Bespoke Brunch Reads: 4/12/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Natural World

A Google Plan to Wipe Out Mosquitoes Appears to Be Working by Kristen V Brown (Bloomberg/MSN)

In order to prevent the spread of infectious diseases, the Google project has developed a bacterial strain that renders mosquito eggs inert after mating. File under “what could possibly go wrong”. [Link]

400-year-old Greenland shark ‘longest-living vertebrate’ by Rebecca Morelle (BBC)

Radiocarbon dating found a Greenland shark that was swimming during the English Civil War. The species doesn’t reach sexual maturity until it has been swimming for 150 years. [Link]

Great Barrier Reef suffers its most widespread mass bleaching event on record by Maddie Stone (WaPo)

Warm waters lead coral to eject the microbial life they host, “bleaching” the coral. While bleaching does not mean death for reefs, repeated or extended bleaching events can destroy coral permanently. [Link; soft paywall]

Pollution Recedes Amid Lockdown, And A View Of The Himalayas Emerges For The First Time In 30 Years by Marley Coyne (Forbes)

Restrictions on all manner of transportation and other activities have led to massive air quality improvements in Northern India, revealing a view of the Himalayan Mountains. [Link]

COVID Containment

Veterinary scientist hailed for Faroe Islands’ lack of Covid-19 deaths by Daniel Boffey (The Guardian)

The tiny Faroe Islands nation has avoided deaths from coronavirus by introducing a mass testing regime early using a facility designed to diagnose salmon viral infections. [Link]

Michael Burry of ‘The Big Short’ Slams Virus Lockdowns in Tweetstorm by Reed Stevenson (Bloomberg)

In a classic case of “don’t meet your heroes”, the hedge fund investor has taken to Twitter on a crusade to get rid of the social distancing measures which have saved lives around the world. [Link; paywall, auto-playing video]

How the 1957 Flu Pandemic Was Stopped Early In Its Path by Becky Little (History)

A doctor at Walter Reed spotted headlines related to a flu outbreak in Hong Kong, and quickly requisitioned samples before formulating a vaccine then forcing it in to production. [Link]

Recession Effects

Quantifying the Adpocalypse by Value Mule (Medium)

Some interesting figures on the huge blow to ad spending that the recent decline in economic activity, with implications for the broader economic outlook as well. [Link]

The most exposed workers in the coronavirus recession are also key consumers: Making sure they get help is key to fighting the recession by Christina Patterson (Equitable Growth)

The demographic groups who are most likely to lose income during recessions are also the groups most likely to spend (rather than save) additional income. In short, making sure these groups don’t lose income is a powerful tool for keeping consumer spending up. [Link]

Essential Services

New York’s Kings of Clean by Tunk Varadarajan (WSJ)

The physically challenging and critically important work of municipal sanitation workers is coming into new light during a period of extreme stress and dislocation thanks to the coronavirus. [Link; paywall]

Grocery Revolution

‘I Just Need the Comfort’: Processed Foods Make a Pandemic Comeback by Julie Creswell (NYT)

Comfort foods like Chef Boyardee, Spaghetti-Os, lasagna, ice cream, Hamburger Helper, and Yoplait are getting huge demand bumps after years of declining sales. [Link; paywall]

A student created a computer program that tells you when an Amazon Fresh or Whole Foods delivery slot opens up by Todd Haselton (CNBC)

Amazon and other food delivery services often offer no space for pickups, but a quick script written by a Georgetown student allows users to book a delivery slot by constantly watching the sites. [Link]

High Yield

Billionaire Fertitta Offers Record 15% Loan Rate to Save Empire by Davide Scigliuzzo and Jeannine Amodeo (Bloomberg)

The owner of Golden Nugget casinos and Landry’s restaurants is paying a 15% coupon to sustain its business with a $250mm leveraged loan. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 4/9/20

This week’s Bespoke Report newsletter is now available for members.

There’s an old saying that uncertainty breeds opportunity, and if that’s the case, boy are there a lot of opportunities now. Let’s highlight some examples of how much uncertainty and confusion there is in the United States right now. For starters, the Baker, Bloom, and Davis US Economic Policy Uncertainty Index is currently at record highs, easily eclipsing peaks that were seen in prior periods of stress in the country. And what did the stock market do this week as Economic Uncertainty hit an all-time high? Rally more than 12% of course!

This week’s Bespoke Report covers all this week’s market events and discusses how they may impact performance going forward. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Chart of the Day: Best Week For The S&P 500 Since 1974

Bespoke’s Sector Snapshot — 4/9/20

Gold Up, Dollar Down

For a majority of the past year the US dollar has been fairly range bound, but the massive move away from risk assets more recently led to major buying for what is globally considered a safe haven currency. From its 52 week low and high on March 9th and March 20th, respectively, the dollar index rose 8.28%. But since that peak just before the equity market’s bottom, the dollar index has come back down; currently ~3.25% below that high.

With the dollar lower, another safe haven that tends to trade inversely has benefited: gold. Since late February, the yellow metal had struggled to break out to new highs, but this week it has finally broken out. Currently, gold is at its highest level since late 2012. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Claims Still High

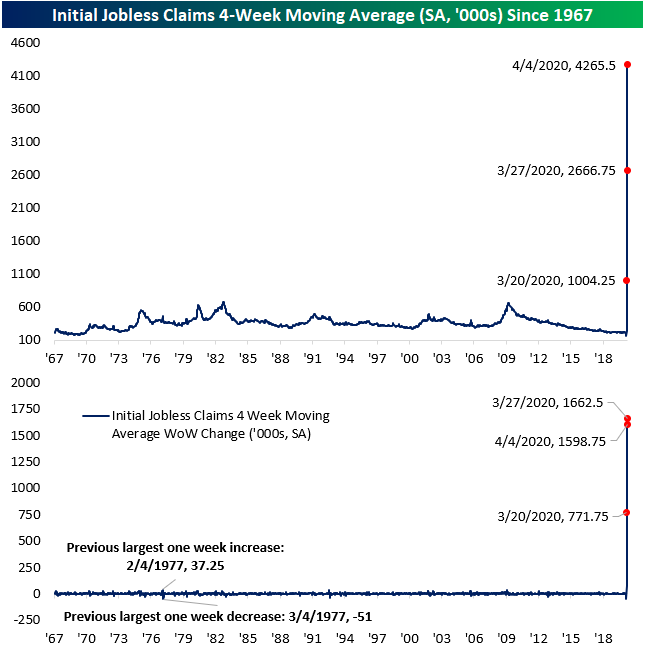

Jobless claims were forecast to come in at 5 million this week which actually would have been a significant improvement from last week. Instead, claims came in much higher at 6.606 million while last week’s number was revised up even higher to 6.867 million. That 261K decline over the past week surpassed the 141K decline back in July of 1992 for the largest weekly drop in claims on record. Granted, that does not mean too much given how high claims are and the fact that over the past three weeks there has been a total of over 16.78 million claims reported, or about 5% of the entire US population. Absolutely devastating.

Before seasonal adjustment, this week’s number looks even worse at 6.203 million. That is slightly higher than the 6.016 million last week which sets a new record.

As the low readings from before the massive claims spike continue to roll off of the four week moving average, the average has reached new record highs rising to 4.266 million. That 1.599 million increase from last week is only slightly smaller than the move the previous week. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup – 4/9/20 – Corona Friday a Day Early?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

With US markets closed for Good Friday tomorrow, it was looking like Corona Friday was coming a day early this week as US futures were indicating a decline of 1% at the open. Jobless claims were just released and came in at a level of 6.606 million versus forecasts of 5.0 million. That’s off last week’s record high, but still much higher than expected.

Right in sync with the release of jobless claims, the Fed is now just out with an announcement of adding $2.3 trillion in new loans to support the economy. Say what you want, but when the history of this is written, no one will be able to accuse the Fed of not going big. In response to the Fed’s announcement, futures have erased all of their declines and are now flat to slightly higher.

Read today’s Bespoke Morning Lineup for a discussion of the latest trends and statistics of the outbreak, an analysis of groups driving the rally in Europe this week, and a big drop in Machinery Tool Orders in Japan.

It was only a week or so ago that we were looking at a situation where there were just about no stocks in the S&P 500 that were overbought, while nearly all of them were oversold. That situation has changed a lot in the last few days. Through yesterday’s close, less than 10% of stocks in the S&P 500 were oversold, but at the same time, less than 10% of stocks in the S&P 500 were overbought as well. In other word’s right now the market is basically in no man’s land.

The Closer – No Way In – 4/8/20

Log-in here if you’re a member with access to the Closer.

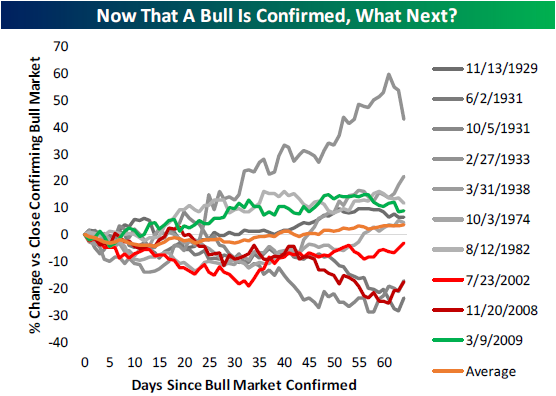

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we show how breadth has been lagging the indices’ gains over the past few sessions. Next, we take a look at what the official end of the bear market means before pivoting over to today’s 30 year bond auction. We then show the record increase in crude oil inventories and normalizing fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/8/20

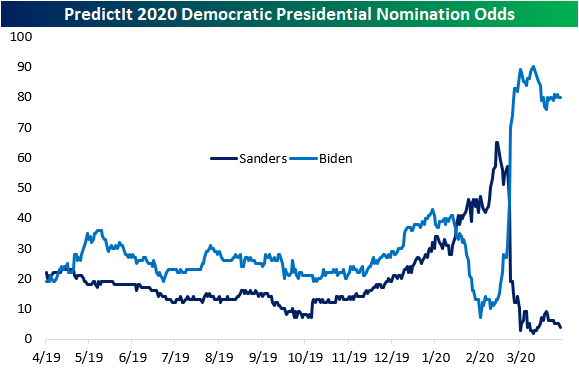

Health Care Gets No Booster Shot From Sanders

Bernie Sanders dropped out of the Presidential race today, and while his chances of ever securing the nomination were slim to none, his dropping out does reduce a small amount of uncertainty. The chart below illustrates this trend as the Vermont Senator’s odds to win have dropped dramatically since Super Tuesday.

As we have noted in the past, the odds of winning for the more progressive candidates on the Democratic ticket have typically had an inverse relationship to the Health Care sector’s performance because their policies are more likely to shake up the business model of companies in this sector. Despite that relationship, Health Care stocks saw little in the way of a boost from Sanders dropping out of the race. There wasn’t a single point in the trading day today where Health Care was the top-performing sector in the S&P 500, although its performance relative to the S&P 500 did pick up slightly in the afternoon after the Sanders announcement. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive tools.