Bespoke’s Morning Lineup – 9/28/22 – Britain Blinks

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“History, Stephen said, is a nightmare from which I am trying to awake.” – James Joyce

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures have been whipping around all over the place this morning. After some relatively steep declines overnight, this morning’s announcement from the Bank of England to buy long-dated government securities has put some temporary support in the market causing interest rates to pull back from their overnight highs and equity futures to rally. How long this reprieve lasts remains to be seen, but market participants will take any break they can get these days. On one positive note, we would note that from a historical perspective at least, over the last ten years, the upcoming three-month period for equities has been better than any rolling three-month period of the year.

Buying equities during the throes of a bear market can be a humbling experience, and never has that been more true than in 2022. The chart below shows the percentage of time that the S&P 500 tracking ETF (SPY) has traded higher on the day versus the period day’s close in each year of its existence. Since its inception in 1993, there have only been seven prior years where SPY traded higher on the day less than half of the time, but this year’s current pace of 43.8% is easily the lowest reading since SPY’s inception. The forces of gravity on stock prices haven’t been this strong or consistent in at least 30 years.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bear Market Breadth

As we highlighted in yesterday’s Chart of the Day as well as in our Sector Snapshot, the S&P 500’s 10-day advance decline (AD) line reached a record low at yesterday’s close. The 10-day AD line essentially measures the percentage of stocks in the S&P that have risen or fallen on a daily basis over a 10-day span. While the broad index saw its 10-day hit a record low, it was not alone. Real Estate (which admittedly has a smaller history of data only going back the past six years) and Technology also saw record low readings while a number of other sectors came close to records as well. As shown below, Materials had the fourth lowest reading, Energy and Industrials had the third lowest, and Health Care had the runner up lowest reading on record. For most sectors, these are readings that are well over 3 standard deviations below the norm since our data begins in 1990.

Additionally, the weak readings are somewhat unusual when compared to other bear markets. As shown, historically the 10-day AD lines of defensive sectors (Consumer Staples, Health Care, Real Estate, and Utilities) as well as Energy have averaged positive readings during bear markets. That is far from the case at the present moment with the strongest reading coming from Consumer Staples, however, even that reading is over 2 standard deviations lower than normal and ranked as the 121st worst reading of all trading days since at least 1990.

Pivoting over to a longer run look at breadth, the cumulative AD line has been confirming the moves in price with the line plummeting down towards the spring lows. That comes after the AD line went on a much stronger run than price during the late spring/summer rally.

Once again comparing the breadth line to past bear markets, below we show the path of the cumulative AD line over the course of each bear market since 1990. At the moment, the current bear is the third longest in terms of time, but the cumulative AD line is not quite at as low of a level as other bear markets. For example, the 2020 bear market as well as the 2007 to 2008 bear markets saw much lower readings and consistent moves lower than has been observed this year. At the highs this summer, the line even managed to move into positive territory. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

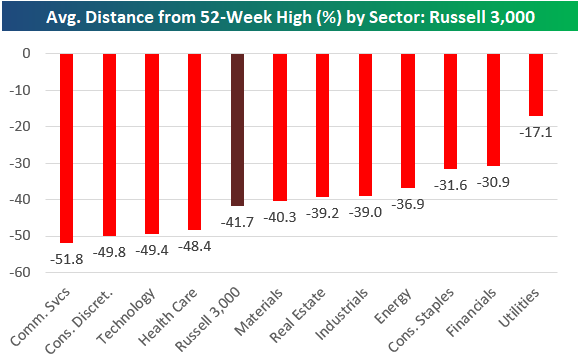

Stocks and Sectors with the Biggest Declines

The average stock in the Russell 3,000 was down 41.7% from its 52-week high as of the close yesterday. That means the average stock would need to rally 71.5% from here to get back to its high. It’s much worse in some sectors, though. As shown below, four sectors have average prices roughly 50% below their 52-week highs. Communication Services is at -51.8%, Consumer Discretionary is at -49.8%, Tech is at -49.4%, and Health Care is at -48.4%. Even Energy stocks are 36.9% below their 52-week highs. Click here to learn more about Bespoke’s premium stock market research service.

Below is a look at the stocks that have seen the biggest drops in market cap since the end of 2021. Across the entire Russell 3,000, we’ve seen more than $13 trillion in market cap erased, and there have been five individual stocks that have seen their market caps fall by more than $500 billion — Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN), and Apple (AAPL). There have been 18 stocks that have seen market cap fall by more than $100 billion, including names like Tesla (TSLA), JP Morgan (JPM), Home Depot (HD), Nike (NKE), Intel (INTC), and Cisco (CSCO). Five of the names on this list are down 60% from 52-week highs: META, NVDA, NFLX, ADBE, and PYPL. This is just true carnage in equities unlike anything we’ve seen since the Financial Crisis or the Dot Com bust.

If you want to see even more pain, below is a list of Russell 3,000 stocks with market caps still above $2 billion that are down more than 75% from their 52-week highs. These stocks collectively add up to just $300 billion in market cap at this point, and their market caps are down about $680 billion since the end of 2021.

Carvana (CVNA) and Peloton (PTON) are the only members of the “down 90%+” club, while stocks like Affirm (AFRM), Wayfair (W), RingCentral (RNG), Unity Software (U), Roku (ROKU), and Teladoc (TDOC) are down more than 80%. The list below is basically a “who’s who” of widely-traded growth stocks that saw huge gains post-COVID only to give it all back over the last year.

One Way Bonds

As noted in our Morning Lineup today, 2022 has been the year with no safety in US Treasuries. The declines this year have been painful and persistent. With the BofA 10+ Year US Treasury Index already down 7% this month, September will be the eighth month this year that long-term US Treasuries have had a negative total return, and there are still three months left in this miserable year! Even if they don’t have another down month this year, 2022 will be tied (with several other years) for the largest number of down months in a calendar year going all the way back to at least 1978.

On a rolling 12-month basis, the current backdrop is even more extreme. September will be the ninth month in the last twelve that long-term Treasuries were down, and that’s tied with October 1994 and August 2013 for the most in a twelve-month window. Furthermore, if either of the next two months are down, the rolling twelve-month total will move up to a record of ten. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 9/27/22 – No Safety In Treasuries

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Treasury securities are considered a safe and secure investment” – treasurydirect.gov

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures are attempting to rebound this morning after yet another decline in the equity market yesterday. It’s a busy day for economic data as Durable Goods Orders were just released and came in roughly in line with expectations, but there are still several more indicators on the calendar with FHFA House Prices and Case Shiller at 9 AM Eastern and then Consumer Confidence, Richmond Fed, and New Home Sales all at 10 AM.

Treasuries took another pasting yesterday as yields once again surged to new multi-decade highs. Every day there’s another way to show the carnage, so here’s the one for today. The iShares Long Term Treasury ETF (TLT) fell nearly 2% yesterday taking its YTD decline to more than 30%. 30%. In Treasuries! Weren’t they supposed to be safe and boring? For most of our entire investment careers, when markets hit turmoil, market commentary would include something along the lines of “investors rotated into the safety and security of Treasuries. Even Treasurydirect.com, which is run by the Treasury Department says as much on its website.

2022’s word of the year could very well be turmoil, yet US Treasuries are having a down year for the ages. Even on a y/y basis, since its inception in 2003, TLT’s performance over the last 12 months has been the worst on record. It’s even down more than the Nasdaq!

The weakness in Treasuries is not to say that the performance of US equities has been positive this year. With the exception of the Dow ETF (DIA), every other ETF that tracks a major US index is down more than 20%, and every single one of them closed yesterday at ‘extreme’ oversold levels (more than two standard deviations below 50-DMA).

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Morning Lineup – 9/26/22 – Still Falling

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“But I do think that we’re going to do all that we can at the Federal Reserve to avoid deep, deep pain. And I think there are some scenarios where that’s likely to happen.” – Raphael Bostic

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You know it’s bad out there when a Fed official ‘thinks’ that the Fed will do all it can do to avoid ‘deep, deep pain’. Early on in the tightening cycle, Fed Chair Powell said that the Fed’s path to higher rates could result in a ‘softish landing’ for the economy. A few weeks later, he noted that the policy could be accompanied by ‘some pain’. Last week, the Fed chair told reporters that no one knows if this process will result in a recession. Over the weekend, it wasn’t the Fed chair speaking, but Atlanta Fed President Raphael Bostic had the comments above in an interview on ‘Face the Nation’. In the span of five months, Fed officials have gone from describing the impact of tighter policy on the US economy as a softish landing to short of ‘deep, deep pain’.

If there’s anything positive to say this morning, at least September has only a week left. Heading into the last trading week of the month, the S&P 500 has already shed 6.6% which ranks as one of the worst MTD performances heading into the last week of the month in the post-WWII period. The table below lists each year where the S&P 500 was down over 5% on the month heading into the last week of September along with how the index performed in the final week of the month.

In the 12 prior months where the S&P 500 was down over 5%, the final week of the month experienced a median decline of 0.44% with positive returns just 42% of the time. That’s hardly anything to get excited about, but it is also not much worse than the average performance for the final week of the month in all years since WWII (-0.34%). One thing you can probably count on is volatility. To close out the month. In 7 of the 11 prior years show, the S&P 500 was up or down at least 1% in the final week of the month. The most extreme downside move was 2.2% in 2002 while the most positive upside move was 7.8% in 2001.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 9/25/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Russia

Russia’s underperforming military capability may be key to its downfall by Jack Watling (The Guardian)

A comprehensive framework for understanding why the much larger, more expensive, and ostensibly more capable Russian military is underperforming so dramatically versus Ukraine. [Link]

Russia to conscript 1.2 million people (Meduza)

Dissident Russian outlet Meduza reports that the “partial mobilization” announced this week plans to intake more than 1mm soldiers, though the Russian Defense Ministry later denied the reporting. [Link]

‘They Are Watching’: Inside Russia’s Vast Surveillance State by Paul Mozur, Adam Satariano, Aaron Krolik and Aliza Aufrichtig (NYT)

A massive leak of detailed documents casts a light on the bureaucracy that manages the Russian populace’s social media censorship. [Link; soft paywall]

Commuting

U.S. Return-to-Office Rates Hit Pandemic High as More Employers Get Tougher by Peter Grant (WSJ)

Office use for a sample of 10 major metros was back to just below half of 2020 levels, the highest level since late-March 2020 as managers demand more time at the office and the population moves on from the pandemic. [Link; paywall]

Can You Actually Ditch Your Car for an E-Bike? Maybe by Brigid Mander (WSJ)

Surging e-bike adoption is helping more Americans go from car to bike, putting more range in the pedals of commuters and errand-runners alike. [Link; paywall]

Real Estate

Potential home buyers and sellers continue to hesitate, prices continue to soften (August 2022 Market Report) (Zillow)

Zillow’s data shows the largest monthly price drop since 2011 as affordability concerns amidst high mortgage rates hamper demand and drive up time on market. [Link]

Central Banking

Does the UK need an emergency rate hike? by Louis Ashworth (FTAV)

Collapsing sterling and soaring rates has the market wondering if the BoE can or maybe needs to raise rates on an emergency basis. [Link; reservation required]

The Fed Is Getting Even Tougher on Inflation. Here’s What To Watch First. by Christopher Leonard (Politico)

A long-form thesis arguing that the Federal Reserve actually faces a much tougher set of trade-offs than the ones faced by the famed Volcker Fed which today’s FOMC is trying to emulate. [Link]

Social Media

‘The Chaos Machine’ author on celebrity hacks and how social media threatens IT security by Eoin Higgins (IT Brew)

An interview of a Max Fisher, NYT reporter and author of a book that delves into the darkest recesses of social media business models as well as the catastrophic externalities that support them. [Link]

Supply Chains

Ford’s Latest Supply-Chain Snarl: Not Enough Blue Oval Badges by Nora Eckert (WSJ)

Even the iconic Blue Oval badges which denote a Ford have disappeared from inventories, a relatively simple and straightforward part that has still run into a wall amidst disruptions to value chains throughout the auto industry. [Link; paywall]

‘Crippling’ Energy Bills Force Europe’s Factories to Go Dark by Liz Alderman (NYT)

It’s hard to melt glass to manufacture tableware when you don’t have enough natural gas, or run steel blast furnaces, smelt aluminum, or produce zinc. [Link; soft paywall]

High Natural-Gas Prices Push European Manufacturers to Shift to the U.S. by David Uberti (WSJ)

As factories and smelters shut down in Europe due to energy constraints, companies are looking to the US with cheap and reliable energy supplies being the primary attraction. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Bespoke’s Morning Lineup – 9/23/22 – Not Another Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Price is what you pay. Value is what you get.” – Warren Buffett

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Down and down she goes, where she stops, nobody knows. Global equities are tanking this morning as interest rates surge at what, in some cases are unprecedented rates. In Europe’s STOXX 600, just 19 stocks are currently higher on the day, and the UK government’s 5-year gilt has seen its yield surge by nearly 100 bps this week alone. Over at least the last 30+ years, there has never been that large of an increase in the 5-year gilt yield in such a short period of time. Fixed-income markets around the world are caught in an upward spiral of yields that most of the traders trying to navigate them have never seen. Alongside the surge in rates, stocks are flushing, and while the magnitude of the decline is not as severe as the move in fixed-income markets, good luck convincing anyone to step up and buy on a Friday against a backdrop where the Federal Reserve is getting exactly what it wants. If today’s declines hold at 1% for the S&P 500, it will be the twelfth 1% to close out a week this year which would already rank as the sixth most since at least 1952 and there are still another 14 weeks left in the year.

With the 2-year yield surging another 7 basis points (bps) on Thursday and another 13 bps this morning, it is trading more than 2.5 standard deviations above its 50-day moving average (DMA). Since 1976, there have only been 288 other trading days where the 2-year yield finished the day more than 2.5 standard deviations above its 50-DMA, and six of those occurrences have been in the last nine trading days!

The 2-year yield is also on pace to finish the day at ‘overbought’ levels (more than 1 standard deviation above its 50-DMA) for 24 straight trading days. As shown in the chart below, though, overbought closes for the 2-year yield have been a regular occurrence lately, and there have been two other streaks this year that have lasted considerably longer. Maybe a better question is how often this year has the two-year yield not finished a trading day at overbought levels?

The answer to that question is less than 25%. Of the 182 trading days this year, there have only been 41 where the two-year yield closed the day less than one standard deviation above its 50-DMA. Flipping that around, the yield has finished the day at overbought levels 77.6% of the time. Going back to 1977, there has never been another year where there was a higher percentage of days that the two-year yield finished the day at overbought levels. The only two years that were even close were 1978 (72.7%) and 1994 (71.6%). There’s still a quarter of the year left, so this percentage could decline, but at the current pace, the pace of relentless increase in the two-year yield has been unprecedented.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

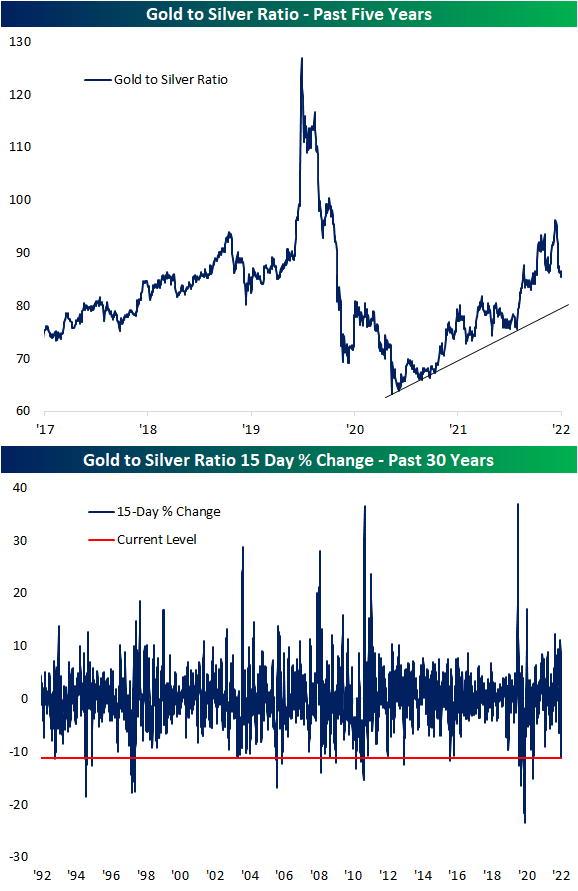

Gold to Silver Ratio Plummeting

In spite of it being considered a safe haven asset and inflation hedge, gold has had a rough year with a nearly 10% decline year to date. The yellow metal has consistently traded below its 50-DMA over the past few months while the 200-DMA is fairly flat. Over the past several days, gold has been trending sideways right near 52-week lows.

Silver has not avoided declines and like gold has largely remained below its moving averages. However, its sideways action in recent days has proven a bit more constructive. Unlike gold, silver rallied in the first half of September moving back above its 50-DMA in the process. Since then, there has not been a massive degree of follow-through, but it has managed to hold above that moving average.

For the past year and a half, gold has generally outperformed silver as shown in the uptrend of the ratio of the two metals since early 2021. However, the underperformance of gold in recent weeks has led the ratio to pivot sharply lower. Over the past 15 days, the ratio has fallen 11%; the first double-digit decline since February 2021. Looking back through the early 1990s, there have only been a handful of other periods in which the gold-to-silver ratio has fallen by a similar degree or more in the same span of time. Outside of last year, the only other occurrences in the past decade were 2013, 2016, and 2020. Click here to learn more about Bespoke’s premium stock market research service.

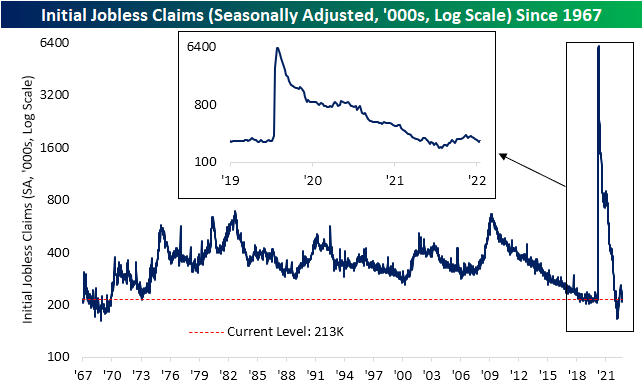

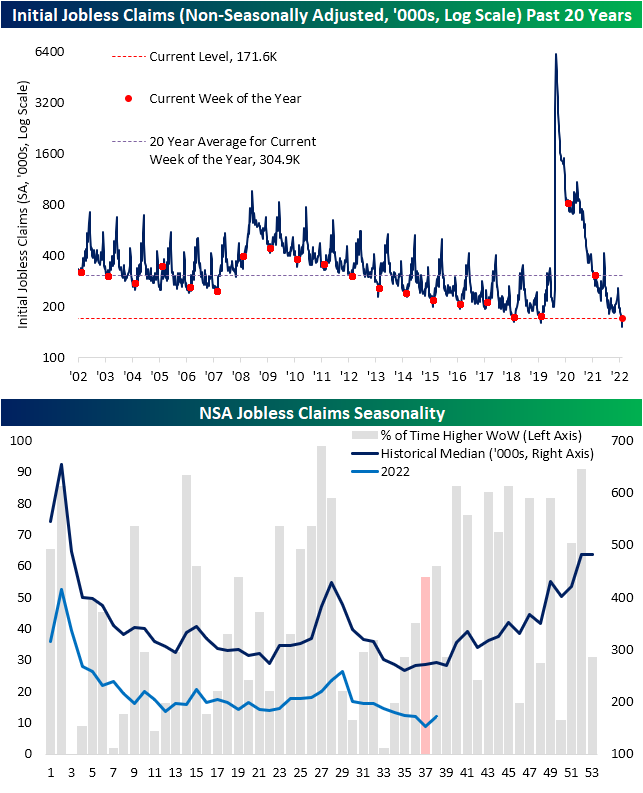

Claims Staying Low

Initial jobless claims came in at 213K this week. That would have been unchanged versus the prior week, but last week’s print was revised down by 5K to 208K. That modest uptick versus the revised number marked the first increase in claims in five weeks. Albeit higher, that level is still within the range of readings from the few years prior to the pandemic.

On a non-seasonally adjusted basis, claims were also higher week over week moving up to 171.6K. That increase could be expected as claims have been overdue to bottom out from a seasonal perspective as we discussed last week. That increase also does not steal from the fact that initial claims remain at historically strong levels. From here, claims are likely to continue to face seasonal headwinds through the end of the year.

As initial claims have come off of recent highs, continuing claims likewise hit the lowest level in several weeks. Seasonally adjusted continuing claims (lagged an additional week to the initial claims number) fell from 1.40 million down to 1.379 million for the lowest print since mid-July.

Earlier in the summer, we had noted how initial claims had appeared to have gotten ahead of continuing claims with the former at a comparatively higher level than the latter. That was evident by the ratio of the two surging to some of the highest levels on record. The past several weeks’ decline in initial jobless claims and the little change in continuing claims have resulted in that ratio turning lower. In fact, the latest release marked the fifth consecutive decline in that ratio. As shown in the second chart below, that now stands out as one of the longer such streaks of declines on record. Click here to learn more about Bespoke’s premium stock market research service.