Lenin’s Investment Insights

“There are decades where nothing happens and there are weeks where decades happen.” – Vladimir Lenin

Today marks the 10th anniversary of Tesla’s entry in the public equity market when it opened for trading after pricing its IPO at $17 per share on 6/28/10. By all accounts, Tesla’s IPO was a success. The stock rallied 40% on its first day of trading providing a boost for Elon Musk, who had declared only four months earlier that he was broke. In spite of the company’s strong showing in its IPO, then like now, there was a fair amount of skepticism towards the stock. One analyst questioned whether Tesla would be able to produce more than “a handful of these – if any – in 2012” while others cited looming competition from the Chevy Volt as a threat to the upstart. With the benefit of hindsight, these concerns were obviously unwarranted.

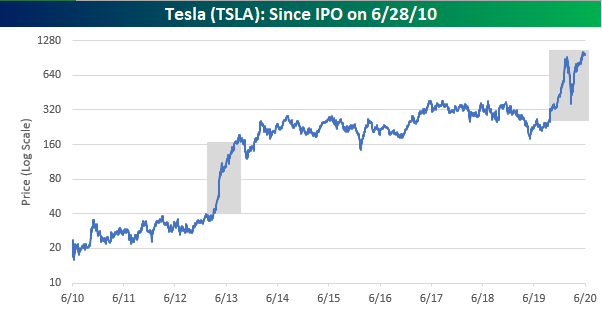

While Tesla’s stock performance has been a home run since the IPO, it hasn’t been a steady climb higher. The chart below shows Tesla’s performance since its IPO on a log scale where each horizontal gridline represents a doubling of the stock. You wouldn’t normally think to take investing advice from Vlad Lenin, but the quote above does a decent job summing up the performance of Tesla’s stock since its IPO. From the time of its IPO in 2010 through early 2013, Tesla’s stock rallied, but it wasn’t until Spring 2013 where the stock really took off, rising from around $40 to $160 in the span of five months. Then from there, the stock practically went into hibernation from late 2013 right up until late 2019 when it once again surged from under $320 to over $1,000. In other words, roughly 90% of Tesla’s gains have been confined to 10% of its trading as a public company (gray boxes). There have been years where Tesla’s stock has been dead money, but there are weeks where decades of gains have been achieved.

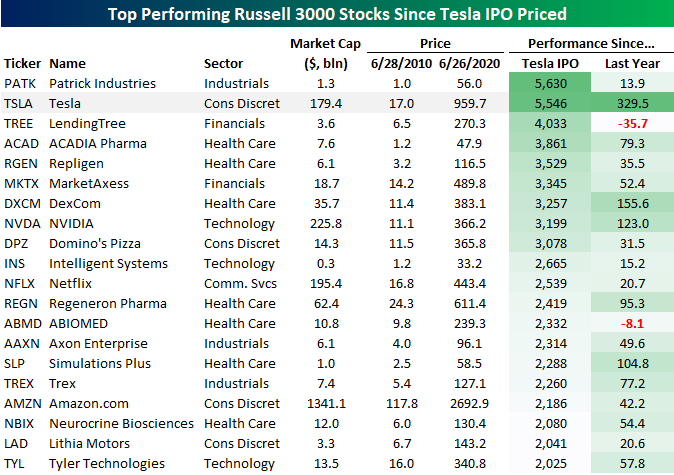

Given it has added two zeros to its share price in the last decade, it should come as no surprise that Tesla has been one of the top-performing stocks in the Russell 3000 since its IPO, but surprisingly it’s not the best. The table below lists the 20 stocks in the Russell 3,000 that have rallied more than 2,000% since Tesla’s IPO priced on 6/28/10. Of these twenty ‘twenty-baggers’, the only one that has outperformed Tesla is Patrick Industries (PATK). While not nearly as sexy as cutting edge electric vehicles, PATK has marginally outperformed Tesla with steady growth in the production and distribution of building products and materials for the RV, manufactured housing, and marine markets. Behind Tesla, Lending Tree has ‘only’ tacked on 4,033% since Tesla’s IPO, but up until recently, it was ahead before falling more than 35% as Tesla tripled in the last year.

Looking at the other big winners in the last ten years, like Tesla (TSLA), there are a number of names like NVIDIA (NVDA), Domino’s (DPZ), Neflix (NFLX), and Amazon.com (AMZN) that all of us have heard of. The majority of names, though, most of us have never heard of. This goes to show that the biggest gains in the stock markets don’t usually come from the names everyone is already talking about, but instead under-the-radar names that operate in the shadows of the ones sucking up all the oxygen. Like Tesla, what a lot of these names have in common is that in most cases the road higher was far from steady. Instead, it was filled with periods of declines or sideways trading where impatient holders of the stocks likely lost conviction and moved on to the newest flavor of the month. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 6/29/20 – A Fresh Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

It’s a fresh start to what will be a shortened holiday week with US markets closed on Friday in observance of July 4th. Even with a shorter week, though, there’s a ton of economic data on the calendar with the usual end of the month/early month reports, including a simultaneous release of both Jobless Claims and the Non-Farm Payrolls report on Thursday at the 8:30 Eastern.

After a poor end to the week Friday, things are a little better in the pre-market with futures firmly in the green as Boeing (BA) trades up over 5% on news that it will resume 737 Max certification flights today. That opens up the path for the place to resume commercial flights, so now all the planes will need is passengers.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, European markets and data, global and national trends related to the COVID-19 outbreak, and much more.

Depending on the day it falls on, the days leading up to and after the July 4th holiday have historically been a quiet time for the market as a lot of Americans either take a day or two off before or after the holiday. With most of the country still under some form of social distancing restrictions this year, the typical holiday hotspots aren’t likely to be nearly as bustling this year, so this year’s July 4th is unlikely to be anything even close to resembling normal.

With the usual caveats in place, we would note that the period leading up to July 4th and the Summer months have, in recent history, been pretty positive for the equity market. The image below is from our Seasonality Tool and it shows the S&P 500’s median one week, one month, and three-month returns from the close on 6/29 over the last ten years. With a median gain of 1.32%, the S&P 500’s one-week return over the last ten years ranks in the 93rd percentile versus all other one-week periods throughout the year. One month later, the median return moves up to 2.58% which ranks in the 87th percentile. Three months later, the median gain comes in at just under 4%, which still ranks strong in the 78th percentile versus all other rolling three-month periods throughout the year.

Bespoke Brunch Reads: 6/28/20

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2020 Annual Outlook special offer.

Investing

Free Trades, Jackpot Dreams Lure Small Investors to Options by Gunjan Banerji and Alexander Osipovich (WSJ)

Inexperienced traders are piling into options as well as single-stock trading, fueled by high volatility and cheap commissions. [Link; paywall]

Announcing STOCKHISTORY by Kaycee Anderson (Microsoft)

The development team behind Microsoft Excel has introduced a new feature which allows users to pull stock price data into spreadsheets using native functions. [Link]

COVID

How the Virus Won by Derek Watkins, Josh Holder, James Glanz, Weiyi Cai, Benedict Carey and Jeremy White (NYT)

A breathtaking set of graphics that illustrate the spread of the coronavirus through the United States over the last several months, using viral DNA to track the movement of the virus through space and time. [Link; soft paywall]

Back to School With Covid-19 Rules: Temperature Checks, Few Sports and Lots of Distance by Lucy Craymer and Andrew Jeong (WSJ)

While the US is still amidst summer holidays, other parts of the world have returned to school after COVID-driven closures, and things look nothing like the world that students left behind back in the winter. [Link; paywall]

Economics

Vast Federal Aid Has Capped Rise in Poverty, Studies Find by Jason DeParle (NYT)

The enormous wave of stimulus checks and unemployment insurance payments which have kept the economy afloat since COVID hit have had a side-effect: pulling people out of poverty even as unemployment surges. [Link; soft paywall]

Black Lives Matter Protests, Social Distancing, and COVID-19 by Dhaval M. Dave, Andrew I. Friedson, Kyutaro Matsuzawa, Joseph J. Sabia, and Samuel Safford (NBER)

In a remarkable case of unintended consequences, it appears that Black Lives Matter protests didn’t substantially increase transmission of COVID-19 because protestors only slightly increased transmission while non-protestors stayed home, leading to no net increase in infections. [Link]

Why a small town in Washington is printing its own currency during the pandemic (The Hustle)

In an effort to provide liquidity, a small town has started printing its own currency for use inside its local economy, facilitating transactions without incurring outside liabilities. That approach is one that was used widely during the Great Depression. [Link]

Sports

NFL To Tarp Off Lower Rows Of Seats, Allow Teams To Sell Signage To Local Sponsors by Ben Fischer (Sports Business Daily)

A new NFL ticketing plan would see lower rows sealed off for fans, with advertising visible to TV viewers replacing that part of the stadium. [Link]

Food

What’s Gotten Into the Price of Cheese? by Matt Phillips (NYT)

COVID has massively disrupted supply chains in the dairy industry and the result has been massive volatility in an obscure corner of the futures market that trades cheese. [Link; soft paywall]

Conspicuous Consumption

A New Card Ties Your Credit to Your Social Media Stats by Arielle Pardes (Wired)

Social media influencers who aren’t able to get enough credit are the target market for the Karat Black Card, which will take into account social media account followers when evaluating credit decisions. [Link]

The Secret Economics Of A VIP Party by Ashley Mears (The Economist 1843)

Bottle service and prime tables can lead to six or seven figure tabs, but the real currency of the high end club scene are the young women who frequent it. [Link]

Tech Wreck

For tech-weary Midwest farmers, 40-year-old tractors now a hot commodity by Adam Belz (Minneapolis Star Tribune)

Farmers are opting for used tractors instead of relying on newer models that require a dealer to fix any issue thanks to internet-enabled components. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — Can’t Escape COVID

This week’s Bespoke Report newsletter is now available for members.

It was another bout of Friday selling which took stocks to new two week lows this week, led lower by banks in the wake of Federal Reserve stress tests that limited buybacks and dividends. In the background, surging case counts across the US Sunbelt are driving market concern over how the virus can be contained along with the impact on the economy. We take a look at the outlook for the economy and markets in depth, as well as reviewing the US political and policy outlook in this week’s Bespoke Report.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 6/24/20

Share Price Performance

The US equity market made its most recent peak on June 8th. From the March 23rd low through June 8th, the average stock in the large-cap Russell 1,000 was up more than 65%! Since June 8th, the average stock in the index is down more than 11%. Below we have broken the index into deciles (10 groups of 100 stocks each) based on simple share price as of June 8th. Decile 1 (marked “Highest” in the chart) contains the 10% of stocks with the highest share prices. Decile 10 (marked “Lowest” in the chart) contains the 10% of stocks with the lowest share prices. As shown, the highest priced decile of stocks are down an average of just 4.8% since June 8th, while the lowest priced decile of stocks are down an average of 21.5%. It’s pretty remarkable how performance gets weaker and weaker the lower the share price gets. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Stocks for the COVID Economy

Russell 1,000 Decile Performance Since the 6/8 High

Nasdaq – Russell Spread Pulling the Rubber Band Tight

The Nasdaq has been outperforming every other US-based equity index over the last year, and nowhere has the disparity been wider than with small caps. The chart below compares the performance of the Nasdaq and Russell 2000 over the last 12 months. While the performance disparity is wide now, through last summer, the two indices were tracking each other nearly step for step. Then last fall, the Nasdaq started to steadily pull ahead before really separating itself in the bounce off the March lows. Just to illustrate how wide the gap between the two indices has become, over the last six months, the Nasdaq is up 11.9% compared to a decline of 15.8% for the Russell 2000. That’s wide!

In order to put the recent performance disparity between the two indices into perspective, the chart below shows the rolling six-month performance spread between the two indices going back to 1980. With a current spread of 27.7 percentage points, the gap between the two indices hasn’t been this wide since the days of the dot-com boom. Back in February 2000, the spread between the two indices widened out to more than 50 percentage points. Not only was that period extreme, but ten months before that extreme reading, the spread also widened out to more than 51 percentage points. The current spread is wide, but with two separate periods in 1999 and 2000 where the performance gap between the two indices was nearly double the current level, that was a period where the Nasdaq REALLY outperformed small caps.

To illustrate the magnitude of the Nasdaq’s outperformance over the Russell 2000 from late 1998 through early 2000, the chart below shows the performance of the two indices beginning in October 1998. From that point right on through March of 2000 when the Nasdaq peaked, the Nasdaq rallied more than 200% compared to the Russell 2000 which was up a relatively meager 64%. In any other environment, a 64% gain in less than a year and a half would be excellent, but when it was under the shadow of the surging Nasdaq, it seemed like a pittance. Like what you see? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 6/26/20 – Drifting Lower

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

After trading near the flat-line just a short time ago, futures have been drifting lower, but even after these declines, the S&P 500 is only poised to erase less than half of its last hour gain in yesterday’s session. Financials are leading the weakness following the release of last night’s stress test results. Looking ahead to today, the only economic data of note is Personal Income (less bad than expected) and Spending (lower than expected) as well as Michigan Sentiment. While it’s not economic data, per se, daily updates from states on the status of COVID are also likely to move markets heading into the weekend.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, a discussion of last night’s stress test results, European markets and data, global and national trends related to the COVID-19 outbreak, and much more.

Outside of the Nasdaq 100, every one of the index ETFs in our Trend Analyzer are down YTD with small caps leading the way. While the Nasdaq 100 is up over 15%, the Russell 2000 is down by almost that amount. When it comes to US indices this year, it’s definitely been a tale of two cities.

The Russell 2000 has been a laggard on the year, but it has formed a nice and steady uptrend off the March lows. At the moment, though, it’s testing that level after just testing it two weeks ago. While there have been plenty of tests of that uptrend line over the last three months, every other time we have retested this trend line it came after the Russell made a higher high. This time, though, the test is coming from a lower high. Definitely keep this chart on your radar as the lower high could be signaling a loss of momentum.