Bespoke Stock Scores — 4/21/20

S&P 500 Dividend Yield vs. 10-Year Yield Blowout

With the dramatic plunge in equities in late February and March, the S&P 500’s dividend yield rose all the way up to a high 2.81% on the March 23rd low. The subsequent rally off of that March 23rd low has seen the dividend yield pull back to 2.15%. While dividend cuts on account of slowed business could result in that yield falling further as earnings season progresses, at the moment, the S&P 500’s yield remains far more attractive than that of US Treasuries which are historically low after the flight to safety recently. As of today, the 10-Year Treasury only yields 55 bps which is just off of the March 9th low of 54.07 bps.

On March 23rd the difference between the S&P 500’s dividend yield and that of the 10-Year Treasury was around 1.915 percentage points; the most in the past half century. Today the spread has narrowed a bit to 1.59 percentage points, but as shown below, that still remains wider than anything we’ve seen over the last 50 years. Start a two-week free trial to Bespoke Premium to access our full range of research and interactive tools.

Health Care Leading in New Highs

Breadth was pretty lackluster yesterday with only about 15% of the S&P 500 finishing the day higher. Despite this, of the stocks that did rise, there were a handful that reached new 52-week highs. As shown below in charts from our Daily Sector Snapshot, with yesterday being no exception, recently the stocks reaching 52-week highs have been predominately concentrated in the Health Care sector which saw a net of 10% of its stocks at new highs yesterday. Meanwhile, Technology and Consumer Staples were the only other sectors that saw an uptick in net 52-week highs yesterday. While there were no other highs across each of the other sectors, there was not an increase in 52-week lows either. In other words, for the most part, S&P 500 stocks are now trading somewhere within the past year’s range rather than breaking out or down.

The charts below are from the 52-week highs screen at our Chart Scanner tool. These are the 10 S&P 500 stocks that broke out to new 52-week highs yesterday. Most of these have been in uptrends for the past year while the recent spike in volatility has ended patterns of sideways trends for others like Abbot Labs (ABT) and General Mills (GS). As previously mentioned, the bulk of these stocks are Health Care names including Abbott Labs (ABT), Baxter (BAX), Incyte (INCY), Eli Lilly (LLY), Regeneron (REGN) and Vertex (VRTX). Additionally, Consumer Staples stocks benefiting from the COVID economy like major grocery chain Walmart (WMT) and food manufacturer General Mills (GIS) also make the list. Start a two-week free trial to Bespoke Institutional to access our Chart Scanner, custom screens, and much more.

Not Your Typical Tuesday. Or Is It?

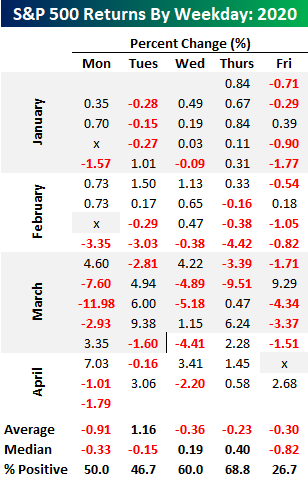

While every other day of the week has seen multiple gaps down of more than 1.5% since the peak in February, today is the first time in that span that there will be a gap down of more than 1.5% on a Tuesday. Given the lack of big gaps down, Tuesdays have also seen the strongest average return of any weekday so far in 2020. While every other day of the week has averaged declines, Tuesday has seen an average gain of 1.16%. That’s quite a disparity!

While average returns for Tuesday relative to other weekdays have been stellar, it doesn’t tell the whole story. The table below shows the S&P 500’s daily returns so far in 2020. Looking at the individual occurrences, Tuesdays have actually been up days less than half of the time. If it wasn’t for three strong Tuesdays in the month of March, returns for the second trading day of the week wouldn’t be nearly as positive.

Looking at median returns instead of averages shows how Tuesdays haven’t been nearly as strong as they seem. Looked at this way, Tuesday’s median decline of 0.15% ranks right in the middle of the pack behind gains for Thursday and Wednesday but well ahead of the 0.33% decline for Mondays and the 0.82% decline on “Corona Fridays”. Outside of a couple of outliers, Fridays have not been a good day for equities this year. Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.

Chart of the Day: S&P 500 (SPY) Gaps Down of 1.5%+

Bespoke’s Morning Lineup – 4/21/20 – No Turnaround in Equities

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

If you were banking on another turnaround Tuesday following Monday’s declines, it’s not looking that way as of now. A lot can change between now and the close, or for that matter, the open, so we’ll see how it plays out. In earnings news, there hasn’t been much to speak of, which was expected, and investors are generally taking a risk-off approach, sending the VIX back up towards the high 40s.

Read today’s Bespoke Morning Lineup for a discussion of the latest moves in the crude oil market, major earnings releases, the latest trends in the COVD-19 outbreak, and other stock-specific news of note.

The yield on the 10-year US Treasury is down 5 basis points (bps) this morning to a yield of just 0.55%. While that is nowhere near the recent low of 31 bps from early March, on a closing basis, it’s close to new lows. As shown in the chart below, the only day that the yield was lower on a closing basis was on 3/9 when it finished the day at 54 bps- a level that’s certainly within striking distance. In a world where treasury yields are near record lows and crude oil is up over 90% on the day (sort of) and still at negative levels, it’s understandable that the equity market would be under pressure.

The Closer – WTI: Two Truths & A Lie – 4/20/20

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we delve deep into the historic drop into negative crude oil prices today. We look at where else saw negative prices and who is to benefit from the chaos. Next we show just how few companies are providing guidance and how the few largest companies are impacting the market.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Daily Sector Snapshot — 4/20/20

S&P 1500 Sector Weightings — Energy Now the Smallest

With oil prices continuing to plunge, the Energy sector is now officially the smallest of the eleven major sectors in the S&P 1500, which is made up of large-caps, mid-caps, and small-caps. Energy makes up just 2.63% of the S&P 1500, which is 2 basis points lower than the next smallest sector — Materials — at 2.65%. Real Estate and Utilities are the next smallest sectors with weightings of 3.41% and 3.49%, respectively.

At the top of the food chain is Technology with a weighting of 24.78%, or about 10x the size of Energy. Health Care ranks second at 15.71%. Combined, Technology and Health Care make up more than 40% of the S&P 1500 in this new post-Covid world. The seven smallest sectors have a combined weighting that is still less than the weighting of Tech and Health Care.

Even more remarkable is how big some of the largest individual companies are compared to entire sectors of the economy. Below we show the market cap of the entire S&P 1500 Energy, Materials, Real Estate, and Utilities sectors versus the market caps of the four largest stocks in the S&P 1500 — Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), and Alphabet (GOOGL). Microsoft is now nearly two times as large as the entire Energy and Materials sectors, or put another way, the entire Energy and Materials sectors combined are just barely larger than Microsoft (MSFT). Apple and Amazon as well are both larger than the four smallest sectors of the market. And for Alphabet (GOOGL), its market cap puts it right in between the size of the entire Materials and Real Estate sectors. Combined, the four largest stocks make up about 17% of the S&P 1500, while the four smallest sectors in the index make up just 12.2% of the index. There are 339 individual stocks across the four smallest sectors in the S&P 1500. Start a two-week free trial to Bespoke Institutional to access our full range of research and interactive tools.