Value Outperforming Growth But Only for Large Caps

While the S&P 500 traded lower today, value stocks had a strong finish to the week. Starting with a look at dividend stocks, the iShares Select Dividend ETF (DVY) rose 1.35% today for its best day since January 6th when DVY rose nearly 4%. As shown below, DVY has recently been on a tear.

Along with the dividend ETF (DVY), the iShares S&P 500 Value ETF (IVE) rose 0.31%, reaching a new 52-week high intraday. That compares to the growth counterpart, the iShares S&P 500 Growth ETF (IVW), which saw a bearish engulfing on its 0.65% decline. Today was the widest outperformance for value (IVE) over growth (IVW) since mid-January. As shown below, while both are still trending nicely higher long-term, the value ETF is at new highs while growth is closer to its 50-day moving average.

Value’s outperformance today only applied to large caps, though. While small caps have fallen over the past several sessions, the Russell 2000 Growth ETF (IWO) and Russell 2000 Value ETF (IWN) both rebounded nicely today with identical gains of 2.08%. In the case of small-cap growth (IWO), the recent declines have been more severe meaning today’s strong performance still leaves it further below its highs than small-cap value (IWN). Start a two-week free trial to Bespoke Premium to access our best research available.

Daily Sector Snapshot — 2/19/21

Bespoke’s Morning Lineup – 2/19/21 – You’ve Got to Play Your Hand

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Lately it occurs to me, what a long, strange trip it’s been.” – “Truckin'”, Grateful Dead

Strange may be the understatement of the century when it comes to the last twelve months. One year ago today, the S&P 500 closed at an all-time high as COVID was ravaging China and quietly spreading around the world. What made the S&P 500’s new high even more impressive was the fact that just two days earlier, Apple (AAPL) issued a profit warning due to the fact that factory closures in China would constrain supply. Still, the market bounced back and rallied, It would only be a couple of days later over the weekend that reports of an outbreak in Italy brought it home that COVID wasn’t just a China problem. The following Monday, global equities plummetted, and within basically a month, the S&P 500 lost a third of its value. While the path of the equity market since the March lows has been pretty steady to the upside, everything else has been, to say the least, a strange trip. We’re all hoping for a quick return to normalcy, but if the last year has taught us anything, things often only seem to get stranger by the day.

In market news today, futures are higher while gold and crude oil have pulled back. In economic data, Markit PMI data around the world has generally topped expectations in the manufacturing sector but hasn’t been quite as positive in the more important services sector. Later this morning, we’ll get the same updates for the US economy.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, flash PMI data, an update on the latest national and international COVID trends, and much more.

As we look back on the one-year anniversary of the S&P 500’s pre-COVID high, it’s pretty amazing to think that the S&P 500’s YTD performance this year (4.5%) is nearly identical to the YTD performance on this same day in 2020 (4.6%). If that sense of deja vu makes you nervous, we would note that the similarities are only skin deep. Underneath the surface, the equity market’s rally this year doesn’t look a whole lot like last year.

The chart below shows the performance of S&P 500 sectors on a YTD basis as of the close on 2/18 last year versus this year. Last year (blue bars), the sectors leading the rally included Technology and yield sensitive sectors like Utilities and Real Estate. On the downside, Energy and Materials were the only two sectors down on the year. This year, Energy is leading the way higher with a gain of just under 20%, while Financials and Communications Services are both up over 8%. In fact, looking at the three leading (and lagging) sectors this year none of the top (or bottom) three performing sectors were the top (or bottom) three performing sectors at this point last year. Conversely, none of the top (or bottom) three performing sectors at this point last year were the top (or bottom) three performing sectors at this point this year. As the saying goes, you’ve got to play the hand your dealt.

The Bespoke 50 Top Growth Stocks — 2/18/21

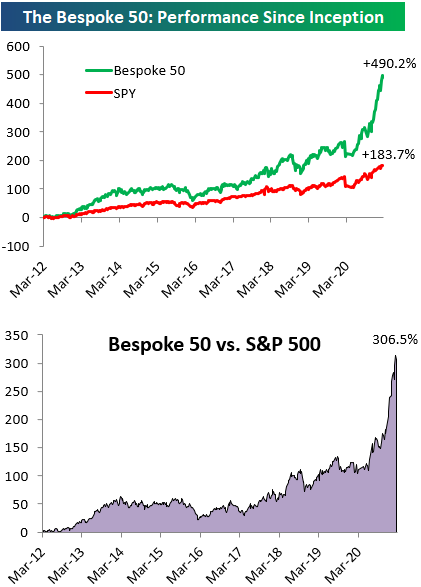

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 490.2% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 183.7%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 2/18/21

B.I.G. Tips – Top Earnings Triple Plays

Prices and Employment Surging in Philadelphia

While the results were not as impressive as the Empire Fed report earlier this week, this morning’s reading on the manufacturing sector from the neighboring Philly Fed did beat expectations. The headline number fell to 23.1 rather than the anticipated decline to 20. While it indicates some deceleration in the rate of growth, activity remains at the high end of the past several months’ readings indicating solid growth, In terms of expectations, though they remain positive, they took an even bigger hit with the index falling from 52.8 down to 39.5. That month-over-month decline stands in the bottom decile of monthly moves.

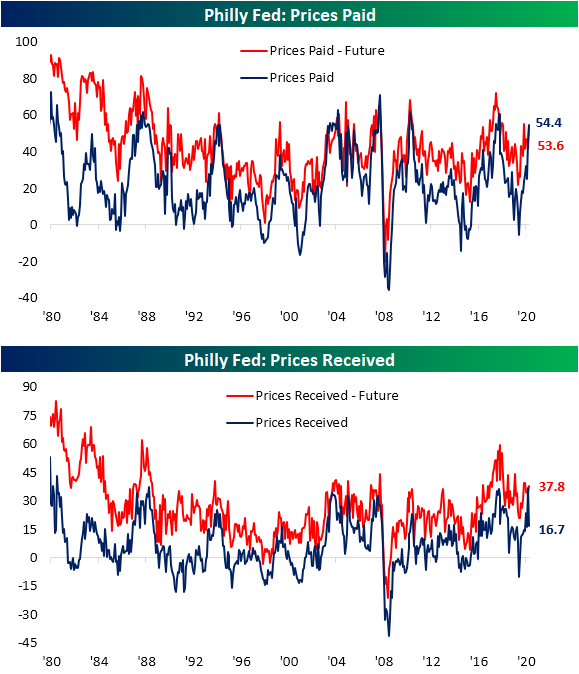

The decline in the headline number can be credited to broad declines in multiple categories. The only indices to move higher were those concerning employment as well as the indices for Inventories and Prices Paid. As for the indices for future expectations, the declines were even broader with only expectations of Prices Paid and Received moving higher.

Indices concerning demand were all consistent with a deceleration in February with the biggest declines coming from Unfilled Orders and Delivery Times. After record and near-record readings last month, the declines in the Unfilled Orders and Delivery Times indices stood in the bottom 6.8% and 1.7% of all monthly moves, respectively. Even after those declines, Unfilled Orders is still in the top 6% of all readings, and Delivery Times is still in the top 2% of all readings. In addition to the decline in the Delivery Times index, the corresponding index for expectations fell to a negative reading this month for the first time since Dember of 2019. In other words, manufacturers are still reporting historically long lead times, but they do foresee improvements on the horizon.

Inventories saw a big move higher in February. That index rose 7.4 points to a reading of 20, which is the seventh strongest reading on record. As for expectations, the Inventories index was one of the standout elevated readings. Whereas most indices for expectations are in the middle of their historical ranges, the Inventories index is in the 84th percentile.

While the report showed prices continued to rise, there was a divergence between prices for final goods and inputs. Prices Paid have continued to accelerate with the index rising to 54.4 which is the highest reading since August of 2018. Conversely, Prices Received slammed on the brakes. The index collapsed from 36.6 last month to 16.7. While that is still above December’s levels, it was the sixth-largest MoM decline on record and the biggest decline since December of 2008.

Perhaps the strongest area of the report concerned labor. The index for Number of Employees rose once again reaching 25.3. That is the seventh-highest reading of all months since the survey data begins in 1968 and is the highest level for the index since July of 2019. Not only are the region’s businesses taking on more employees, but the average workweek has also risen at a historic rate. The index for Average Workweek gained 12 points in February to 30.6. There has only been one higher reading in the history of the data and that was a reading of 34.2 in May of 2018. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Small Changes in Sentiment

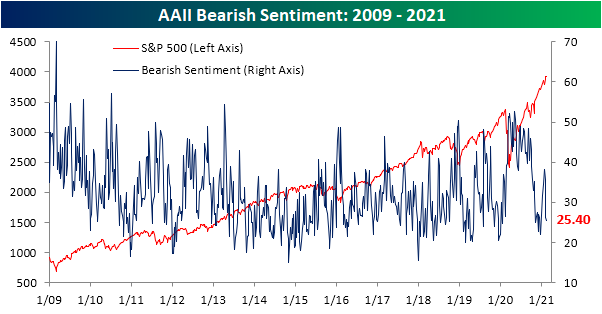

Even though the S&P 500 has essentially traded sideways over the past week, sentiment saw a slight improvement. AAII’s weekly survey of individual investors found 47.1% of respondents reported as bullish. That is up slightly from 45.5% last week and the highest level of bullish sentiment since the week of December 10th.

At the same time, bearish sentiment has continued to decline. Coming in at 25.4%, bearish sentiment has now declined for three straight weeks falling 12.9 percentage points in that span. That is the largest decline in a three-week span since October of 2019 when bearish sentiment fell 15.53 percentage points and leaves bearish sentiment at the lowest level since the week of December 24th when less than a quarter of respondents reported as bearish.

This week’s moves in sentiment resulted in the bull-bear spread rising for a third week in a row. With a spread of 21.7 percentage points, sentiment favors bulls by the widest margin since the first week of December.

Like bearish sentiment, neutral sentiment took a small move lower dropping 0.7 percentage points to 27.6%. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: Yeti (YETI) Yowling

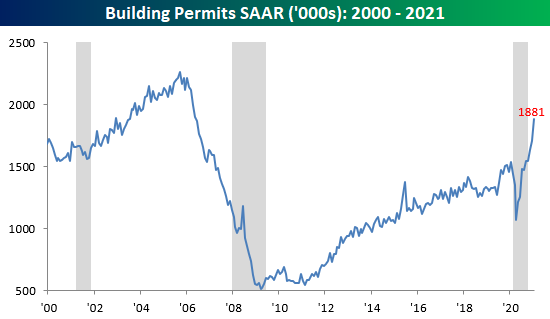

Starts Stuck, Permits Parabolic

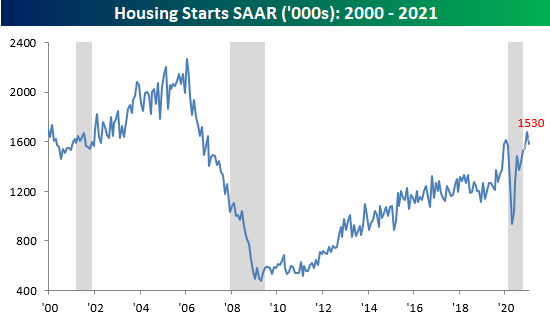

The January report on Housing Starts and Building Permits was mixed relative to expectations, but the overall backdrop remains very strong. Starting with Housing Starts, they posted a decline of 6.0% m/m falling to 1.58 mln versus expectations for a much smaller decline, but keep in mind that it comes after a 10+ year high in December.

Building Permits, which are less impacted by the weather, were much stronger in January. They surged to 1.881 million versus 1.704 mln in December and expectations for a much more modest level of 1.694 mln. Following January’s increase, Permits are now less than 17% from their bubble high in 2005.

Looking at the chart above, Permits have practically turned parabolic in the last few months. While it’s somewhat arbitrary to look at a nine-month rate of change, the fact that Permits have just experienced their second-largest increase in that span is worth highlighting. What’s also worth pointing out, too, is that while Permits are rebounding from a nine-month decline of just over 20%, the two prior spikes highlighted in the chart came following much larger declines.

In terms of the breakdown of this month’s report, the fact that multi-family starts and permits were key drivers of strength is a bit of a drawback. Single family-starts actually dropped more than 12% m/m while permits were up less than 4%. Multi-family units, meanwhile, were up over 15% for both starts and permits. On a regional basis, every region of the country saw declines in starts relative to December, while the Northeast was just barely higher. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.