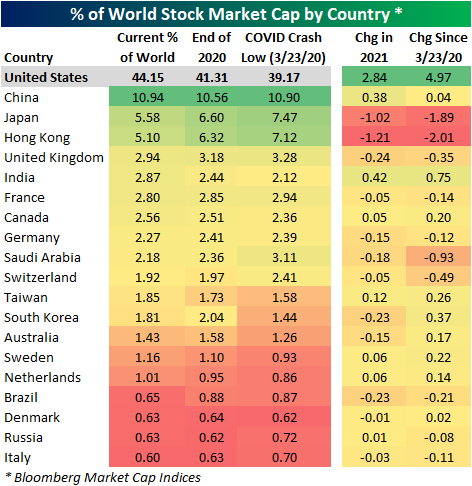

Global Market Cap Distribution

According to Bloomberg market cap readings, as of yesterday’s close, the United States had a 44% share of aggregate global stock market cap; topping the next largest country, China, by a factor of over four. As shown below, the US has seen its share of world market cap increase by 2.84 percentage points so far in 2021, which is a huge gain. This shouldn’t come as too much of a surprise, though, given that the US has outperformed nearly every major country stock market this year. In terms of other countries that have seen an increase in share this year, China has increased by 0.38 percentage points, while India has increased by 0.42 percentage points. The two big losers this year have been Japan and Hong Kong, with each losing more than a percentage point of share. Members of the European Union have an aggregate share of 9.82%; less than a quarter of the share of the United States. All told, the top 20 countries hold 93.06% of global market cap, and the top five have a 68.70% share.

During the mid-2000s bull market leading up to the Global Financial Crisis, the US was consistently losing its share of global market cap to the rest of the world. From the end of the Dot Com Crash to the peak just before the Financial Crisis, the US lost more than 15 percentage points of share. That was a banner period for both emerging and developed markets outside of the US. Since 2009, though, the US has been steadily gaining ground with some acceleration in the past couple of years as US equities have generally outperformed the rest of the world. Notably, the COVID crash did not result in the US shedding any significant share of market cap seeing as the sell-off was a global affair. Instead, the US has seen its share increase nearly 5 percentage points since the COVID Crash low.

The US has been increasing its share versus the rest of the world for more than a decade now, and at some point one has to think this trend will reverse for a bit. International equity markets, especially emerging markets, have essentially gone nowhere versus their levels from the mid-2000s. There are plenty of investors out there that have taken on more and more exposure to international markets in recent years because of their relative weakness to the US, and so far nothing has materialized. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/17/21 – Ending on a Down Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We must take the current when it serves, or lose our ventures.” – William Shakespeare

It’s red all over the screen this morning as equity futures, treasury yields, cryptocurrencies, and commodities are all lower. The only thing higher it seems is COVID case counts. Market sentiment certainly doesn’t feel jolly as Christmas is barely a week away. One positive trend worth noting, however, is that South Africa is reporting that the hospitalization rate for the latest Omicron wave of COVID has been much less than at the same point in the Delta wave, so hopefully, that’s a trend that continues over there and here in the US as the variant takes hold.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

The Nasdaq and Consumer Staples have followed divergent paths over the last month with the Nasdaq down close to 5% while Consumer Staples have rallied nearly 5%. With a performance spread of nearly 10 percentage points between the two, the gap is the widest in the Consumer Staples sector’s favor that it has been in since March of this year, and besides that the only other times in the last ten years that the spread got this wide were in August 2011, October 2018, and March 2020.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

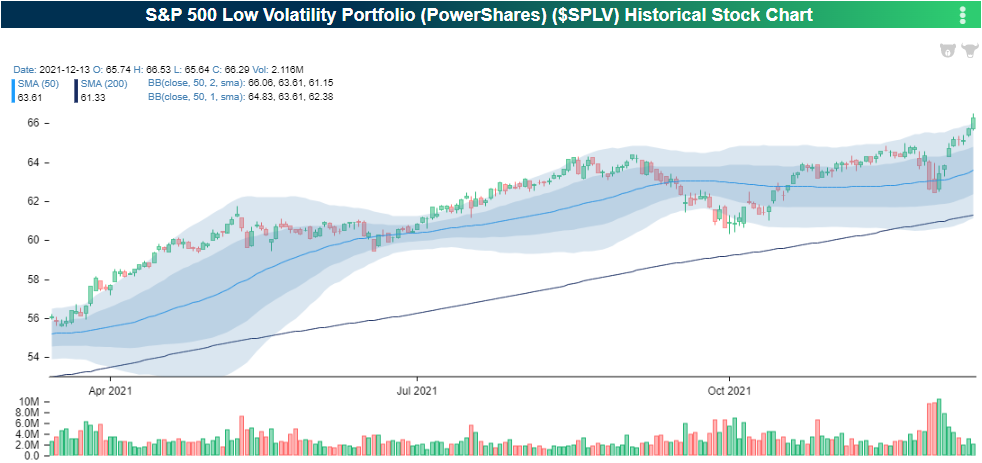

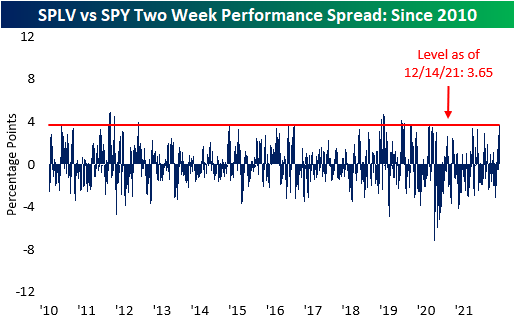

Outperformance from Low Volatility

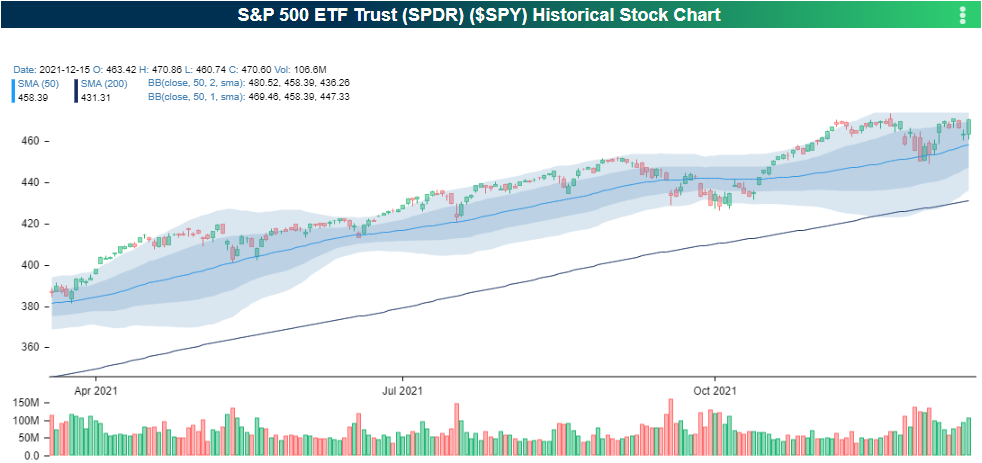

Over the last two weeks, low volatility names have outperformed the broader market. The PowerShares S&P 500 Low Volatility ETF (SPLV) has ticked 6.83% higher over the last 10 trading days as of yesterday’s close. During the same time period, the SPDR S&P 500 ETF (SPY) moved 4.36% higher. Investors have poured into safer names so far in December, but SPLV has still underperformed SPY on a YTD basis. Over the last three months, the performance of these two ETF’s has been essentially identical with SPLV breaking out to all-time highs, while SPY struggles to break out. Although investors are not necessarily selling off equities broadly, they are gaining exposure to lower volatility names, which could be interpreted as taking a more conservative posture.

The two-week performance spread between SPLV and SPY is currently at an elevated level, and as of earlier this week (12/14) was at its widest level since 1/31/20, which is less than a month before the COVID correction began. Investors should watch the performance of low volatility names moving forward, as continued outperformance would signal that investors are becoming increasingly risk averse. Click here to view Bespoke’s premium membership options.

Investor Sentiment Turning More and More Bearish

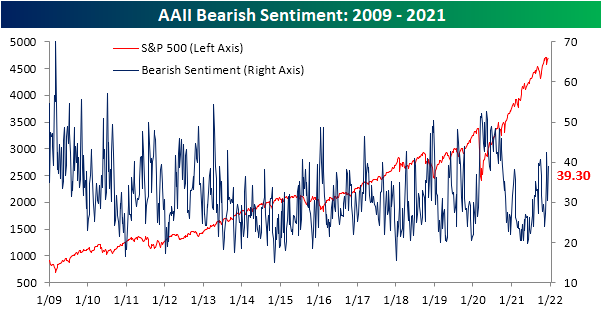

The S&P 500 is hovering right near record highs but recent sentiment readings would have you thinking otherwise. The AAII‘s reading on bullish sentiment fell from 29.7% last week to 25.2% this week. That is the lowest reading on bullish sentiment since the week of September 16th when it was at 22.4%.

Bearish sentiment, in turn, rose 8.8 percentage points to 39.3%. While that was the largest one-week uptick in bearish sentiment since mid-September, the actual level of bearish sentiment was even higher only two weeks ago.

Neutral sentiment fell by a similar amount to bullish sentiment this week. After hitting one of the highest levels of the past couple of years last week, neutral sentiment moderated to 35.4% this week.

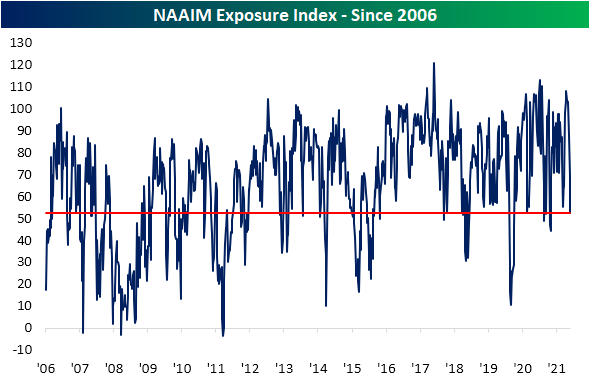

While the AAII survey showed overall bearish tones this week, the NAAIM Exposure Index has taken an even more pessimistic turn. This index ranges from +200 (leveraged long) to -200 (leveraged short) and this week the index fell to 52.2. That indicates reporting investment managers’ exposure to US equities is roughly 50%. That is the lowest reading since this past spring and prior to that, the spring of 2020 was the last time with as low of a reading.

Given the rise of bearish sentiment across indicators this week, our sentiment composite has now fallen to the lowest level since May 2020. This composite averages across the current readings (normalized by standard deviations from the historical average) for the bull-bear spreads of the AAII and Investors Intelligence surveys and the NAAIM index. Click here to view Bespoke’s premium membership options.

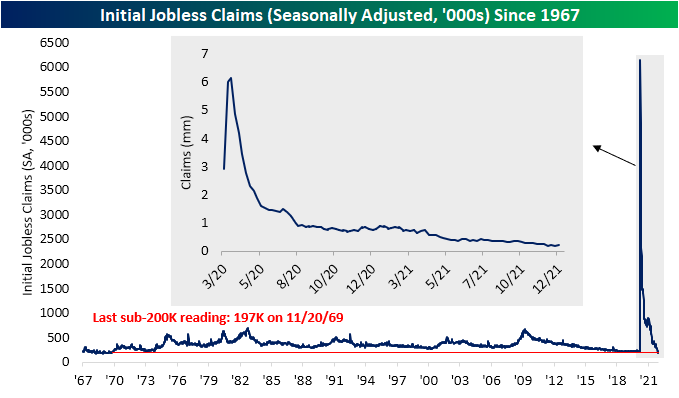

Claims Back Above 200K

After hitting a multi-decade low last week, seasonally adjusted initial jobless claims rose back above 200K. While a minor deterioration, the current level of claims remains one of the strongest readings on record.

While claims are at a healthy level, the seasonal adjustment has had a flattering effect recently. Unlike the SA number, on a nonseasonally adjusted basis, no recent week has seen a sub-200K reading with the current week falling to 267.5K from 283.9K the prior week. From a seasonal perspective, claims falling week over week is very much normal for the given week of the year (50th) with nearly 90% of years since 1967 experiencing such a decline. Only five other weeks of the year have seen claims fall WoW more consistently.

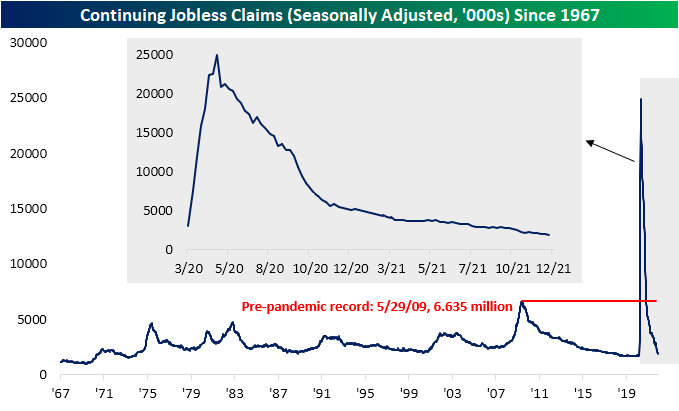

Delayed one week to initial jobless claims, continuing claims hit a new low for the pandemic of 1.845 million in the first week of December. The marks the strongest reading since the week of March 13, 2020.

Including all other programs creates an additional week of lag making the most recent data through the final week of November. Total continuing claims as of that week ticked higher to 2.46 million versus 1.95 million the previous week. That is the highest reading since the end of October. Even though pandemic era programs have now technically expired, the pickup in claims was broad across programs but regular state claims were the main driver of the overall increase. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/16/21 – Fourth Time the Charm?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No one goes there nowadays, it’s too crowded.” – Yogi Berra

Sentiment towards the market may be negative these days, but that hasn’t stopped the S&P 500 from quietly hanging around right at record highs. As Yogi Berra would say, “Everyone is selling stocks because they’re going up so much.”

Futures are staging a relatively impressive follow-through this morning in the wake of yesterday’s FOMC meeting where Powell and company didn’t give the market any surprises. To maintain those gains, though, we have a lot of economic data to get through. Already released were Jobless Claims (slightly higher than expected), Housing Starts (better than expected), Building Permits (better than expected), and the Philly Fed (weaker than expected). On deck we still have to wait for Industrial Production, Capacity Utilization, flash PMI readings for the month of December, and then the KC Fed Manufacturing report at 11 AM will close out the slate of data for the week. That’s a lot to digest!

We haven’t talked a lot about earnings recently, but there are a number of notable names reporting today including Accenture (ACN), Adobe (ADBE), Jabil (JBL), and FedEx (FDX). Of those four, ACN is trading up 10%, JBL is up 5%, and ADBE is trading down 7%. FDX isn’t scheduled to report until after the close.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Earlier in the week, we referred to it as the market treading water, and that remained the case heading into yesterday’s close as the S&P 500 closed right at its recent resistance level once again. As shown in the chart of SPY below, the ETF has managed to trade above $470 multiple times in the last six weeks as it first broached that level on an intraday basis on November 5th. Since then, there have been multiple attempts to break through that level, but all of them have failed. Could today be the day? In pre-market trading, SPY is trading just above $473 which would be close to a record intraday high. If these levels hold throughout the trading day and SPY can stay above $470, it could just be the welcome Santa was waiting for.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

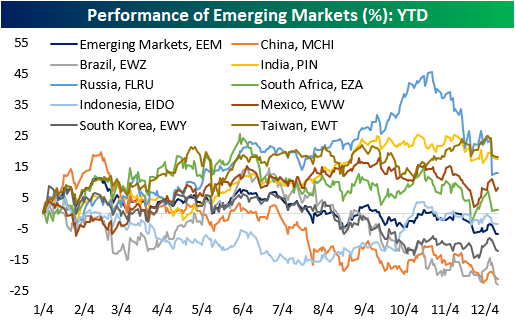

Pockets of Strength in Emerging Markets

So far this year, the US has outperformed every other country on the planet. Broadly speaking, developed economies have outperformed emerging economies. The iShares MSCI Emerging Markets ETF (EEM) has declined 6.8% in 2021, but this does not necessarily mean that performance across every emerging economy has been negative. Although China, Brazil, and South Korea have been particularly weak (three of the top six countries of exposure for EEM), countries like Taiwan, India, Russia, Mexico, and South Africa have experienced positive returns this year.

Just like individual sectors in the US cannot be expected to perform equally, emerging economies don’t always perform in unison with each other. Differences include natural resources, political & legal structure, trading partners, and much more. Although EEM has declined on a YTD basis, the average performance of the nine countries that we tracked was a modest loss of 0.1%, and the spread between the best performer (Taiwan) and the worst (Brazil) is currently 41.3 percentage points. Moving forward, investors may want to consider selecting individual countries to gain emerging market exposure, as the broader ETFs tend to have a large concentration in just a few countries. Emerging markets are inherently higher-risk investments in comparison to developed nations due to uncertainty in future prospects, but in the long run, there are excellent opportunities within pockets of emerging markets, although not all countries will see the same performance. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 12/15/21 – Big Data Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

If you insist on certainty, you will paralyze yourself.“ – J. Paul Getty

Ahead of today’s FOMC meeting, we just got some important economic data in the form of Empire Manufacturing, Retail Sales, and Import Prices. Overall, the results weren’t very good. While Empire Manufacturing came in better than expected, retail sales were much weaker than expected at both the headline level and ex-autos and gas. Headline retail sales came in at just 0.3% versus expectations for a gain of 0.8%. When you factor in inflation, though, sales were negative. Lastly, import prices rose more than expected coming in at 0.7% versus forecasts for an increase of 0.6%. On a y/y basis, import prices were up 11.7%.

Futures were flat heading into the report, and have actually picked up a little steam with Nasdaq leading the way. In addition to these reports, Business Inventories and homebuilder sentiment from the NAHB will be released at 10 AM.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

While the stock is already down 4% from its intraday high on Monday, shares of Apple (AAPL) still remain about 25% above their 200-day moving average (DMA). That’s off the recent high of 28% back on Friday, but it’s still elevated relative to history. Going back to 2011, there are only two periods where the stock’s spread relative to its 200-DMA reached significantly higher levels than 25% while there are another three (2014, 2017, and 2018) where the spread reached similar levels before pulling back.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Meet the New Boss, Even Stronger Than the Old Boss

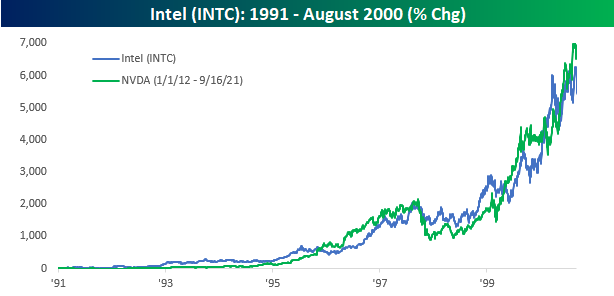

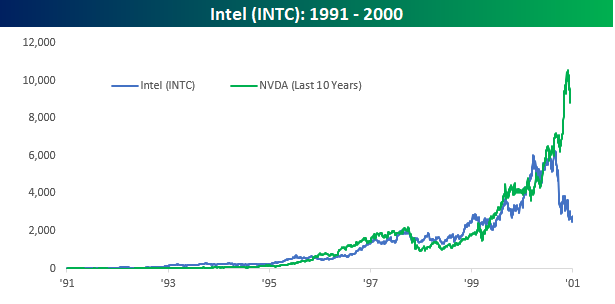

Back in the late 1990s, almost everyone had a similar story. They either had ‘this friend’ or knew someone who without a lot of financial background took a flier on a stock called Intel (INTC), held it for years, and became a millionaire in the process. Granted, these stories don’t seem as impressive nowadays with some people turning thousands into millions in a much shorter period of time, but at the time, the run in INTC was something dreams were made of. Looking just at the stock’s performance beginning in 1991 and through its peak in August 2000, INTC rallied nearly 6,300%. That’s a ten-bagger times six!

Despite semiconductors only becoming a bigger part of the economy in the most recent bull cycle, INTC has been a laggard relative to other semis over the last ten years. Hands down, the star of this cycle has been Nvidia (NVDA), and if we compare the performance of INTC from 1991 through the end of 2000 to NVDA now, there are a number of similarities. The first chart compares INTC’s performance in the 1990s through its August 2000 high to NVDA’s performance starting in 2012 and covering the same amount of time. As shown, both stocks followed very similar paths. Whereas INTC was up 6,300%, NVDA was up over 6,700%.

The last four months of 2000 were rough on INTC, though. From September through December 2000, INTC shares fell nearly 60%, cutting the nearly 6,300% advance down to 2,780%. Unlike INTC, though, NVDA has kept running. At its most recent high on 11/19, NVDA’s rally since the start of 2012 was 10,000% – or a hundred bagger! Since that peak, NVDA shares have pulled back just over 15%, taking its total gain down to ‘just’ 8,610%.

Not only were the last four months of 2000 painful for INTC, but the declines didn’t end there. 2001 and 2002 were also painful years for the stock, and by the time it bottomed in January 2003, INTC was down 79% from its August 2000 peak. Even after that low, INTC didn’t make much headway and actually made a lower low during the depths of the financial crisis, and it wasn’t until 2018 that INTC finally took out its highs from 2000. Just because INTC crashed and burned from its peak during the dot-com bubble after its epic run hardly means that this era’s star from the semiconductor sector will follow a similar path, and it’s not a bet we would make. However, the odds of any stock rallying more than 10,000% in the span of ten years are low enough, but the odds of one trading at over 60 times earnings that is already up 10,000% in ten years continuing that pace in the years ahead are even slimmer. Click here to view Bespoke’s premium membership options.

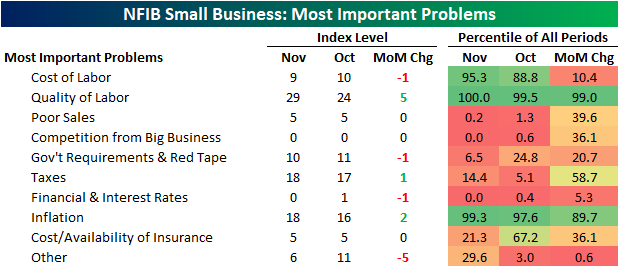

Inflation Concerns Surging

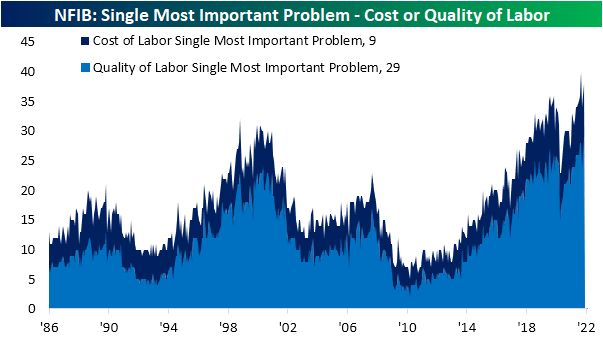

Small business sentiment picked up slightly in November with the NFIB’s monthly reading rising 0.2 points as expected. As for what businesses reported to be their biggest problems, as we noted in today’s Morning Lineup, labor concerns remain top of mind. A combined 38% of respondents reported either cost or quality of labor as their biggest issue. The former of which actually improved in November while the latter surged 5 percentage points. That was one of the largest one-month upticks to date and leaves it at a record high. Meanwhile, there have been been a couple of other indices hitting record lows: competition from big businesses and financial conditions and interest rates. Poor sales also came in the bottom 1% of readings.

While the largest share of companies see cost or quality of labor as a concern and the combined reading was higher versus October, that was still below the peak of 40% set in September.

Panning across the other problems, other than labor, inflation is the other key issue for small businesses. The percentage of respondents reporting inflation as their biggest issue has surged in recent months gaining another two percentage points to 18% in November. As shown below, the only other time in which as high of a share of respondents saw inflation as the biggest issue was in 2008. While there is not enough information to distinguish what the exact problems are, “other” also plummeted in November after a brief spike higher in October.

Pivoting back to inflation, the massive jump in November means it tied taxes as the second most important problem for small businesses. In the chart below, we show the rankings of those two series as well as the quality of labor (which is currently the most important problem) over the history of the survey. The surge in inflation’s importance is unprecedented in this data save for 2008 when it was briefly the most important problem. Click here to view Bespoke’s premium membership options.