B.I.G. Tips – Big Drops in Gold and Silver

Chart of the Day: Rotation Underway

Bespoke’s Morning Lineup – 8/12/20 – Summer Reruns

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“From neither the White House nor any other senior administration post would there come any leadership, any attempt to set priorities, any attempt to coordinate activities, any attempt to deliver resources.” – John M. Barry, The Great Influenza

In reading the quote above, critics of the President would think that it’s a description of the current attitude in the White House towards the Covid-19 outbreak. It’s actually from the book, The Great Influenza: The Story of the Deadliest Plague in History. Back in 1918. Amazingly, President Wilson never made a single public statement related to the flu pandemic and acted like it never happened and instead had a singular focus on mobilizing the country for WWI.

In looking at today’s “Overnight Trading” chart from the Morning Lineup, it looks the exact same as yesterday’s chart. For the sake of the bulls, let’s hope that today’s intraday trading for US stocks isn’t a re-run of Tuesday as well.

Joe Biden’s selection of Kamala Harris wasn’t particularly surprising to the market as she was already considered one of the leading contenders along with Susan Rice, and the pick makes sense for Biden as Harris will likely be solid on the campaign trail and go after Trump in the way that a VP candidate is expected to. While the selection isn’t likely to provide much of a boost for Biden, at this point it likely won’t hurt him either. Harris wasn’t exactly successful as a Presidential candidate in her own right, but back in 2008 neither was Biden and that didn’t hurt Obama.

On the inflation front, after yesterday’s PPI doubled expectations (+0.6% vs 0.3% forecast), today’s CPI for July saw the exact same print on a headline basis relative to the same consensus expectation for an increase of 0.3%.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

Since last Thursday’s close, the S&P 500 is down 0.46%, but the decline has been far from broad-based. As shown to the right, four sectors are up over 1% during that period with Industrials and Financials both rallying more than 4%. On the downside, Technology has been the main drag with a drop of over 3.6% while Communication Services has dropped 1.8%. Of the 500 stocks in the index, nearly two-thirds are actually up during that span, so the vast majority of stocks in the index and the US for that matter have risen during this period.

Daily Sector Snapshot — 8/11/20

Bespoke Stock Scores — 8/11/20

B.I.G. Tips – New Highs In Sight

Whether you want to look at it from the perspective of closing prices or intraday levels, the S&P 500 is doing what just about everybody thought would be impossible less than five months ago – approaching record highs. Relative to its closing high of 3,386.15, the S&P 500 is just 0.27% lower, while it’s within half of a percent from its record intraday high of 3,393.52. Through today, the S&P 500 has gone 120 trading days without a record high, and as shown in the chart below, the current streak is barely even visible when viewed in the perspective of all streaks since 1928. Even if we zoom in on just the last five years, the current streak of 120 trading days only ranks as the fourth-longest streak without a new high.

While the S&P 500’s 120-trading day streak without a new high isn’t extreme by historical standards, the turnaround off the lows has been extraordinary. In the S&P 500’s history, there have been ten prior declines of at least 20% from a record closing high. Of those ten prior periods, the shortest gap between the original record high and the next one was 309 trading days, and the shortest gap between highs that had a pullback of at least 30% was 484 tradings days (or more than four times the current gap of 120 trading days). For all ten streaks without a record high, the median drought was 680 trading days.

Whenever the S&P 500 does take out its 2/19 high, the question is whether the new high represents a breakout where the S&P 500 keeps rallying into evergreen territory, or does it run out of gas after finally reaching a new milestone? To shed some light on this question, we looked at the S&P 500’s performance following each prior streak of similar duration without a new high. To read the report, start a two-week free trial to Bespoke Premium today.

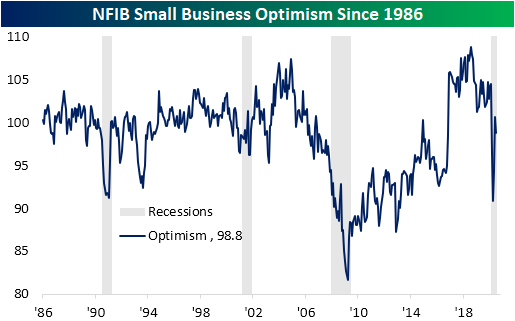

Small Business Split

After two months of some of the largest gains to small business confidence on record, NFIB’s Small Business Optimism index pulled back slightly in July. The index fell 1.8 points to 98.8 which was also below expectations of a reading of 100.5. While lower sequentially and still well off the highs from prior to the pandemic, July’s level of 98.8 was less than half a point from the historic average for small business optimism of 98.4.

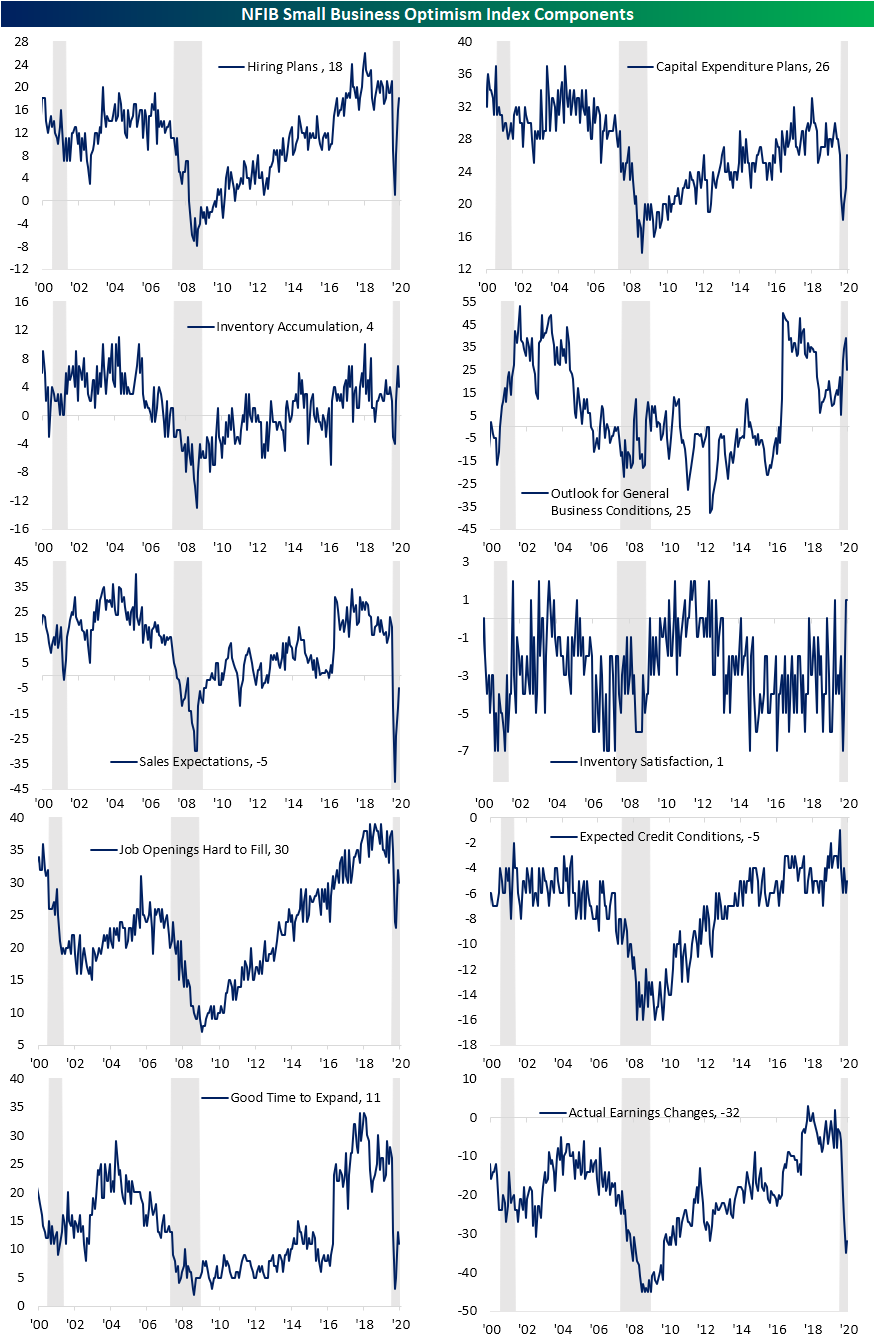

Overall, breadth was very mixed in the July report. Of the ten components of the headline index, four fell, one was unchanged and the other five rose. As the pandemic drags on, the most glaring decline weighing on the headline number was for expectations of improvements in the economy. Fewer companies reported now as a good time to expand (that index fell to 11 from 13 in June) and a net percentage of 25% expect the economy to improve compared to 39% in June. The 14 point decline is tied with an identical decline in August of 2011 for the seventh-largest MoM decline on record for that index, but it only leaves that component in the 81st percentile of all readings. In other words, small businesses are less optimistic for the future than they were in June, but on net are still expecting the economy to improve. That can be seen through hiring plans as a higher share plan to increase employment and increase capital expenditures with those indices rising 2 points and 4 points, respectively. On the other hand, fewer businesses plan to increase inventories as those expecting higher sales remains muted albeit improving. That can also be seen through the 3 point rise in the index for actual earnings changes. Fewer businesses were also reporting weak sales as the most pressing issue for business.

Additionally, although they are not inputs to the headline index, a record low of 26 percent reported borrowing on a regular basis, though, the cause of that does not appear to be due to credit availability. The index for credit availability was slightly higher in July and remains in the top 5% of all readings. The most important issues echo this as only 1% reported financials and interest rates to be the biggest issue; unchanged from last month. The biggest issue for businesses remains the quality of labor. That index rose from 19 in June to 21 in July. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Gold (GLD) Gaps Down

Bespoke’s Morning Lineup – 8/11/20 – New Highs Back in View

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Can we make it eight in a row? Based on this morning’s move in the futures, the DJIA and S&P 500 are both on pace to extend their current seven-day winning streaks to eight. The Nasdaq, meanwhile, is working on its own streak as it is on pace to underperform the S&P 500 for the third straight day.

In economic news, the NFIB Small Business Optimism report missed expectations, and PPI came in much higher than expected. That hotter than expected inflation data hasn’t had any impact on futures as of yet, though.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

As the S&P 500 sets its sights on new record highs, its cumulative A/D line has already set the path. With a number of positive readings in the last few days, the cumulative A/D line has broken out of its short consolidation range from the last couple of weeks. That’s an encouraging sign for the direction of the market going forward, even as tech starts to take a back seat.