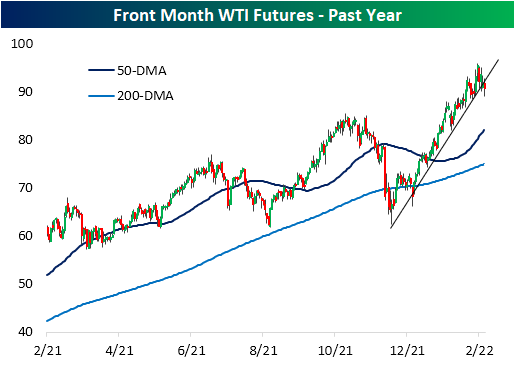

Crude Oil Snapping a Historic Winning Streak

With front-month WTI futures lower again today and in addition to the losses earlier this week, black gold declined over 2% this week. As shown below, this week’s decline looks to be breaking the commodity’s uptrend that has been in place since late last year which has brought it up to some of the highest levels in several years.

The rally over the past few months has been very consistent for crude oil. In fact, crude oil is on pace for its first weekly loss in eight weeks. Historically, it has been uncommon for crude oil to rally for such a long span. Since 1983, there have only been five other weekly winning streaks that have also gone on for at least 8 weeks in a row. The most recent of these ended at nine weeks last October.

Below we show the performance of crude oil following each time that it has ended a winning streak of at least 6 weeks, of which there have been 24 since 1983. Performance following the end of these streaks has been mixed with positive performance around 50% of the time one week, one month, six months, and one year later across these instances. Three returns, however, have more consistently seen positive returns which have on average been larger than the norm. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 2/18/22 – Same ______, Different Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“In preparing for battle I have always found that plans are useless, but planning is indispensable.” – Dwight D. Eisenhower

It’s Friday again, and heading into the weekend, investors are preoccupied with the same issues they were last Friday, namely Russia and the Fed. While a week has passed, there still hasn’t been much more clarity on either front. Regarding the Fed, the question remains whether they will go with a 25 or 50 bps hike at the March meeting, and market expectations have actually shown a decline in expectations for a 50 bps hike down from close to 100% late last week to just about 36% now. On the Russia front, the only real differences are that the 2/16 ‘invasion date’ came and went without much activity, but now rather than having investors on edge heading into a two-day weekend, this Friday, we’re heading into a three-day weekend which only increases the level of uncertainty.

Closing out the week, the only economic indicators on the calendar are Existing Home Sales and Leading Indicators which will both be released at 10 AM. Futures, which were indicated higher have now reversed into the red on headlines that separatists in Donbas are evacuating women and children into Russia as tensions escalate.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Even when futures were trading higher, it did little to improve the technical picture for the S&P 500. Besides the fact that the downtrend from the January high remains firmly in place, yesterday’s decline took SPY back below its 200-day moving average, so until that changes, bulls will have little incentive to take a stand.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

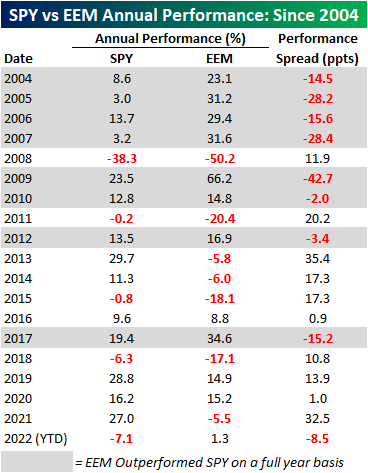

Diminishing Relative Strength For The US

In 2021 US equities, using the S&P 500 ETF (SPY) as a proxy, outperformed emerging markets (EEM) by 32.5 percentage points (ppts). That performance spread fell just short of 2013 when the performance spread was 35.4 percentage points (ppts). After 2013, SPY also outperformed EEM for each of the following three years by an average of 11.8% (median: 17.3%). Notably, we are currently on a streak of another four consecutive years of SPY outperforming EEM, which is tied with the period from 2013 through 2016 for the longest streak on record since EEM began trading in July of 2003. So far this year, SPY has traded down by 7.1% while EEM has gained 1.3%, thus resulting in a performance spread of 8.5 ppts.

The start to 2022 has been tough for US equities relative to emerging markets, but what, if anything, does this mean for performance in the remainder of the year? Today (2/17) is the 33rd trading day of 2022, and since 2004, SPY actually only outperformed EEM at this point on a YTD basis 36.8% of the time. When EEM has outperformed SPY in the first 33 trading days of the year, the average rest of year performance spread has been -3.4 ppts (median: -5.6 ppts), meaning that EEM tends to continue outperforming for the rest of the year. While SPY tended to underperform, which one performed better for the remainder of the year was basically a coinflip as EEM only outperformed a little bit more than half of the time (54.5%). In terms of relative performance at this point in the year, 2022 ranks as one of the worst on record, second only to 2006 when SPY underperformed by 8.5 ppts. In 2006, EEM continued to outperform gaining 15.6% for the rest of the year compared to a 9.9% gain for SPY.

Since 2004, there have only been four years where SPY traded down from the close on the 33rd trading day of the year through year-end, and three of those occurrences were in years where SPY underperformed EEM in the first 33 trading days. When EEM outperforms SPY by over 4% in the first 33 trading days, the average rest of year performance for SPY has been a gain of 10.6% (median: 9.9%) and 10.0% (median: 15.6%) for EEM. Neither of these performance numbers differs all that much from the median rest of year returns in all years since 2004.

The chart below shows the relative strength of SPY vs EEM and European equities, as measured by the iShares Europe ETF (IEV) over the last six months where a rising line indicates outperformance of US stocks while a falling line indicates underperformance. Relative to both ETFs, US stocks are still outperforming over the last six months, but there was a clear shift in performance that began late in 2021, and both EEM and IEV are outperforming SPY.

Within the emerging markets group, Brazil (EWZ), South Africa (EZA), and Hong Kong (EWH) have been the strongest performers YTD, gaining 18.0%, 14.2%, and 6.0%, respectively. Of all of the countries we tracked that are classified as emerging markets, only one has underperformed the US YTD: Russia (ERUS). ERUS is down 8.2% YTD as the prospects of devastating sanctions from a potential invasion of Ukraine have been increasingly priced in. Click here to view Bespoke’s premium membership options.

Big Expectations Out of Philly

The New York Fed started off this month’s regional Fed manufacturing indices on a high note rising back into expansionary territory. While the reading is still positive, the neighboring Philly Fed’s index saw a more significant decline this month dropping 7.2 points to 16. That is only slightly above the December low of 15.4 indicating a material deceleration in activity as the index now sits in the middle of its historical range.

Breadth in this month’s report was weak with most current condition categories declining. Expectations were far worse without a single index moving higher and a couple now in the bottom few percentiles of their historical ranges. While lower, most indices remain positive, and those that are negative—Unfilled Orders and Delivery Times—are not necessarily outright negatives as they indicate expectations for alleviation of backlogs and supply chain stress.

Demand slowed in February with the New Orders index facing a 3.7 point decline with a similar decline in the expectations index. While that reading was still above the December low, the Shipments index dropped to the lowest level since August 2020. Unfilled Orders also fell by over 7 points this month, but that leaves the index at a much more elevated reading seeing as the January print was in the top 1% of all months. Expectations are in an entirely different situation, though. The expectations index plummeted 11.3 points to -18.2 which was the lowest level since July 1998. In other words, the region’s firms expect to massively catch up on existing orders in the months ahead.

One likely reason for that optimism is expectations for alleviations in supply chains. Higher readings in the Delivery Times index points to businesses reporting longer lead times. That index remains well above most readings of the past several decades, but it also has peaked and fallen to the lowest level since September. Expectations have outright collapsed to -22.3 which is the lowest reading since October 2008. This month’s decline was also the third-largest one month drop on record.Click here to view Bespoke’s premium membership options.

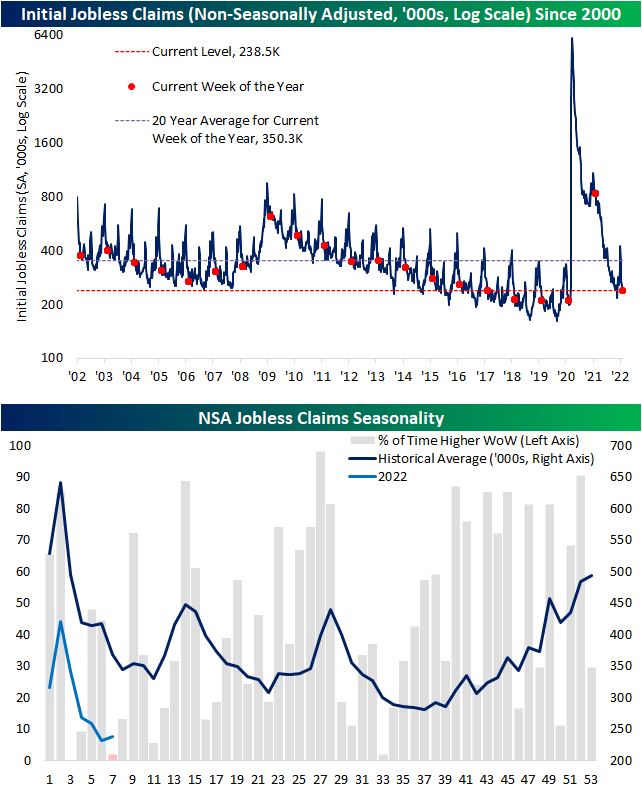

Seasonally Unusual Uptick Drives Claims Higher

Initial jobless claims rose 23K this week to 248K after a seasonally unusual increase in claims (more on that below). That marks the largest one-week increase in the seasonally adjusted number since the week of January 14th when claims rose by 59K.

The current week of the year has historically been an impressive one for claims. In fact, going back to 1967 when claims data begins, the only year in which the current (the 7th) week of the year has seen NSA claims rise week over week was 1978. This year can be added to that list now as NSA claims rose a modest 7.8K. That seasonally unusual uptick was part of the reason for the large rise in SA claims. Although claims were higher, the current level remains healthy and within the range of pre-pandemic years.

Continuing claims are lagged an additional week to initial claims and that reading fell more than expected dropping to 1.593 million. While off the lows from the end of last year, that remains one of the strongest readings of the past several decades. Click here to view Bespoke’s premium membership options.

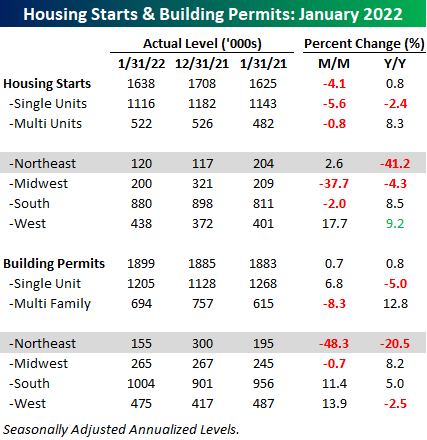

Mixed Housing Reports

Today’s report on Building Permits and Housing Starts from the US Census came in mixed relative to expectations and last month’s readings. Versus expectations, Housing Starts were weaker while Building Permits unexpectedly rose. As shown in the table below, the weakness in Housing Starts this month continued to come from single-family units which have faced delays due to shortages of materials and labor. On a regional basis, the Northeast was notably weak with the year/year reading falling more than 41%. Unlike Housing Starts, Building Permits showed strength among single-family units, rising 6.8% despite still being down 5% y/y. Multi-family units, on the other hand, saw the complete opposite pattern play out as the m/m reading dropped 8.3% while the y/y reading was still up over 12%. On a regional basis, the Northeast was once again the weakest area of the country as the m/m reading dropped nearly 50% while the y/y reading dropped just over 20%.

Trends in housing starts have been a great leading indicator of the economic cycle over the years as the 12-month average of total Housing Starts tends to peak and roll over well in advance of a recession. Updating the chart with January’s levels, the 12-month average made another cycle high in January, but the rate of increase is starting to flatten out. For example, this month’s increase in the 12-month average was the smallest m/m increase since February 2021. It’s still far from rolling over, but momentum in housing has clearly slowed.

While actual starts may not be rolling over, homebuilder stocks have already done so. After stalling out in the mid to high eighties three times in late 2021, the sector has seen a sharp pullback in 2022. With interest rates rising and lack of adequate materials and labor to meet demand, it’s no mystery what is driving the weakness in the sector. Current levels look like an interesting juncture for the group, though, as XHB has been hanging around right around $70 for the last few weeks. That is also a level that acted as support multiple times in the second half of last year. As long as these levels hold, the technical picture for the group does not raise any red flags, but should this support level break down, it could start the beginning of a new leg lower for the group. Click here to view Bespoke’s premium membership options and sign up for a trial.

Bespoke’s Morning Lineup – 2/17/22 – Snap Out of It!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you have more than 120 or 130 IQ points, you can afford to give the rest away. You don’t need extraordinary intelligence to succeed as an investor.” – Warren Buffett

Futures are in the red again this morning but just modestly, and while they’re off their lows of the overnight session, they’ve just recently started heading lower again. Russia continues to take up a lot of the headlines, but unfortunately, there’s little in the way of resolution on the horizon. Just released headlines quoting US officials suggest that Russia is moving towards an imminent invasion, and US Secretary of State Anthony Blinken will head to the UN today to address the Security Council. No one besides Putin really knows when and how the situation will resolve itself.

Earnings season came to an ‘unoffical’ close today with Walmart’s (WMT) better than expected report, and given the multiple tape bombs that were dropped throughout the reporting period, investors will be happy to see this earnings season wind down. It was a busy morning for economic data as well, and while most of this week’s data has been better than expected, this morning’s results were mixed. To hear out instant take on all of the reports listen to it here.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

We’ll discuss it in more detail later today, but after seeing the latest investor sentiment readings from the American Association of Individual Investors (AAII), we couldn’t not mention them. As of the latest survey, bullish sentiment dropped from an already low reading below 25% to less than 20% this week. As shown in the chart below, the only other times that bullish sentiment was as low as it is now were in January and May 2016. Just about every survey of sentiment these days, whether it covers the economy or financial markets, shows elevated levels of pessimism. We realize there’s no shortage of concerns out there and you can take your pick as to which one is the biggest problem, but one has to ask whether these levels of pessimism are starting to get a bit extreme.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

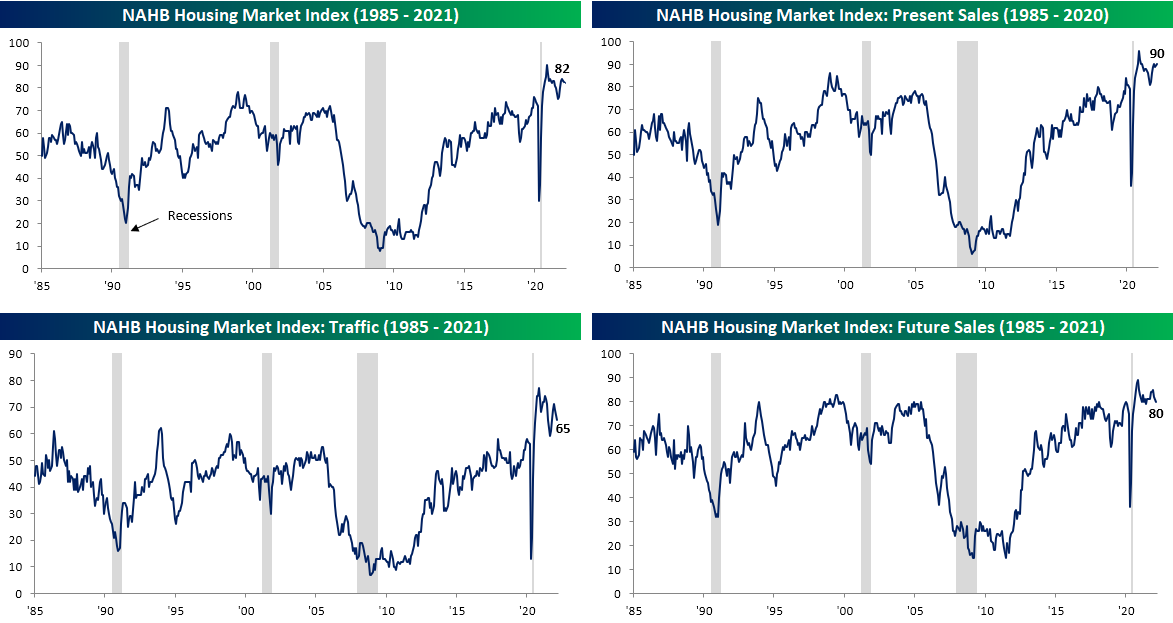

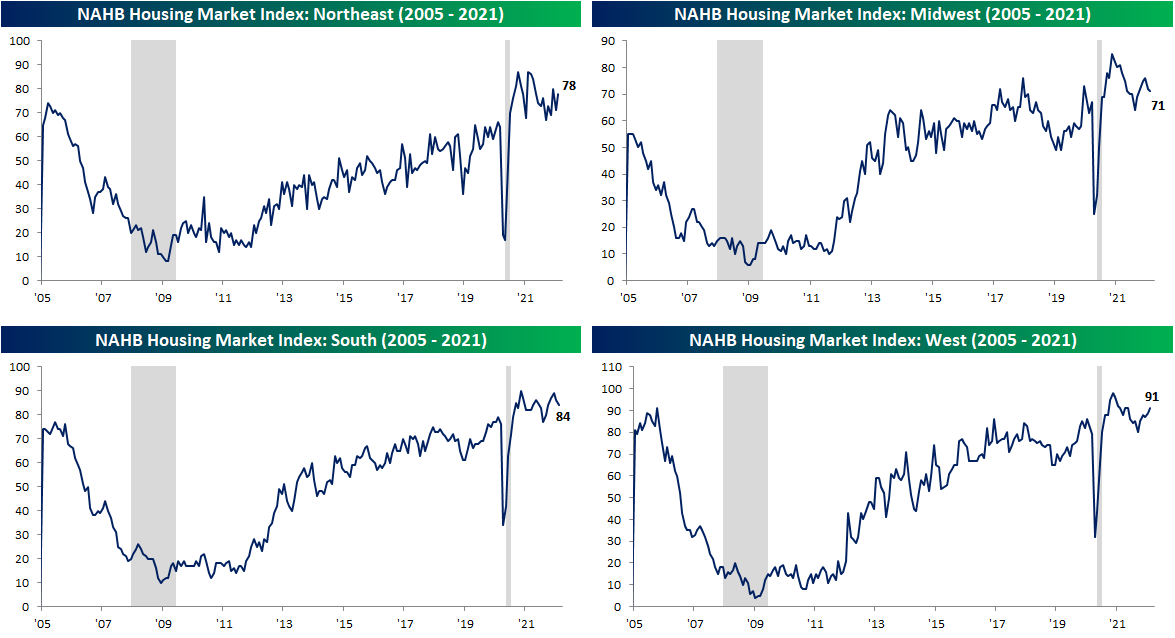

Homebuilder Sentiment and Stocks Rangebound

It was a busy morning of economic data, and included on the list was homebuilder sentiment from the NAHB monthly survey. After surging in the first year of the pandemic, the past year has seen homebuilder sentiment moderate until last summer when it made a short-term low at 75 (still a historically elevated reading), and for most of the time since then sentiment has rebounded. The first two months of 2022 have seen further moderation though with the February reading of 82 marking the second month in a row with a one-point decline. While sentiment is no longer improving, though, it remains well above any pre-pandemic reading.

Taking a closer look at the components of the survey, traffic and future sales have been the more pessimistic readings having continually ground lower in the past year. Present sales, however, have held up relatively well. This month even saw that index rise to 90 which tied the December reading for the strongest level since last Febraury.

As for a geographic breakdown, pretty much each region has fallen back into the middle of the range of post-pandemic readings. In February, the Northeast saw the most substantial improvement rising 7 points to 78. That is an upper decile reading in terms of both its level and month-over-month change. The West was the only other region to improve in February, and that is in the context of what has now been several months of consistent improvements.

Like sentiment, homebuilder stocks have come off their highs. The iShares Home Construction ETF (ITB) made a double top in December, which was followed by a break below its 50-DMA and 200-DMA in the new year. For the past few weeks, ITB has been consolidating between overhead resistance at the 200-DMA and support at the lows from this past July and October. If those lows don’t hold, though, there isn’t much more support further below. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 2/16/22 – Retail Sales Lead a Busy Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Swim upstream. Go the other way. Ignore the conventional wisdom.” – Sam Walton

Retail Sales were just released and came in much stronger than expected at the headline level (3.8% vs 2.0%). Backing out Autos and Gas, the numbers were even stronger relative to expectations. Last month’s report was revised lower than originally reported but not by enough to offset this month’s strength. Other data released this morning includes Import and Export Prices, and both of those were also stronger than expected. Still on the calendar today, we have Industrial Production (9:15), Capacity Utilization (9:15), Business Inventories (10:00), and Homebuilder Sentiment (10:00). Then at 2 PM we’ll see a release of the Minutes from the January meeting.

Futures have seen a bit of a bounce in reaction to news but are still indicated to open modestly in the red.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was just the third time in 2022 that the S&P 500 tracking ETF (SPY) traded in positive territory from the opening to the closing bell, and over the last 50 trading days, there have been just eight times where the S&P 500 traded higher all day. As recently as 2/1, though, the trailing number of times over the last 50 trading days that the SPY traded higher all day was at just six which was the lowest reading since March 2018. What’s even more notable is that back in early December, just as Powell was retiring the term transitory, the 50-day reading of the number of trading days that SPY traded in positive territory for the entire trading day reached a record high of 20. In other words, there’s been quite a reversal in the last three months where the market has frequently opened higher and stayed there to more a of choppy environment where the market has jumped between gains and losses throughout the trading day.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

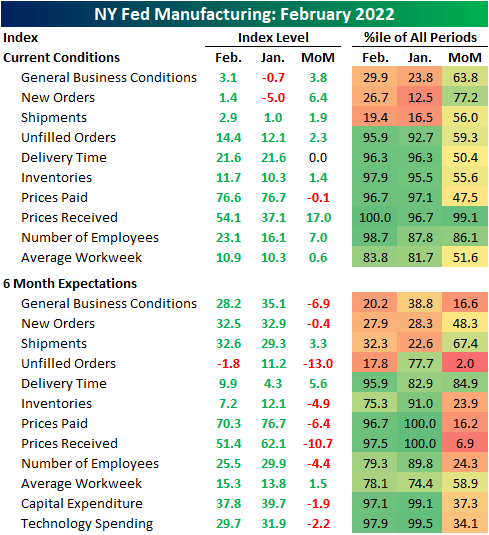

Empire Fed Back In Expansion

The New York Fed released the February results of the Empire Fed Manufacturing survey this morning. Last month saw the index fall into negative territory for the first time since June 2020. This month, the headline number is back into expansionary territory rising to 3.1.

As the region’s activity is once again expanding, most areas of the report showed improvement. New Orders are once again growing alongside shipments, although each of those indices are at the lower end of their historical ranges. Other areas are much more elevated with Prices Received even setting a new record high. Six-month expectations saw weaker breadth in February and are generally at lower levels with respect to their ranges.

Similar to the headline number, New Orders went from a negative reading to a positive one in the past month after rising 6.4 points. Unfilled Orders picked up in tune with a 2.3 point increase to 14.4 which was the highest reading since October. Expectations, however, experienced a dramatic 13-point decline ranking in the bottom 2% of all monthly moves. That marked the largest one-month drop for the index since June 2016.

The index of Delivery Times went unchanged at 21.6. Without any change, the index remains historically elevated but significantly improved versus the record highs in the fall. In other words, supply chains continue to show historic strain, but it appears to have alleviated to a degree.

Although the decline was small at just 0.1 points, Prices Paid fell for the third month in a row. In spite of having peaked, the index remains very high. Contrary to the move in Prices Paid, Prices Received surged from 37.1 in January to 54.1 this month. That wasn’t only a record high for the index, but it also marked the largest one-month gain in a decade.

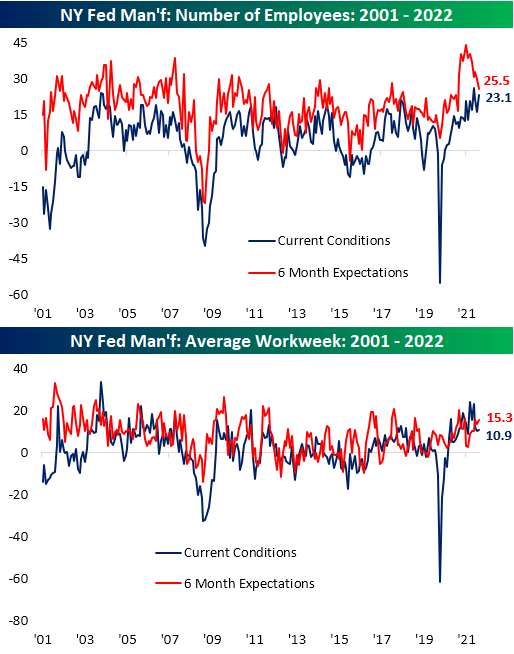

The employment situation also improved with the index for Number of Employees edging higher indicating the region’s firms took on more workers at an accelerated rate. Average Workweek meanwhile saw a small move only rising 0.6 points. Click here to learn about Bespoke’s stock market research services.