Bespoke’s Morning Lineup – 2/5/21 – Jobs Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Gambling, beer and football filled the horizons of their minds.” – George Orwell

It may be Super Bowl weekend, but most people looking to enjoy a couple of beers watching the game this year will be following the lead of George Thorogood and drinking those beers alone- or at least with nothing more than a small group! Before we get to thinking about Sunday’s game, though, we still have the last trading day of the week to get through, and what a week it has been. The S&P 500 is up over 4% and on pace for its best week since the Election.

The January Non-Farm Payrolls report was just released and the results were mixed. While total Non-Farm Payrolls rose less than expected (49K vs 105K), the Unemployment Rate fell to 6.3% versus expectations for 6.7%. Average hourly earnings were slightly weaker than expected at 0.2% on a month over month basis, but because of revisions showed a larger than expected y/y increase. The average workweek spiked up to 35 hours which is a level that hasn’t been seen in years. Despite millions of jobs lost since the start of the pandemic, Americans who are working are working more and earnings more than they have in years.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, economic data out of South Korea and Europe, an update on the latest national and international COVID trends, and much more.

What a difference a week makes. In last week’s Bespoke Report and our B.I.G. Tips report from Sunday evening, we noted that after the declines from the prior week, major US index and sector ETFs had sen their timing scores in our Trend Analyzer shift from mostly ‘Poor’ to ‘Good’. Below is a snapshot of where things stood for US indices through last Friday’s close. Over the trailing five trading days, every index ETF was down, but with the exception of the Micro-Cap ETF (IWC), every ETF had a ‘Good’ timing score.

After the gains of the last four trading days, the picture has changed a lot. Over the last five trading days, every ETF in the Trend Analyzer was up over 1% and most are up well over 2%. With these gains, all of the ETFs have now moved back into overbought territory, and all of the timing scores have now shifted to ‘Neutral’ or ‘Poor’. That doesn’t mean that the market will necessarily pull back from here, but the risk/reward is skewed more towards the risk side again. As always, pick your spots.

The Bespoke 50 Top Growth Stocks — 2/4/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 472.7% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 180.4%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 2/4/21

January 2021 Headlines

Chart of the Day: Meme Stocks Are Night & Day

B.I.G. Tips – No Love for Earnings Beats

Over a Quarter Eying a Correction

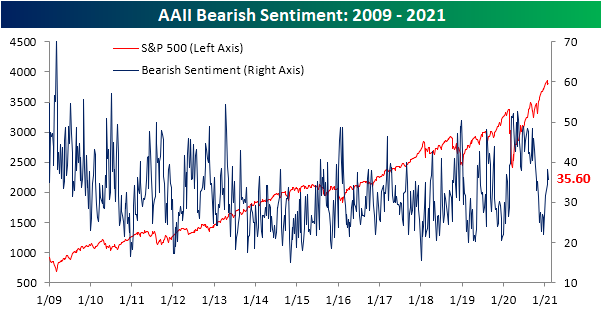

In spite of the continued craziness in the headlines over the past week, sentiment has seen little in the way of change. AAII‘s weekly sentiment survey saw bullish sentiment fall just 0.3 percentage points to 37.4%. That is a third consecutive decline and leaves bullish sentiment at the lowest level since the end of October.

Bearish sentiment was also lower this week dropping to 35.6% compared to last week’s reading of 38.3% which was the highest level since early October. That leaves bearish sentiment right in the middle of the range of the past year, still several percentage points below last year’s elevated levels and the more recent historically low readings.

The bigger decline in bearish sentiment relative to the move in bullish sentiment resulted in the bull-bear spread to move back into positive territory after briefly dipping to -0.6 last week; the first negative reading since mid-October.

Neutral sentiment picked up the losses rising to 27.1% from 24% last week. That 3.1 percentage point week over week increase only brings neutral sentiment back to similar levels to the end of 2020.

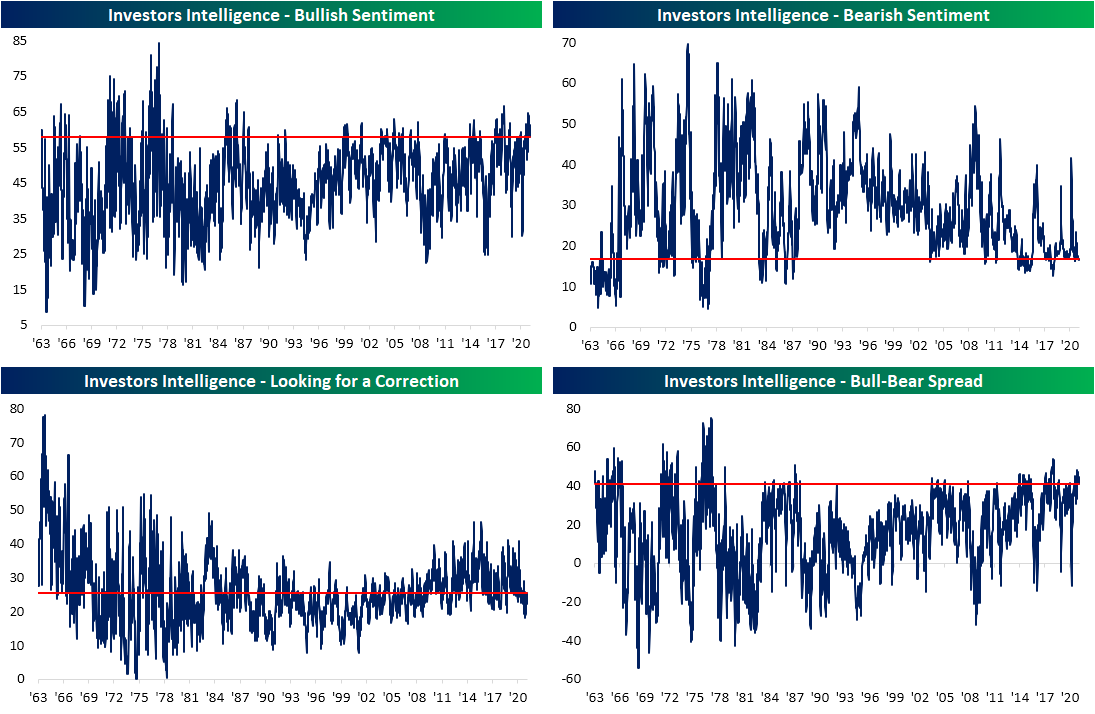

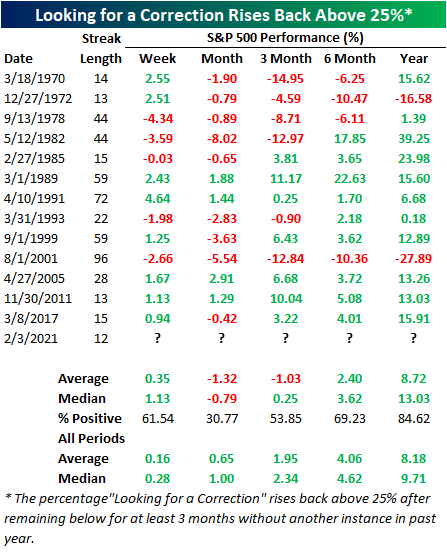

In another sentiment survey from Investor’s Intelligence, which surveys newsletter writers rather than individual investors, the readings were similar. Bullish sentiment in this survey also came in at some of the lowest levels since the fall. At 57.8%, it was the first sub-60% reading since mid-November and the lowest reading since November 4th. Bearish sentiment was slightly higher rising to 16.7% from 16.5% though it is still below levels from two weeks ago. While these survey results still lean historically bullish with the bull-bear spread at 41.1—which is in the top decline of readings going back to the 1960s—a higher share of respondents did report that they are looking for a correction. That reading climbed above 25% for the first time since the first week of November. While that is far from a historically high reading (historical average of 25.77%), it did end a streak of consecutive readings below 25% at 12 weeks long.

Across the history of the survey, there have been 42 streaks of readings of “looking for a correction” below 25% that lasted for at least 12 consecutive weeks. In the table below, we show the 14 of these instances that occurred without a prior occurrence in the past year. These streaks coming to an end have typically pointed to some short term weakness with the next month and 3 month periods averaging a decline. For the one month period, returns have only been positive 30.77% of the time. Six months later performance has leaned positive but underperforms the norm. On the bright side, one year after these streaks come to an end performance has much more consistently been positive with slightly above-average returns. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Stock Performance Around CEO Changes

More Jobless Claims Improvements

There was a lot to like in this morning’s jobless claims release. For starters, claims beat expectations falling to 779K rather than the forecasted decline to only 830K. Additionally, last week’s number was revised down by 35K to 812K compared to the original 847K number. This week, claims fell for a third week in a row with the 33K decline bringing the total drop to 148K over the past three weeks since the high of 927K. While there is still plenty of room for further improvement given claims remain well above the pre-pandemic record high of 695K, at 779K claims are now at the lowest level since the last week of November’s level of 716K which was also the second-lowest reading of the pandemic behind November 6th’s 711K print.

On a non-seasonally adjusted basis, claims have also dropped sequentially for three weeks in a row. Unadjusted claims have now fallen by nearly 300K since the high of 1.113 million in the second week of the year. Now at 816.2K, non-adjusted claims are at the lowest level since the last week of November. As we have noted the past couple of weeks, falling claims are normal for this time of year with last week (the fourth week of the year) and the previous week (the third of the year) historically having seen claims lower week over week 90.74% and 100%, respectively, of the time all years since 1967. Turning to the current week of the year, there is not as consistent of a trend as the past couple of weeks, but historically claims have moved lower more often than not.

Even including PUA claims, total initial jobless claims dropped this week. Alongside the 23.535K decline in regular state claims, PUA claims fell by 54.68K. In total, this week saw 1.165 million claims between the two programs, down from 1.243 last week marking a continued return towards the low of just above 1 million at the end of October.

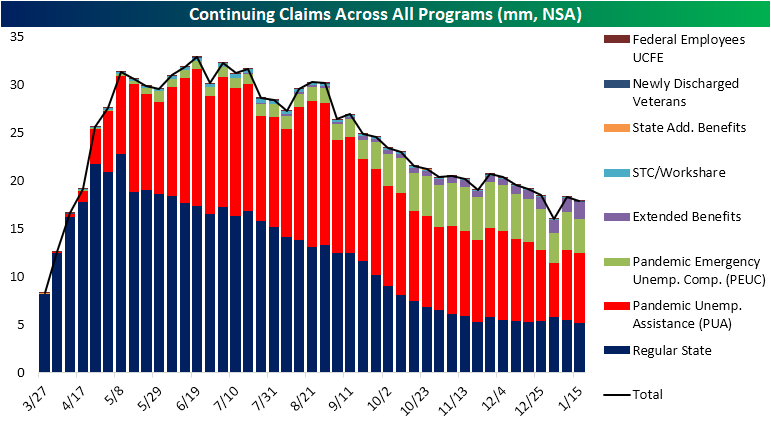

As for continuing claims which are lagged an additional week to initial claims, the declines keep coming. Continuing claims totaled 4.592 million this week, down 193K from the prior week’s upwardly revised reading. Like initial jobless claims, that was better than the expected reading of 4.7 million and also set a new low for the pandemic.

Including all programs adds another week’s lag but for the week of January 15th, total claims across all programs declined to 17.87 million from the prior week’s spike higher to 18.359. Most programs contributed to that decline with the biggest contribution coming from the Pandemic Emergency Unemployment Compensation (PEUC) program which saw claims fall by 289.91K. Outside of the first week of the year when this program fell by over 1 million (likely due to benefits expiration at the end of 2020 and other discrepancies as a result of the timing of the spending bill) that 289.91K decline was the largest week over week drop on record. Despite that decline, a 197K uptick in the Extended Benefits program made for a new high in the extension programs’ share of total claims. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/4/21 – That’s a Negative

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“An investor without investment objectives is like a traveler without a destination.” – Ralph Seger

There’s not a whole lot going in in the markets this morning…yet. While futures are indicated just modestly positive, there’s a bunch of economic data on the calendar starting with jobless claims (779K vs 830K, lowest since November), unit labor costs (6.8% vs 4.0%), and productivity (-4.8% vs -3.0%) all just hitting the wires. One interesting item of news out of the UK was that even as the Bank of England took a large haircut to 2021 growth forecasts (from 7.25% down to 5.0%), it said it does not plan to signal that negative rates are on the way. That being said, the Bank did instruct banks to start preparing for negative rates nonetheless. How’s that for certainty?

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, a discussion of recent moves in the all-important iron-ore market, moves in the euro, an update on the latest national and international COVID trends, and much more.

To say that the last week has been a see-saw for the market would be an understatement. Last week, the S&P 500 went from overbought levels (one standard deviation above 50-DMA) to below its 50-DMA in the span of three trading days. Just two trading days later, the S&P 500 was not only back above its 50-DMA, but it was also back at overbought levels. That may not sound like all that an extreme of a reversal, but going all the way back to the start of the S&P, there have only been 14 other periods where the S&P 500 closed below its 50-DMA after being at overbought levels within the prior three trading days and then went on to close at overbought levels within the next three trading days. Looking at the occurrences on the chart, it hasn’t been a very consistent market signal, but it does shed light on just how volatile the last several trading days have been.