Chart of the Day – Crude Oil Gushes

Short Interest Update

Yesterday, bi-weekly short interest data was released for the period ending January 30th. In the chart below, we show the Russell 3000 broken up into deciles based on short interest as a percent of the float at the end of 2020 and these decile’s stock’s median change in short interest from then to yesterday’s release. As shown, with the short squeeze episode playing out in the second half of January, the stocks that came into 2020 the most heavily shorted have seen the biggest declines in short interest. That decile of what had been the most heavily shorted names has seen short interest as a percent of float fall for a median of 2.65 percentage points. Deciles two and three have similarly seen sizable declines, though, they are far smaller than those of the most shorted stocks. On the other hand, the decile of the least shorted stocks is the only one that has seen the median short interest reading move higher since the end of 2020.

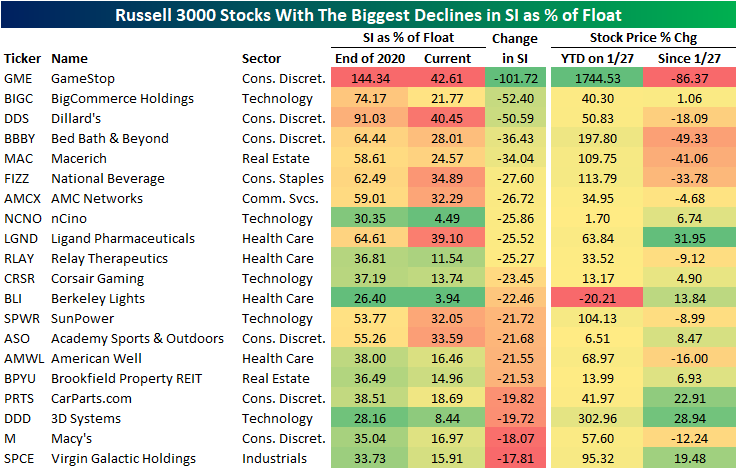

In the table below, we show the stocks that currently have the highest short interest as a percent of float. After the historic move higher, short squeeze poster child GameStop (GME) is no longer the Russell 3000’s most heavily shorted name! Having dropped over 100 percentage points since the start of the year, only 42.61% of shares are now short compared to 43.57% for Gogo (GOGO); currently the most shorted stock in the index. GOGO has actually seen its shorts come off a bit this year as well but that decline has been far more modest of only a little more than one percentage point. Of the other stocks in the index, only Tanger Outlets (SKT) and Dillard’s (DDS) also currently have more than 40% of the float sold short.

On the January 27th closing high, GME was up 1,744.53% year to date. But with the short squeeze unwinding, the stock has fallen over 86%. Others of this cohort have similarly seen big reversals of their earlier surges. For example, National Beverage (FIZZ) had doubled YTD at the time of the GME peak, but since then it has been cut by 33.78%. Not all of these have been losers since the pinnacle of short selling though. Fulgent Genetics, which now has over 30% of shares short, has risen 91.01%. Clovis Oncology (CLVS) and Ligand Pharmaceuticals (LGND) have similarly seen big gains of over 30%.

Given GME came into the year with an absurd number of shares sold short, the squeeze has resulted in it being the biggest decliner in terms of short interest of any Russell 3000 stock. Short interest as a percentage of float has fallen over 100 percentage points YTD. The next biggest drop came from BigCommerce Holdings (BIGC) and Dillard’s (DDS) which both saw larger than 50 percentage point drops. Of the rest of the top twenty biggest decliners, a baker’s dozen have seen short interest drop by at least 20 points. Additionally, of these stocks that have seen short interest fall the most, only three—nCino (NCNO), Berkeley Lights (BLI), and 3D Systems (DDD)—now have a single-digit short interest as a percent of float.

Given the massive short squeezes, there are far more stocks that now have a lower short interest as a percent of float than at the start of the year. In fact, of the Russell 3000 stocks, 1887 have seen declines in short interest compared to only 1146 that have seen an increase. In the table below, we show the twenty stocks to have seen the biggest increases in SIPF since the start of the year. As shown, there is only one, International Game Technology (IGT), that has seen short interest rise by double digits since the end of 2020.

Retailers notably dominate the list of stocks with the biggest declines in short interest. To quantify this, in the chart below we show the aggregate number of shorted shares as a percent of total float for each industry group as of the most recent short interest data and the end of 2020. As shown, just as it was at the start of the year, retailers remain the most heavily shorted industry group, but it has greatly improved with only 5.86% short compared to 8.15% at the end of 2020. That is the only industry group to have seen short interest drop by a full percentage point or more. The industry group to have experienced the next largest decline was Transportation with aggregate short interest falling from 5.08% to 4.13%. Conversely, there are two industries, Banks and Materials, that have higher short interest as a percent of float than they did at the end of 2020. Click here to view Bespoke’s premium membership options for our best research available.

Not All Fixed Income is Broken

So far this year, returns in the US treasury market have gotten off to a bad start. Based on the performance of the BofA indices, long-term US treasuries are already down over 5% YTD which would be only the second time in the last ten years that the asset class started off the year so poorly. While treasuries have been weak, not all areas of the fixed income market have performed poorly. In fact, high yield debt, which tends to be more closely correlated to the equity market, is having a much better year, gaining a bit over 1%.

The chart below shows the YTD performance spread between high yield and long-term US Treasuries 28 trading days into each year since 1995. With a current spread of over five percentage points, high yield is outperforming long-term Treasures by the widest margin since 2012 and the fifth widest margin since 1995. The only other years besides 2012 where the spread was wider were 2011, 2009, and 2001.

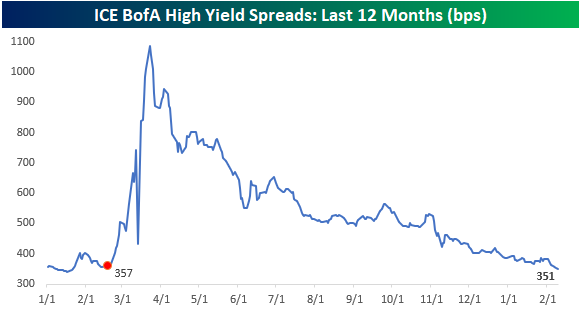

High yield has also achieved a pretty notable milestone this week as spreads relative to US Treasuries have narrowed to their lowest levels since the February 2020 pre-COVID peak in the S&P 500. On 2/19/20, when the S&P 500 peaked before the COVID crash, high yield spreads were at 357 basis points (bps). After finishing off last week at 358 bps, spreads have narrowed this week to the current level of 351 bps. It’s certainly been a wild year for the high yield market. Less than a year after spreads topped 1,000 bps and were within the 97th percentile of all historical readings, today spreads are two-thirds lower and just below the 20th percentile relative to all other readings. So, spreads are very low, but they’re not necessarily at a historical extreme. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Charts We’re Watching – 2/10/21

Bespoke’s Morning Lineup – 2/10/21 – Russell Goes For Eight

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

Futures have been drifting higher all morning as positive momentum continues. Interest rates are modestly higher (although those increases have been erased following the release of CPI), and bitcoin is down nearly 3%. All in all, it’s been a pretty quiet morning so far. In economic data, CPI for January was just released and despite some concerns that the report would come in hot, the headline print was right in line with forecasts (0.3%) while the core reading was unchanged versus expectations for an increase of 0.2%. On a y/y basis, CPI is up just 1.4% versus expectations for an increase of 1.5%. As much as the Fed wants it, inflation just won’t seem to budge.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, an update on the latest national and international COVID trends, and much more.

Although the S&P 500 and Dow ended Tuesday modestly in the red, small caps continued to shine as the Russell 2000 extended its winning streak to seven days. In the history of the Russell 2000 dating back to 1979, there have been seven prior winning streaks of seven or more trading days, so they are not particularly uncommon. Based on those prior streaks, the Russell’s performance on day eight has been an average gain of 0.15% (median: +0.18%) with positive returns 71% of the time. So, more often than not seven-day streaks make it to eight.

In more recent history, seven-day streaks have been a little less common. Since the start of 2019, there have only been two other streaks of seven or more trading days and they were both in 2019 (February and June).

Daily Sector Snapshot — 2/9/21

B.I.G. Tips – Stocks Trump Bonds

Bespoke Stock Scores — 2/9/21

Rabid For Small Caps

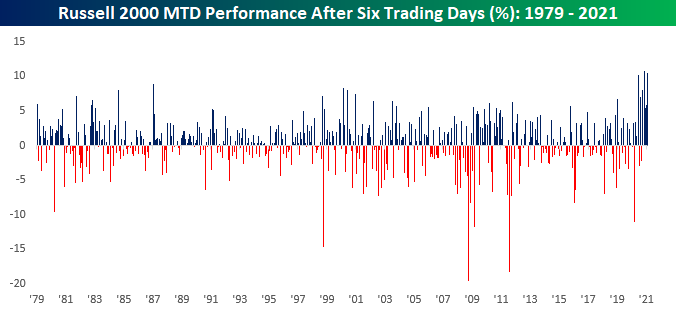

We’ve seen some pretty extreme trends over the years, but the recent run of small caps ranks right up there with the best of them. As noted in our Closer report from Monday, the Russell 2000 was further above its 200-day moving average (DMA) than it has ever been before. After Monday’s close, the Russell 2000 was also already up 10% for the month. While a 10% MTD gain in just six trading days may sound impressive, this month’s performance to start the month was only the best since November – three months ago! Not only that but in the two months (December and January) between those two 10%+ gains, the Russell 2000 was up over 5% in the first six trading days of the month, and in October it was up over 8%. In other words, in each of the last five months, the Russell 2000 has been up at least 5% MTD after just six trading days. It gets even crazier too. Back in June and August, the Russell 2000 was up 10.25% and 7.04%, respectively, after just six trading days.

In the entire history of the Russell 2000 dating back to 1979, the Russell 2000 has been up at least 5% MTD after six trading days 35 times (7% of all months) and there have never been more than two months in a row of back to back 5%+ starts to the month. In the last nine months, however, there have been seven 5%+ starts to a month including a streak of five straight. Included in those seven months, three have also been gains in excess of 10%, and prior to June 2020, that had never happened before. In the wake of last year’s COVID crash, the rotation into small caps has been unprecedented. Click here to view Bespoke’s premium membership options for our best research available.