Google Trends: Tightening The Belt

Earlier this week, a hotter-than-expected CPI print countered the belief that inflation has peaked. Even with that CPI report, though, there have been a number of other indicators pointing to the opposite. For example, readings on prices from various PMIs have rolled over and PPI decelerated dramatically. Some other evidence can be found in Google searches. Google Trends provides tracking of search interest for a provided search term. Lower readings indicate fewer Google searches for a provided term whereas higher readings indicate elevated search interest with these series indexed to their peak reading. In the charts below, we have adjusted these series for seasonality and re-indexed them so that like the raw data, peak readings are indexed to 100.

Searches for “inflation” surged during the pandemic and reached a record high in August. So far in September, that reading remains extremely elevated but it has pulled back significantly. The month isn’t over yet, so time will tell if searches for inflation have in actuality reversed to that degree, but the peaks for related terms have moved even further in the rearview. For example, searches for “costs”, “high costs”, and “expensive” all surged in the first half of the year reaching a high in the spring. Since then, these readings have been on the decline, although, searches for “expensive” and “high costs” remain well above levels observed in years prior.

Taking a more granular look at specific consumer expenses shows a bit more nuanced picture. Rent has been one of, if not the, biggest single driver for CPI recently as we noted in our recap of the latest CPI release. Search interest appears to back that up as searches for the term “rent cost” have exploded higher. Even though it remains well above readings from any other period since the data begins in 2004, that reading has rolled over in the past few months. As for other housing costs, searches for “Utilities Bill” and “Electric Bill” are at and nearing record highs, respectively, after rising sharply in the past year. Those higher readings are understandable as energy prices have skyrocketed, but gasoline prices are much lower than they were at the start of the summer and search interest has reflected that. Regardless, higher gas prices makes driving less attractive. In turn, searches for “car pool” are much higher than they were at other times in the pandemic years.

Grocery and food-related searches have also spiked in recent months indicating people are looking into why they are paying more when they head to the store. Again though, similar to rent, these readings have in fact started to roll over in the past few months.

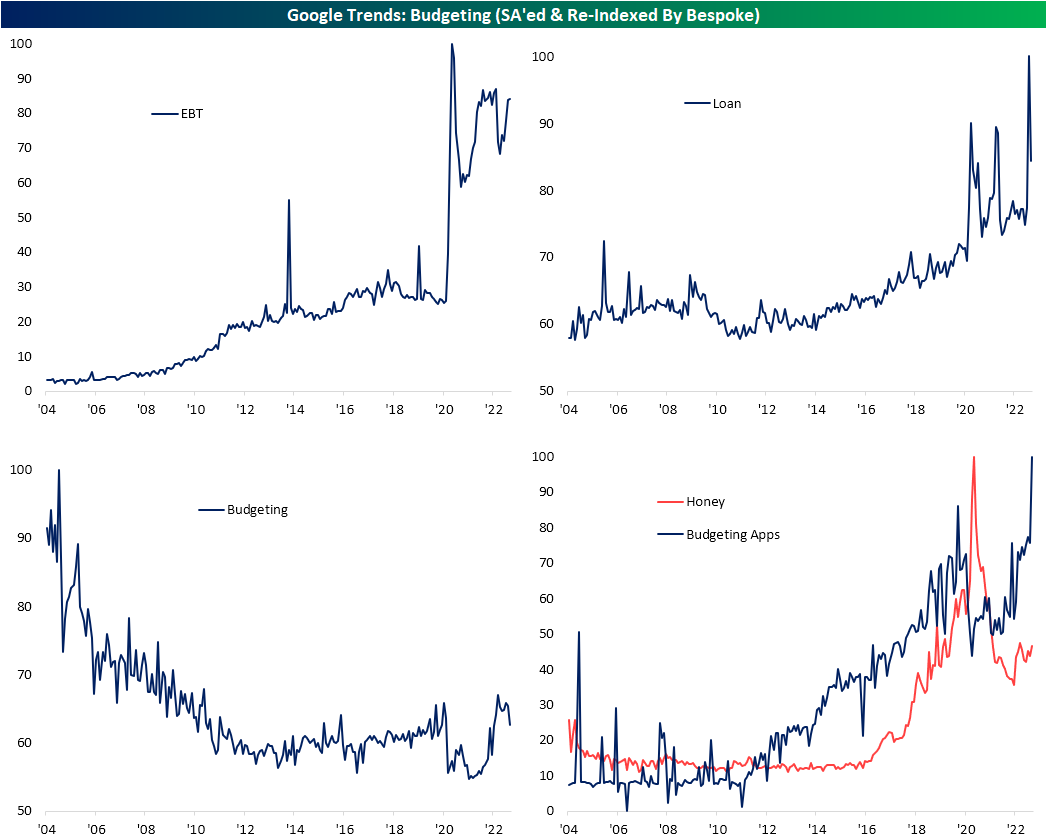

There is only so much the average consumer can do to fight inflation, and the Google Trends data provides some insight into what people are doing to cope with higher costs. For starters, searches for Electronic Benefits Transfer, or EBT, exploded at the start of the pandemic and have remained extremely elevated relative to pre-pandemic levels. Current search interest levels are below the highs from the early days of the pandemic, but they have also begun to rise toward the upper end of the range over the past several months. Meanwhile, searches for “loan” have seen a structural move higher since the pandemic began as well with a particularly sharp increase in recent months.

Searches for “budgeting” used to be much higher in the first decade of the 2000s but as technology increasingly engrained itself into society, those searches appeared to have been replaced by searches for “budgeting apps”. One more specific example is the popular Paypal (PYPL) owned Google Chrome extension Honey which automatically applies coupon/discount codes to online purchases. Over the past year, interest in each of these terms have risen as inflation remains elevated and consumers look for ways to tighten their belts. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/16/22 – At Least He Warned Us

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.” – Jerome Powell

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s looking like another day of declines heading into the weekend after FedEx (FDX) lowered guidance last night, making an already weak backdrop even weaker. FDX wasn’t the only company to warn since the close yesterday. Companies like GE and Huntsman (HUN) also lowered guidance citing issues like supply chain bottlenecks and high energy costs. If the S&P 500 does finish down 1% today, it will be the sixth straight week of a gain or loss of 1%+ on the last trading day of the week. That would be the longest streak since May 2020 (ten weeks) and tied for the second-longest streak since at least 1952 (when the five-day trading week on the NYSE started).

The only economic report on the calendar is the Michigan Sentiment report at 10 AM Eastern. Economists expect the headline reading to bounce to 60.0 from 58.2 at its last read. The most important aspect of the report to watch, though, is inflation expectations. In that respect, economists are expecting one-year inflation expectations to fall to 4.6% from 4.8% while 5-10 year inflation expectations are forecast to remain unchanged at 2.9%.

When Powell said back in August that businesses and households would feel ‘pain’ from higher interest rates he wasn’t lying, but is a situation like FedEx (FDX) what he had in mind? The stock is currently trading down over 20% in the pre-market which would rank as the worst single-day decline for the stock since its IPO in 1978. Declines of this magnitude weren’t even felt during the 1987 crash, the financial crisis, or during the COVID crash. At the open today, FDX will still be well above its COVID lows (when global trade essentially shut down temporarily), but it will be right at levels it was trading at right before COVID hit US shores.

Given the trends we have seen this year, you would have expected FDX to be blaming increased labor and energy costs as well as supply chain bottlenecks for the weakness in results, but those issues were notably absent. Instead, FDX cited “global volume softness that accelerated in the final weeks of the quarter” and “macroeconomic weakness in Asia and service challenges in Europe”. With a warning like this, it raises the question of whether the Fed is too busy fighting yesterday’s battle and missing what’s on the horizon.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

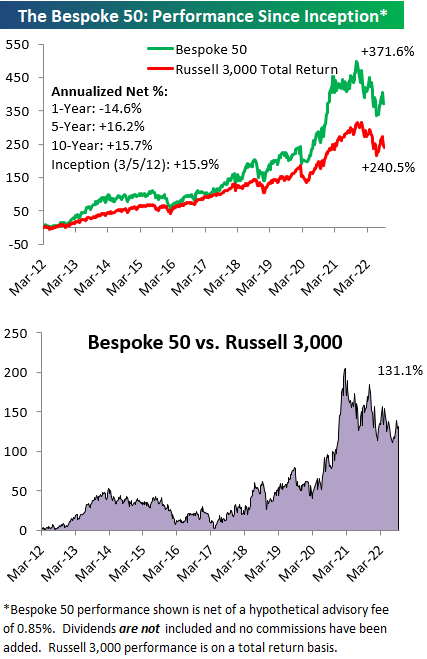

The Bespoke 50 Growth Stocks — 9/15/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Sentiment Contradicts Price Action

The S&P 500 may have fallen around 1.5% over the past week, but individual investors have reportedly become increasingly bullish. 26.1% of responses to the weekly AAII sentiment survey reported as bullish this week, up from a recent low of 18.1% last week. With the S&P 500’s worst day in since June 2020 and a hotter-than-expected CPI print occurring late in the response collection period (12:01 AM on Thursday through 11:59 PM Wednesday night), the timing of responses is a potential cause for the increase in optimism that was contrary to equities’ price action. In other words, responses that came in prior to Tuesday were likely far more bullish than those that came in afterward and therefore elevating the level of bullish sentiment. As such, next week will be a more telling read on individual investor sentiment as it will more fully capture recent price action and inflation data.

While bulls rose back above a quarter of responses, bears fell back below 50%. Bearish sentiment dropped to 46% which was only the lowest level since the week of August 24th.

Those moves meant the bull-bear spread rose 15.3 points week over week going from -35.2 up to -19.9. That was the largest one-week jump in the reading since the end of June. However, that indicates sentiment remains heavily in favor of pessimism as the streak of negative readings grows to 24 weeks long; the second longest streak of negative readings on record.

The AAII survey was not alone in showing a rebound in sentiment. Both the Investors Intelligence survey and the NAAIM Exposure Index highlighted increased bullishness in the latest week’s data. As with the AAII survey, though, the collection periods likely did not fully capture the effects of Tuesday’s inflation data and historic one-day decline. Overall, the story remains that investors are remarkably bearish. Click here to learn more about Bespoke’s premium stock market research service.

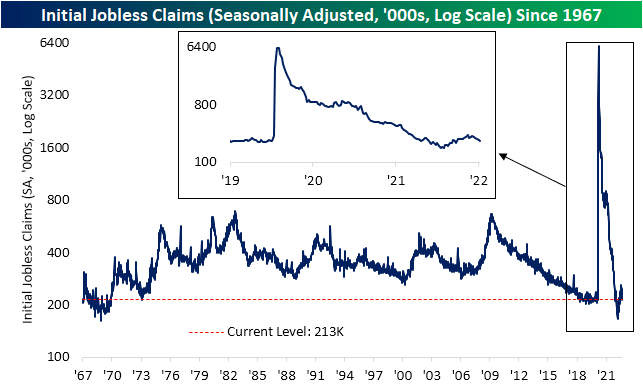

Claims Avoid Seasonal Lows

The move lower in jobless claims pressed on this week as the seasonally adjusted reading dropped another 5K down to 213K in addition to last week’s reading being revised 4k lower to 218K. That exceeded expectations which were calling for claims to rise up to 225K. This week was the fifth consecutive decline in adjusted claims with a total drop of 39K in that span. That is the longest streak of declines since December of last year when claims had fallen for 11 weeks in a row as the end of pandemic era programs was approaching.

Although the continued decline in seasonally adjusted claims have not resulted in any sort of a new low, unadjusted claims are far more impressive. Taking a historical average of claims throughout the year, most of the time claims would have bottomed by now, but that is not the case this year. Unadjusted claims have continued to fall over the past couple of weeks and are all the way down to 156K; the lowest level since October 1969. That is not to say claims are completely bucking seasonal trends as the current week of the year has marked seasonal lows in years like 2009, 2010, 2015, and 2016. In other words, it is hard to distinguish how much of the continued decline is seasonal versus material improvement in claims, and regardless, claims remain at historically strong levels.

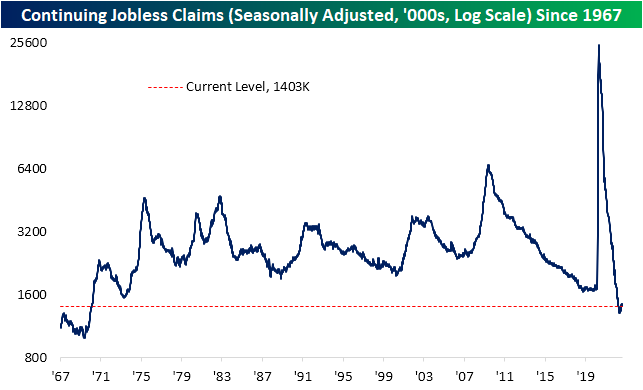

As for continuing claims, the latest reading for the week of September 2nd edged up modestly to 1.403 million. As with initial claims, continuing claims saw the previous week’s reading revised lower from 1.473 million to 1.401 million resulting in the latest print coming in well below estimates of 1.478 million.

Recently we have been highlighting the ratio between initial and continuing claims to highlight how the latter has generally been stronger than the former. However, with initial claims falling for a fifth week in a row without a similar decline in continuing claims, the ratio of the two has been reversing lower and is approaching more normal levels. In fact, the one-month change in the reading has been on the large size ranking in the bottom 3% of all moves on record. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/15/22 – Lehman Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The key to risk management is never putting yourself in a position where you cannot live to fight another day.” – Dick Fuld

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

To some, September 15th means that summer ends in a week, but others remember September 15th as the day Lehman died. Regardless of what comes to your mind first, it’s a lousy day. Equity futures are lower, treasury yields are higher, and crude oil is lower heading into what is going to be a busy day for data. Things kicked off at 8:30 with jobless claims, retail sales, import prices, Empire Manufacturing, and the Philly Fed. Jobless Claims were better than expected as were Retail Sales. Import Prices were less weak than expected, and finally, both the Empire and Philly Fed reports were negative, although the Empire was slightly better than expected while the Philly report was weaker. Perhaps most notable was that in both regional Fed reports, the Prices Paid components were at the lowest levels since December 2020. At 9:15, we’ll get updates on Industrial Production and Capacity Utilization, and then finally at 10:00 we’ll finish the day of data with Business Inventories.

Asian markets were mixed overnight while Europe is mostly higher. Japan’s Finance Minister warned markets that any intervention in the currency markets would be ‘swift’ and not announced in advance. In Europe, an ECB policymaker said he sees price pressures spreading out in the economy and warned that the central bank might be forced to raise rates more than expected.

September has historically been a lousy month for stocks, and the second half of the month has been notoriously weak. Over the last 40 years, the S&P 500’s median performance has been a decline of 0.49% with positive returns just 40% of the time. Making matters even worse, the years where the S&P 500 was down in the second half of the month saw a much larger magnitude of decline (-1.92%) than the years when it was up (1.07%). The last ten years have been even more painful. From 2012 to 2021, the second half of September has only been up three times and the median decline has been 0.81%.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Big Gap Down Takes Out the 50-Day

Headed into Tuesday, the S&P 500 had been on a solid post-Labor Day rally, however, the hotter-than-expected CPI reading sent stocks reeling. After gapping down below its 50-day moving average, the S&P 500 (SPY) finished the day with a decline of over 4%. Additionally, another technical development of note as a result of yesterday’s move was that the breakout above the past few weeks’ downtrend line appears to have only been a pump fake.

While moves above or below the 50-DMA are a fairly common technical development, those similar to Tuesday are a bit rarer than might be expected at first glance. Prior to yesterday, the S&P 500 ETF (SPY) had only opened below its 50-DMA thanks to a gap down of at least 2% four other times since the ETF began trading in 1993: April 8, 1996, April 27, 2000, June 24, 2016, and February 24th, 2020. Looking across each of these instances, the 2020 occurrence was the only one that was followed by a prolonged period with the SPY staying below its 50-day. By comparison, the 1996 and 2000 instances saw the S&P continue to fluctuate around its 50-day in the months ahead. In fact, the April 2000 occurrence actually saw the S&P 500 rise back above its 50-day by the end of that same day. Meanwhile, the 2016 instance saw SPY quickly regain its losses as it traded above its 50-DMA for much of the next few months. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/14/22 – Holding For Now

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“He who fears being conquered is sure of defeat.” – Napoleon Bonaparte

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were modestly higher relative to yesterday’s decline for a little while this morning, but those gains have evaporated almost as fast as yesterday’s decline erased the prior four days of gains. Yesterday was pretty much a bloodbath in the equity market as not a single stock in the S&P 1500 was up 5%, and only 18 stocks in the entire index of 1500 stocks were even up on the session. Strangely enough, though, only 12 stocks in the index declined 10%+. For a day when the index was down over 4%, that’s a surprisingly low number. we’ve seen more stocks down by 10%+ on days when the broader market was only down 1%.

After yesterday’s hotter-than-expected CPI report, the August PPI was right in line at the headline level with a 0.1% m/m decline and an 8.7% y/y increase. Stripping out food end energy, the m/m reading was 0.4% compared to expectations for a gain of just 0.3%. The y/y reading was also higher than expected at 7.3% versus forecasts for an increase of 7.0%. This report certainly wasn’t as bad as the CPI report, but levels remain stubbornly high.

At the open yesterday, the S&P 500 erased the prior two days of gains, and by the close, it had basically erased the gains of the two days before that. How’s that for efficiency? As bad as the sell-off was, the one thing bulls have working in their favor is that the uptrend line off the June lows has held for now. If that trendline – currently around 3,920 – doesn’t hold today, it won’t be much of a positive backdrop for a time of year that has historically already been among the weakest times of the year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: Breadth Doesn’t Get Much Hotter

COTD Bullet Points:

- The past week (before Tuesday) has seen outright impressive breadth from the S&P 500 as the 5-day advance/decline line has risen to one of the highest levels of the past decade.

Chart of the Day:

Although equities are pulling back sharply in the wake of the CPI release, leading into today the S&P 500 had taken a straight shot higher since coming back from the Labor Day holiday with the index moving higher each day save for last Tuesday. Even more impressively, it wasn’t just a handful of FANG-type mega caps driving the index higher. Breadth has been impressively strong. Typically, we track short-term breadth using the 10-day advance/decline (A/D) line which we update daily in our Sector Snapshot. While that line was basically neutral heading into today, the 5-day A/D line was at the extreme side of historically positive readings. Reaching a reading of 52.8% as of Monday’s close, the reading ranked in the 99.7th percentile of all days since 1990 when our data begins. As for some other most recent examples of breadth reaching such extended levels, there have been two occurrences in the past year: one near the end of 2021 and one this past May.

To read the rest of today’s Chart of the Day as well as gain access to our other reports and tools, start a two-week trial to Bespoke Premium.

Pain in CPI

With investors expecting consumer prices to fall month-over-month heading into the day, this morning’s higher-than-expected headline and core CPI reports caused an instantaneous reversal in market sentiment heading into the opening bell. While equity index futures were indicating a gain of around 75 basis points heading into the print, after the release, indications were for a decline of 2%. When the opening bell finally rang, the S&P 500 gapped down 2.27% as indicated by the tracking ETF – SPY.

Going back to 1998, today marked just the sixth time that SPY gapped down in excess of 2% on the day of a CPI release. As shown in the top of the table below, on four of the five prior 2%+ gaps down on CPI days, SPY not only gapped down by over 2%, but it continued lower throughout the trading day. While that doesn’t necessarily bode well for today, we would note that on many of those prior occurrences, there were other overriding factors impacting the market. From the Russian debt default and collapse of Long-Term Capital Management (LTCM) in 1998 to the Financial Crisis in 2008, the US debt downgrade in 2011, and then COVID in 2020, on most of these other days, investors had other issues besides inflation to worry about. The only time that there wasn’t another major issue impacting the market was on 5/14/99 when headline CPI exceeded forecasts by 0.3 ppts and core CPI exceeded consensus estimates by 0.2 ppts.

At the bottom of the table, we have listed every other time since 1998 that core CPI exceeded consensus forecasts by 0.3 ppts or more. Today’s report is just the fourth time that core CPI has topped estimates by such a wide margin, but what stands out most is that every other prior occurrence since 1998 came after COVID. We noted numerous times in the past how COVID has created so many distortions in the economy that the job of forecasting it has become exceedingly difficult, and the fact that every ‘beat’ of this magnitude in core CPI has occurred since COVID only reinforces this point. Click here to learn more about Bespoke’s premium stock market research service.