Empire Fed Back In Expansion

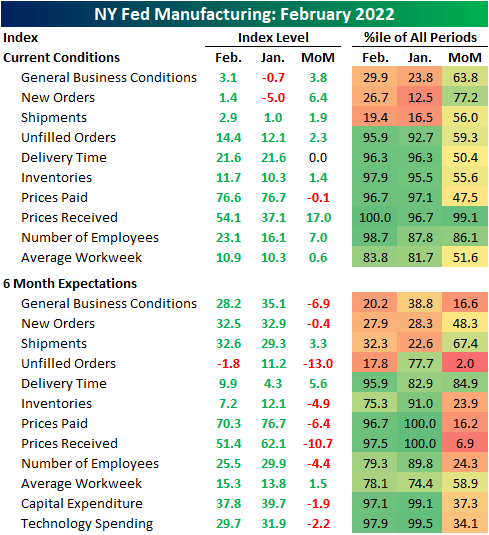

The New York Fed released the February results of the Empire Fed Manufacturing survey this morning. Last month saw the index fall into negative territory for the first time since June 2020. This month, the headline number is back into expansionary territory rising to 3.1.

As the region’s activity is once again expanding, most areas of the report showed improvement. New Orders are once again growing alongside shipments, although each of those indices are at the lower end of their historical ranges. Other areas are much more elevated with Prices Received even setting a new record high. Six-month expectations saw weaker breadth in February and are generally at lower levels with respect to their ranges.

Similar to the headline number, New Orders went from a negative reading to a positive one in the past month after rising 6.4 points. Unfilled Orders picked up in tune with a 2.3 point increase to 14.4 which was the highest reading since October. Expectations, however, experienced a dramatic 13-point decline ranking in the bottom 2% of all monthly moves. That marked the largest one-month drop for the index since June 2016.

The index of Delivery Times went unchanged at 21.6. Without any change, the index remains historically elevated but significantly improved versus the record highs in the fall. In other words, supply chains continue to show historic strain, but it appears to have alleviated to a degree.

Although the decline was small at just 0.1 points, Prices Paid fell for the third month in a row. In spite of having peaked, the index remains very high. Contrary to the move in Prices Paid, Prices Received surged from 37.1 in January to 54.1 this month. That wasn’t only a record high for the index, but it also marked the largest one-month gain in a decade.

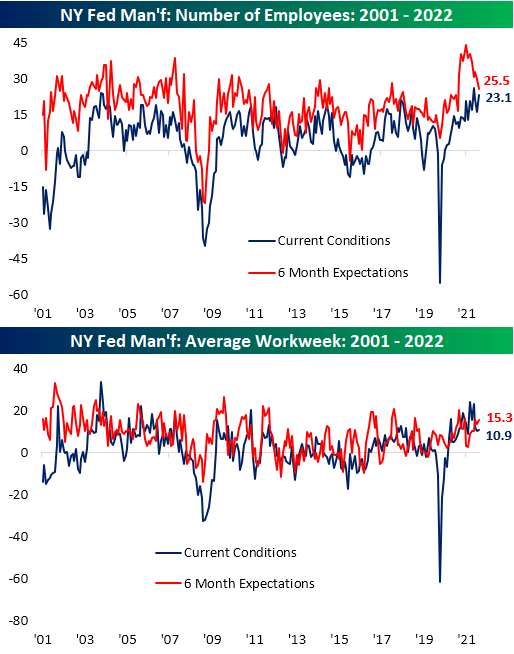

The employment situation also improved with the index for Number of Employees edging higher indicating the region’s firms took on more workers at an accelerated rate. Average Workweek meanwhile saw a small move only rising 0.6 points. Click here to learn about Bespoke’s stock market research services.

Revisiting the Biggest Winners and Losers Since the COVID Crash Low

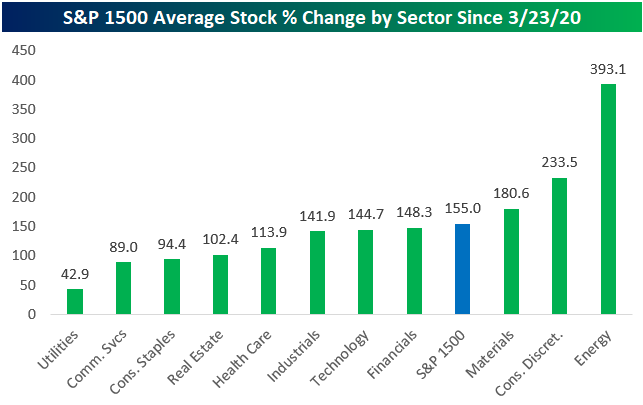

In a little over a month on 3/23/22, we’ll be exactly two years removed from the stock market’s COVID Crash closing low. Below we show how the average stock that’s currently in the S&P 1500 has done since the 3/23/20 low by sector. Stocks in the S&P 1500 are up an average of 155% since the COVID Crash low. By far the best performing sector has been Energy where the average stock is up 393%. Consumer Discretionary stocks are up the second most on average at +233.5%, while Materials stocks rank third with an average gain of 180.6%. Notably, stocks in the Financials and Technology sectors are both up roughly the same on average since 3/23/20 with gains of 148% and 145%, respectively. Three sectors have average gains of less than 100%: Consumer Staples (+94.4%), Communication Services (+89%), and Utilities (+42.9%). Note that these results are only based on price change, so higher dividend-paying sectors like Utilities are up more on a total return basis.

There are currently 59 stocks in the S&P 1500 up more than 500% from their closing level on 3/23/20, and there are 11 up more than 1,000%. GameStop (GME) remains at the top of the list with a gain of 3,042%, followed by SM Energy (SM) and Matador Resources (MTDR) with gains of more than 2,000%. Aluminum-maker Alcoa (AA) is the best performing Materials stock on the list with a gain of 1,160% since 3/23, rising from $5.67/share up to $71.45 as of this morning. The average share price of the 11 stocks that are up 1,000%+ was just $4.42 on 3/23/20. Their average share price now is $66.78!

Tesla (TSLA) is by far the largest company on the list of best performers with a market cap of more than $900 billion at the moment. Back on 3/23/20, Tesla (TSLA) shares closed at $86.86. Since then, the stock has gained 944%, putting shares above the $900 level.

There are 56 stocks currently in the S&P 1500 whose price today is lower than it was at the close on 3/23/20. Below are the 35 stocks that are down at least 10% in price since then. eHealth (EHTH) and Tabula Rasa (TRHC) have been the worst two with declines of more than 80%. Another three are down more than 50% (QURE, STRA, IVR), while 16 more are down 20%+. The two stocks on the list of worst performers with the largest markets caps at the moment are Gilead (GILD) and Biogen (BIIB). These two stocks performed well in the very early days of COVID, but they’ve been trending lower ever since and currently trade at the same levels they were at in mid to late 2019.

Clorox (CLX) is an interesting name to see on the list of worst performers. When COVID first hit, there was a run on disinfectant products like bleach that Clorox manufactures. (Remember trying to find Clorox wipes throughout the first half of 2020? They were nowhere to be found!)

The supply/demand imbalance pushed shares of Clorox (CLX) sharply higher from January to August 2020, but since then shares have steadily trended lower and lower, and they’re now right back to where they were trading in early January 2020. Normally, we see stocks “take the stairs up and the elevator down,” but the two-year chart for Clorox looks like the opposite: it took the elevator up when COVID first hit, and it has taken the stairs down ever since. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 2/15/22 – On Again, Off Again

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“What we know is a drop, what we don’t know is an ocean.” – Isaac Newton

Investors have breathed a sigh of relief this morning on headlines that some Russian troops on the border of Ukraine are starting to return to their bases. Setting aside the fact that it wouldn’t make a lot of sense to take comments from a would-be invader seriously, investors will take any positive news while they can get it. The bottom line is that like the quote above, there is much more we don’t know about the situation at hand than what we do know, and that doesn’t even include the FOMC and the state of the US economy. On the latter, the economic calendar starts to pick up today and for the rest of the week. Today’s reports include PPI and Empire Manufacturing which will both be released at 8:30. For our first take on the data, make sure to listen to our Twitter Spaces where we will break it all down.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

A potential easing of Russia-Ukraine tensions has caused WTI crude oil prices to fall over 3% from yesterday’s close to the lowest levels since – hold on for it – last Friday. With energy prices lower, you would expect Energy stocks to show weakness today, and that’s exactly what we’re seeing in the pre-market with the Energy Select Sector ETF (XLE) trading down nearly 2%. While the positive correlation between crude oil prices and energy stocks is holding up so far today, we would note that in yesterday’s trading the two traded inverse with each other as WTI traded up over 2% while energy stocks traded down more than 2%. That was the first time in over a year that energy stocks were so weak on a day that crude oil was up over 2%.

Despite yesterday’s inverse trading, crude oil and energy stocks have been joined at the hip for the last year. Through the close yesterday, WTI was up 59% over the last year while the Energy sector was up 53%. While those performance numbers are already similar to each other, before Monday’s divergence, less than one percentage point separated their performance over the trailing twelve months. If tensions over Ukraine do in fact ease over the coming days, look for energy prices and therefore energy stocks, to take a breather from their torrid performance this year.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

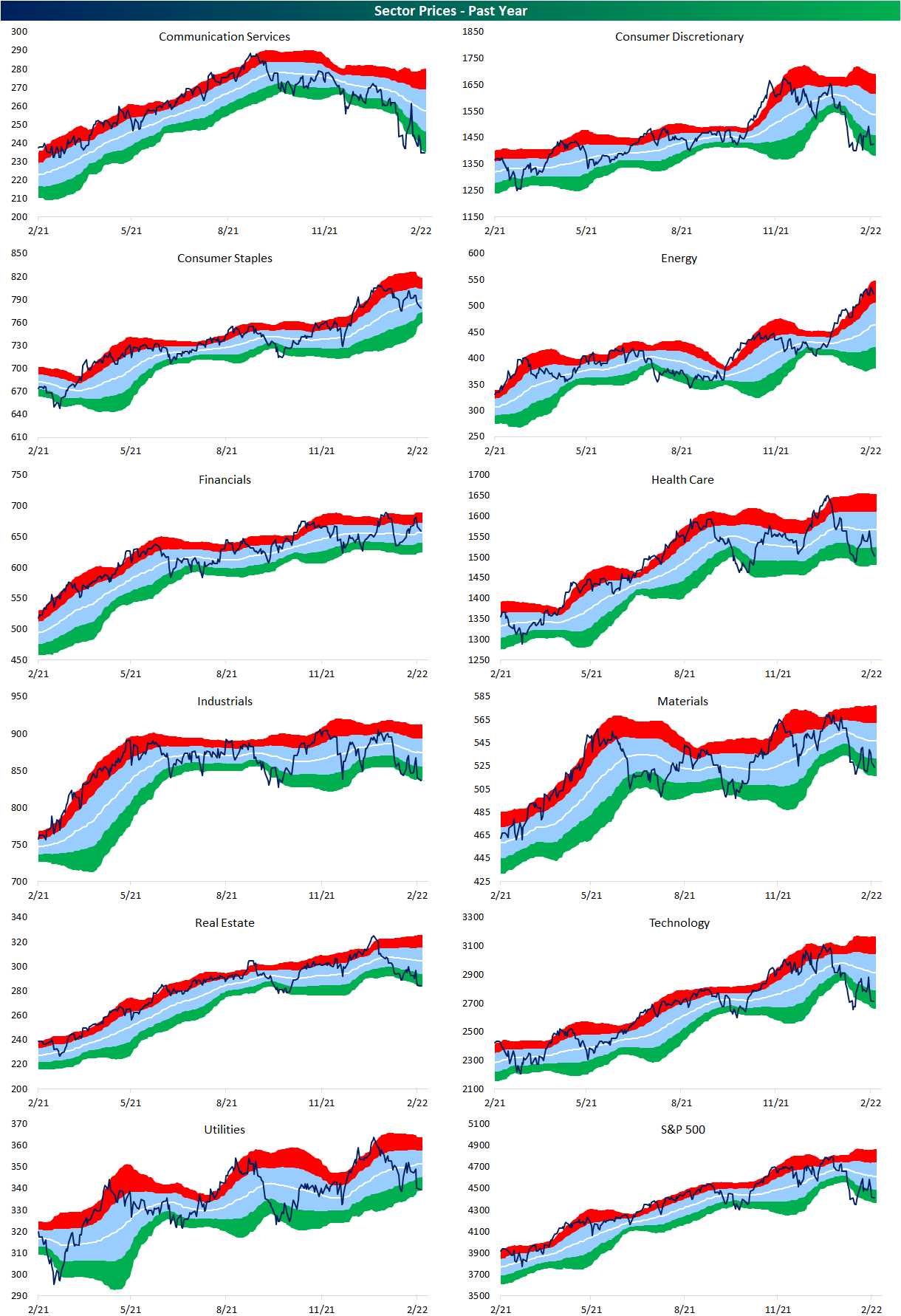

One of These Sectors Is Not Like the Others

Looking across the charts of each sector from our Daily Sector Snapshot, trends range from well-defined and longer-term downtrends as is the case for Communication Services to more sideways price action like what we’ve seen lately in the Financials and Industrials sectors. Then there’s Energy. In spite of the broader market weakness, the Energy sector has continued to roar higher having closed at overbought levels (at least one standard deviation above its 50-DMA) every day since the start of the year. In fact, while most sectors are firmly in the red on a year-to-date basis, Energy has rallied over 25%, and it’s only mid-February!

As a result of Energy stocks’ continued outperformance, the ratio of the sector versus the S&P 500 has made a sharp and significant move higher. Ever since the Financial Crisis, the ratio has consistently been grinding lower, meaning Energy has underperformed the broader market. Over the past two months, though, the ratio has seen a record-sized move having risen nearly 35% surpassing the previous record set almost a year ago in March 2021 when the ratio rose 33% in a two-month span. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup: 2/14/22 – Russia, Russia, Bullard

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I’m just one person on the committee.” – James Bullard

It was looking like a rough start to the week as European equities traded down well over 2% and US futures were lower by more than 1%, but comments from Russian Foreign Minister Sergei Lavrov that appeared to open the door to diplomacy have caused some relief and a rebound in futures. Now, attention has shifted to St. Louis President James Bullard who is being interviewed on CNBC for further insight into his views on inflation.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

After two weak days heading into the weekend, all of the major averages closed out last week back below their 200-day moving averages (DMA). As recently as Wednesday, the DJIA (DIA) was above its 50-DMA, but Thursday’s CPI and subsequent comments from Bullard and then the Russia tensions on Friday pushed the index back below both of those levels. For the Russell 2000 (IWM), neither the 50 nor 200-DMA ever even came into play last week. The Nasdaq 100 (QQQ) managed to barely close above its 200-DMA on Wednesday but closed out the week near its lows as sellers took control. Last but not least, the S&P 500 (SPY) looked to make a run for its 50-DMA on Wednesday but couldn’t quite get there before the tide turned into the end of the week. In down trending markets, moving averages shift from acting as support to resistance, and based on the last several days of trading, moving averages for the major indices have increasingly acted as a ceiling on prices rather than a floor.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 2/13/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Cashflow

Peloton CEO John Foley to Step Down, Firm to Cut 2,800 Jobs by Cara Lombardo (WSJ)

After a drop-off in demand, connected fitness company Peloton has re-oriented towards slower growth and cut back on ambitions for massive scale. [Link; paywall]

This Could Be When Shale Driller Discipline Cracks, Citi Warns by David Wethe (Bloomberg)

Tight oil management companies are getting ready to raise capex by 40% to take advantage of high crude oil prices, in a move that may cap prices amidst a massive rally in WTI this year. [Link; soft paywall]

Inflation

Bottlenecks and monetary policy by Philip R. Lane (ECB)

A thoughtful examination of the drivers of post-pandemic inflation and how they have been influenced by supply chains and swings in durable goods demand. [Link]

What Are You Expecting? How The Fed Slows Down Inflation Through The Labor Market by Skanda Amarnath and Alex Williams (Employ America)

A critical examination of the conventional wisdom around how monetary actually works in practice, which is likely to leave you wondering whether conventional monetary policy approaches are worthwhile. [Link]

Searching for Maximum Employment by Sarah Albert and Robert G. Valletta (FRBSF)

A series of adjustments to headline labor market data seeking to answer the question “How close are we to maximum employment?”. [Link]

Transportation

Transit Time: Golf cart market picks up speed by Cristina Bolling (The Charlotte Ledger)

With auto prices high and amenities close by, some senior citizens are turning to golf carts for transportation around their neighborhoods. [Link]

Car Insurers Rush to Raise Rates as Inflation Takes a Toll by Leslie Scism (WSJ)

With claims rising thanks to higher prices for repairs, replacement parts, and rental cars, insurers are raising rates to offset the increased cost of covering their clients’ claims. [Link; paywall]

Good Tech

Nuclear fusion heat record a ‘huge step’ in quest for new energy source by Iam Sample (The Guardian)

A test fusion reactor in the UK has set a new record for heat generated during a fusion reaction, emitting the same amount of energy as more than 30 pounds of TNT in a 5 second burst. [Link]

New FDA-approved eye drops could replace reading glasses for millions: “It’s definitely a life changer” (CBS News)

A new eye drop product corrects vision loss that can lead to a need for reading glasses, with drops lasting six to ten hours and costing about $80 for a 1 month supply. [Link; auto-playing video]

Bad Science

SpaceX Satellites Falling Out of Orbit After Solar Storm by Marcia Dunn (Cheddar)

A geomagnetic storm caused by elevated solar activity knocked 40 SpaceX Starlink satellites out of orbit by making the atmosphere thicker and dragging them back to earth. [Link; auto-playing video]

Kids are flocking to Facebook’s ‘metaverse.’ Experts worry predators will follow. by Will Oremus (WaPo)

While Meta’s virtual reality is supposed to be adults only, large numbers of children appear to be getting access to spaces that have few safety tools and present serious dangers to young people. [Link; soft paywall]

Crypto

Alfa Romeo unveils new electric-hybrid SUV with NFT, blockchain technology by Michael Wayland (CNBC)

A new Alfa Romeo model will come with an NFT for buyers, part of the iconic brand’s shift towards electric vehicles by 2027. [Link]

BlackRock Planning to Offer Crypto Trading, Sources Say by Ian Allison (CoinDesk)

The $10trn asset manager is adding crypto trading and credit facilities that allow clients to trade and borrow against existing positions. [Link]

Smart Money

The craziest ways Wall Street is spending this year’s record-setting bonuses by Zachary Kussin and Christopher Cameron (NYP)

Flush with bonuses from booming issuance and strong markets activity, bankers are leaning in to big payouts with caviar, cars, and wine all seeing robust demand. [Link]

Adults Back in Charge of Stock Market as Fed Awakens Big Money by Lu Wang (Yahoo!/Bloomberg)

The retail trading craze has subsided, with institutional volumes ramping up activity as smaller amateurs and market newcomers leaving the scene. [Link; auto-playing video]

Models Behaving Badly

Climate Scientists Encounter Limits of Computer Models, Bedeviling Policy by Robert Lee Hotz (WSJ)

Models for the earth’s climate are necessarily extremely complex, but sometimes adding more detail only makes problems worse. That presents a unique challenge in the effort to better understand how the climate shifts. [Link; paywall]

DNA

Macron refused Russian COVID test in Putin trip over DNA theft fears by Michel Rose (Reuters)

French authorities were so concerned Russian intelligence were trying to get ahold of President Macron’s DNA that they refused to submit to a PCR test during a recent state visit. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Super Bowl Indicator

Americans across the country are gearing up for Super Bowl LVI this Sunday. The Rams are currently a four-point favorite, and the Bengals could struggle to contain the league’s best defensive line. Both teams come into this game with their respective offenses on fire, and the last few weeks of the playoffs have resulted in nail-biting finishes.

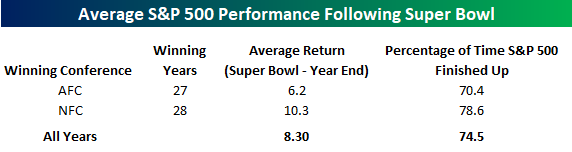

One outlandish market theory suggests that when the NFC wins the Super Bowl the market will perform better than average. Conversely, when the AFC wins, the market underperforms. Although there is no basis of truth to justify these claims, the conclusion has historically been accurate. As you can see from the table below, the S&P 500 averages a gain of 10.3% from the Super Bowl through year-end when the NFC takes home the Lombardi trophy. On the other hand, when the AFC wins the Super Bowl, the S&P 500 averages a gain of 6.2%, which is 4.1 percentage points lower. The positivity rates have slightly favored an NFC victory as well (78.6% vs 70.4%).

Neither the Rams nor the Bengals have won multiple Super Bowls. The Rams have won just once (in 2000), and this is the Bengals third time competing in the Super Bowl. Of the teams that have won multiple Super Bowls, the S&P 500 has performed best through year-end when the Steelers, 49ers, Broncos, or Bucs take home the trophy. After the Dolphins, Raiders, and Giants won Super Bowls, forward returns were negative on an average basis.

Given that the one Super Bowl the Rams won was in 2000, you would think that the last thing a bull would want to see on Sunday is a win by Matt Stafford and crew. On the other hand, in the two prior Super Bowls that the Bengals played in and lost, the S&P 500 was up over 20% for the remainder of the year both times, so it’s a bit of a push. Within the Bespoke crew, the Bengals are a near but not unanimous pick, Who has heads on the coin toss? Like these charts? See more stock market research from Bespoke by starting a two-week trial to Bespoke Premium today.

Biggest Losers Bounce the Most

The near-term closing low for major US equity indices occurred back on January 27th. Since then, the average stock in the Russell 1,000 is up just under 7% through Friday morning. You can see the low made in the charts below of select ETFs like SPY, QQQ, and ARKK.

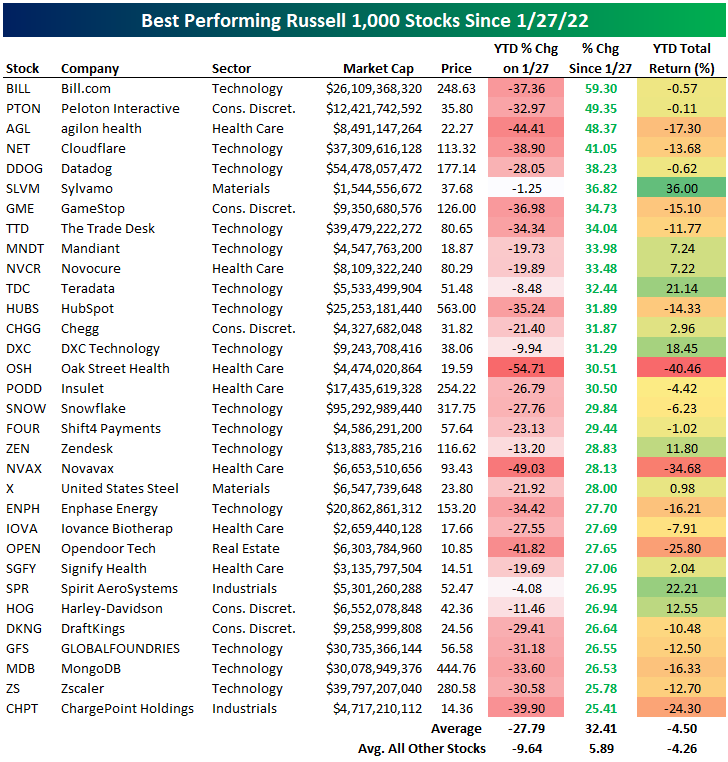

What we’ve seen since the January 27th low is a rip higher in the stocks that had been hit the hardest on a year-to-date basis up to that point. On January 27th, the bottom 10% of stocks in the Russell 1,000 in terms of YTD performance were already down an average of 33.3% on the year! As shown below, this decile of stocks has seen an average bounce back of 14.8% since January 27th. Conversely, the decile of stocks that had held up the best YTD through January 27th are up an average of 4.9% since 1/27.

Below is a list of the 32 stocks in the Russell 1,000 that have rallied 25% or more since the January 27th close just over two weeks ago. At the top of the list is Bill.com (BILL) with a gain of 59.3%. Three other stocks have risen more than 40% — Peloton (PTON), agilon health (AGL), and Cloudflare (NET), while another 12 have risen more than 30%. Other notable stocks on the list include GameStop (GME), Chegg (CHGG), Snowflake (SNOW), Zendesk (ZEN), US Steel (X), Enphase Energy (ENPH), Harley-Davidson (HOG), DraftKings (DKNG), and ChargePoint (CHPT).

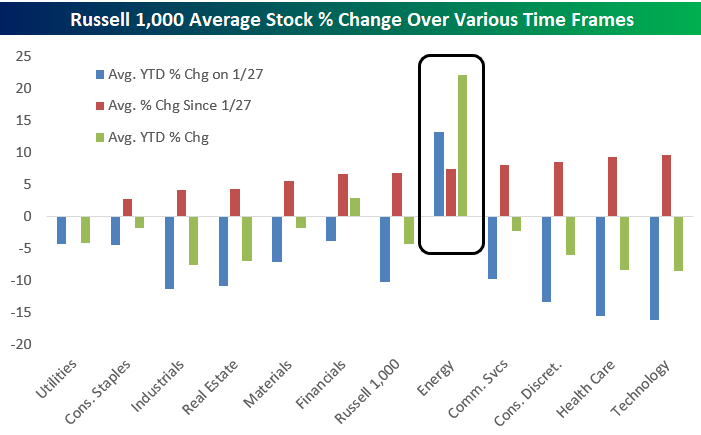

Below we show the average performance of Russell 1,000 stocks by sector over three different time frames: YTD through 1/27, since 1/27, and YTD through today. Technology stocks were down the most YTD on 1/27, they’ve bounced back the most since 1/27, and they’re still down the most YTD of any sector. The biggest standout is Energy, where the average stock is up over each of the three time frames. Year-to-date, the average Energy sector stock is now up more than 22%. Financials is the only other sector that has seen the average stock post gains on a year-to-date basis. Like these charts? See more stock market research from Bespoke by starting a two-week trial to Bespoke Premium today.

Bespoke’s Morning Lineup – 2/11/22 – Nowhere to Hide

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you’re not a risk taker, you should get the hell out of business.” – Ray Kroc

After yesterday’s E.F. Hutton impersonation by St Louis Fed President James Bullard where he literally spoke and tanked the market, equities are looking to end the week on a high note as futures have erased earlier losses and are now flat to slightly higher. After the market became increasingly concerned with a 50 bps rate hike at the March meeting, some Fed officials were out overnight (Daly and Barkin) downplaying the chances. The only economic indicator on the calendar today is Michigan Confidence which is expected to decline modestly, but the key thing to watch will be inflation expectations.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

One of the more notable aspects of this year’s weakness in the equity market has been the fact that there has been nowhere for investors to hide. Through yesterday’s close, both the S&P 500 and long-term US Treasuries were down over 5% YTD. While there have been other times in the past where the S&P 500 or long-term US Treasuries were down 5% over a six-week period, it’s extremely rare to see them both down 5% at the same time.

The scatter chart below shows the rolling 30-day performance of the S&P 500 ETF (SPY) and the iShares 20+ Year US Treasury ETF (TLT) for every day since 2003. During that span, there have only been 26 days where the rolling 30-trading day return for both ETFs was below negative 5% at the same time. Interesting times indeed!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Sector and Index Ratios

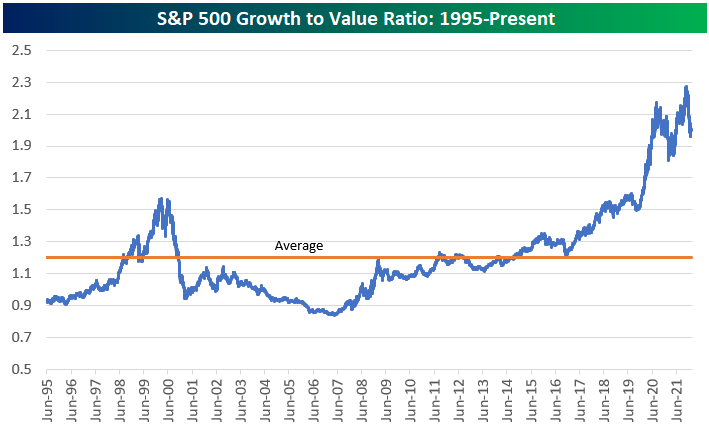

Today we wanted to highlight a number of charts looking at the historical ratio between different stock market indices, sectors, or ETFs. In the first chart, we show the historical ratio between the S&P 500 Growth and Value indices going back to 1995. In this chart, a rising line means Growth is outperforming Value, while a falling line means Value is outperforming Growth. As you can see, Value had a long period of outperformance during the early and mid-2000s after the Tech Bubble burst, but Growth has generally been trending higher versus Value since 2007. The last five years (especially at the onset of the COVID outbreak) saw Growth rapidly outperform Value, taking the ratio to new highs. Over the last month or so, we have seen Value perform well while Growth has stumbled, but this ratio is still significantly above its historical average.

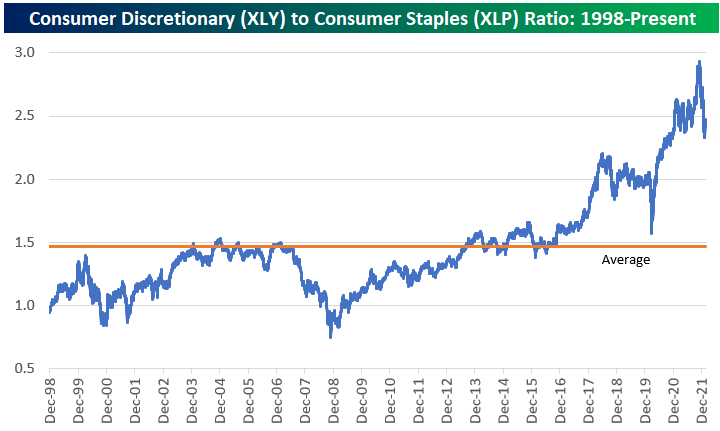

The Consumer Discretionary (XLY) to Consumer Staples (XLP) ratio is somewhat similar to Growth versus Value, as discretionary goods and services are viewed as cyclical while staples are viewed as defensive and non-cyclical. The Consumer Discretionary sector is also heavily weighted towards Amazon.com (AMZN) and Tesla (TSLA). Consumer Discretionary has significantly outperformed Consumer Staples going back to the mid-2010s, but the ratio has dropped quite dramatically over the last couple of months similar to the drop seen during the COVID Crash in February and March 2020. Here again, though, the ratio remains well above its long-term average even after its recent drop.

The S&P 500 Technology (XLK) to Utilities (XLU) ratio is another interesting sector ratio chart. This ratio exploded higher during the late 1990s Tech Bubble, but then it plunged from the peak in early 2000 and continued lower right through the Financial Crisis that ended in early 2009. After hitting 2.5 at the peak of the Dot Com Bubble, the ratio got all the way down to 0.5 at its low. Just recently, the ratio briefly ticked above 2.5, eclipsing its prior high made more than 20 years ago. While the Tech sector has struggled over the last couple of months as the prospect of higher interest rates has weighed on growth stocks, this ratio shows that there is still A LOT to unwind if a new secular shift has begun.

Below we show the ratio of the S&P 500 to the Philly SOX Semiconductor index going back to 1994. In this chart, a rising line means the S&P 500 is outperforming semis, while a falling line means the semis are outperforming. As the “Transports of the 21st Century,” many investors view the semiconductor group as a leading indicator for the broad market. In the bull market of the mid-2000s that followed the bursting of the Dot Com bubble, the S&P actually outperformed the semis throughout. Since the end of 2012, however, we’ve seen the semis steadily outperform. While the semis have underperformed slightly over the past month or so, the move thus far hardly registers on the long-term ratio chart.

Our final two charts relate to US versus international equity markets. Below we highlight the ratio of the S&P 500 (SPY) ETF to the All-World ex-US ETF (CWI) going back to 2007. While international markets outperformed the US coming out of the Dot Com bust during the early and mid-2000s, the US has absolutely crushed the rest of the world over the last ten years. At the moment, the ratio between SPY and CWI is just below its all-time high of 16, which is nearly double the historical average. Similar to growth versus value, the relationship between the US stock market and the rest of the world has stretched dramatically in recent years.

The emerging markets ETF (EEM) goes back to 2003, so we can see its ratio versus the S&P 500 (SPY) a little further back than CWI (shown above). After outperforming SPY significantly from 2003 through 2008, EEM has been underperforming ever since. This is another ratio that has a lot to unwind to get back to “average” levels if a big shift were to occur. Like these charts? See more stock market research from Bespoke by starting a two-week trial to Bespoke Premium today.