Bespoke’s Morning Lineup – 12/6/19 – A Neglected Jobs Report

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Gaps Got Filled, Trade Tumult, Ivey Surge – 12/5/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we show the gaps that have gotten filled for banks, technology, and quality factor ETFs before delving into today’s trade balance data which was much narrower than forecast. We take a look at the major drivers of this narrowing in terms of products and countries. We finish with a look at October new orders, sales, and inventories data and the turnaround in Canada’s Ivey PMI.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Bespoke’s Sector Snapshot — 12/5/19

Chart of the Day: Unifi-ed Technicals

Less Optimistic But Not Pessimistic

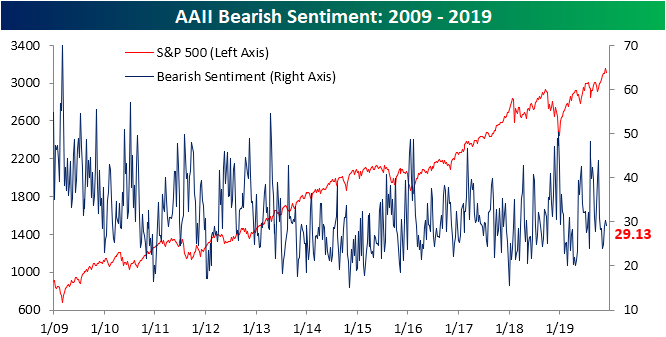

As equities have pulled off of their highs, so too has sentiment which has continued to shift more negative in the three weeks since its recent peak of 40.7%. This week marked a third consecutive week with a decline for AAII’s bullish sentiment reading. Now at 31.72%, it is the lowest level since October 10th when it had fallen to a much lower level of 20.31%. For reference, that was the lowest bullish sentiment reading since May of 2016. This week also marked the seventeenth week in a row that bullish sentiment has been below its historical average. That is the longest such streak since the one ending at 25 weeks in October of 2017. While bullish sentiment has been restrained, levels haven’t been extreme as we’re still within one standard deviation of the historical average.

Another survey determining investor optimism, the Investors Intelligence survey also showed a decline in bullish sentiment this week with 54.8% of respondents reporting as bullish. That is down from the 13-month high of 58.1% from last week. Meanwhile, the survey’s reading on bearish sentiment ticked up to 17.3% and the percentage of respondents looking for a correction rose to 27.9%. Although higher, both of these are only the highest since late October/early November.

While investors have been less bullish, they are not becoming increasingly bearish either. Unlike the Investors Intelligence survey’s slight increase, the percentage of respondents reporting as bearish in AAII’s survey actually fell this week down to 29.13% from 30.28% the prior week. That is the first decline after three consecutive increases, brining it right around the historical average of 30.36%.

As investors failed to take a bullish or bearish stance, neutral sentiment was the major mover this week rising to 39.16%. The 3.07 percentage point increase was the largest since mid-September as the indicator is back near the upper end of the past year’s range. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

B.I.G. Tips – After Hours vs. Intraday for the Nasdaq 100 (QQQ), Russell 2,000 (IWM), and Gold (GLD)

November Employment Report Preview

There’s been quite a bit of conflicting signals in the US labor market recently. After some elevated readings in weekly jobless claims earlier this month, the last two weeks have seen claims come back in with the latest print of 203K marking the lowest weekly print in over six months. While jobless claims have moved back down towards the low end of their range, the latest ADP Private Payrolls report missed expectations by more than 70K. If that’s not confusing enough, the latest ISM data has shown big divergences with the employment component of the manufacturing report falling in four of the last five months while the employment component of the services report has risen for two months straight.

Heading into tomorrow’s Non-Farm Payrolls report, economists are expecting an increase in payrolls of 185K, which would be a 57K increase from October’s reading of 128K. In the private sector, economists are expecting a similar increase from 131K up to 179K. Job growth in the Manufacturing sector is expected to rebound from –36K up to 40K. Even with the expected big increase in Non-Farm Payrolls, the Unemployment Rate is expected to stay unchanged at 3.6% while average hourly earnings are forecast to increase 0.3% compared to October’s reading of 0.2%.

Ahead of the report, we just published our eleven-page preview of the November jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in November. We also include a breakdown of how the initial reading for November typically comes in relative to expectations and how that ranks versus other months.

For anyone with more than a passing interest in how equities are impacted by economic data, this November employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Give Thanks For The Big Drop In Claims

Initial jobless claims data of late has been all over the place. In early and mid-November, the indicator broke out of the range that had been in place over the prior several months topping out at 228K which was the highest level since June. Over the past two weeks, though, those higher prints have completely reversed themselves, and this week’s report came in at the lowest level since April’s multi-decade low of 193K.

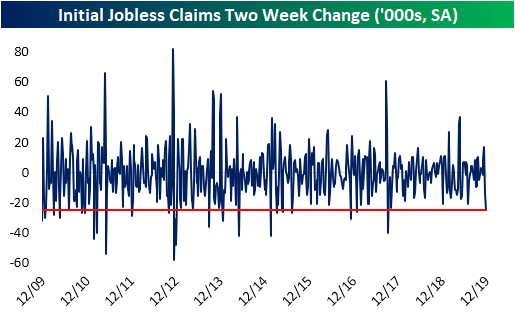

In recent history, it hasn’t been common to see this large of an improvement in claims in such a short period of time. Just two weeks ago, claims had risen by 17K over the prior two weeks. As shown in the chart below, that was the largest two-week increase since the 37K increase in April when claims were coming off of the aforementioned low of 193K. Now, the 25K drop in the past two weeks has been the largest two-week decline since September 2017 when it fell from 300K to 260K. Looking back over the past decade, there have only been a handful of other times where claims have fallen by 25K or more (red line) in the span of two weeks. In other words, claims data has become increasingly volatile in the past month.

Given the recent highs in early and mid-November and new lows in the past two weeks, the four-week moving average is only back to where it was at the start of November. Dropping to 217.75K from 219.75K last week, the 2K drop is only the largest decline since the first week of September. So while the past month has painted a conflicting picture, and seeing as one week does not make a trend, this week’s stronger reading has not had a major impact on longer-term trends. Looking ahead to next week, assuming no major revisions and a similarly strong print next week, the moving average does have the potential to continue to improve as one of 227K readings roll off the average.

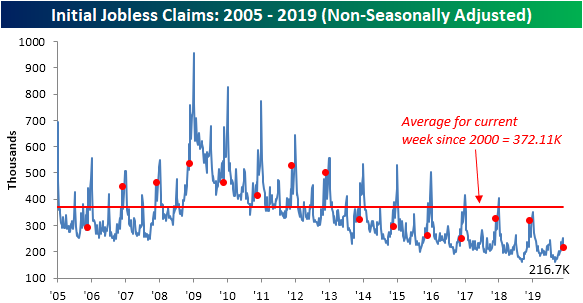

Non-seasonally adjusted data similarly had a strong showing this week with a decline to 216.7K from 252.4K last week. This week’s decline is in the seasonal context of claims rising to their yearly highs. This week’s non-seasonally adjusted claims also continued the trend of readings below the average for the current week of the year since 2000.

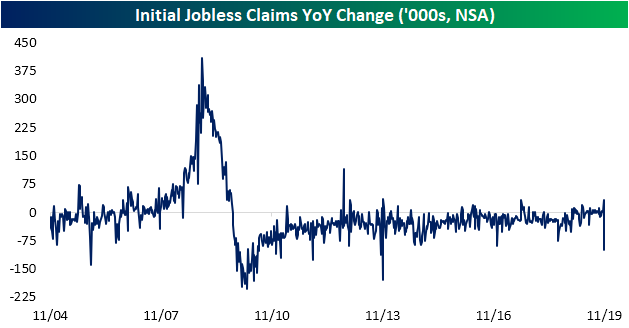

The 35.7K decline week-over-week for the non-seasonally adjusted number was the largest decline since July 19th of this year. Even more notable is the decline year over year which totaled more than 100K. While YoY changes like this were fairly common in the first years coming out of the last recession, there have been only a handful of other times in the past decade that NSA claims have fallen by such a large amount. The last time this happened was in 2013, similarly during a year when Thanksgiving week came one week later than the year before.

While this week’s data certainly showed improvement, due to seasonal factors—namely the timing of the Thanksgiving holiday coming on the 48th week of the year rather than the 47th like the past couple of years—we would be hesitant to take it entirely at face value and jump to the conclusion that labor data has dramatically and concretely improved to the degree that the data suggests. But, even if it should be taken with a grain of salt, an improvement is an improvement. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

The Bespoke 50 Top Growth Stocks — 12/5/19

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 113.6 percentage points. Through today, the “Bespoke 50” is up 239.8% since inception versus the S&P 500’s gain of 126.2%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Morning Lineup – 12/5/19 – What Labor Market Weakness?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.