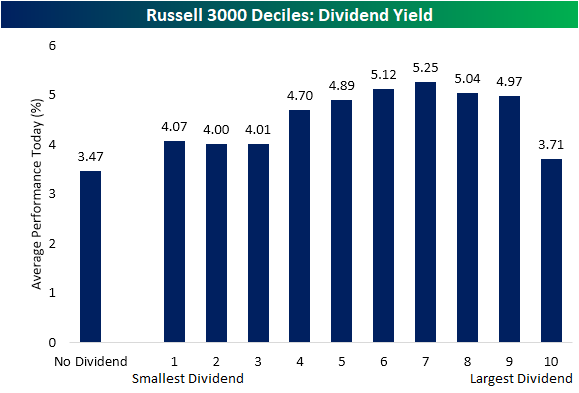

Quality Dividends Showing Strength

Dividend stocks are having a great day with the iShares Select Dividend ETF (DVY) up over 4% as of this writing. That is the best day for dividend stocks since early November and is nearly 3 percentage points of outperformance relative to the S&P 500 (SPY). Looking at Russell 3000 stocks based on the constituents’ dividend yields, stocks that do not pay any dividends, which there are over 1600 of, are up by an average of 3.47% today compared to an average gain of 4.58% for all stocks in the index that do pay a dividend. Breaking up those stocks that pay dividends into equal-sized deciles, generally, those stocks with higher yields are performing better. Granted, the 10th decile which is comprised of stocks with the highest yields have actually underperformed other dividend payers with an average gain of just 3.71%. That compares to deciles six through nine which have all risen around 5% on average. Although worse than other stocks that pay dividends, the performance of the 10th decile is still better than those stocks without a payout.

Taking a look at performance based on dividend growth over the past year, the stocks that have seen their payouts lowered from last year are actually up the most today. On the other hand, companies with higher dividends are underperforming with an average gain of just 4.36%. Again, while that is underperformance relative to other dividend payers, it is still stronger returns than those stocks with no payouts. Meanwhile, companies that have not changed their payout have seen more middling performance.

Investors also do not appear to be chasing just any yield. When a stock has a high payout ratio, it is typically viewed as being less likely to be able to maintain its dividend. Today, those stocks with the highest payout ratios have seen weaker gains. For example, the ninth decile actually is averaging weaker performance than non-dividend paying stocks. Comparatively, deciles three through six which are comprised of those with healthy payout ratios ranging between the low teens to low 40’s are all up over 5% on average. The bottom two deciles made up of the lowest payout ratios have seen slightly weaker returns, but those are also still stronger than those with the highest payout ratios. Click here to view Bespoke’s premium membership options for our best analysis available.

Bespoke Consumer Pulse Report — January 2021

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

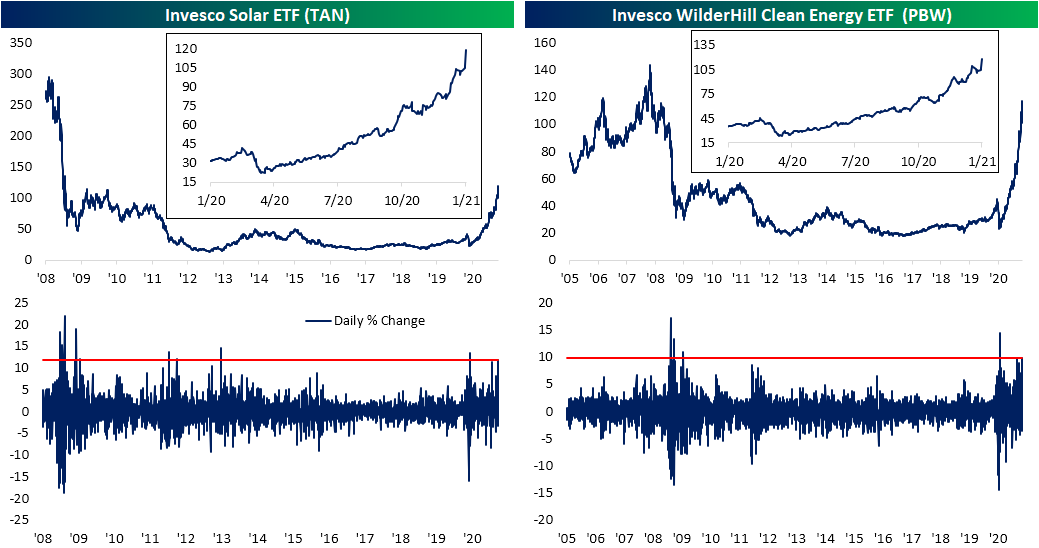

Massive Outperformance From Renewables and Banks

With the Democratic party looking to pick up two more seats in the Senate, investors are flocking to names that would benefit from the party’s agenda; namely renewable energy stocks. While valuations in the renewables space have already been stretched in the past year as we noted in last night’s Closer, today the multiple expansion has only accelerated as these names are having a banner day. The Invesco Solar ETF (TAN) as well as the Invesco WilderHill Clean Energy ETF (PBW) are up around double-digit percentages or more in today’s session and are on pace for the best day since March 24th of last year- the first day of the current bull run.

Relative to the broader market, today’s performance is even more spectacular. In the charts below, we show the ratio of TAN and PBW relative to the S&P 500. For TAN, the move higher in the ratio today surpasses any day of the past year. In fact, the 10.39% rise in the ratio today is on pace to be the largest single-day increase since April of 2013. For PBW, the increase in the ratio is second only to March 26th of 2009.

Another area of huge outperformance today is the banks. The 10-year yield has topped 1% for the first time since March. With yields providing a more welcoming environment for the industry, the S&P Regional Banking ETF (KRE) is up 8.5%. That is the best day since November 9th when the ETF popped over 15%. While nearly half of that day’s rally, KRE’s performance today still stands in the top 1% of all days since it began trading in 2006.

Again, just like the renewable energy ETFs, the strong performance of banks relative to the broader market is historic today. Prior to today, the ratio of KRE to SPY has only seen a larger daily increase five times since 2006. One of those days was the aforementioned rally in November with the other days occurring in July and September of 2008 and March of 2009. Click here to view Bespoke’s premium membership options for our best research available.

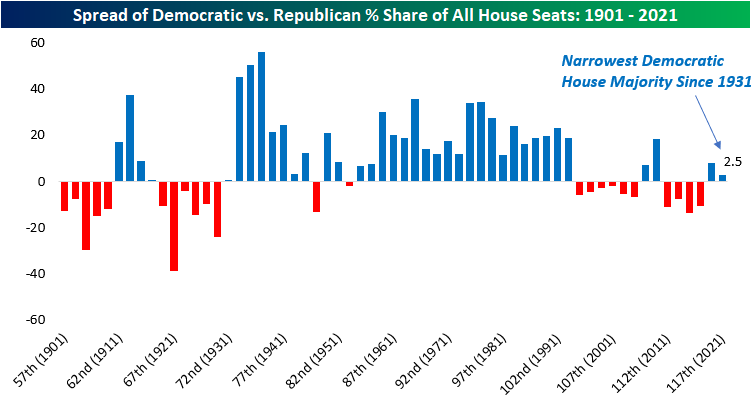

Chart of the Day: Slim Democratic Control

With the results from the Georgia run-off elections for the US Senate now mostly in, it looks all but official that the Democratic Party will essentially have control of the Presidency, the Senate, and the House. As we noted in the Washington section of our annual outlook, “While individual laws or legislative proposals can, and often do, impact individual companies, the impact of DC on financial markets is over-rated.” With that caveat in mind, in today’s Chart of the Day, we provided an analysis of market returns when the Democratic Party had full control in DC. To read the full report, sign up for a free trial to one of Bespoke’s research offerings.

One notable aspect of the upcoming session of Congress, however, is how narrow the Democratic Majority will be in both houses of Congress. In the Senate, the majority will come down to a tiebreaking vote, while in the house, their majority will only amount to 2.5% of all House seats. As shown in the chart below, that will be the narrowest Democratic majority in the House since 1931! While Democrats will likely have full control in DC in the 117th session of Congress, it’s hard to remember a time when the divide was so close down the middle as it is now.

Bespoke’s Morning Lineup – 1/6/21 – Small Caps Surge; Growth Thumped

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“What is now proved was once only imagined.” – William Blake

Georgians went to the polls yesterday, and in what proved to be extremely tight races, the Democratic candidates have come out on top. While the results aren’t official, both Warnock and Ossoff look to have the necessary votes to win the election to the US Senate. We’re seeing some big reactions in the market this morning as growth stocks are getting hit hard on the prospect of higher rates, while small caps surge on hopes of more spending and stimulus.

There will be all sorts of takes from both sides that the results mean this or that for the prospects of the market, and while the policies of a Washington fully controlled by the Democrats will have some good and bad impacts at the margin, as we noted in the Washington section of our 2021 Annual Outlook, the market is much bigger than the politicians in DC. The secular trends that have been in place leading up to this election are still in effect now.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, the results of the Georgia races, an update on the latest national and international COVID trends, and much more.

As noted above, we’re seeing some big moves in markets this morning as investors digest the results of the Georgia elections. As a case in point, this morning the Russell 2000 is on pace to open up over 2% while the Nasdaq 100 is indicated more than 1.5% lower. That spread, if it continues through the opening bell, will mark just the fifth time since 2000 that the performance spread between the two ETFs that track these indices was more than 3.5 percentage points at the open. The first was in September 2008, while there were three last year (one in May, one in June, and one in November).

Daily Sector Snapshot — 1/5/21

Bespoke Stock Scores — 1/5/21

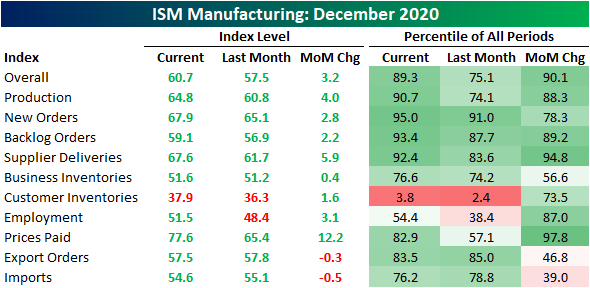

ISM Prices and Production Packing a Punch

This morning saw the release of an impressive reading on the manufacturing sector from ISM’s Manufacturing PMI for the month of December. For the seventh month in a row, the index was consistent with growth in the manufacturing sector (readings above 50 generally indicate month over month growth). Not only did the ISM’s reading show yet another month of growth but that growth accelerated as the index rose to 60.7 – the highest level since August of 2018. Prior to that, you would need to go all the way back to January and May of 2004 to find readings as high as this past month.

Chart Source: https://www.ismworld.org/

Along with one of the highest readings in two decades for the headline index, breadth in the report was very strong. The only indices to fall were those for Exports and Imports, and even those declines were minor. Meanwhile, the indices for Production, New Orders, Order Backlogs, and Supplier Deliveries all came in the top decile of readings of their respective histories. To summarize, overall conditions continued to improve with strong demand and production on the rise to meet that demand. There are some supply issues like low inventories and longer lead times, though and that’s contributing to sharply rising prices.

Table Source: https://www.ismworld.org/

The commentary section gives a bit more color into this. Comments frequently mention that there are supply chain issues due to recent COVID outbreaks. Such issues include logistics and supplier delays, as well as labor shortages. On the bright side, there are also several mentions that sales have not only gotten back on track but have actually passed levels from prior to COVID.

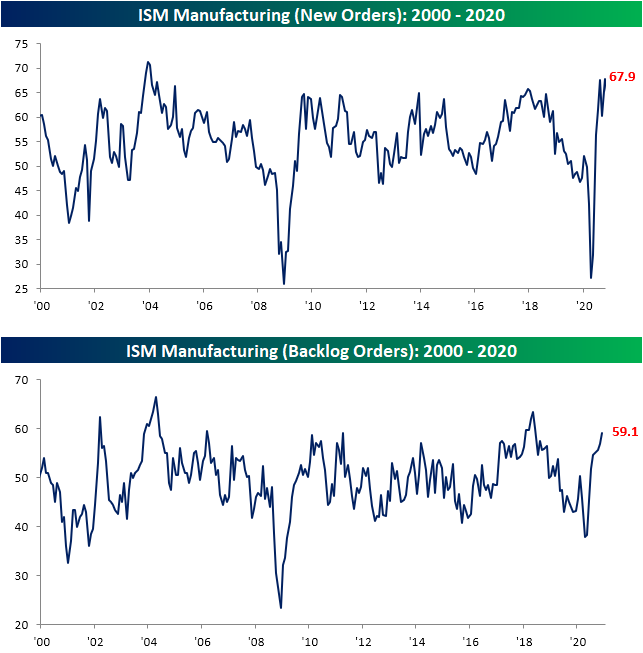

The data from the report backs up that strength in sales noted in the commentary section. The New Orders Index rose 2.8 points to 67.9. That is back up to where the index stood in October which was/is also the highest level since late 2003/early 2004. As New Orders have come in at such a strong pace, order backlogs have continued to rise. The index for Backlog Orders rose to 59.1 in December, the highest level since June of 2018.

Chart Source: https://www.ismworld.org/

Chart of the Day – Prices on the Rise in the Manufacturing Sector

Counterintuitive Rise in New Highs

Although equities fell out of bed yesterday with the S&P 500 dropping nearly 1.5% on bad breadth, counterintuitively, there was a pick up in the percentage of stocks that had reached new 52 week highs on an intraday basis. With stocks initially gapping up at the open before tumbling throughout the morning and early afternoon, there were 54 S&P 500 stocks that traded at new 52-week highs intraday. Conversely, in spite of the broad declines and weak breadth, there were no stocks in the S&P 500 that made a new 52 week low. On a net basis, therefore, over 10% of the index made a new 52-week high on the first trading day of 2021. That’s the highest reading in net new 52 week highs for the S&P 500 since November 24th and the eighth-highest reading of all days since the bear market low on March 23rd of last year. On an individual sector basis, as shown in the charts from our Sector Snapshot below, Consumer Discretionary, Financials, Health Care, Materials, and Tech are all to thank. Financials perhaps had the most impressive reading. At 13.85%, there was a higher percentage of new highs from sectors like Materials (28.57%) or Technology (21.9%), but that reading for the Financials sector was the highest since February 14th of last year. For the other sectors, these were only the highest readings of only the past couple of months.

Again, Monday’s new highs were on an intraday basis meaning these stocks did not exactly close at those highs. Furthermore, with the selling throughout the session, of the 54 stocks that traded at new 52-week highs, only 10 managed to even close in the green on the session. Tapestry (TPR) had risen the most of these rising over 5%. While none of the other stocks closed with as large of a gain as TPR, at their intraday highs, Freeport-McMoRan (FCX), Albemarle (ALB), and Tesla (TSLA) were all up over 5% and in what was a broadly weaker tape, they all still managed to close in the green. Click here to view Bespoke’s premium membership options for our best research available.