Bespoke Wealth Management

Bespoke Investment Group offers wealth management services for investors who are looking for a portfolio manager to handle either all or a portion of their assets. Bespoke offers management services for the following taxable and retirement account types:

- Individual

- Joint Tenants

- Trusts and Estates

- Traditional IRA

- Rollover IRA

- SEP IRA

- Simple IRA

- Individual Pension and 401k

Bespoke’s portfolio management team uses rigorous in-house research to construct portfolio strategies for investors based on their financial goals and needs. Bespoke offers multiple strategies, including aggressive growth, conservative growth, conservative income, and asset allocation models. We also run a “Triple Plays” strategy that holds names with strong earnings momentum.

Bespoke’s accounts are housed at Charles Schwab, which acts as custodian. Charles Schwab offers in-depth broker/dealer services with full transparency at all times. Bespoke has an account minimum of $200,000, and our management fee is 0.80% per year.

If you would like to learn more about Bespoke’s wealth management services and inquire about opening an account, please feel free to send us an email or give us a call at 914-315-1248.

You can access our most recent Form ADV Part 2 and Form CRS for additional information.

It’s Over

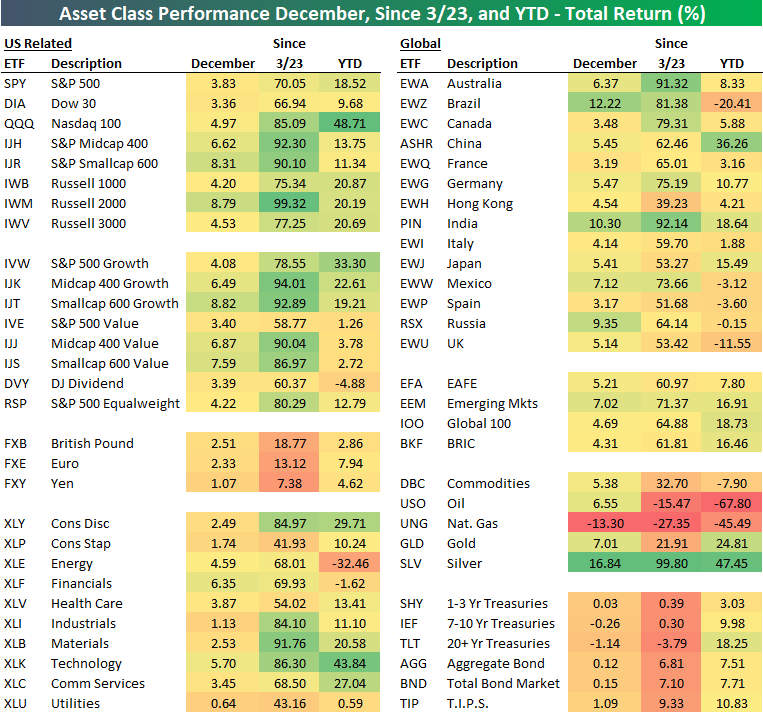

The 2020 market year is officially behind us, and for most of the ETFs in our Asset Class Performance Matrix is was a great year. The top-performing ETF in our matrix was the Nasdaq 100 (QQQ), which advanced 48.7% on a total return basis. Fittingly, in second place silver (SLV) posted a gain of 47.5%. Other big winners this year were large-cap growth (IVW), Consumer Discretionary, (XLY), Technology (XLK), Communication Services (XLC), and China (ASHR). All of these ETFs posted annual returns of more than 25%. On the downside, there were some big losers, though. Oil (USO) lost two-thirds of its value, while Natural Gas (UNG) dropped 45%. The only other ETFs that experienced declines of more than 20% were Brazil (EWZ) and Energy (XLE).

The middle column of our matrix shows each ETF’s total return since the 3/23 closing S&P 500 low. There were some truly mind-boggling returns as SLV, India (PIN), Australia (EWA), the Materials sector (XLB), Mid Cap Value (IJJ), Small Cap Growth (IJT), Mid Cap Growth (IJK), the Russell 2000 (IWM), the Small Cap S&P 600 (IJR), and the Mid Cap S&P 400 (IJH) all advanced 90% or more. Over that same span, the only ETFs that were down were long-term US Treasuries (TLT), UNG, and USO.

What was a very strong year for financial assets in 2020 was capped off with a strong December. In the US, every major index ETF was up at least 3%, every sector was positive, and every international ETF finished in the green. In fact, of the nearly 60 ETFs in the matrix, only three were down in December (IEF, TLT, and of course UNG).

Bespoke’s Weekly Sector Snapshot — 12/31/20

The Bespoke 50 Top Growth Stocks — 12/31/20

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 413.1% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 170.4%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Fifty to Zero in 283 Days

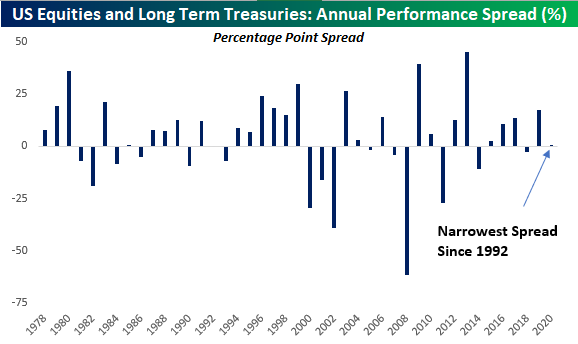

In a year with some pretty crazy charts, the one below is right up there with some of the best. After all the markets have been through this year, bot the S&P 500 and Long-Term Treasuries have seen nearly identical returns on a total return basis. That’s right, with just a few hours left in the trading year, the S&P 500’s total return in 2020 has been a gain of 17.6%, while Long Term US Treasuries, as measured by the B of A Merrill Lynch Long-Term Treasury Index has rallied 17.3%. What makes this nearly identical performance all the more incredible is that on March 23rd, the performance gap between the two was more than 50 percentage points.

The fact that stocks and bonds have essentially seen identical returns this year isn’t typical. The chart below shows the annual performance spread between the S&P 500 and long-term US Treasuries going back to 1978. During that time, the S&P 500 has historically outperformed long-term US Treasuries by an average of 3.9 percentage points per year, but the average gap in performance between the two has been over 15 percentage points. In the 43 years since 1978, there have only been seven other years where the performance spread between the two asset classes was less than five percentage points and just two years (1985 and 1992) where the performance spread was less than a percentage point.

Small Sentiment Shifts

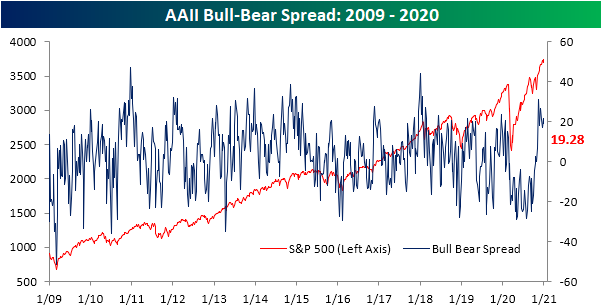

The S&P 500 has returned to and held up around record highs in the past week, and bullish sentiment has risen hand in hand. AAII’s weekly survey of individual investor sentiment rose from 43.57% up to 46.08% this week. While still off the peak of 55.84% from mid-November, bullish sentiment remains elevated relative to other readings not only this year but throughout the history of the survey. Given the bear market and a lack of recovery in sentiment until after the election was over and concrete vaccine news made headlines in November, the average reading on bullish sentiment in 2020 was 33.87%. That compares to the historical average over the life of the survey of 37.95%.

Last week saw bearish sentiment make a new low as it fell down to 21.99%; the lowest reading since the first week of 2020. That reversed this week as bearish sentiment rose nearly 5 percentage points to 26.8%. Just as with bullish sentiment, even off of more extreme levels of the past few weeks, the current level of bearish sentiment is still low when compared to where bearish sentiment has been for most of the year. This year, bearish sentiment averaged a reading of 38.83%, 12 points above current levels. As shown in the second chart below, that is the highest yearly average of bearish sentiment since 2009, and before that, 2008 and 1990 are the only years that have averaged higher readings of bearish sentiment.

It is more of the same with the bull-bear spread. At 19.28, sentiment still largely favors bulls though not to the same extreme as November. Current levels are not just well above those observed for most of the year, but also stand in the top decile of readings of the past five years’ range.

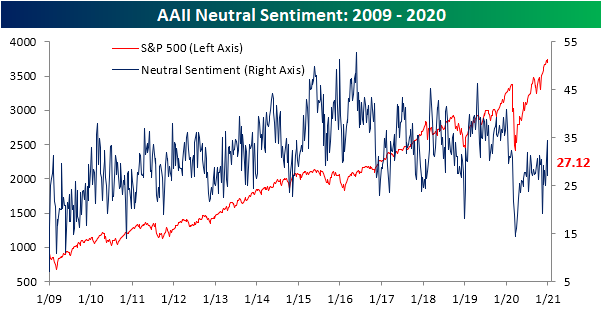

After rising back to levels not seen since the beginning of the year over the past couple of weeks, neutral sentiment saw a big drop this week of more than 7 percentage points rising from 34.4% to 27.12% which is just about in line with the average reading for 2020. That means that in the most recent week, investors appear to have become more polarized in their view of the markets, though, overall attitudes are more optimistic than pessimistic. Click here to view Bespoke’s premium membership options for our best research available.

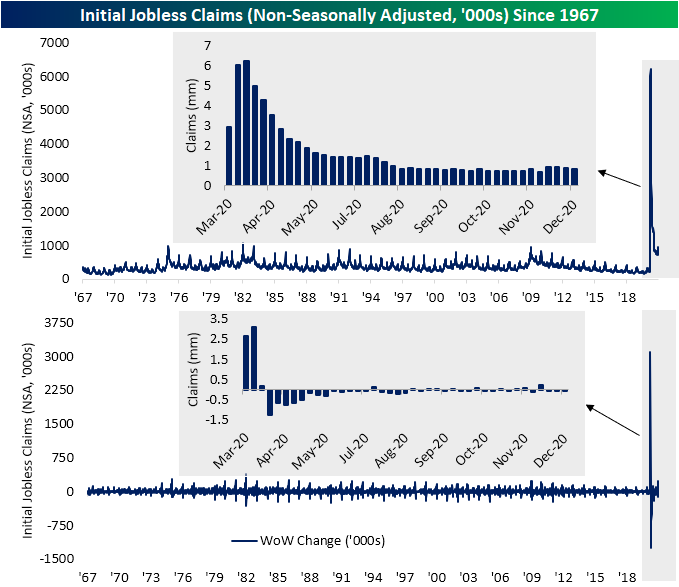

Claims Improve Into Year’s End

Earlier this month, jobless claims had reversed much of the move lower that occurred throughout the fall when they topped out at 892K, the highest level since early September. Last week saw a significant improvement as claims fell back down to 806K and the improvements continued this week with a further drop to 787K. That was much better than expectations which had been calling for an increase to 835K. With the back to back declines over the past couple of weeks, claims are healthier but need to fall another 76K to take out the pandemic low of 711K from the first week of November. To move back below the pre-pandemic record high of 695K from 1982, claims would need to fall 92K from current levels. In other words, in spite of the past couple of weeks’ improvements, claims are going to kick off 2021 at what are still elevated levels both historically and relative to the lows of the past few months.

On a non-seasonally adjusted basis, this week similarly marked a solid improvement as claims fell from 872.8K down to 841.1K. That was the third week in a row that the unadjusted number was lower, but claims by this measure too have much further to go until they are back to their post-pandemic low of 718.5K from the last week of November; over 100K below current levels.

With the addition of other programs, namely Pandemic Unemployment Assistance (PUA) which extends jobless benefits to the likes of the self-employed and independent contractors, the picture is largely the same. Total initial claims between regular state and PUA programs totaled 1.149 million this week, down from 1.27 million last week. Both programs drove those declines with the regular state program accounting for 31.7K of that decline and an even larger 88.7K decline coming from PUA claims. Once again, while total claims between these programs have declined in back to back weeks, it is still off the past few months’ lows. We would also note in regards to the PUA program, the original provisions in the CARES Act set the program to close to new applicants at the end of the year, but with the relief bill signed over the weekend, this program will be extended through March 14th. The same also applies to the Pandemic Emergency Unemployment Compensation Program which adds another 13 weeks of payments to those who have exhausted regular state benefits.

As we have noted over the past few weeks, even though initial claims have been somewhat elevated (albeit improving) recently, continuing claims have uninterruptedly trended lower. Continuing claims came in at 5.219 million for the week of December 18th; the lowest level since March. With another decline this week, looking at the past half-year, seasonally adjusted continuing claims have fallen week over week for 22 of the past 26 weeks. Additionally, unlike seasonally adjusted initial claims which remain well above the pre-pandemic high, continuing claims have now fallen more than 1 million below the peak from the Global Financial Crisis years.

Including all programs for continuing claims adds another week’s lag to the data meaning the most recent week’s reading would be for December 11th. This more complete picture shows further broad declines in the number of people receiving jobless benefits. The total across all programs fell back below 20 million and sits just off the pandemic low of 19.077 million from the week of November 20th. Declines in the PUA program were the main driver dropping by more than 800K. Regular state claims experienced a much smaller 62.8K decline that same week. As we have frequently made mention of in recent months, while overall claims have improved, extension programs account for a growing share of existing claims. In fact, in the most recent week’s data, 29% of all claims were for extension programs. That was up roughly 1.5 percentage points from the previous week and set a new high for the pandemic. Some of that increased share is thanks to further declines in regular state and PUA programs. On the other hand, whereas PEUC claims were actually lower (-20.38K), a larger uptick in the Extended Benefits program (+89.83K) made up for the difference and added share of these types of programs. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Sliding Into The New Year

Bespoke’s Morning Lineup – 12/31/20 – Fin

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The record shows I took the blows and did it my way.” – Frank Sinatra, “My Way”

What most people around the world have been wishing for months now is finally starting to come true, and in some areas of the world, it already has. 2020 is coming to an end! Unfortunately, 2021 is going to start out looking a lot like 2020, but hopefully, by the end of the year, it’s looking more like something better.

In markets today, things are understandably quiet for the last trading day of the year. The only significant data point of the day is jobless claims. Initial claims came in lower than expected at 787K which was below consensus forecasts for a reading of 830K. Continuing Claims also came in more than 100K below the consensus forecast of 5.39 million and were the lowest of the COVID era. So, at least there’s some positive economic news to close out the year.

There’s typically not a lot of liquidity in markets on the last trading day of the year, so you never know what is going to happen, especially in the final minutes of trading for the year. However, whether we finish the day higher or lower, don’t read too much into it.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, a recap of global equity market performance, an update on the latest national and international COVID trends, and much more.

Nasdaq futures are currently indicating a higher open, and if it sticks through the closing bell, the index will have finished the day higher on 61.1% of all trading days in 2020. At that level, 2020 would rank as the fourth-highest percentage of positive days for a given year in the index’s history. The only three years that saw a higher percentage of positive days were 1978 (65.5%), 1979 (66.0%), and 1980 (64.0). The big difference between now and those three years, though, is that while in 2020 the Nasdaq is a well known and widely followed exchange where some of the largest companies in the world are listed, back in 1980, most people probably had no idea what the Nasdaq was.

If today ends up being a down day for the Nasdaq, 2020 would then fall into the fifth position in terms of the highest percentage of positive days, trailing 1989 (61.9%).