecedented throughout history. Yesterday’s rally was the 7th straight trading day where the S&P 500 experienced a one-day move of more than 4%. That’s NEVER happened before, and the way things are playing out today, the S&P 500 is on pace for its 8th straight 4% move.