ISM Manufacturing Returns to Expansion

Last month, ISM’s headline manufacturing number saw a slight rebound rising from the April low of 41.5 to 43.1. That indicated that activity was still worsening in May albeit at a slower pace than April. Fast forward to June’s reading released this morning and ISM’s manufacturing report showed a huge rebound in activity with the headline index rising 9.5 percentage points to 52.6. That is the headline index’s highest reading since March of last year and was also the first back to back increases since June 2018. A reading above 50 also indicates the first expansionary reading in the manufacturing sector since February. Lastly, perhaps most notable about today’s report was that the 9.5 point m/m increase was also the third-largest on record behind a 10.5 point increase in August of 1980 and a 12.1 point jump all the way back in August of 1952.

Respondent commentary reinforced the rebound with most making some mention of demand or production improving in June. Important to note, while they point to improved conditions from the past few months, that is not to say activity has necessarily returned to pre-COVID levels. In fact, one comment out of the Chemical Products industry reported that it ha been a “slow recovery” and the Petroleum & Coal Products industry mentioned that things are still “below normal volumes”. Regardless, as the commentary from a Plastics & Rubber Products respondent put it, things are still “trending toward normal”. In other words, things are back on the right track, but activity has not fully recovered.

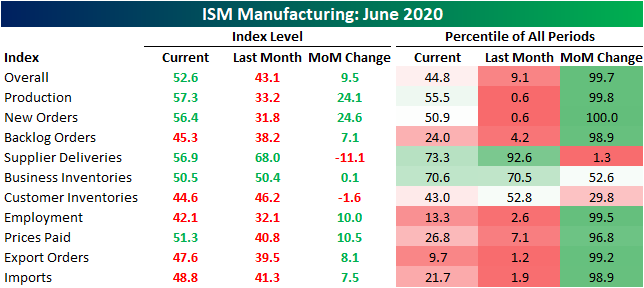

Taking a look across the various sub-indices of the report, the headline number was not alone in terms of historic monthly rebounds. Outside of the inventories index, every indices’ MoM rise was in the upper 90th percentiles of all readings. Now 6 of the 11 indices are showing expansionary readings compared to just two last month.

As previously mentioned, production has been ramping back up with the index rising to 57.3, its highest level since November of 2018. The only larger one month jump in production was in August of 1952 when the index rose 46.8 percentage points. Meanwhile, New Orders saw its largest one month increase on record. Granted that only leaves it in the dead middle of its historic range while backlog of orders are still in contraction for a fourth consecutive month. One interesting point of the data recently has been the index for Supplier Deliveries. Recent months have seen very elevated readings indicating longer delivery times meaning supply chains have appeared to have been disrupted. While this month’s reading of 56.9 still indicates longer delivery times, it is a much healthier reading pointing to at least some stabilization. The MoM decline of 11.1 percentage points was also the largest decline since May of 1979.

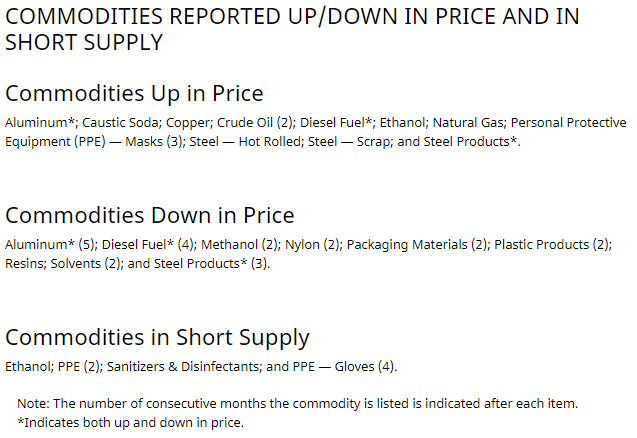

One final note on this month’s report concerns the commodities survey where businesses report price increases and decreases. As could be expected in a pandemic environment, protective equipment remains in short supply and up in price. Meanwhile, many cyclical products are also seeing higher prices indicating strengthened demand. For example, cyclical metals like copper and steel are up in price in addition to various fuels. That further reinforces the overall uptick in economic activity. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Consumer Pulse Report — July 2020

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

July Market Seasonality

At the start of each month, we send members our seasonality report that highlights the historical performance of the US stock market by month. In our July report published yesterday, we highlighted the chart below which shows the Dow’s average change by month over the last 100, 50, and 20 years. One notable trend is that over the last 20 years, the Dow has actually averaged declines in half of all months. The summer months have been particularly negative, but July is the one month that stands out on the bullish side. As shown in the table, July is the only month from May through September that has averaged gains over the last 20 years, and the average gain has been quite strong at 1.32%. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – The Best 100 Days in Over 80 Years

Bespoke’s Morning Lineup – 7/1/20 – Slow Start to the New Quarter

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

It’s a new quarter for the market, and investors appear to be suffering a bit of a hangover after last quarter’s big gains. ADP Private Payrolls were just released and came in weaker than expected (2.369 million vs 2.900 million). In any other environment, a miss of over half a million payrolls relative to expectations would have been newsworthy by itself, but when you’re dealing in millions, what’s a few hundred thousand between friends?

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, PMI Manufacturing data for June, global and national trends related to the COVID-19 outbreak, and much more.

When we first started putting the table below together this morning, SPY was indicated to open down by over half of one percent, but as of now, the margin of decline has been cut in half. Therefore, we have expanded the table to show all days where SPY opened a new quarter with a downside gap of 0.25% or more. Time will tell, but by the time the opening bell rings, we may not even be at that level.

While first impressions in these quarters weren’t very good, SPY’s performance from the open to close tended to be positive with an average gain of 0.38% (median: 0.42%) and positive returns over 70% of the time. For the rest of the quarter, performance was even better as the SPY averaged a gain of 5.40% (median: 6.94%) with gains over 80% of the time. Also, keep in mind that the largest downside gap to open a quarter was last quarter on April 1st when SPY gapped down over 3.5%. That certainly ended up being an April Fools’ joke as SPY rallied more than 25% from the close on 4/1 through yesterday’s close.

Daily Sector Snapshot — 6/30/20

B.I.G. Tips – Huge Quarterly Gains; July Seasonality

“Hodl” Off For Now

Unless we’re talking about long-term US treasuries which were modestly lower in Q2, just about every other asset class was higher. Among those, bitcoin was no exception. During Q2 alone, bitcoin was up slightly more than 40%, which is impressive even for a volatile asset class like cryptocurrencies. While bitcoin’s performance was very strong, though, closing out the quarter, there was a feeling of disappointment that it didn’t finish off the quarter even stronger.

Two things left bitcoin ‘hodlers’ looking for more. First, while the price briefly eclipsed $10,000 during the quarter, it wasn’t quite enough to take out the highs from February. Second, from a longer-term perspective, the intraday high of ~$10,400 on June 4th coincided nearly perfectly with bitcoin’s downtrend line from its record high back in late 2017 when crypto was all the rage. Until bitcoin can take out either its downtrend or make new highs for the year, investors may be best served to wait on the sidelines. Click here to view Bespoke’s premium membership options for our best research available.

Nasdaq to Russell 2,000 Ratio

Last week we compared the recent performance of the Nasdaq to the small-cap Russell 2,000. Below is a look at the relative strength between the Nasdaq 100 and the Russell 2,000. The chart shows the ratio of the Nasdaq 100 to the Russell 2,000 since 1985. In the late 90s, the Nasdaq soared versus the Russell, with the ratio rising from 1:1 in the mid-80s up to 8+ at the peak of the Dot Com bubble. The ratio came crashing back down to the low 2s in the mid-2000s, but it has been on a steep upward trajectory for the last 12 years.

Over the first two months of 2020, with small-caps underperforming and the Nasdaq outperforming, the ratio spiked more than two points from ~5 up to 7.5 at its recent peak. We’d note, however, that since the Covid Crisis hit, we’ve seen the ratio trade sideways in what looks to be a peak for the time being. One day small-caps will have their day in the sun again, it’s just a matter of how long it takes for that to happen. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Market Calendar — July 2020

Please click the image below to view our July 2020 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.