Neutral Sentiment Crosses Above 40%

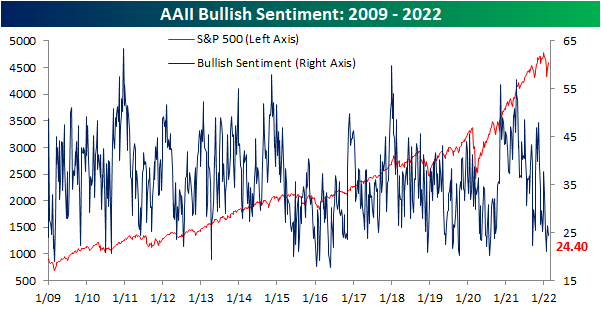

The past week has seen the S&P 500 regain some of its losses as yesterday’s close ran right up to the high from one week prior. In spite of that rally, sentiment has shifted lower with the percentage of respondents to the weekly AAII sentiment survey reporting as bullish falling back below 25% this week after two weeks of higher bullish sentiment readings.

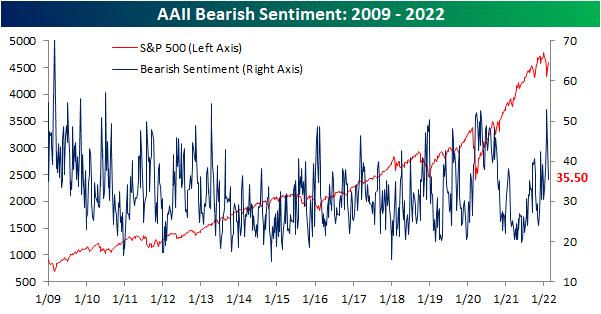

While bulls were lower, bearish sentiment actually experienced another large decline falling from 43.7% last week to 35.5%. That is the lowest level of bearish sentiment since the first week of the year, though it remains above the historical average reading of 30.5%. The two-week decline in bearish sentiment now stands at 17.4 percentage points which is the largest two-week decline since January 2019 when it had fallen over 20 percentage points.

As a result of the moves in bullish and bearish sentiment, overall tones among individual investors remain pessimistic albeit less so than the past couple of weeks.

Given that both bullish and bearish sentiment fell, neutral sentiment borrowed from both readings. Jumping 10.3 percentage points from last week, it was the first time neutral sentiment rose by double-digit percentages week over week since September of last year. While that increase several months ago was actually larger than this week’s rise, the actual level of neutral sentiment is higher this time around. At 40.2%, neutral sentiment saw the highest reading since the first week of 2020.

Crossing above 40%, neutral sentiment is reaching the upper end of its historical distribution of readings. In the past when a similar percentage of respondents have reported that they expect the S&P 500 to be flat in the next six months, the S&P 500 has actually tended to consistently perform positively with longer-term outperformance relative to the norm. Click here to view Bespoke’s premium membership options.

January Peak in Claims Wearing Off

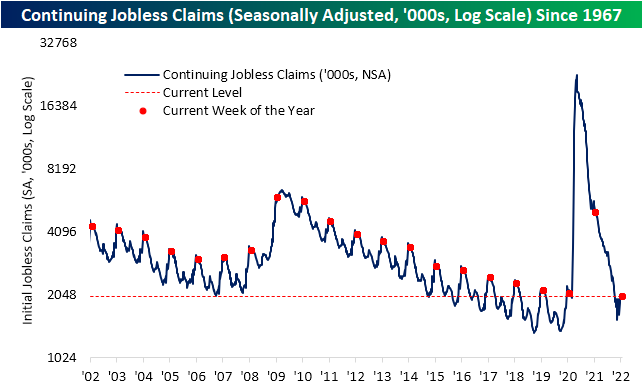

The January spike in jobless claims has continued to unwind in the most recent week’s data. Seasonally adjusted initial claims fell by 16K to 223K versus last week’s 1K upwardly revised reading of 239K. That does not set a new low for claims, only reaching the lowest level since the last week of December and still 35K above the low from the week of December 3rd, but it does mark a third consecutive week of improvement.

On a non-seasonally adjusted basis, claims improved falling to 228.9K. The seasonal peak in claims is now well in the rearview and this week’s reading was essentially right in line with the levels of the comparable week for the few years prior to the pandemic. Historically, the current week of the year has been mixed when it comes to seasonal patterns with claims rising week over week 44% of the time, but in recent years the seasonal tendency has been one of improvement. Other than last year, every year since 2016 has seen NSA claims fall WoW during the current week of the year (6th) with this year marking the largest decline of those.

Continuing claims are delayed an extra week to the initial jobless claims number meaning the most recent print is as of the last week of January. Continuing claims remain below the range of readings in the few decades prior to the pandemic, unchanged versus last week at 1.621 million.

While initial claims are in line with pre-pandemic readings for the same week of the year, continuing claims set a new low for the current week of the year. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 2/10/22 – The CPI You’ve All Been Waiting For

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Things there are no solution to: Inflation, bureaucracy & dandruff.” – Malcolm Forbes

It’s finally here, the CPI report the world has been waiting for. Today’s CPI report for January is very likely one of the most-anticipated economic indicators of the year so far and leading up to it, futures were mixed with the Dow higher while the S&P 500 and Nasdaq marginally lower. That’s certainly a tentative tone given the strong earnings we have seen from the likes of Disney (DIS), Coca-Cola (KO), Uber (UBER), Mattel (MAT), and Twilio (TWLO), which are all up sharply in reaction to their reports. Treasury yields were likewise little changed heading into the report with the 2-year and 10-year maturities trading pretty much unchanged relative to yesterday’s close (1.34% and 1.93%, respectively).

CPI came in higher than forecasts with the headline reading surging 0.6% compared to forecasts for an increase of 0.4%. Core CPI also rose by the same amount versus forecasts for an increase of 0.5%. On a y/y basis, headline CPI was up 7.5% which was the highest reading since 1982. Core CPI was up 6.0% which was also stronger than expected and the highest since 1982. The initial market reaction has been – you guessed it – lower with equity futures selling off and treasury yields moving higher as the 10-year approaches 2.0% and the 2-year trades at 1.45%.

The other indicator released this morning was Jobless Claims which actually came in slightly lower than expected on an initial basis and slightly higher than expected on a continuing basis.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Inflation has easily been the number one concern of investors for the last year now, but in looking at market performance on the day of prior reports since the start of 2021, you wouldn’t necessarily think the markets were preoccupied with inflation. Since the start of 2021, there has only been one CPI report that has come in weaker than expected (August report released on 9/14/21). Of the remaining 12 reports, eight have been higher than forecasts, and four have been right in line with estimates.

Given all those higher than expected reports, you would think that the average S&P 500 performance on CPI days since the start of 2021 would be negative and Treasury yields would move higher, but that hasn’t really been the case. As shown in the table below, the S&P 500’s average performance on the day of CPI reports since the start of 2021 has been a gain of 0.25% (median: -0.04%) with gains 61.5% of the time. Moves in the Treasury market have been even more counter-intuitive. On the 13 prior report days since the start of 2021, the yield on the 10-year US Treasury has dropped an average of nearly 2 basis points (median: -0.6 bps) with increases in yield less than a third of the time.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Morning Lineup – 2/9/22 – A Half Correction

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A deception that elevates us is dearer than a host of low truths.” – Marina Tsvetaeva

Building upon yesterday’s momentum, US equity futures look to trade higher again this morning following strong sessions overnight in Asia and Europe. While there hasn’t been much in the way of a concrete catalyst, lower COVID case numbers and hospitalizations coupled with a trend of easing restrictions in the states that had some of the strictest mandates has investors optimistic that the long-delayed return to normal may be on the horizon. Today’s economic calendar is light, but there are still a ton of earnings to contend with, and we’re now just 24 hours from the biggest economic indicator of the week (and probably the month) with tomorrow’s CPI report for January.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday’s rally and this morning’s strength in the futures markets have been welcomed by the bulls even if there wasn’t much in the way of a catalyst for the move. As markets look to stabilize after some recent volatility, below we provide a quick snapshot of where the major indices stand on a YTD basis and relative to their 50-day moving averages (DMA). The Nasdaq 100 (QQQ) has been the hardest hit YTD and heads into today’s trading session with a decline of nearly 10%. It is also the only major US index trading more than 5% below its 50-DMA. Along with the Russell 2000 (IWM), QQQ is the only other index ETF trading at ‘oversold’ levels (>1 standard deviation below its 50-DMA).

The technical definition of a market correction is a decline of 10% or more from a peak, and with the S&P 500 currently down just over 5% YTD, 2020 would currently qualify as a ‘half-correction’. SPY has barely moved out of oversold territory, but like the Nasdaq 100, it also remains below its 50-DMA. Finally, the Dow is often considered to be one of the least representative of the major indices, and it’s living up to that reputation this year. With a decline of just over 2% YTD, the Dow’s performance looks nothing like any of the other indices, and it’s the only one that is also anywhere close to trading above its 50-DMA. In fact, if current levels in the futures hold, it will be the only index ETF above its 50-DMA today.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

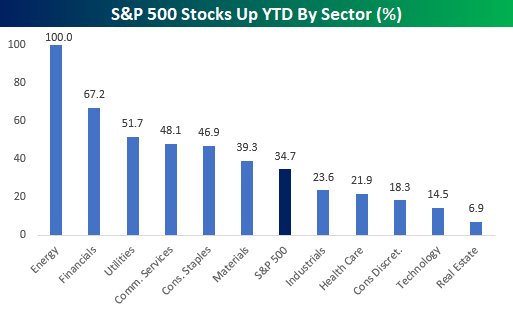

Sector Performance YTD: Energy Dominates

Earlier today in our Morning Lineup post, we highlighted the incredibly wide disparity between the performance of the S&P 500 Energy sector and the rest of the index. To further illustrate the divide, the charts below show the average YTD performance of S&P 500 stocks by sector as well as the percentage of stocks in each sector that are up YTD.

Starting with average performance, stocks in the Energy sector are up an average of 21.6% YTD which is more than 18 percentage points higher than the next closest sector (Financials). Energy is also one of just two sectors in the S&P 500 where the average YTD return of stocks in the sector is positive. For all the stocks in the S&P 500, the average YTD change is a decline of 4.1%, and in the Technology sector, its individual components are already down an average of just over 10% YTD!

With stocks in the Energy sector up an average of over 20% YTD, it shouldn’t come as too much of a surprise that every stock in the sector has posted YTD gains. After Energy, Financials and Utilities are the only two other sectors where more than half of the components are up YTD. For the S&P 500 as a whole, barely more than a third of stocks in the index are up YTD while less than 15% of Technology stocks and just 6.9% of stocks in the Real Estate sector (2 out of 29) are in the black. A number of strategists have said 2022 will be the year of the stockpicker, but so far this year, it’s been increasingly difficult for those stockpickers to find winners – especially outside of the Energy sector. See more in-depth market analysis from Bespoke by starting a two-week trial to Bespoke Premium today.

Bespoke’s Morning Lineup – 2/8/22 – New Highs in Yields

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We don’t have to be smarter than the rest. We have to be more disciplined than the rest.” – Warren Buffett

Futures are modestly higher for the S&P 500 and Dow this morning, but the Nasdaq is indicated to open lower in what’s looking like a mixed session for stocks. Futures started to lose some steam shortly after the European open as Treasury yields have been moving higher with the 10-year eclipsing 1.95% to its highest level since summer 2019.

The latest read on small business sentiment dropped to an 11-month low, but 61% of companies surveyed reported that they have raised prices, so inflation pressures remain firm. On a brighter note, WTI is trading back below $90 after hitting multi-year highs late last week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

We’re barely a month into the new year, but 2022 is shaping up to be a year where it’s Energy and everyone else. Year to date, the sector is up over 25%, and besides Financials, which is up less than 3%, every other sector is staring at losses. The chart below shows the performance of the ProShares S&P 500 Ex Energy ETF (SPXE) compared to the performance of the S&P 500 Energy sector ETF over the last year. For much of the last twelve months, Energy has outperformed the S&P 500 Ex Energy, but as the calendar flipped to 2022, the divergence has widened out to extreme levels. Even as Energy has risen more than 25% this year, the rest of the S&P 500 is down close to 7% on a market-cap-weighted basis, and that has stretched the one year performance gap between the two ETFs over the last year to 50 percentage points (63.96% vs 13.95%).

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Gold “G-loiters”

Everyone knows that gold ‘glitters,’ but for the last year, it’s more like ‘gloiters’ as the commodity has been loitering around the $1,800 per ounce level. This morning, gold is trading modestly above $1,800, which is a level it has crossed above and below multiple times in the last 12 months. In fact, the average price of gold over the last 12 months has been $1,795 per ounce, so there hasn’t been a lot of movement.

Taking a longer-term look at gold shows some interesting trends. On a five year basis, the last 12 months of sideways trading looks like part of a consolidation phase for the commodity as it digests its big move higher from mid 2018 through early 2020 when prices surged from under $1,300 per ounce to more than $2,000.

While gold’s move over the last year looks like a consolidation of a strong rally on a five year chart, a ten year look at gold shows another trading range where prices today are right around the same level they were in 2012. As long as gold can hang around in the $1,700 to $1,800 range, the longer-term technical picture looks positive.

Just as the last year’s sideways pattern for gold looks like a consolidation of a strong rally on the five year chart, the sideways pattern of the last ten years looks like a very long-term consolidation following the rally in the early 2000s where prices rose more than six-fold from under $300 per ounce in early 2002 to nearly $1,900 in August 2011.

With a one-year trading range of less than 15%, gold is trading in its narrowest one-year range since July 2018, and before that, 2005. Eventually this range is going to break, and based on prior experience, once the range breaks, it usually expands pretty rapidly, so one direction or another, gold looks poised for a significant move going forward. See more in-depth market analysis from Bespoke by starting a two-week trial to Bespoke Premium today.

Bespoke’s Morning Lineup – 2/7/22 – Picking Up Steam

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I have never in my life envied a human being who led an easy life. I have envied a great many people who led difficult lives and led them well.” – Theodore Roosevelt

After a lower start overnight, futures have slowly picked up steam this morning and are now in modestly positive territory across the board with the Nasdaq leading the way higher. Overnight, economic data in Asia was on the weak side with China’s Services PMI missing expectations while Japan’s index of Leading Indicators decelerated relative to December.

Here in the US today, the only economic report on the calendar is Consumer Credit at 3 PM Eastern. On the earnings front, key reports after the close today include Amgen (AMGN), Tenet Healthcare (THC), and Simon Properties (SPG).

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

If you talk to just about any investor lately, they’ll tell you that it has been a difficult year in the market. Putting the recent moves into perspective, it could have been a lot worse. Friday’s close marked 23 trading days since the S&P 500’s last closing record high, and during that span, the S&P 500 is down 6.2%. When comparing the last 23 trading days to other 23 trading day periods since 2000, there have been plenty of periods where the market saw much larger declines. Prior to the current period, the last time the S&P 500 declined 6% over a 23 trading day period was in late September 2020, but six months before that we saw what was the largest decline in a 23 trading day period since the Great Depression when the S&P 500 lost more than a third of its value from its peak on 2/19/20 to its low on 3/23/20.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 2/4/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Foreign Affairs

NAHB Welcomes Biden Administration Move to Lower Lumber Tariffs (NAHB)

A Biden administration proposal to reduce tariffs on lumber imported from Canada to the United States got a warm reception from the National Association of Homebuilders this week. [Link]

What the US could learn from China’s nuclear power expansion by Daniel Van Boom (CNET)

China will add ten new nuclear power plants per year over the next decade and a half as it seeks to meet soaring electricity demand while avoiding carbon-intensive power production like coal that has fueled electrification so far. [Link]

Ukraine and Dollar Weaponization by George Pearkes (Atlantic Council)

Bespoke’s macro strategist discusses the macroeconomics driving the unique properties of the dollar as a weapon that could be used to hem in Russian aggression towards Ukraine. [Link]

Battery Joe

Tesla, Who? Biden Can’t Bring Himself to Say It — and Musk Has Noticed by Dana Hull and Jennifer Jacobs (Bloomberg)

A difference of opinion over unions mean the President and the CEO of the world’s largest EV maker don’t see eye-to-eye despite huge enthusiasm for the emission-free vehicles from the White House. [Link; soft paywall, auto-playing video]

Biden’s Race to Convert Trump Voters to EVs by Gregory Korte (Bloomberg)

While EVs are gaining popularity, most GOP-leaning states have rejected the vehicles. Convincing conservatives to ditch gas or diesel for batteries will be a prerequisite for big uptakes in electric vehicles nationally. [Link; soft paywall]

Going Coastal

Jeff Bezos’ new megayacht is so big, the Dutch are going to have to take apart a historic bridge to let it pass by Avery Hartmans (Business Insider/MSN)

The massive, 417-foot yacht that is being built for Jeff Bezos up the river from Rotterdam won’t be able to pass under a bridge on its way to the Atlantic, so the company building the boat is paying to have the bridge temporarily dismantled. [Link]

The Last Oyster Tongers of Apalachicola by David Hanson (The Bitter Southerner)

Collapsing oyster populations in Apalachicola Bay mean that there will be no harvests for five years, part of an effort to rebuild beds so future tongers can ply their trade on ocean skiffs in the Gulf. [Link]

Crypto

Intuit CEO Warns of Tax Bill Shock for Bitcoin, NFT Traders by Joe Williams (Bloomberg)

Millions of small investors are at risk of serious tax liabilities this year, with capital gains taxes as high as 37% on gains from trading crypto and NFTs. [Link; soft paywall]

The Federal Reserve Bank of Boston and Massachusetts Institute of Technology release technological research on a central bank digital currency (Federal Reserve Bank of Boston)

The Boston Fed and MIT partnered in a research effort that was not designed to create a usable CBDC and is separate from the Federal Reserve Board’s own exploration of a CDBC. One codebase designed by the team was able to handle 1.7 million transactions per second with “the vast majority” settling in under 2 seconds. [Link]

Teachers

Teachers Are Quitting, and Companies Are Hot to Hire Them by Kathryn Dill (WSJ)

The pandemic is driving teachers out of the classroom even as the private sector goes on a hiring binge, and teachers are a popular target to work in a range of fields. [Link; paywall]

Novel Ideas

Our data centers now work harder when the sun shines and wind blows by Ana Radovanovic (Google)

This news is a bit old (published in 2020) but it’s still interesting: Google shifts data center use to ramp up when renewable electricity is more available, reducing the amount of non-renewable electricity data centers consume. [Link]

This company says it’s developing a system that can recognize your face from just your DNA by Tate Ryan-Mosley (Technology Review)

An Israeli startup claims it may be able to use DNA to predict what a person looks like, though the company is somewhat dodgy and experts see the technology as “pseudoscience”. [Link]

COVID

One Million Deaths: The Hole the Pandemic Made in U.S. Society by Jon Kamp, Jennifer Levitz, Brianna Abbott, and Paul Overberg (WSJ)

The US death toll from COVID is about to move above 1mm, with hundreds of thousands succumbing to the virus and huge numbers dying from related or adjacent causes. [Link; paywall]

Baseball Cards

This Philadelphia startup tells you what your old baseball cards are worth — with just a photo by Kennedy Rose (Biz Journals)

A start-up allows users to digitize their trading card collections with a mobile phone, making valuing and monetizing the cards much easier and more efficient than traditional assays. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

A “Sell First, Ask Questions Later” Earnings Season

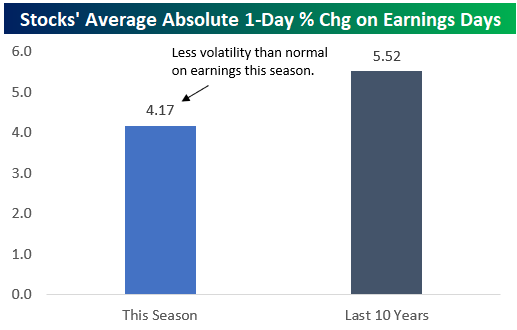

Through Thursday morning, 549 companies had reported Q4 2021 numbers since the current earnings season began the week of Jan. 10th-14th. While it may seem like stocks have been extremely volatile on their earnings reaction days this season due to a number of high-profile names seeing extreme one-day moves, on average, earnings-day volatility has actually been lower than normal. Over the last ten years, the average stock that has reported earnings has seen an absolute one-day change of +/-5.52% on its earnings reaction day. (For stocks that report before the open, its earnings reaction day is that trading day. For stocks that report after the close, its earnings reaction day is the next trading day.) So far this season, the average stock that has reported has seen an absolute one-day change of just +/-4.17%.

While earnings volatility has been lower than normal across all of the stocks that have reported this season, share-price reactions to earnings have also been much weaker than normal. Below are a number of charts showing how stocks have performed on their earnings reaction days this season versus the average over the last ten years based on a number of earnings scenarios.

As shown in the first chart below left, stocks that have beaten consensus analyst EPS estimates have risen by an average of just 0.06% on their earnings reaction day this season. Over the last ten years, the average EPS beat has gained 1.65% on its earnings reaction day. Reactions to top-line sales beats have actually been negative. As shown, stocks that have beaten sales estimates this season have averaged a one-day drop of 0.41% on their earnings reaction days versus an average gain of 1.36% for sales beats over the last ten years.

While EPS and sales beats are usually rewarded with positive share-price reactions, this season they’re not being rewarded at all, and in the case of sales, beats are actually being punished!

Interestingly, while beats have experienced much weaker than normal performance this season, misses are performing in line to better than they normally do. The average stock that has missed EPS estimates has declined 3.34% on its earnings reaction day this season, which is the exact same as the average reading for the last ten years. The average stock that has missed sales estimates has fallen 1.65% on its earnings reaction day this season, which is actually better than the 10-year average of -2.07%.

Stocks that beat both EPS and sales estimates have averaged a one-day gain of 2.36% on their earnings reaction days over the last ten years. This season, stocks that have beaten on both the top and bottom line have seen a minuscule one-day gain of just 0.15%. On the flip side, stocks that have missed both EPS and sales have averaged a one-day drop of 4.22% this season, which is slightly better than the average drop of 4.47% seen for EPS and sales misses over the last ten years.

Finally, below we look at price reactions based on forward guidance. Normally, a stock that raises guidance sees the biggest reward on earnings reaction days with a one-day average gain of 4.04% over the last ten years. This season, the average stock that has raised guidance has gained just 0.82% on its earnings reaction day. Stocks that lower guidance have historically gotten crushed with an average one-day drop of 5.3%. This season, the average stock that has lowered guidance has fallen even more with a one-day drop of 6.03%.

To conclude, investors have simply not been willing to reward companies that have posted strong results this earnings season. In a “normal” market environment where investors are focused more on fundamentals at the micro-level, we see buying in reaction to positive reports and selling in reaction to negative reports. This season, there seems to be much less of a focus on the micro and a much bigger focus on the macro, with the economy (and Corporate America) facing the key headwind of higher interest rates down the road. Of course, this type of environment also presents opportunities for investors to find stocks that may be getting unduly punished because others are looking to “sell first and ask questions later.” Bespoke publishes in-depth earnings analysis for subscribers on a daily basis throughout earnings season, including Conference Call Recaps as well as individual results and share price reactions. You can see these reports by starting a two-week trial to Bespoke Premium today.