Markets Gone Wild

Today’s reversals in the financial markets were really the types of moves that don’t come around too often. Exhibit 1 is gold. After rallying more than 2.5% from Tuesday’s close, gold hit a 52-week high only to reverse lower throughout the trading day. As we type this, it’s now down over 1% from Tuesday’s close. Going all the way back to 1980, there have only been six other days where gold rallied more than 1% to a 52-week high only to finish the day down over 1%.

The swing in crude oil was even larger. Earlier in the day, WTI was up over 4% relative to Tuesday’s close. Do you know where it finished? Down over 4%! All in all, WTI traded in a range of 9.9%. How’s that for a volatile session? Start a two-week free trial to Bespoke Institutional to access our Chart of the Day, full coverage of earnings season, and so much more.

Chart of the Day: Triple Plays Heading Into Earnings Season

Gold Breaks Out Again But Will It Hold?

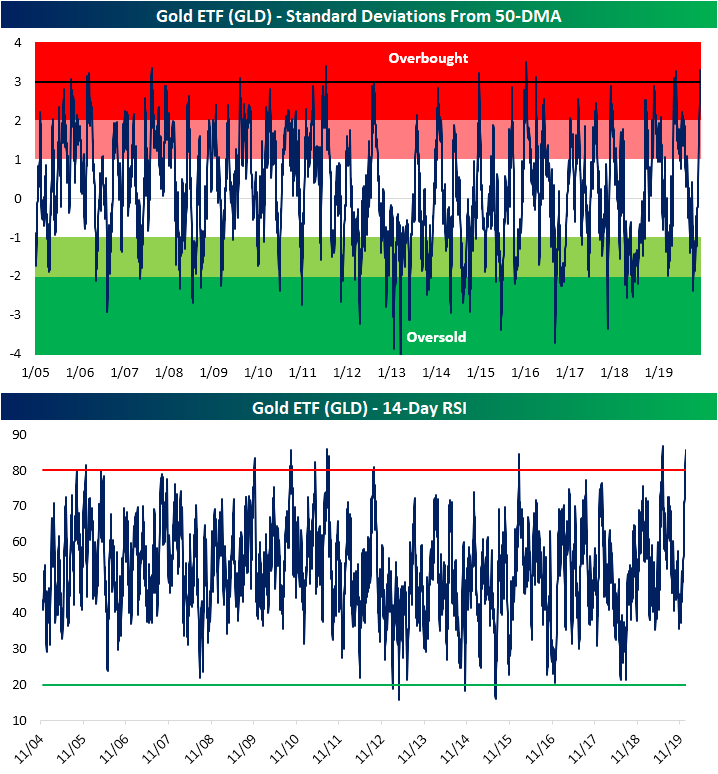

At the end of December, we highlighted in a Chart of the Day that gold was entering 2020 with a bullish technical backdrop. After sitting in a downtrend since its peak set in early September, GLD had begun to break out on December 23rd. Since then it has rallied 5.7% fueled by a shift towards safe-haven assets as geopolitical tensions have built with the Middle East. In the past few days, GLD has experienced yet another breakout taking out the September 4th closing high of $146.66.

Although it has held above these levels so far, the rapid rise of the yellow metal in the past few weeks has led it to be extremely overbought by multiple measures. This means there is likely to be some form of mean reversion in the near future testing the sustainability of the most recent breakout. As shown in the chart below, yesterday’s close over a dollar above the September high has led GLD to now sit over 3 standard deviations above its 50-DMA. That is the first time it has done so since June, and before that, you would have to go all the way back to April 2016 to find a time GLD was as extended by that measure.

Similarly, another overbought/oversold indicator, the 14-day RSI, is echoing the extreme readings. While readings above 70 typically indicate that an asset is running hot, the current reading is now over 85! While there have only been a handful of times since the ETF first began trading that the RSI has tipped above 80, readings above 85 are even rarer. Similar to the price in regards to the 50-DMA, the last time things got this extended were in June of 2019. Prior to that, there have only been two other times the RSI has been 85 or greater: once in 2010 and again in 2011. Start a two-week free trial to Bespoke Institutional to access our Chart of the Day, Trend Analyzer tool, and much more.

Fixed Income Weekly – 1/8/20

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we talk about the direct linkages between oil and interest rate markets.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Global Macro Dashboard — 1/8/20

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – 1/8/20 – Futures Flat; Quiet Night?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

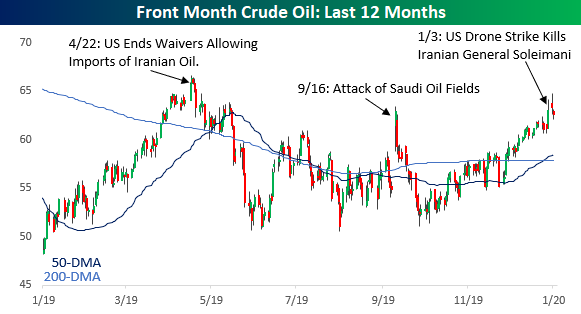

Based on the reaction of crude oil to the events of the last week, it doesn’t appear as though investors are concerned about last night’s events. Not only is crude oil now down relative to where it was before last night’s attacks, but it has now given up almost all of its gains that followed last week’s drone strike on Iranian general Soleimani.

The Closer – Value, Real Yields, FX Rally, Factory Sales, Chinese Imports – 1/7/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the relationship between value and momentum stocks with the yield curve. We also take a look at real yields and EMFX. Turning to economic data, we review today’s factory orders and durable goods numbers before finishing with a recap of the trade balance.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Chart of the Day: Time to Play Defense With Defense Stocks?

Another Iran-Related Conflict Kills a Crude Oil Rally

It may sound completely illogical now, but another Middle-East conflict involving Iran looks like it’s going to stop a crude oil rally in its tracks. After last Friday’s drone strike in Iraq that killed Iranian General Soleimani, crude oil prices originally surged 6% rising from $61.18 up to $64.72. Since that peak, though, prices have given up 60% of their gains and are now up just 2.4% since last Thursday’s close. While prices are still higher relative to where they were last Thursday, the current pattern is beginning to look a lot like the pattern we saw following other Iran-related issues in the Middle East over the last year.

Back in April 2019, crude oil capped off a 30% rally with a gain of 2.5% after the US announced it would end any waivers to countries importing Iranian oil. Cutting off Iranian oil from the market would cut supply which should have led to higher prices, but after that short-term move higher, prices reversed lower falling more than 20% in less than two months. In September, crude oil prices saw an even larger one-day move of nearly 15% after Saudi oil fields were attacked by what was widely believed to be Iranian drones. The rally from that attack lasted all but a day and within two weeks all of the gains (and more) were erased. The latest surge in crude oil prices also followed what was a steady uptrend (like the one in April), and like that rally, will Friday’s rally end up marking another blow-off top? Join Bespoke Premium to receive our best investment research on a daily basis. Click here to receive half off for the first three months.

Updated S&P Case Shiller Home Price Data

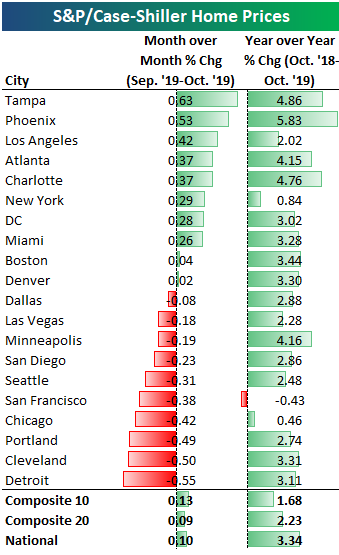

Below is an updated look at home price changes across the country using the most recent S&P Case Shiller home price indices. As shown, the National index rose just 10 basis points month-over-month and 3.34% year-over-year. Notably, the number of cities that saw rising and falling home prices month-over-month was evenly split at ten apiece, so we’re no longer seeing broad-based, nationwide increases like we were a few years ago. Mid-west cities like Detroit, Cleveland, and Chicago were three of the four biggest decliners month-over-month, while the West Coast and Northwest cities like Portland, San Francisco, Seattle, and San Diego all declined as well.

After seeing an epic surge in home prices for years during the current expansion, San Francisco is now the only city that is down year-over-year with a decline of 0.43%.

Below is a chart showing the change in home prices from their peak level at the top of the housing bubble in mid-2005. This allows you to see which areas have fully recovered from the housing crash and which have not. Denver and Dallas are both more than 50% higher now than they were at their peaks in the mid-2000s, while the National index has eclipsed its housing bubble highs by 15%.

On the downside, Las Vegas is the farthest below its prior highs at -17%, followed by Chicago at -14%, Phoenix at -13%, and Miami at -12%. DC, Tampa, and New York are the three remaining cities that have still not recovered all of their losses from the housing crash/financial crisis.

Below is a look at how much home prices have risen from their housing crash lows that were mostly reached in 2012. The National index is now up 59% from its lows, while San Francisco and Las Vegas are both up more than 110%. Remember, though, that while San Francisco has easily eclipsed its prior highs from the mid-2000s, Las Vegas is still 17% below its prior highs even though prices have more than doubled off of their post-crash lows.

On the weak side, New York home prices are up the least of any city at just 29%. (Note that the 20 cities are usually based on the city and its surrounding areas. For the New York region, it includes New York City, Long Island, the mid-and lower Hudson Valley, Newark, Jersey City, Paterson, Elizabeth, and Edison, NJ, and Bridgeport, New Haven, Stamford, Waterbury, Norwalk, and Danbury, CT.)

Below are historical charts of all the home price indices tracked by S&P Case Shiller. Cities with green shading are ones that have made new highs this cycle above their highs at the peak of the housing bubble in the mid-2000s. These indices are all indexed to 100 as of January 2000. Join Bespoke Premium to receive our best investment research on a daily basis. Click here to receive half off for the first three months.