Canada on Top

As shown below, there is not a single BRIC or G7 country that has a total return of less than 50% since the March 23rd, 2020 COVID low through today. Of all of these, India (PIN) boasts the best return having more than doubled and leading the pack throughout basically all parts of the past year. There were only a couple of points in time early on in the recovery that PIN was not the leader. That was when Brazil (EWZ) was up the most, but since the end of 2020, the country’s equities have significantly underperformed. The same applies to China (ASHR). Meanwhile, Russia (RSX) and the US (SPY) have more steadily continued higher alongside PIN.

As for the developed world, things have been more stable. There has not been a G7 country that has fallen sharply recently in the same way as Brazil or China. As a result, China (ASHR) actually has the worst return over the past year out of all G7 and BRIC countries and Brazil would rank as the second-worst. Earlier in the pandemic, Canada (EWC) and Germany (EWG) had been vying for the best-performing G7 country, but since the fall, EWC has put some distance between itself and the rest. The US has the next best returns with a 78.46% total return over the past year.

Click here to view Bespoke’s premium membership options for our best research available.

Historic Year for the S&P 500

Tomorrow will mark the one-year anniversary of the S&P 500’s closing low from the COVID crash, and for most stocks in the index, it has been a historic year. Within the S&P 500, stocks in the index are up an average of 104.22% through Friday’s close, and just three stocks – all from the Health Care sector – are actually lower. Leading the losers, Gilead (GILD) has declined over 10%. Recall that GILD performed well during the initial stages of the pandemic on the promising results of its drug Remdesivir in treating COVID patients, but once the market started to rally, it was left behind.

The table below lists the top 25 performing stocks in the S&P 500 since the closing low on 3/23/20. Topping the list with a gargantuan gain of 763% is ViacomCBS (VIAC). After trading below $12 per share last March, the stock is close to triple-digits today. Behind VIAC, Tesla (TSLA), L Brands (LB), Etsy (ETSY), and Freeport-McMoRan (FCX) round out the top five, and all have gained in excess of 500%. Interestingly enough, despite the strength of the sector for what seems like years now, the only stock on the list from the Technology sector is Enphase Energy (ENPH). In fact, after ENPH, you have to go all the way down to the 53rd spot to find the next stock from the Technology sector (Applied Materials – AMAT, +186%).

Leading the way higher, stocks in the Consumer Discretionary and Energy sectors are both up an average of over 150%, while Consumer Staples and Utilities are the only two sectors where each one’s components are up an average of less than 50%. Just to the right of the S&P 500 in the chart below is the Technology sector which is one of five sectors where the average performance of its components is less than 100%. A gain of 96.1% in a year is nothing to sneeze at in any market environment, but just the fact that the average performance of stocks in the Technology sector since the March lows is now lower than the average of the S&P 500 illustrates the shift we have seen since the sector’s peak relative strength last fall. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/22/21 – Nasdaq Leading a Mixed Bag

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The road to success and the road to failure are almost exactly the same.” – Colin R. Davis

It’s been a while since we’ve had a “vaccine Monday” but today’s supplier of positive headlines is AstraZeneca (AZN). The company announced earlier that its vaccine was 79% effective against symptomatic COVID-19 and 100% effective against severe disease. More importantly, AZN also reported no safety concerns such as the blood clotting issues that had been reported in the EU last week. Unlike prior vaccine Mondays where equity futures have typically surged in reaction to the news led by the DJIA and S&P 500 while the Nasdaq lagged, this morning’s picture is the complete opposite. DJIA futures are actually lower heading into the opening bell, the S&P 500 is flat, Nasdaq futures are up half of one percent, and the 10-year yield is actually lower. With AZN likely to now enter the fray, it’s only a matter of weeks before vaccine shortages in the US turn to gluts.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events from the US and around the world, including a discussion of the chaos in Turkey after its Central Bank chief was fired for raising rates last week, data on Korean Exports, Eurozone Current Account, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Also, if you weren’t able to catch it earlier this morning, make sure to check out our interview on CNBC’s Squawk Box.

Tomorrow marks the one-year anniversary of the S&P 500’s COVID low and what an impressive run it has been. The chart below shows the performance of each of the S&P 500’s components since the close on 3/23/20. Of the 500 names shown, the average gain through Friday’s close has been just over 100%! Even more amazing is the fact that only three stocks in the entire index are down during this span. The worst of the three has been Gilead (GILD). With a decline of just over 10%, the maker of Remdesivir, which originally rallied on the promising prospects of its potential COVID treatment, has been a dog ever since.

On the other end of the spectrum, the top-performing stock has been ViacomCBS (VIAC). Since the close on 3/23. VIAC has rallied nearly 800%. Behind VIAC, four other stocks are up 500% (TSLA, LB, ETSY, and FCX). Notably absent from the list of top performers is the Technology sector. Of the top 50 performing stocks in the S&P 500 since 3/23, only one stock from the Technology sector (Enphase- ENPH) made the cut.

Bespoke Brunch Reads: 3/21/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

3 Ways the Pandemic Has Made the World Better by Zeynep Tufecki (The Atlantic)

Custom-designed vaccines, deeper use of digital infrastructure, and open science are three critical benefits of the COVID-19 pandemic that will be with us for a long time to come. [Link; soft paywall]

America’s Covid Swab Supply Depends on Two Cousins Who Hate Each Other by Olivia Carville (Bloomberg)

Swabs that are critical for testing were only manufactured by two companies globally at the advent of the COVID pandemic. The American one was rife with disfunction, making it a very poor candidate to ramp production to meet impossibly high demand. [Link; soft paywall]

Why Black Parents Aren’t Joining the Push to Reopen Schools by Melinda D. Anderson (Mother Jones)

A deep dive into why there’s a racial divide between black and white parents over the question of school reopenings. [Link]

Changing Preferences

Boat sales took off during the pandemic and now dealers can’t keep up with demand by Katie Tsai (CNBC)

Boat sales are at decade-plus highs, with first-time buyers by far the biggest segment of new buyers and sustaining their enthusiasm despite the waning of the COVID pandemic. [Link]

Roughly 4 in 5 Manhattan Office Workers Will Not Return Full-Time, Survey Says (NBC New York)

A Partnership for New York City survey showed that just 22% of the large employers on the island of Manhattan plan to bring their workforces back to the office full time. Two-thirds reported planning on a hybrid model. [Link]

Speculation Is Our Middle Name

Tapping Day-Trader Cash, ETF Launches Go From Risky to Roaring by Claire Ballentine (MSN/Bloomberg)

Betting and iGaming, SPAC-Derived, Social Sentiment, and Equity Sentiment ETFs have proliferated, fueled by a huge class of day traders and novice investors who have arrived in stock markets during the pandemic. [Link]

ARKK Copycat Is Beating Cathie Wood’s Original by 10-Fold by Claire Ballentine (Bloomberg)

A small ETF that goes by the memorable ticker MOON is aiming to take on the ARK Invest empire via a focus on innovation. Unlike ARK products, MOON is index-based. [Link; soft paywall]

Morgan Stanley becomes the first big U.S. bank to offer its wealthy clients access to bitcoin funds by Hugh Son (CNBC)

Clients with more than $2mm in assets at Morgan Stanley and an “aggressive risk tolerance” are now eligible to buy funds that offer bitcoin exposure via the MS platform. [Link]

Bonds

Investing in bonds has ‘become stupid,’ Ray Dalio says. Here’s what he recommends instead by Mike Murphy (MarketWatch)

Somewhat hilariously given the fact that the largest hedge fund in the world owns massive exposure to government bonds, its founder has argued that owning bonds is “stupid”. [Link]

Economic Research

The ‘China Shock’ revisited: insights from value added trade flows by Adam Jakubik and Victor Stolzenburg (Journal of Economic Geography)

The authors decompose imports and exports to identify the US component of gross value added in trade flows and the output that stems from them in order to illustrate a very different impact on US labor markets than previously estimated from the “China Shock”. [Link]

Autos

‘No one focuses on the pain here’: Inside Oakland’s abandoned car epidemic by Ariana Bindman (SFGate)

Thousands of abandoned vehicles have piled up in Oakland, often after they’ve been stolen and stripped for valuable parts. The city has under-budgeted a response that requires large resources to properly deal with the scale of the problem. [Link]

Beer

Why Did Women Stop Dominating the Beer Industry? by Laken Brooks (Smithsonian Magazine)

During the Middle Ages, women were the ones that brewed beer. But the advent of scalable quasi-industrial brewing meant that men had an incentive to force them off their turf. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Bespoke Careers

Bespoke Investment Group is looking for highly qualified individuals to join our growing financial research and portfolio management advisory team.

Please email us if you have an interest in any of the positions listed below. We’ll contact you if we think there’s a fit.

Research and Marketing Analyst

Bespoke is seeking a Research and Marketing Analyst to research and write about financial markets and market Bespoke’s research through our various content channels. Please click here for more information on this opportunity. Salary: $60-80k + benefits and annual bonus.

Email Marketing Manager

Bespoke is seeking an Email Marketing Manager to manage and optimize Bespoke’s email marketing, CRM & retention efforts. You will be our in-house expert on email marketing strategy and execution in order to drive best-of-breed performance. Please click here for more information on this opportunity. Salary: $60-80k + benefits and annual bonus.

Financial Markets Writer

Bespoke is seeking a Financial Markets Writer to research and write about current and historical events across equities, fixed income, alternative assets, ETFs, hedge funds, commodities, currencies, crypto, and the economy. Please click here for more information on this opportunity. Salary: $60-80k + benefits and annual bonus.

Bespoke Advisors

Bespoke is looking for individuals or small teams within the investment advisory community to join our growing portfolio management advisory business. Our goal is to find smart, prudent wealth managers that have interest in growing a book of business under Bespoke’s portfolio management arm. Please email us or call us at 914-315-1248 if you’d like to start a conversation.

Summer Intern

Bespoke is currently looking to fill its Summer Intern opening that runs from mid-May to mid-August 2021. This role is geared towards students that are currently progressing towards an undergraduate degree. Please click here for more information on this opportunity.

Office Assistant

Bespoke is currently searching for an office assistant to perform day-to-day operations tasks. Salary: $40-50k + benefits and annual bonus.

Labor Shortages in the Third District

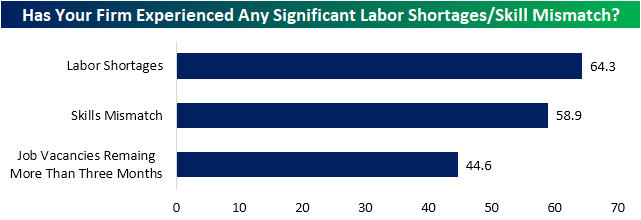

In addition to the usual Philly Fed indices released yesterday, the report also featured a handful of special questions all of which concerned employment and labor shortages. Overall, the results showed a surprisingly tight labor market: of responding firms, 64.3% reported that they currently are experiencing a shortage in labor while 58.9% reported that there is a skills mismatch. Given these issues with labor supply, 44.6% reported that there are job vacancies that have been open for more than three months.

The survey also asked whether these labor shortages were in general or specific to certain skills. Just 8.9% of firms reported that they are receiving qualified candidates. Meanwhile, over a quarter reported that they are seeing a significant shortage in qualified applicants for some skills and positions; another 17.9% reported that the shortage is so bad they are struggling to fill any position. Another 21.4% responded that it is still possible to fill positions with qualified applicants, although, it is getting harder to do so. In total, over two-thirds appear to acknowledge the labor shortage to some degree.

This has led to some inflationary pressures in terms of wages as a majority of firms are raising wages to entice new hires; 21.4% also reported that they are increasing recruitment incentives and 10.7% are increasing benefits. 42.9% are also reporting that they are settling for less-skilled workers; furthermore, 37.5% and 28.6%, respectively are providing more training to new or existing workers. 23.2% are also partnering with education institutions to align curriculums with their hiring needs. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/19/21 – Hesitant Futures

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If football taught me anything about business, it is that you win the game one play at a time.” – Fran Tarkenton

If football taught us anything, it’s that TV networks (and now streaming services) are still willing to pay an arm and a leg for the rights to broadcast games!

In markets today, futures are hesitantly higher as the major indices look to pick up the pieces from yesterday’s weakness. Obviously, the focus will once again be on US Treasury yields, but economic data won’t have an impact as the calendar is entirely clear.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, an update on Japanese inflation, capital flows in China, UK Consumer Confidence, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

2021 is shaping up to be one of those years. Yesterday’s 3% decline for the Nasdaq was the fourth daily move of 3%+ up or down already this year. The trading year is only 52 days old, but would you believe that there have only been 15 years in the last 50 that saw more 3% days in an entire year? While this year has been volatile already, keep in mind that last year the Nasdaq experienced 30 3%+ days (the most since 2008).

Through just the first 52 trading days of every year since 1971, there have only been seven other years that saw as many or more than four 3% days in the first 52 trading days of the year. Again, last year at this time there had already been 12 different 3% days, and the record was 16 in both 2001 and 2009.

Optimism Growing Across Indicators

Whereas last week saw a big upswing in bullish sentiment in AAII’s weekly survey, this week’s readings were a snoozefest. Neither bullish, bearish, or nor neutral sentiment moved more than 1% either up or down. That is the first time this has happened since last August. Of those small moves, bullish sentiment’s move was the largest, pulling back half of one percentage point. The bulk of that loss went to neutral sentiment as bearish sentiment only rose 0.1 percentage points. As a result, the bull-bear spread edged slightly lower to 25.3%. Regardless of that decline, sentiment remains overwhelmingly positive with the bull-bear spread still around some of the highest levels since early December at the high end of the past several years’ range.

While that survey did not see much of a move, the Investors Intelligence survey of equity newsletter writers saw bigger changes. Last week, inverse to the AAII results, the Investors Intelligence survey took a more negative tone. Turning to this week, the survey finally reflected equities general move higher over the past couple of weeks. Bullish sentiment in this survey rose 4.9 percentage points to 55.9%. That is only the highest level since the end of February. Meanwhile, bearish sentiment fell a full percentage point to 19.6%. While lower, outside of last week that is still the highest reading since the first week of November. Additionally, a smaller share (24.5%) of respondents reported that they are looking for a correction as that reading fell to the lowest level in a month.

One other additional sentiment reading also took a more optimistic shift this week. The National Association of Active Investment Managers (NAAIM) Exposure Index tracks the equity market exposure of active money managers. Index readings of -200 would indicate the average manager is leveraged short, -100 would be fully short, 0 is 100% cash or market neutral, 100 would be fully long, and 200 would be leveraged long. From the week of February 10th up through last week, the index had fallen 31.73 points to a low of 48.62. That means reporting managers had the lowest long exposure to equities since last April. But this week that has reversed in a big way as the index jumped 29.93 points.

That ranks as the thirteenth largest one-week uptick in the index since July of 2006. As shown below, the last increase that was as large if not larger than the past week’s move was fairly recent occurring in the week of February 10th when the index jumped 31.13 points. Prior to that, April of 2019 was the last move as large as this week’s rise.Click here to view Bespoke’s premium membership options for our best research available.

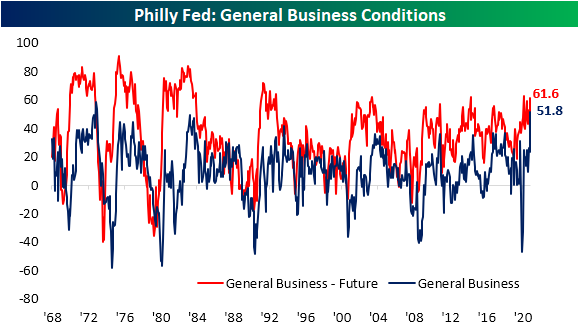

Historic Strength Out of Philly

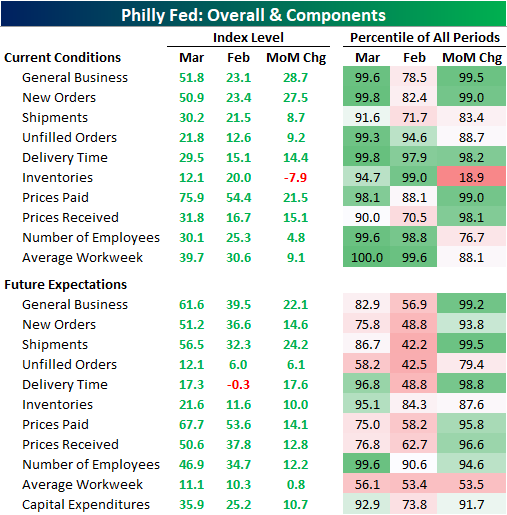

It’s hard to get a report much stronger than this morning’s release of the Philadelphia Fed’s Manufacturing Report. The report showed the region’s manufacturing economy expanded rapidly in March across categories with similarly strong optimism with regards to the future. The headline number was expected to see only a 0.9 point increase from last month’s reading of 23.1. Instead, it more than doubled, leaping 28.7 points versus February’s reading. That is the largest one-month gain since the record 57.6 point increase in June of last year. Other than that, only September and October of 1980 have seen larger monthly moves in the data going back to 1968. Not only was the size of the move large, but at 51.8, the index reached the third-highest level on record behind March (58.5) and April (53.6) of 1973. Similarly, while not at the same sort of historic high, the expectations component of this month’s report also experienced a massive uptick that ranks in the top 1% of all monthly moves.

Given that strength in general business activity, it should come as no surprise that every index for current conditions came in the top decile of all readings with the same applying to some of the month over month moves. As for the indices regarding future expectations, the current levels are more modest relative to their historic ranges with only those for Delivery Times, Inventories, Number of Employees, and Capital Expenditures notably elevated. Like the current conditions indices, though, many of these saw moves that stand around the top 5% of all periods or better.

Demand was certainly a bright spot in this month’s report. The New Orders Index rose 27.5 points to the second-highest level on record. Like the index for General Business Activity, the only time that the New Orders Index was higher was back in March 1973. While the one-month gain still stands in the top 1% of all monthly moves, there was actually a larger increase just two months ago when the index rose 28.1 points. Given the rapid acceleration in New Orders, Unfilled Orders also has risen sharply and has only been higher four other times. The most recent of these was back in January, but once again, prior to that, you would need to go all the way back to 1973 or earlier for readings as high as now.

Considering the high level in new and unfilled orders, the reading in the Shipments Index was perhaps a bit more modest. In fact, the spread between the indices for Shipments and New Orders was at a record low in March. Although it is still at very healthy levels in the top 10% of all periods, at 30.5, the Shipments Index actually saw a stronger reading as recently as October. One potential factor in the difference between the growth in orders and products actually getting out the door could be related to supply chain disruptions. Higher readings in the Delivery Time Index indicate longer lead times. This month, the index rose up to 29.5 which is only a half-point below the record high in January. Meanwhile, the Inventories Index fell to the lowest level in four months.

As a result of all of this, prices (particularly prices paid) continue to accelerate at a rapid pace. The Philly Fed noted that over 77% of the responding firms to the survey reported higher input prices compared to 55% last month. That lead the Prices Paid Index to increase 21.5 points to 75.9; a level that has not been observed since early 1980. Expectations are also on the rise but are more toned down as that index rose 14.1 points to the highest level since only April 2018.

As for Prices Received, things are tamer albeit, at 31.8, this index is also at historically strong levels. While that is still several points below the higher level of 36.6 from two months ago, the last time readings above 30 were observed was back in the spring and summer of 2018.

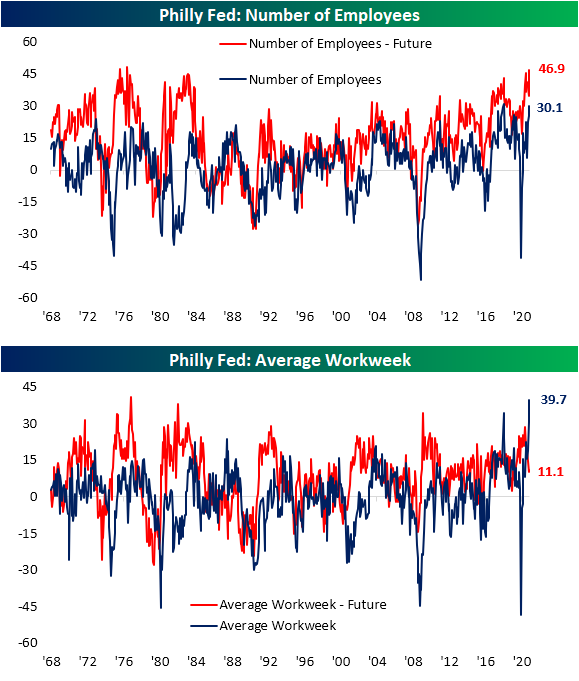

Today’s report also showed some very interesting trends concerning the labor market. The index for the Number of Employees rose to 30.1. The only time that it was higher was in May and June of 2018. The region’s firms also appear to want to continue to increase hiring down the road as the index for expectations reached 46.9. That is one of the highest levels on record with the last time such a level was reached being 1976. Even though firms are reporting more employees, the Average Workweek is skyrocketing. Last month, that index had reached 30.6 which was the second-highest reading on record. Fast forward to this month, the March print left both last month and the previous record of 34.2 from May 2018 in the dust. That increase in the average workweek is likely a result of firms doing more with less labor as they can’t fill certain positions. The special questions asked in the survey shed some additional light on this as 64.3% of companies reported labor shortages and 44.6% of job vacancies have been open for 3 or more months. Click here to view Bespoke’s premium membership options for our best research available.

Plenty to Like About Claims Despite Missing Expectations

Today’s release of initial jobless claims was anticipated to see a new low for the pandemic. Rather than the expected reading of 700K, though, seasonally adjusted claims surprisingly rose to 770K. That is the highest reading since the week of February 12th which was also the last time claims were above 800K. In addition to this week’s number unexpectedly rising, last week’s print was revised up from 712K (which was 1K above the pandemic low of 711K from early November) to 725K.

On a non-seasonally adjusted basis, regular state claims rose from 722.2K to 746.5K. From a seasonal perspective, that uptick is very unusual. In the data going back to 1967, only 5.5% of years have seen claims rise during the current (11th) week of the year. In addition to last year, the only other years that have seen unadjusted claims move higher WoW during the current week of the year were in 2017 and 1996. In spite of that unusual increase in the headline number, under the surface, there were a lot more silver linings.

Factoring in Pandemic Unemployment Assistance (PUA), the overall picture for claims was actually pretty good with total claims falling to 1.02 million, the lowest since the week of November 27th. PUA claims obviously drove that decline falling by just under 200K, coming in at 282.39K. That is the lowest level since the first week of the year when the program saw lapses due to the timing of the signing of the spending bill. Given that week was more or less an outlier, this week’s print would still mark one of the lowest readings since the program began just under one year ago.

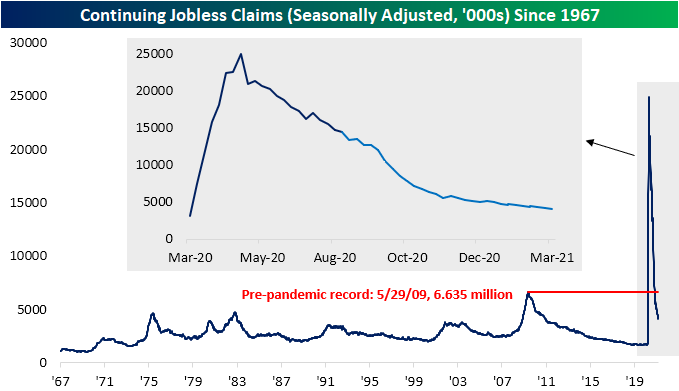

Continuing claims have continued to decline with this week’s reading of 4.124 million marking yet another pandemic low. Even though the 20K weekly drop marked the ninth consecutive week with a lower reading, this number was above expectations of a larger decline down to 4.035 million.

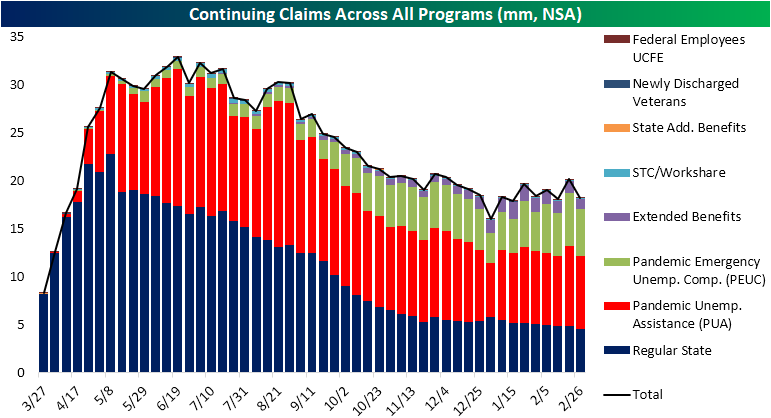

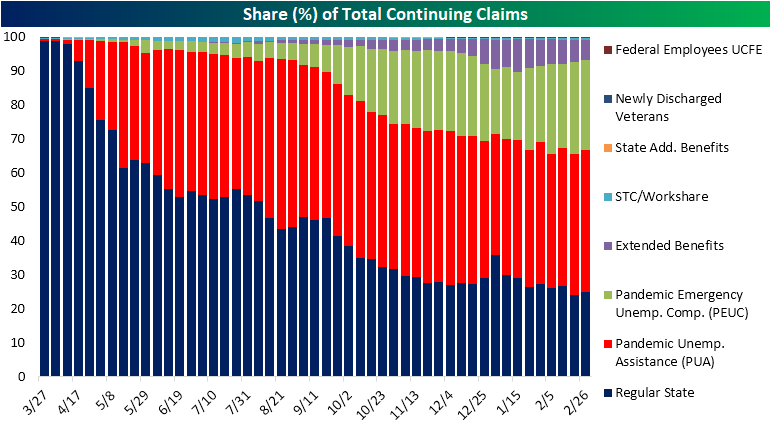

Including all programs adds some additional lag to the data meaning the most recent reading is through the last week of February. That week saw a reversal of the prior week’s uptick as total claims across all programs fell from 20.16 million to 18.25 million. That decline was a result of a drop across all programs although the PUA and PEUC programs accounted for the largest share with declines of 772.58K and 640.73K, respectively. The Extended Benefits program also saw its largest single-week decline of the pandemic period as it now sits at the lowest level since mid-December. Click here to view Bespoke’s premium membership options for our best research available.