Daily Sector Snapshot — 12/30/20

Chart of the Day: Bitcoin “Pounds” Gold

Growth Dragging on Small Caps

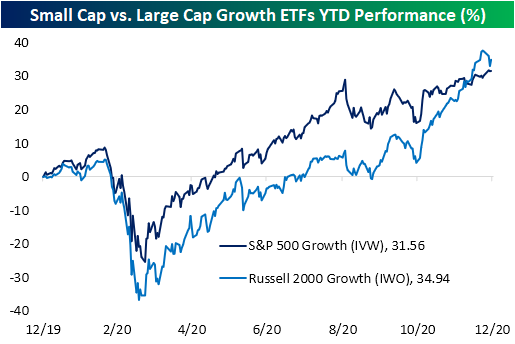

In the past couple of weeks, we have frequently been keeping tabs on small-cap equities which have been particularly strong performers of late resulting in very overbought readings as well as extended valuations. More specifically, taking a look at growth-oriented small-caps, with only a couple days left in the year small-cap growth stocks—proxied by the Russell 2000 Growth ETF (IWO)—are on pace to have outperformed large-cap equivalents in 2020. On December 10th, IWO surpassed the S&P 500 Growth ETF (IVW) in terms of YTD performance, and even after pulling back in the past week, IWO is still in the lead.

As a result of recent moves, there has been a sharp reversal on a relative basis between the two ETFs in the past week. In the chart below, we show the ratio of the Russell 2000 Growth ETF (IWO) versus the S&P 500 Growth ETF (IVW). This ratio took off beginning in the early fall meaning small-cap growth drastically outperformed large-cap growth. But the former’s weakness in the past several days has put a halt to that move.

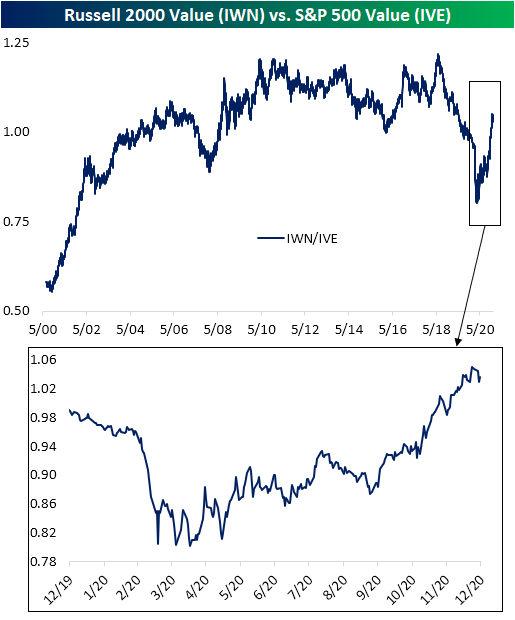

As to just how sharp of a reversal this was, in the five days through yesterday’s close, the decline in the ratio of IWO to IVW was the largest since June. Before that, April and March saw declines that were even larger. Not only was this one of the biggest drops in the relative performance of small-cap growth to large-cap growth in the past few months, but that also stands in the bottom 0.5% of all readings going back to 2000 when the ETF first began trading. Outside of this past spring, the only other periods that have also experienced this type of underperformance of small-cap growth relative to large-cap growth was at various points in 2011, 2008, and a handful of times in the early 2000s.

Small-cap underperformance has not necessarily been broad though. For value stocks, small caps (IWN) have generally outperformed large caps (IVE) for the entirety of the new bull market. While there was a bit of a turn lower in recent days, it has been nowhere close to as dramatic of a move as growth stocks.

In the charts below, we show average performance over the past week of Russell 2000 stocks broken into deciles based on their price to sales and price to book ratios. As shown, the most aggressively valued deciles have averaged the worst performance in the past week. Stocks with low P/S and P/B ratios have not been immune from the weakness, but they have held up significantly better. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Irrational Exuberance and Crash Confidence

Back-to-Back Big Years for Technology

With just two trading days (including today) left in 2020, the S&P 500 Technology sector is on pace for its second year in a row of rallying more than 40%. Going back to 1990, the only time the Technology sector experienced back-to-back returns of more than 40% was in 1998 and 1999. Back then, not only was the Technology sector up 40%+ in back-to-back years, but it was also up over 75% in both of those years. If you think markets are pretty crazy these days, they still have nothing on the last two years of the 1990s!

In terms of cumulative returns, the Technology sector is up 210% since the last trading day of 2018, whereas in 1999 it was up 317% in a two-year span. What’s also interesting to note about the last 31 years of returns for the Technology sector is how it has only experienced five down years, while the S&P 500 has been down in ten different years during that span. Furthermore, since 2009 there has only been one down year and the decline was a paltry 1.6%. Not a bad 12-year run!

Given that the sector has more than doubled in the last two years, there have been some big individual winners. Topping the list with a gain of just under 400% is Advanced Micro Devices (AMD). On the last day of 2018, AMD traded hands for under $20 per share. Today’s it’s over $90. AMD has a lead of more than 100 percentage points over the next closest stock – NVIDIA (NVDA) – which is up 288%. Interestingly, there aren’t a lot of major outliers to the upside compared to the sector’s 210% gain, but that’s because Apple (AAPL), the sector’s largest stock, has paced the sector’s gains by rallying more than 240%.

On the downside, just four stocks in the Technology sector have declined in the last two years. The worst of these has been DXC Technology (DXC) which has lost more than half of its value, while Juniper (JNPR) and HP Enterprise (HPE) are down between 10% and 20%. Lastly, FLIR Systems (FLIR) has declined less than 2%, so depending on how it acts in the next two days, it could move into positive territory just as Intel (INTC) did yesterday after Third Point bailed it out and moved the stock barely into positive territory for the last two years.

Bespoke’s Morning Lineup – 12/30/20 – Drifting into Year End

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Charity is injurious unless it helps the recipient to become independent of it.” – John D. Rockefeller

Futures are higher this morning, but there’s very little news to speak of impacting the markets. What else do you expect on the second to last trading day of the year. In Washington, it seems unlikely that the Senate will pass the $2,000 check proposal that President Trump and the House have been pushing for, but the $600 checks have already started hitting the bank accounts of Americans who qualify.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, an update on the latest national and international COVID trends, and much more.

In a post yesterday, we highlighted the Energy sector and how a number of stocks in the sector, as well as the sector ETF (XLE) that tracks it, have experienced golden crosses with respect to their 50 and 200-day moving averages in recent trading. Golden crosses are considered bullish technical patterns that occur when a security’s shorter-term moving average crosses up through a longer-term moving average as both are rising. While the Energy sector ETF has already experienced a golden cross, the sector hasn’t quite completed the pattern, although at this point it’s only a matter of time before it follows suit.

Golden crosses may be considered bullish technical patterns in theory, but do they work in practice? We took a look at that trend in today’s Morning Lineup. Sign up for a free trial to find out!

Daily Sector Snapshot — 12/29/20

Vaccine Makers: Buy the Rumor, Sell the News

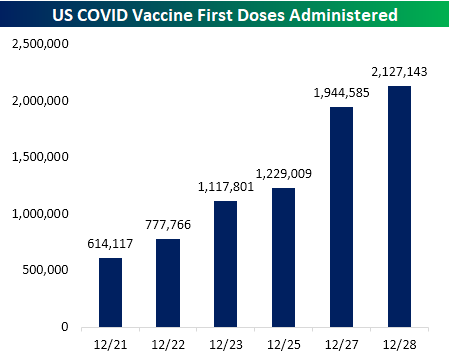

Vaccinations for COVID have begun to roll out around the world over the past few weeks with over 2 million people in the US having received their first dose as shown in the chart from our Morning Lineup below.

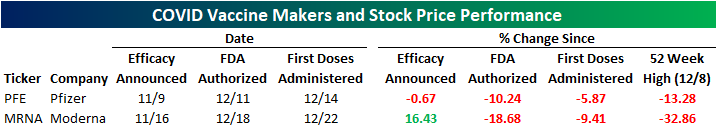

There are two vaccines currently available to the public: one from Pfizer (PFE) and the other from Moderna (MRNA). These two companies released the efficacy results of their vaccines over a month ago back in November with PFE the first of these on 11/9 and MRNA coming one week later on 11/16. In the case of Pfizer, the stock heads into year-end basically flat on the year and that is also right about where it stood at the time of that efficacy announcement. Granted, PFE originally surged alongside the rest of the equity market in the wake of its announcement in November. From 11/9 through its 52-week high on 12/8, PFE had gained 14.5%. Only a few days after that peak, the FDA issued an emergency use authorization for the vaccine, but that is when losses began to pileup for PFE as investors cashed in on the news. Since the FDA authorized its vaccine, Pfizer’s stock has dropped 10.24%. The first vaccines from PFE being administered to the public have also not provided any respite as the stock is down 5.87% since that date.

The vaccine saga has played out a bit differently for Moderna (MRNA). Overall, the stock has seen far larger and more positive moves than PFE. MRNA started off the year at under $20/share but has nearly quintupled through today. By the time the company announced the efficacy of its vaccine on 11/16, it was up just over 400% on a year-to-date basis. Like PFE, that announcement provided a further boost as the stock rose 73% from November 16th through its high on December 8th. But just like PFE, the stock has fallen sharply as the vaccine has actually found its way into the arms of Americans. MRNA has declined 18.68% since the FDA authorized its vaccine and it is nearly down 10% since the first doses were administered. While MRNA has seen a sharper decline since its peak, it has performed much better than PFE on the year, rising nearly 500%. In the cases of both stocks, though, the trade was the same for PFE and MRNA: buy the rumor that the FDA would authorize the vaccines based on the efficacy announcements and sell the news of the actual FDA authorization and vaccine rollout. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke CNBC Appearance (12/29)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box this morning to discuss the market outlook and Taco Bell. To view the segment, click on the image below. Click here to view Bespoke’s premium membership options for our best research available.

Golden Crosses Abound in Energy

Since mid-November, the Energy sector (XLE) has consistently traded above its moving averages. While it has pulled back a bit recently, XLE’s moving averages have continued to move higher. In fact, today XLE is setting up to experience a golden cross. A golden cross is when an upwards trending 50-DMA moves above an upwards trending 200-DMA.

Not only is the sector ETF potentially about to experience a golden cross, but it will be the first time in a long time that the 50-DMA has even traded above the 200-DMA. As shown below, the last time that XLE’s 50-DMA was above its 200-DMA on a closing basis was way back in November of 2018, 537 trading days ago. Since XLE began trading in the late 1990s, that is the longest stretch on record in which the shorter-term moving average has been below the longer-term 200-DMA. The next longest streak ended at 389 days in May of 2016.

As for the individual stocks of the sector, there are many charts that are showing a similar trend. Each day in our Chart Scanner and Trend Analyzer tools, we highlight recent golden crosses. As recently as last Thursday, Chevron (CVX), EOG Resources (EOG), National Oilwell Varco (NOV), and Transocean (RIG)—not an S&P 500 member and as such not included below—all made their way onto the screen. Looking across other S&P 500 Energy names, there have been several other recent golden crosses like Apache (APA), Diamondback Energy (FANG), and ConocoPhillips (COP).

As those stocks have completed the pattern, there are still others that are getting close to experiencing a golden cross. Perhaps the closest is Occidental Petroleum (OXY) whose 50-DMA was just 5 cents below its 200-DMA as of yesterday’s close. As for other stocks in the sector, names like Kinder Morgan (KMI) and Exxon Mobil (XOM) have further to go but generally have their moving averages trending in the right directions. Click here to view Bespoke’s premium membership options for our best research available.