Bespoke Market Calendar — October 2022

Please click the image below to view our October 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 10/3/22 – New Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If I’ve made myself clear, I’ve misspoken.” – Alan Greenspan

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It’s a new quarter, and investors hope the clean slate leads to a more positive backdrop for equities. That being said, with S&P 500 futures indicated 1% higher at the open, it would only erase two-thirds of Friday’s decline, not to mention the losses from the rest of the week. Along with higher equity futures, oil prices are up around 5% on the news out this weekend of a potential million barrel per day production cut by OPEC+. Treasury yields are significantly lower this morning as the 10-year yield dipped below 3.70%. On the economic calendar, the big report to watch this morning will be the ISM Manufacturing at 10 AM. Economists are forecasting the headline number to drop modestly from 52.8 down to 52.4.

Heading into the new quarter, the YTD losses for individual sectors and where they are trading relative to their 50-day moving averages are staggering. Year to date, four sectors are down over 25% and another three are down over 20%. Two more are down over 10%, and the 7% decline in Utilities seems like a win at this point. The only sector in the green YTD remains Energy, and with oil prices higher this morning on reports of an OPEC+ production cut, the sector is poised to add to those gains this morning.

While the YTD declines have been steep, the recent weakness has really put many sectors into deeply oversold territory. The fact that all but two sectors (Health Care and Energy) are at ‘Extreme’ oversold levels (greater than two standard deviations below 50-DMA) is illustrative enough, but it’s not often that you get seven sectors trading more than 10 percentage points below their 50-day moving averages.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 10/2/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

FT on LDI

LDI: the better mousetrap that almost broke the UK by Alexandra Scaggs and Louis Ashworth (FTAV)

An explainer on liability-driven investing (LDI), which is being fingered as the biggest factor in the collapse of the UK government bond market this week amidst new fiscal plans and a plunge in the pound. [Link; registration required]

Who exactly has the BoE bailed out? by Toby Nangle (FTAV)

When the BoE intervened to make sure the gilt market didn’t collapse under a mountain of margin calls, who was the ultimate beneficiary? Was it underwater pension funds or their counterparties? [Link; registration required]

Housing

The U.S. Rental Housing Market is Cooling Off Fast by Jay Parsons (RealPage)

Higher rates, inflation, and collapsing consumer confidence are destroying demand for housing as the process that creates new households slows down. As demand slows, so too will rents over the coming months. [Link]

Remote Work and Housing Demand by Augustus Kmetz, John Mondragon, and Johannes Wieland (FRBSF Economic Letter)

New research suggesting that the increase in remote work during the pandemic drove more than half of the overall increase in national home prices between November 2019 and November 2021. [Link]

10 Markets Where Sellers Are Cutting Home Prices the Most by Shaina Mishkin (Barron’s)

Price cuts are mounting across a US housing market that has been frozen by high rates. Sunbelt cities like Phoenix, Austin, and Las Vegas have the largest share of the market with cuts in price. [Link; registration required]

Florida

Hurricane Ian to add reinsurance rate momentum, disrupt Florida market: KBW by Steve Evans (Artemis)

Insurance analysts are growing increasingly concerned about the impact Ian will have on the Florida insurance market, with a price tag above $50bn most likely. For thinly-capitalized insurers who don’t have much reinsurance capacity, it could spell doom for the Floridian property insurance market. [Link]

Ukraine

The 90km journey that changed the course of the war in Ukraine by Henry Foy, Sam Joiner, Sam Learner and Caroline Nevitt (FT)

A step-by-step review of the lightning breakthrough which has led to a collapse in Russian lines across Eastern Ukraine, in a fantastic multimedia format. [Link; paywall]

Denmark, Germany and Poland warn of ‘sabotage’ after Nord Stream leaks by Richard Milne, David Sheppard, and Guy Chazan (FT)

Underwater explosions that led to ruptures in the Nord Stream pipeline complex have led multiple countries to identify Russia as the most likely culprit and likely to strike at other infrastructure as well. [Link; paywall]

New York

NYC Proposal Offers Cash for Spotting Parking Violations in Bike Lanes by Fola Akinnibi and Skylar Woodhouse (Bloomberg)

A new law in New York City would turn citizens into bounty hunters seeking cars that so often block bike lanes around the city. [Link; soft paywall]

Yankees’ threat of sitting Aaron Judge finally ended long rain delay with Red Sox by Brendan Kuty (NJ.com)

ESPN was desperate to air a final at bat for Aaron Judge in his pursuit of 61 homeruns and pressured MLB to extend a rain delay. In response, Yankees manager Aaron Boone threatened to sit the start. [Link]

New Jersey

Three men charged with fraud in $100 million New Jersey deli scheme by Mike Calia and Dan Mangan (CNBC)

A tiny deli ended up being listed as part of a $100mm market cap company that is now embroiled in a series of charges including securities fraud. [Link]

Political Science

Can nonviolent resistance survive COVID-19? by Erica Chenoweth (Journal of Human Rights/Taylor & Francis Online)

The COVID-19 pandemic did not reduce the number of mass protests around the world but those protests did show much less efficacy in achieving their aims. [Link]

Food

The story of white sauce, Virginia’s unique contribution to Mexican American cuisine by Mattew Korfhage (The Virginia-Pilot)

Virginia isn’t known for its Mexican food, but that hasn’t stopped the state from developing a unique contribution to the cuisine: a white sauce that won’t be found anywhere else. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 9/30/22 – Crush the Economy: Mission Accomplished

This week’s Bespoke Report newsletter is now available for members.

Remember earlier this year when Fed official after official was happy to be in front of any microphone and proclaim that tighter monetary policy would have little impact on the health of the economy? Well, that policy has evolved over the last nine months. In May, Chair Powell said that policy moves could result in a ‘softish landing’ for the US economy. Softish eventually turned to ‘some pain’ on the horizon, and then this month the Fed Chair told reporters at a press conference that “No one knows if this process will lead to a recession” which in Fed-speak translates to “it’s on.”

Everywhere you looked this week, Fed officials were speaking, and their message was in sync. They are focused on one thing and one thing only—stamping out inflation, and no amount of economic weakness will knock them off course until they are 110% certain that their goal has been met. Each official reiterated the same point, but just in case it wasn’t obvious, Cleveland Fed President Loretta Mester made herself loud and clear on 9/29 when she said that a “recession won’t stop the Fed from raising rates.” Good luck economy!

In this week’s Bespoke Report, we summarize recent market returns, the crazy moves in the fixed income market, economic trends increasingly pointing to a recession, some extremely oversold technical conditions, and much more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke’s Morning Lineup – 9/30/22 – Q3 Almost Done

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We must recognize that no amount of formal planning can anticipate changes” – Andrew Grove

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were a lot higher earlier in the morning but in what has increasingly become the norm this year, those gains were fleeting. Ahead of some important inflation data, equity futures were essentially flat, and the 10-year yield was trading down to 3.7% after topping 4% earlier this week. Nike (NKE) has been a drag on equity prices as the stock is down 10% in reaction to earnings. That would rank as the stock’s largest downside gap in reaction to earnings since at least 2001. The other major report since the close yesterday was Micron (MU) and while the company lowered guidance, it’s still trading up in the pre-market.

In terms of economic data, Eurozone CPI came in at 10% y/y for the month of September which was nearly a full percentage point higher than August’s reading of 9.1%. There’s been no let-up in inflation on the other side of the Atlantic. Over here, it’s a busy day for economic data to close out the quarter with Personal Income (inline), Personal Spending (stronger than expected), and PCE Core (higher than expected) all being released at 8:30. Chicago PMI will be released at 9:45, and then at 10, we’ll close out the quarter’s data with Michigan Sentiment.

It’s been a lousy back half of the quarter, so just about everyone is happy to see it come to an end, but there are still 6.5 hours of trading to get through.

The Philadelphia Semiconductor Index (SOX) traded lower yesterday as it has on more than half of all trading days this year. As a result, the index is down just under 42% from its record closing high in late December. The current drawdown in the SOX is now deeper than the 35% drawdown from the COVID crash and ranks as the fourth largest decline from a record closing high in the index’s history. The only three that were deeper were two 50%+ declines in the mid to late 1990s, and then the 80%+ drawdown from the dot-com peak. The two drawdowns in the 1990s were short-lived lasting two years or less before new highs were once again reached, but the high from the dot-com peak in 2000 wasn’t eclipsed for another 18 years. One can only hope that in the late 2030s we aren’t finally celebrating the first new high in the Semiconductor index since 2021!

Even though the SOX is down nearly 42% from its all-time high, it may sound hard to believe but throughout its history, it has been further below its all-time high than it is now 57% of the time! With semis consistently trading down so far from record highs over the years, you would think the sector has been a bad investment. Since its inception in 1994, though, the SOX has returned more than 12% annualized on a total return basis. Not bad for an index down over 40% this year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Optimism Nowhere to Be Found

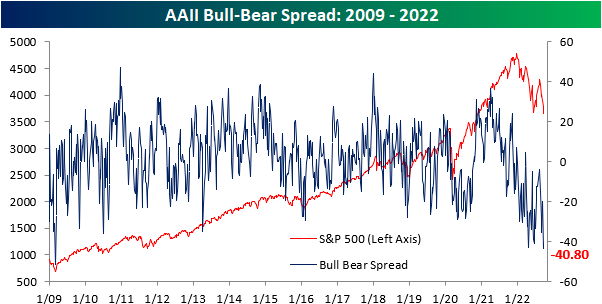

Although the S&P 500 hit 52-week lows for the first time since June this week, bulls actually stepped back up to the plate (in a very small way). Bullish sentiment, according to the AAII sentiment survey, rose back up to 20% after a low of 17.7% last week. Even with that modest increase, bullish sentiment remains historically muted at 17.7 percentage points below the historical norm.

Bearish sentiment likewise remains elevated and hardly improved. The latest reading dropped marginally from 60.9% to 60.8% marking the first time on record that there have been back-to-back readings of 60% or more as we noted in an earlier tweet. The only other times bearish sentiment came in above 60% were in March 2009, October 2008, and August and October 1990.

Given the near record high in bearish sentiment coupled with the slight increase in bullish sentiment, the bull-bear spread improved rising from -43.2 to -40.8. Again, in spite of that improvement, the latest reading shows that bears continue to heavily outweigh bulls to a historic degree.

Given both bulls and bears are at extremes, recent moves have borrowed heavily from neutral sentiment. That reading has fallen sharply over the past three weeks and is back below 20% for the lowest reading since April 2020. The 9.5 percentage point decline over the past three weeks has been the largest drop in such a span since May pointing to investors being increasingly polarized.

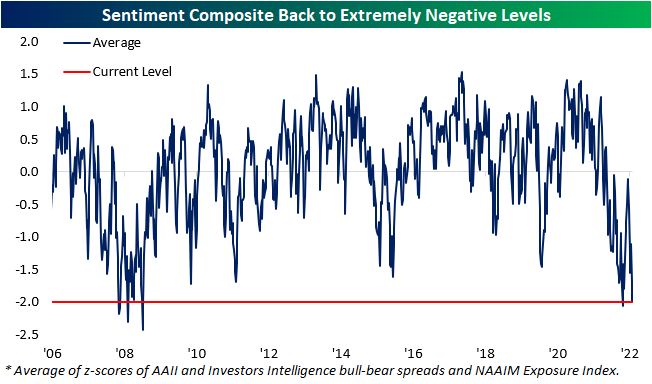

The AAII survey may have moved slightly less bearish this week on net, but other sentiment surveys saw the opposite results. The Investors Intelligence survey saw bulls hit the lowest level since 2016, and the NAAIM exposure index showed the least long exposure to equities since March 2020. Standardizing and then combining each of these surveys shows that the average reading is now two full standard deviations below the historical norm. That is slightly better than the June low with the only other period with as depressed a level of sentiment being the financial crisis years. Click here to learn more about Bespoke’s premium stock market research service.

Claims Go Lower and Lower

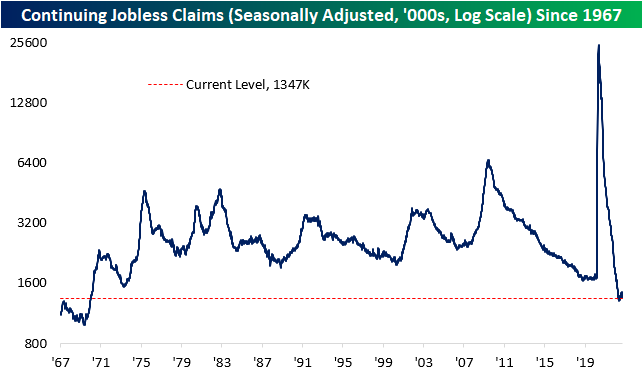

Adding ammunition to the hawkish tone out of the Fed, this week’s initial jobless claims number showed yet another decline to already impressively low levels. Not only was last week’s reading revised down by 4K to 213K, but this week’s reading fell back below 200K. Now at 193K, claims are back to where they were in April after having fallen for six of the last seven weeks. With a drop back below 200K, claims have fallen back below the range from the couple of years prior to the pandemic. Outside of lows earlier this year, that would be some of the best levels for claims since 1969.

Before seasonal adjustment, it is an even equally impressive low. For the comparable week of the year, this most recent reading of 156.1K was the lowest since 1969 and was only slightly above the seasonal low from a couple of weeks ago. While it does not steal from how strong claims have been, we would note that the current week of the year does have some seasonal tailwinds with a decline roughly 70% of the time.

Continuing claims are lagged an additional week to initial claims making the most recent print through the week of September 16th. Claims fell for the sixth consecutive week to reach 1.347 million, the lowest level since the first week of July. Click here to learn more about Bespoke’s premium stock market research service.

The Bespoke 50 Growth Stocks — 9/29/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were 19 changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup – 9/29/22 – Fundamentals Don’t Matter

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When you see only problems, you’re not seeing clearly.” – Phil Knight

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The rally was fun while it lasted. Futures are sharply lower this morning and poised to give up over half of Wednesday’s gains at the opening bell. An interview with Cleveland Fed President Loretta Mester where she reiterated her hawkish stance hasn’t helped sentiment nor has the fact that initial jobless claims dropped below 200K and continuing claims were also lower than expected. As if that wasn’t bad enough, the GDP Price Index and Core PCE were both revised higher. If there’s any silver lining to those upwardly revised inflation readings, it’s that it will make it more likely that these readings for Q3 show some deceleration.

These days, either all stocks rise, or they all fall. There is little in-between. It’s like flipping a switch. In yesterday’s rally, the S&P 500’s net A/D reading was +477 which was the strongest single-day breadth reading since late July and before that April 2020. Yesterday’s strong breadth reading was the 7th this month and the 31st ‘all or nothing’ day (single day breadth reading either above +400 or below -400) for the S&P 500 this year, bringing the full-year pace to 42. That would be just one shy of the 2020 total of 43 and the sixth highest single-year total since 1990. Besides 2020, the only years with a higher number of all or nothing days were during and coming out of the Financial Crisis from 2008 through 2011.

In a normal functioning market, fundamentals play a large role in the direction of individual stock prices. There are certain times, like now though, where the seas get rough, and Captain Macro takes the helm relegating fundamentals to steerage. If you’ve ever been seasick on a boat, though, the last place you want to be is down below.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Global Equities Reaching New 52-Week Lows

Being the last Wednesday of the month, today we published our most recent update of our Global Macro Dashboard which provides overviews of 22 major global economies. In the matrix below, we show the performance of ETFs that track the stock markets of these same countries.

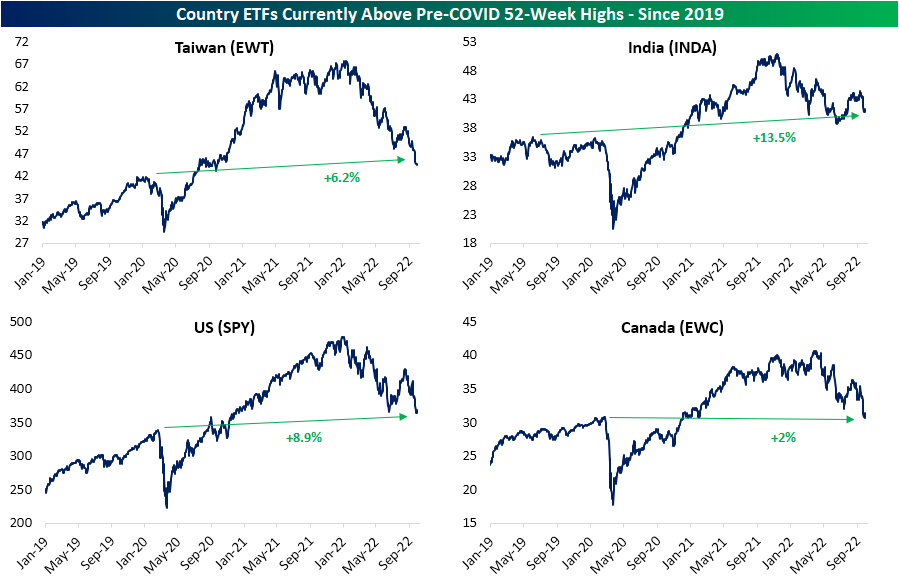

Globally, stocks have gotten crushed in the past year with an average decline of 30% from 52-week highs; we would also note that developed markets have faired slightly worse than emerging markets. In fact, in the past few days, nearly every one of these countries has made a new 52-week low. There are a couple of holdouts though: Brazil (EWZ) and India (INDA). Compared to the S&P 500 low on June 16th (which was the 52-week low prior to this week and the level the index is currently hovering near) INDA and EWZ are again the only two countries with a solid gain by any stretch. As for one other distinguishing characteristic, these two countries are the only ones to not be in or be in the process of entering—as is the case with Mexico (EWW)—oversold territory.

While everything is well below current 52-week highs, there are only four country ETFs that are also above pre-COVID highs (the 52-week high as of the S&P 500 high on 2/19/20). India (INDA) is, of course, the most elevated above those levels at 13.5% followed by the US. Taiwan (EWT) and Canada (EWC) are within more tangible reach of pre-COVID highs given their recent breach of spring support has been far more material than SPY. Click here to learn more about Bespoke’s premium stock market research service.