Daily Sector Snapshot — 2/23/21

Chart of the Day – S&P 500 Up, While Energy Leads and Tech Lags

Bespoke Stock Scores — 2/23/21

Where the Jobs Are and Aren’t

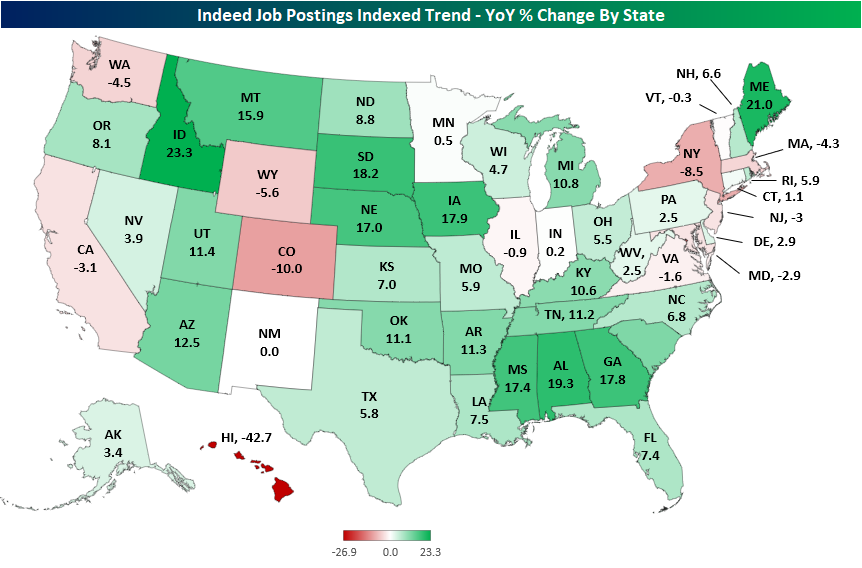

In last night’s Closer, we reviewed data from job listings website Indeed.com made available through the St. Louis Fed. While somewhat convoluted, Indeed’s indices show the year-over-year change in the seven-day moving average of the seasonally adjusted number of job postings on their website indexed to February 1st of 2020. For the most recent data updated through February 12th, job listings in the US have continued to trend higher up 3.9% year over year. Indeed also breaks down this data on a state-by-state basis. As shown in the heatmap below, most states in the Midwest and South currently have postings up year over year, but some coastal states like New York and California as well as some Southwestern states are lagging in their recoveries. By far the worst state continues to be Hawaii which is likely a result of a crippled travel industry.

Getting even more granular, Indeed also provides the data broken down by metro areas with populations larger than 500,000 people of which there are 110. Below we show the 20 metros that have the strongest and weakest job posting readings as of February 12th. Unsurprising given the state-level reading, Honolulu, Hawaii has the weakest reading followed by San Jose and San Francisco, California. Taking a look at the other weakest metro areas, there are a number of massive areas like New York City, LA, Boston, Chicago, DC, Seattle, and Denver to name a few. On the other hand, smaller metro areas dominate the list of those that have job postings most improved from a year ago.

Further quantifying this, in the chart below we show the average reading of metro areas grouped by their respective populations. As shown, metros with smaller populations (those under 1 million people) have seen the strongest growth in job postings, up over 11% year over year. As you move up the ladder of higher and higher populations, the job postings readings get weaker. Metros with populations between 2 and 3 million people only have postings up 0.56% year over year. The worst of these groups are the largest metros with populations over 4 million. On average, this group’s job postings are only up 0.35%. Click here to view Bespoke’s premium membership options for our best research available.

Consumers Still Stuck in a Rut

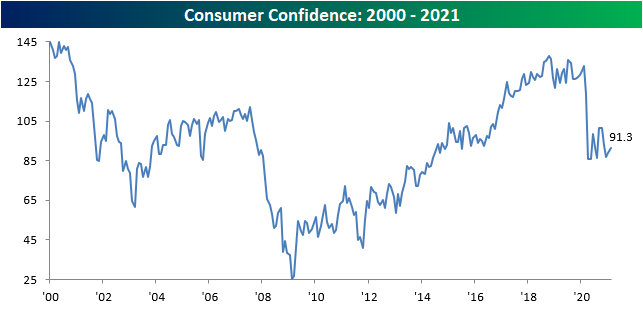

The stock market and economy have both exhibited different degrees of v-shaped patterns over the last year, but one area where the v-shaped pattern has been noticeably missing involves Consumer Confidence. The latest read on consumer sentiment for the month of February showed a modest improvement from January’s downwardly revised reading of 88.9. While economists were forecasting the headline reading to come in at a level of 90.0, the actual reading showed a modestly larger increase coming in at 91.3. Even as financial conditions and the economy improve and vaccines roll out, though, consumers remain stuck in a rut.

Breaking out confidence by Present Conditions and Expectations shows the same trend. While sentiment towards the present has seen a bigger bounce off the lows, expectations continue to trend lower. At first glance, this seems strange given the improved trends regarding COVID case counts and the rollout of the vaccines, but then again, if you told most Americans a year ago that we’d still be at the current level of restrictions and closures, they wouldn’t have believed you. Maybe the fact that expectations remain so muted is just consumers taking the attitude of, “I’ll believe it when I see it.”

Another reason for the muted sentiment is the fact that jobs simply aren’t there yet. Like overall confidence, the ‘Jobs Plentiful’ index has barely bounced off its lows. As long as jobs remain hard to find, don’t expect consumer sentiment to improve much.

One surprising aspect of this month’s report concerned sentiment towards the stock market. While there’s an overall abundance of bullish sentiment, the percentage of consumers in this survey expecting higher stock prices is barely higher than the percentage expecting lower stock prices. Normally, when the stock market makes record highs, consumers are bullish towards the market. This month, though, the lack of consumer enthusiasm has even made its way into sentiment towards the stock market. Click here to view Bespoke’s premium membership options for our best research available.

Travel Stocks Red Hot

The past year has been rough for the travel industry, but more recently these companies’ stocks have been red hot. As shown in the snapshot of our Trend Analyzer below, there are several S&P 500 travel stocks (those in the airlines, cruise, and hotel industries) that are off the chart overbought. Only two names, Las Vegas Sands (LVS) and Wyndham Worldwide (WYND), did not close yesterday at least 2 standard deviations above their 50-DMAs, but even though they did not technically do so, they were very close to joining the rest of their cohorts in extreme overbought territory. Another remarkable aspect of these readings is that just last week some of these stocks were oversold. After more than 20% rallies in the past five days, cruise lines Royal Caribbean (RCL) and Norwegian (NCLH) have gone from oversold levels to deep into overbought territory.

From a charting perspective, in spite of the very overbought conditions, many of these stocks have now broken out above their highs from a few months ago thanks to these recent gains. As shown in the snapshot of our Chart Scanner below, within the past couple of days stocks like Booking Holdings (BKNG), Carnival (CCL), Southwest Airlines (LUV), and Las Vegas Sands (LVS) to name a few have now broken out. Not only have they broken out, but some are even reaching 52-week highs as pre-pandemic levels roll off the chart. In fact, just yesterday, Alaska Air (ALK), Booking Holdings (BKNG), Expedia (EXPE), Hilton (HLT), Southwest (LUV), Las Vegas Sands (LVS), Marriott (MAR), MGM Resorts (MGM), and Wynn Resorts (WYNN) all reached 52-week highs. Click here to view Bespoke’s premium membership options for our best research available.

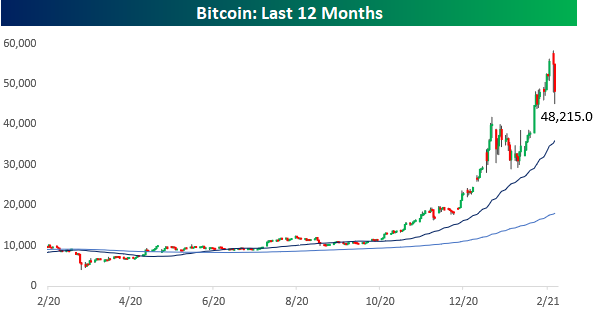

Bitcoin’s Largest Drawdown Since Last Month

Bitcoin hit record highs over the weekend, but it’s having a week to forget. After topping $58,000 on Sunday, bitcoin’s price barely held $45,000 this morning, and at current levels is still down over 17.4% from its record high three days ago. As sharp as bitcoin’s decline seems now, we’d note that it is still 34% above its 50-day moving average (DMA) and more than 167% above its 200-DMA. Those spreads show just how strong the recent rally in bitcoin has been.

While bitcoin is down over 17% from its recent highs, at this point it has been a relatively modest pullback for the leading crypto-currency. The chart below shows the history of bitcoin’s daily price relative to its prior all-time high going back to 2015. During the last six years, bitcoin’s average drawdown from its all-time high has been 35%, or double the current level of 17.4%. While the pullback this week has been swift, you don’t even have to go back a month to find a larger drawdown from a record high. Back on 1/27, bitcoin was down over 26% from its prior record high of 41,981. That prior record high is 12% below current levels. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/23/21 – More Pain in Tech

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If your only goal is to become rich, you will never achieve it.” – John D. Rockefeller

What goes up must come down. After a rough day for tech and bitcoin yesterday, we’re seeing more of the same again today, as Nasdaq futures are down over 1% and bitcoin, while well off its lows, is still down 10%. There’s not a lot of economic news on the calendar today, but we will get updates on Consumer Confidence and economic activity in the Richmond Fed district at 10 AM. Also at 10, Fed Chair Powell will give his semi-annual monetary report.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, inflation data out of Europe, an update on the latest national and international COVID trends, and much more.

Days like yesterday don’t happen very often. Even as the DJIA was up marginally, the Nasdaq finished down more than 2%. The charts below show both indices going back to the start of 1986. Before yesterday, there was only one other day since 2001 that saw a similar setup and that was last July. In the period from early 1999 through May 2001, there were 33 occurrences, and then before that, the only two other occurrences were right after the 1987 crash. Let’s just say that prior divergences like yesterday didn’t exactly occur during periods of low volatility.

While days like yesterday are rare, the way futures are positioned right now, we could see the same thing happen again today. While Nasdaq futures aren’t down quite 2% yet, they’re still down over 1.5%. Needless to say, back-to-back days where the DJIA was up and the Nasdaq was down 2% are extremely uncommon. The only four other times it has occurred since 1986 were in 2000 (4/10-4/11, 9/5-9/6, 10/2-10/3, and 12/12-12/13).

Daily Sector Snapshot — 2/22/21

Another Big Beat in Regional Fed Data

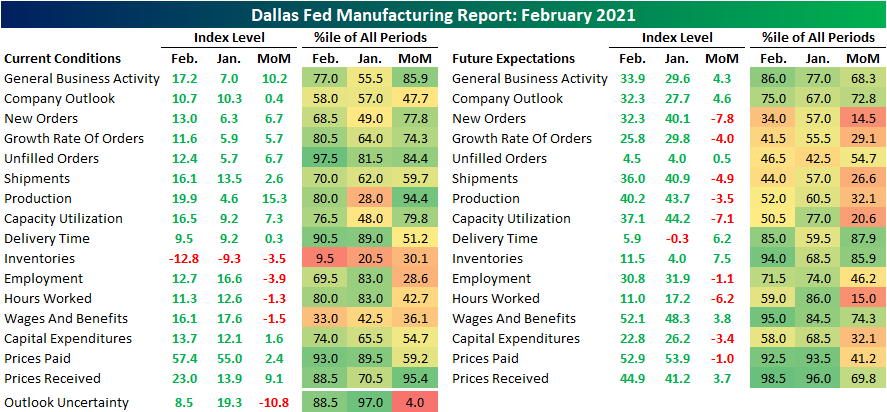

Just like last week’s release of the Empire Fed Manufacturing report, this morning’s reading on the manufacturing sector from of the Dallas Fed saw a much stronger than expected reading. Rather than the forecasted reading of 5, today’s release more than tripled those estimates coming in at 17.2. Since at least 2009, that is the fifth biggest beat relative to forecasts on record. The last time the Dallas Fed report’s headline reading exceeded expectations by this much or more was back in June, coming out of the depths of lockdowns. That reading of 17.2 indicates the region’s manufacturing sector not only grew for a seventh consecutive month but also accelerated in February. Meanwhile, firms remain optimistic for their future as the future outlook index rose to the highest level since October of 2018.

Breadth in this month’s report was broadly positive though there were some areas of weakness. For the current conditions indices, every category with the exception of Inventories continued to show expansionary readings. Alongside inventories, only those categories concerning employment saw lower month-over-month readings. Additionally, the index for uncertainty experienced a sizeable 10.8 point decline.

Again, most indices in the table above did move higher in February including all of those concerning demand. Indices for things like New Orders, the New Order Growth Rate, Shipments, Capacity Utilization, and Production were all higher in February though they remain off their peaks from several months ago. One exception though is for Unfilled Orders. That index more than doubled rising to 12.4 which is the highest level since July of 2018. That is also in the top 2.5% of all readings throughout the history of the survey dating back to 2004. Altogether, this means that orders came in at a more rapid pace in February leading order backlogs to grow at a historically strong rate.

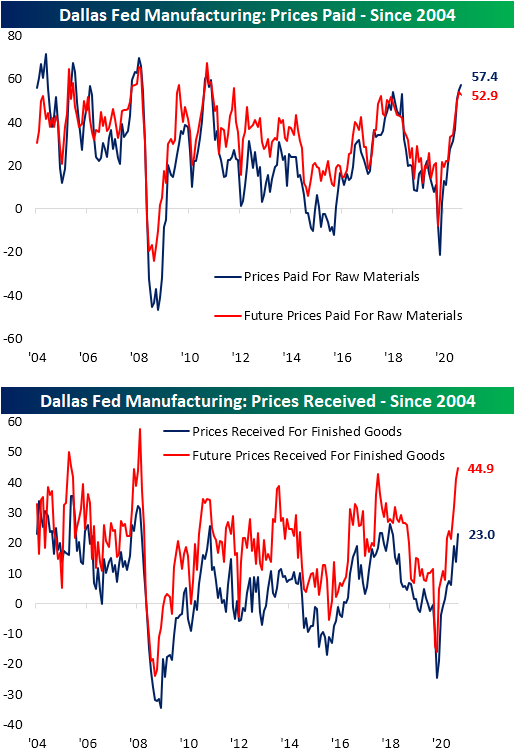

Consistent with other readings on the manufacturing sector of late, the Dallas Fed’s report showed both prices paid and received are accelerating. Starting with the former, the index for Prices Paid rose another 2.4 points to 57.4. That is the seventh straight month over month increase for that index; a new record for most consecutive months with higher readings taking the index to its highest level in nearly a decade.

While Prices Received are also on the rise with that index moving up to a reading of 23, they are not as historically elevated with the February number only the highest level since June of 2018. Granted, expectations would point to Prices Received more closely resembling Prices Paid at some point down the road. The index for future Prices Received rose to 44.9 which is the fourth highest reading on record behind September and October of 2005 and July of 2008.

As previously mentioned, perhaps the weakest area of the report this month concerns employment. Most of these indices continue to indicate further employment growth in terms of the Number of Employees, Hours Worked, and Wages & Benefits, but the pace of improvement decelerated in February. While current readings on Wages and Benefits saw slower growth, though, expectations are far more elevated. That index rose to 52.1 which is in the top 5% of all readings in the history of the index. Click here to view Bespoke’s premium membership options for our best research available.