Bespoke’s Morning Lineup – 9/10/20 – Heads or Tails?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Seek advice on risk from the wealthy who still take risks, not friends who dare nothing more than a football bet.” – J. Paul Getty

It’s that time of year again as the NFL is set to kick off its season this evening as it typically does every year on the first Thursday after Labor Day. The season will go off as usual with a full season, playoffs, and the Super Bowl LV on February 7, 2021. Why are we even talking about this? Because after six months of abbreviated seasons and canceled events in the world of sports, the return to a normal season for a major league is a step in the right direction. Some degree of normality in just a small part of their lives is what just about everyone could use right now. The Chiefs even plan to allow fans to the stadium for tonight’s game against the Texans. While ticket sales were capped at 16,000, for some teams these days, that’s a perfectly normal crowd.

In economic data this morning, jobless claims were higher than expected on both an initial and continuing basis, while revisions to last week’s report were minimal. On the inflation front, PPI came in slightly higher than expected. Futures were modestly lower on the S&P 500 and higher for the Nasdaq heading into the release and basically remained there after the report as well.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

Where the market goes from here in the short-term is basically a coin-flip, and the S&P 500 intraday chart from the last week has something for both the bulls and bears. On the bullish side, yesterday’s open broke what was starting to look like a downtrend from the high on 9/2. As the market rallied throughout the day yesterday, though, it ran out of steam right at Friday’s close. So until that level from Friday can be broken to the upside, the bears are on top.

Daily Sector Snapshot — 9/9/20

JOLTS Show Some Return To Normalcy

Today’s Job Openings and Labor Turnover Survey (JOLTS) report from the Bureau of Labor Statistics (BLS) on the flows in and out of jobs as well as the number of job openings was pretty encouraging. As shown in the first pair of charts below, the number of open jobs as a percentage of the labor force has surged back to pre-pandemic levels and is close to the very strong levels seen at the prior peak. This is a good sign that labor demand is holding up pretty well in aggregate.

Also encouraging is that while not at extreme lows, layoff and discharge rates are back to the levels they sat at in 2019. Instead of settling at a new higher level, the 1.4% private sector layoff and discharge rate is at the same level it was at numerous times during 2019 and the first two months of 2020. Hiring, which crashed and then surged as businesses started to reopen, was 4.1% the labor force in July. That was a stronger pace than any month in the history of the last expansion.

Finally, we think quit rates are about the best indicator of labor bargaining power available. As shown, they are bouncing and bouncing hard. They have not fully recovered from COVID’s hit, but the size and speed of the bounce is consistent with a very strong trajectory for labor markets relative to what other indicators (for instance, permanent job losses in the Employment Situation Report, or the level of unemployment claims) are saying. We will have more granular analysis of the JOLTS report tonight in The Closer. Click here to start a free trial and receive The Closer tonight with more analysis on the JOLTS report for July.

B.I.G. Tips — The Market? Or a Market of Stocks?

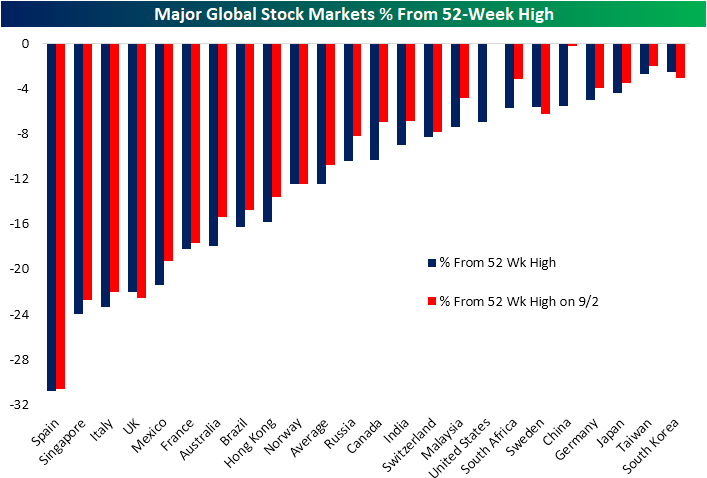

Pullback Seen Around the World

Through yesterday’s close, the S&P 500 has fallen just under 7% from its high on September 2nd. Compared to other major global stock markets that we track in our Global Macro Dashboard, only China has also fallen over 5% in the past week. The average global stock market of these 23 markets is down 1.8% since 9/2. Only three—South Korea, Sweden, and the UK—have risen in the past week. In other words, stocks have dropped around the globe but the US and China’s declines have far outpaced the rest of the world.

One interesting point of the past week is these declines have only brought US stocks off of their 52-week highs. As of last Wednesday, whereas US equities were at a record high, the average global stock market was over 10% below its 52-week high. As shown below, other than the US, the only other country that was within 1% of a 52 week high last week was China; the second-largest decliner in the past week. After those large declines in the past week, the US and China stand out far less than they did last week in terms of distance from 52 week highs.

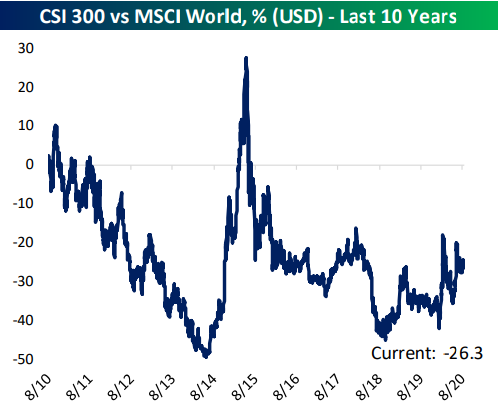

That dynamic of the US outpacing its global peers is nothing new though. As shown in the chart from our Global Macro Dashboard below, the US has consistently outperformed the rest of the world over the past ten years (a rising line indicates outperformance and vice versa). While its relative strength has been more mixed over the past ten years, China has similarly seen its equities outperforming recently. Click here to view Bespoke’s premium membership options for our best research available.

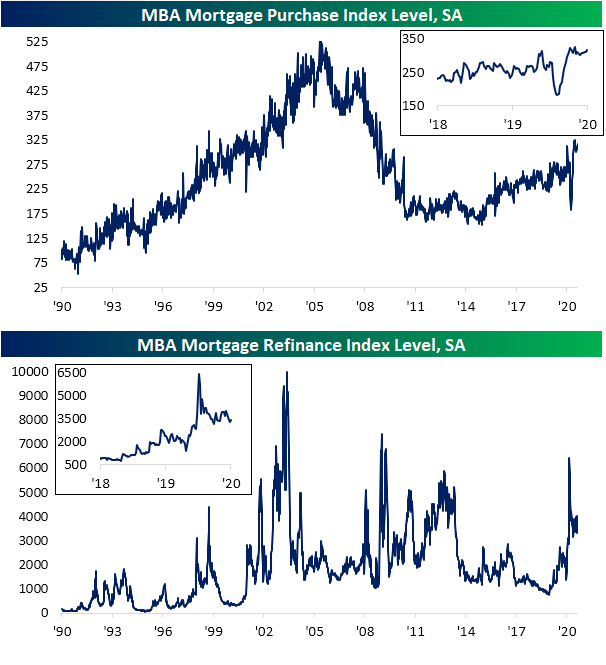

Housing Still Hot Headed Out of Summer

This morning, the Mortgage Bankers Association (MBA) released this week’s reading on mortgage applications. Seasonally adjusted purchases were up 2.6% from last week, rising to the highest level since the first week of July. In the past few months as housing activity has surged, other than that July reading, there was only one other time that purchases were stronger, and that was in the second week of June. In other words, purchase activity is once again on the rise after taking a bit of a breather in the summer months and is currently back to some of its strongest levels since early 2009. With rates staying low, refi activity similarly remains around some of its stronger levels of the past decade gaining nearly 3% this week. Granted, that is still in the range that the index for refinances has been in since the spring.

As shown in the charts below, on a non-seasonally adjusted basis, purchase applications continue to run well above trend. Even with the big decline that went against seasonal norms in the spring (first chart below), the index of YTD purchase applications has averaged 290.1 each week compared to 272.4 last year (second chart below); these are by far the strongest readings of the past decade. For every week since the mid-June 2020 peak (which was later in the year than usual due to pent up demand; denoted by the blue dot in the first chart below), purchase applications have been consistent with seasonal trends, but each week’s reading has been higher year over year by an average of over 24%. This week, thanks to the timing of the Labor Day holiday, the NSA purchase index rose by an even stronger 40% YoY which was by far the strongest reading of any week of this year.

Another housing indicator showing similarly strong demand that we touched on in last night’s Closer was the July version of Black Knight’s monthly Mortgage Monitor. Although it is at a greater lag than MBA’s readings, this was yet another data point pointing to strong housing demand as new originations in June (lagged an extra month to the rest of the report that covered the month of July) surged to over 1.3 million which was the highest reading since at least 2013; doubling year over year. The July Mortgage Monitor also indicated that delinquencies as a percentage of all loans have continued to improve, falling to 6.9% compared to its recent peak of 7.76% back in May. Albeit improved, the delinquency rate is still elevated at its highest levels since early 2013/late 2012. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke CNBC Appearance (9/9)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box this morning to discuss the outlook for large-cap tech stocks and the broader market. To view the segment, please click on the image below. Click here to view Bespoke’s premium membership options for the best market analysis available.

September Mean Reversion

In today’s Morning Lineup, we showed an update of our ETF Performance Matrix, which summarized the performance of key ETFs across asset classes on a YTD and MTD basis as well as since the March 23rd low. In looking through the matrix, it’s clear that much of the declines that equities have seen since the start of September have been a reversal of what we saw for equities coming off the March lows through now. As noted, the Nasdaq has been underperforming small caps this month, value has been outperforming growth across all market cap ranges, and international stocks are mostly outperforming US equities. From the March lows through the start of September, though, it was the Nasdaq, growth, and US stocks that were outperforming the small caps, value, and international stocks.

One way to illustrate this relationship is in a scatter plot below comparing the performance of each equity-related ETF in the matrix from the lows on 3/23 (y-axis) versus their performance in September through Tuesday’s close (x-axis). Looking at it this way, there is a pretty clear inverse relationship between performance over these two time periods. As another example, the top ten performing of the 50 equity related ETFs in the matrix so far this September had an average rank of 36 in their performance off the March lows. Conversely, the ten worst performing ETFs in the Matrix so far this month had an average rank of 16 in their performance of the march lows. Every dog has their day, and the ‘dogs’ of the market off the March lows have been holding up very well on a relative basis so far in September. Click here to view Bespoke’s premium membership options for the best market analysis available.

Chart of the Day: Nasdaq Falls 10% But Still Above 50-DMA

Remarkably, the Nasdaq 100 managed to fall 10%+ over the last three trading days and still close above its 50-day moving average! This data point highlights just how extended into overbought territory that the index was leading up to its recent drop. The only other times the index has seen a 3-day drop of 10%+ and still closed above its 50-DMA were on January 6th, 2000 and May 30th, 2001. Following the January 2000 occurrence, the index bounced back sharply over the next month (+21.6%), but ultimately peaked in March of that year and went on to enter an extended bear market. The May 2001 occurrence also saw a big bounce-back of 7% over the next week, but that was right in the middle of the bear market and the index rolled over by 14% over the next three months.

As shown below, the Nasdaq 100 has closed above its 50-day moving average for the last 103 trading days. There have only been nine prior streaks of 100+ days above the 50-DMA in the index’s history dating back to 1985. The 50-DMA will eventually break and the streak will come to an end, and in today’s Chart of the Day, we highlight how the Nasdaq performed in the days and weeks following the break below support at the 50-DMA. We also highlight how the index performed in the days and weeks following prior three-day drops of 10%+. If you’re wondering what history has shown following past moves that are similar to what we’ve just seen for the Nasdaq, today’s Chart of the Day is a helpful read. You can access the report with a two-week free trial to any of our three premium membership levels. CLICK HERE to start your free trial now.

Bespoke’s Morning Lineup – 9/9/20 – It’s All About Your Perspective

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“We’re not retreating, we’re advancing in reverse” –Skulduggery Pleasant, Playing with Fire by Derek Landy

After three tough days for US stocks where the Nasdaq has declined 10%, it has quickly turned into a tough September for US equity markets. This morning the picture for futures looks brighter, but the move has little in the way of a catalyst behind it, so traders aren’t exactly trusting the move at this point.

On the economic front, the only US report on the calendar is the July JOLTS report, but given it’s looking back at July, it shouldn’t have too much of a market impact.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, an analysis of Japanese Machine Tool Orders (a positive report), market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

Back at the end of August, we noted that a lot of equity indices and sectors were showing returns for the month of August that would normally be considered good years. September is now just five trading days old and returns this month have already in many cases been the equivalent of an entire bad month or in some cases even a bad year.

The Nasdaq 100’s 8%+ decline in just five trading days so far this September includes two trading days with gains to start the month off. To put this move in perspective, for an entire calendar year, the last time the Nasdaq 100 dropped over 8% was in 2008. Other indices covering the US equity markets have ranged from a 5% decline for the Russell 1000 to a loss of 3.12% for the Dow.

In the growth versus value matchup, value, for a change, has had the upper hand as ‘cheaper’ stocks outperform growth across all three market cap ranges.

Among individual sectors, Tech has led the way lower (-8.7%) followed by Energy, which is the only other sector down 5%.

In international markets, most countries have outperformed the US month to date so far, and Brazil has actually managed a gain of 1.7%.

One trend to note about performance so far in September is that it has essentially been the opposite of what we have seen since the March lows. In other words, the best performing ETFs from 3/23 through now have also been among the worst-performing ETFs since the start of September.