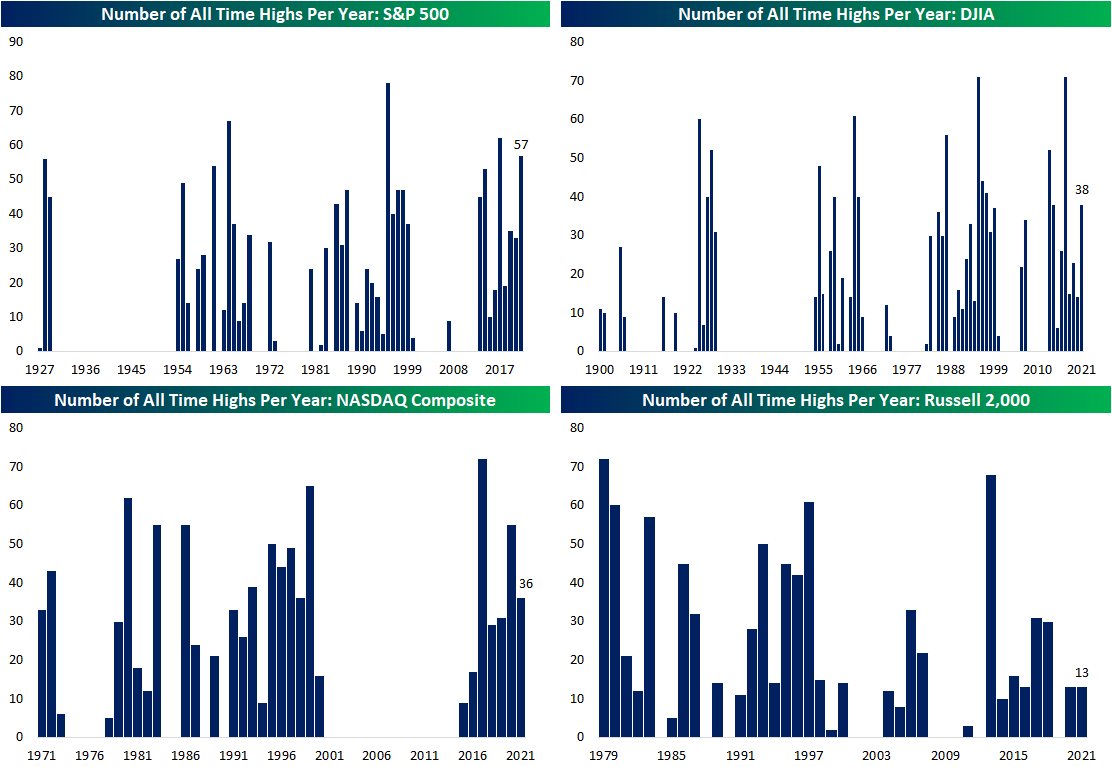

High Number of Record Highs

Major US equity indices have returned to all-time highs in the second half of October with the S&P 500 and Dow both hitting record levels today. Meanwhile, the NASDAQ Composite is roughly a quarter of one percent away and the closest to a new all-time high since the last one on September 7th. The Russell 2,000, on the other hand, is at the high end of the past several months’ range, but it is still over 2% below its high from March 15th.

With the S&P 500 having been at new highs over the past few days, it has made 57 new all-time highs year to date. As shown in the top-left chart below, there have only been three other years in the past that have seen more record highs during the full course of the year: 2017 (62), 1964 (67), and 1995 (78). For the other major indices, the pace of record highs is less impressive but still strong. The Dow has made 38 new highs in 2021 which is more than triple the historical average. This year is on pace to see the highest number of record highs for the index since 2017 when it tied 1991 for the record of 71 closes at an all-time high. The NASDAQ Composite has also seen a solid number of highs at 36 which is well above the historical average of 19 per year historically. Given the index has been rangebound essentially all year, the Russell 2,000, conversely, has only seen 13 closing record highs. That is the same number as last year and it is actually below the average of 20 per year historically. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/26/21 – Discretionary Leads the Way

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Some people don’t like change, but you need to embrace change if the alternative is disaster.” – Elon Musk

After yesterday’s gain, ten out of eleven sectors have posted positive returns over the last week and are above their 50-day moving averages. With the rally, a number of sectors have now also moved into overbought territory with two – Consumer Discretionary and Financials – now at what we classify as ‘extreme’ overbought levels (more than two standard deviations above their 50-day moving average).

The Consumer Discretionary sector has really surged over the last seven trading sessions after breaking out above resistance earlier this month. It must be optimism on the part of investors over a strong holiday season for the retailers. Right?

Well, not exactly. Normally, when the Consumer Discretionary sector sees a large gain, the reflex response is to pull up a chart of Amazon.com (AMZN) which accounts for about a fifth of the index. But looking at the performance of AMZN over the last several months, it has not contributed anything to the sector’s performance.

The main driver of the Consumer Discretionary sector during this most recent run has actually been Tesla (TSLA). Yes, TSLA is actually classified as a Consumer Discretionary sector stock, and given its recent surge to the trillion-dollar market cap level, it has become an increasingly large share of the sector. In fact, we’re getting to the point where out of a sector of more than 60 stocks, AMZN and TSLA account for close to 40%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Welcome to the Trillion Dollar Club, Tesla (TSLA)

After a 12% gain today on the back of a deal to sell 100,000 Model 3s to Hertz (HTZZ), Tesla (TSLA) joined the trillion dollar market cap club.

In June of this year, Facebook (FB) joined the $1 Trillion Club, bringing the total companies in this exclusive club to five at the time. Below is a look at the one-year forward performance of the five companies that had hit the trillion dollar market cap level prior to Tesla doing so today. Facebook (FB) rallied a bit initially after first crossing $1 trillion, but the stock has been trading lower recently and now has a market cap of ~$925 billion. Amazon (AMZN) did the best in the year after first crossing $1 trillion, followed by Microsoft (MSFT) and Alphabet (GOOGL). Apple (AAPL) initially performed okay after first crossing $1 trillion, but then ran into some speed bumps and was essentially flat twelve months after it became the first company to cross the $1 trillion threshold. It of course remains to be seen how Tesla (TSLA) will do in the year ahead.

Below we extend out even further by showing each of the $1 Trillion Club members’ performance since first crossing the $1 trillion threshold. While Apple trended sideways in the first year after crossing $1 trillion, it surged in year 2 and beyond and currently has a market cap of ~$2.5 trillion. Microsoft (MSFT) has also kept running up to its current market cap of ~2.3 trillion.

The six companies that have been $1 Trillion Club members at any point in time currently represent 25.2% of the S&P 500. With over a quarter of the index being comprised of these names, nearly every investor is tied to their performance in one way or another. The current market cap of these six names is over $10 trillion. To put that into perspective, that is nearly half of US 2020 GDP.

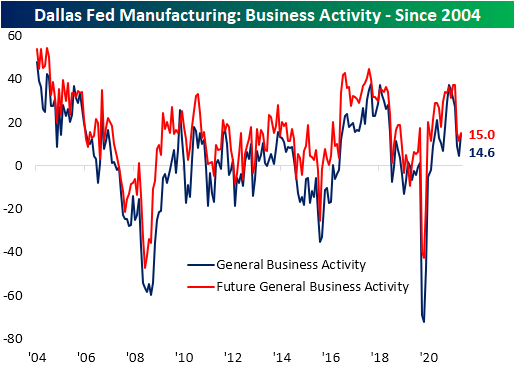

Dallas Fed Divergences

Released earlier this month, the New York and Philly Fed surveys on the districts’ manufacturing sectors both showed larger than expected declines. Next up was the Dallas Fed this morning, and in a breath of fresh air, the results showed activity accelerated by more than expected as the headline reading rose ten points to 14.6.

Last month, the index was not far off the historical median, and even after the double-digit increase in October, the index is not necessarily elevated in a historical sense. Some categories are similarly more middling within their historical ranges, but there are several others that remain in the upper few percentiles of readings like Prices Paid and Received, Wages and Benefits, Employment, and Unfilled Orders. The only index in contraction this month was that of Inventories. Additionally, breadth was positive with ten categories higher and six lower MoM.

Demand saw a modest uptick as New Orders came in at a slightly stronger rate. That led the Unfilled Orders index to erase most of September’s move lower as it is now back in the historically elevated range that was in place throughout the spring and summer. While it too moved higher month over month, unfilled orders expectations remained barely negative and significantly lower than the current conditions counterpart. As for another divergence between current and future conditions, the Shipments indices moved in opposite directions this month. Current conditions hit the lowest level since January while expectations rocketed higher by 15.6 points. That ranks in the top 3% of all monthly moves. Outside of the June high of 59.8, it also makes for the strongest reading in three years.

In other words, demand has bounced back a bit, but the region’s businesses are not getting products out the door at as fast of a rate (although that is expected to improve down the road). One likely reason for the weaker reading on shipments is a slowdown in production. That index fell MoM alongside Capacity Utilization. Again, in spite of the decline in current conditions, there appears to be optimism that these readings will be stronger in the future.

The same goes for Delivery Times which rose back to the highest level since June while expectations moderated. Given the higher lead times and deceleration in production amidst higher demand, the inventories index collapsed falling 12.2 points and ranking in the 3rd percentile of all month-over-month moves. While those supply chain-type risks are still evident, the picture for Prices Paid is the same: stalled out albeit at historically elevated levels while Prices Received hit a new record high.

One other area of the report that saw a notable divergence between future expectations and current conditions concerned employment. While the current conditions component made progress in moving back up toward its record high, expectations saw the fourth largest MoM decline on record. Expectations for Hours Worked also saw a significant decline ranking as the tenth-largest on record, though the current conditions index saw a coincident decline. Click here to view Bespoke’s premium membership options.

Heavy Hitters on Deck for Earnings

Earnings season is now off to the races and the week ahead is one of the busiest of the season. Of the S&P 1500 index members, 472 are scheduled to report over the coming week, and another 557 are scheduled to report the following week. In terms of market cap, that is more than $20 trillion this week and $7 trillion the next. Obviously, there is a huge divergence in the number of companies reporting and the size of those companies over the next couple of weeks. As we noted in today’s Chart of the Day and as shown in the chart below, one big reason for that is the fact that the FAAMG cohort is reporting this week. Today, Facebook (FB) is the first of those stocks with its $900+ billion market cap. Similarly, Tuesday will see Alphabet (GOOG) and Microsoft (MSFT) report, and their combined market cap is over a trillion dollars more than the 86 other S&P 1500 members reporting that day. Even more impressive, on Thursday, Amazon (AMZN) and Apple’s (AAPL) combined $4 trillion market cap outweighs the entire market cap of every other S&P 1500 stock reporting that day. In other words, this week has a huge number of stocks reporting, but the overall market’s direction will likely be dictated by the results of a small handful of names. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/25/21- Modestly Positive Start to the Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We can guarantee cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power.” – Alan Greenspan

US equities are on pace to kick off the week with a modestly positive open, while WTI crude oil nears $85, treasury yields rise, and bitcoin has rebounded from a weekend decline. It’s a quiet day for economic data today, but the pace of earnings will really ramp up after the close with Facebook (FB) and continue that way for the rest of the week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Equity futures remain subdued to kick off the week, but October has already been an extremely positive month. Through Friday’s close, the S&P 500 was up over 5.5% this month. Heading into the final week of October, that represents the best MTD performance for the index since 2015 (+8.08%) and just the 10th time in the post-WWII period that it has been up 5%+ heading into the final week of the month.

In the table below, we list each of the prior years where the S&P 500 was up 5%+ heading into the last week of October and show how it performed in the final week of the month. Of the nine prior occurrences, the index was up four times and down five times for a median decline of 0.07%. For comparison, in all other Octobers where the S&P 500 was up less than 5% heading into the last week of the month, the median performance was a gain of 0.64% with gains 62.7% of the time.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/24/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Supply Chains

How to fix the port traffic jam by Ryan Petersen (ThreadReader App)

A detailed plan that will help alleviate the traffic jam at the ports in Southern California which is creating huge feedback loops through the entire trans-Pacific trade network and the rest of the global economy. [Link]

Biden Races Clock and Holds Few Tools in Supply-Chain Crisis by Josh Wingrove, Jill R Shah, and Brendan Case (Bloomberg)

Most of the problems that led to the supply chain snarl up are rooted in years of underinvestment and there are no quick fixes that can be quickly pushed by the White House or anybody else. [Link; soft paywall]

New Business Models

Selling Cars in the Era of the Chip Shortage: Online Chats and No More Haggling by Patrick Thomas (WSJ)

With inventories extremely tight, automakers are trying to match production to demand as closely as possible. That’s led to a much different buying experience than the traditional model of purchase out of dealer inventory. [Link; paywall]

Net Promoter 3.0 by Fred Reichheld, Darci Darnell, and Maureen Burns (Harvard Business Review)

An explanation of how net promoter scores (“How likely are you to recommend this product to a friend?”) have a complementary accounting concept, and how they tie together. [Link]

Business Travel’s Demise Could Have Far-Reaching Consequences by Alana Semuels (Time)

The demise of business travel is likely to be long-lasting, and that has major consequences for the way the travel industry functions as a whole given the premiums historically paid by people moving around the country on business. [Link]

Renewables

Bechtel, Hatch Win Leads on Australia-Singapore Power Megaproject by Mary B. Powers and Debra K. Rubin (ENR)

A massive solar-battery combined project in rural northern Australia will send power overland to Darwin, a port on Australia’s northern coast, via a 500 mile transmission line. From there, it will run all the way to Singapore via underwater cables (a total of 2600 miles). The massive storage project will be able to store 36-42 GWh of electricity and supply one-fifth of Singapore’s total power needs. [Link]

History

Viking Artifacts Give Precise Date for Europeans’ Earliest Presence in North America by Robert Lee Hotz (WSJ)

Wooden artifacts discovered in Newfoundland date back 1,000 years, almost half a millennium before Columbus is credited with “discovering” the Americas. The technique used is fascinating, relying on solar storms, tree rings, and radio carbon dating to arrive at an exact date that was much earlier than previous estimates. [Link; paywall]

Exotic Animal Japes

Officials hope to capture loose zebras with new plan involving even more zebras by Alanea Cremen (WUSA9)

A Maryland county is planning to lure zebras that escaped from a farm with the rest of the herd those exotic mammals escaped from. [Link]

Foreign Affairs

KGB archives show how Chrystia Freeland drew the ire (and respect) of Soviet intelligence services by Simon Miles (Globe & Mail)

During her time studying abroad in the Ukraine, current Canadian Foreign Minister Chrystia Freeland was surveilled by the Soviet Union’s secret police for her activity as a pro-democracy activist. [Link]

Real Estate

Will 4% Mortgage Rates “Halt the Housing Market”? by Bill McBride (Calculated Risk)

Some context on a prediction that the US is building too much housing relative to its population and that a move higher in interest rates will destroy home prices. [Link]

Flu Season

Walgreens Flu Index Shows Flu Activity Is Up 23 Percent Compared to Last Flu Season as People Return to More In-Person Activities (Yahoo!/BusinessWire)

The pharmacy chain is tracking a significant uptick in flu virus prevalence across the southern tier of the country after a year with record low flu activity thanks to masking and social distancing measures that helped prevent the spread of the more endemic virus as well as COVID. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Equity Market Pros and Cons (and everything in between)

This week’s Bespoke Report is an updated version of our “Pros and Cons” edition for Q4 2021.

With this report, you’re able to get a complete picture of the bull and bear case for US stocks right now. It’s heavy on graphics and light on text, but we let the charts and tables do the talking!

On page two of the report, you’ll see a full list of the pros and cons that we lay out. We then provide slides for each “pro” or “con” that we’ve highlighted.

To read this report and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium.

Bespoke’s Morning Lineup – 10/22/21 – Stairs Down, Elevator Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you wish to increase your success rate, double your failure rate.” – Thomas Watson

Futures are mixed this morning following some weak earnings in the technology space. Both the S&P 500 and Dow futures are in the green, while the Nasdaq is indicated to open lower following disappointing earnings from Intel (INTC) and Snap (SNAP) after the close yesterday. If the S&P 500 manages to close out the day in positive territory it will mark the eighth straight day of gains for that index. The only economic data on the calendar this morning are preliminary Markit Manufacturing and Services PMI readings for October.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

You read the title of this post correctly. Traditionally, investors are used to seeing steady moves higher in the market followed by sharp and swift pullbacks. Since the S&P 500’s peak in early September, though, we have seen the opposite pattern play out. In the most recent 5% pullback, the period from the peak to trough on 10/4 covered 21 trading days. Since the recent low on 10/4, though, it only took 13 trading days to erase all of the prior losses from the 9/2 peak. Talk about a quick rebound!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

An Impressive 2021 So Far, But Flows Are Slowing

Yesterday the Investment Company Institute updated weekly fund flow numbers for the US mutual fund and ETF industry. As shown in the chart below, total mutual fund flows were positive this year but compared to the performance of ETFs, the inflows have been only modest at best. ETFs have logged more than $700bn in inflows, and while mutual funds avoided a fourth straight net outflow, their $66bn in inflows wasn’t that impressive. Across mutual funds and ETFs, bonds have been the massive winner this year, with more than $500bn in inflows. Equity funds record outflows over time as a mechanical result of equity retirements, but this year inflows have been the largest since 2014 with more than $210bn in buying across mutual funds and ETFs. About a quarter of total equity fund inflows so far this year have been dedicated to funds buying the domestic stock market. That’s the best year for domestic equity fund flows since 2014, and breaks a string of five consecutive years of outflows, though net flows have been stable for months now.

This analysis was first published last night in The Closer, Bespoke’s end-of-day macro note. To receive The Closer and all of Bespoke’s other reports covering sentiment and positioning, sign up for a two-week trial today if you’re not yet a member.