Brazil (EWZ) Beaten and Battered

Looking across the country ETFs from the 23 countries tracked in our Global Macro Dashboard, most countries have pulled back in the past week though they remain up on the year. But one notable exception has been Brazil (EWZ). EWZ has gotten crushed falling 11.24% in the past five days alone and is now in a new bear market with a 20%+ drop from its 52-week high. Given these steep declines, the ETF is deeply oversold at nearly 3 standard deviations below its 50-DMA. There are only two other country ETFs that are currently oversold: Malaysia (EWM) and Switzerland (EWL). Granted, neither of these are nearly as oversold as EWZ. In fact, EWM is on the cusp of moving out of oversold territory. In addition to these countries, Mexico (EWW) is the only other one that is down year to date. While Brazil is down double digits this year, Taiwan (EWT) has risen over 11.5%. It is the only country ETF to have gained double digits so far this year while South Africa (EZA) and Sweden (EWD) are both closing in on doing the same. China (MCHI) is the next best-performing country this year, but it sits much further below its 52-week highs than the other top performers in 2021. Since the mid-February high, MCHI has fallen 9.6%. In recent days, that decline is resulting in a test of its 50-DMA. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Higher Prices All Over the Place

Mixed Results From Triple Plays

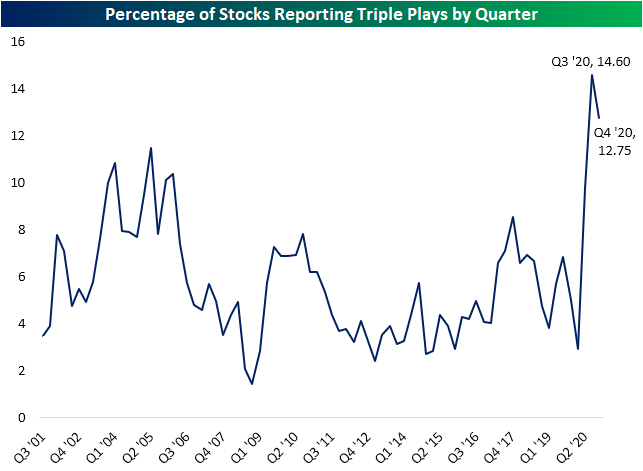

Earnings season unofficially came to a close a couple of weeks ago, and as such, the pace of earnings is slowing with the highest number of companies reporting for any day of the next month being March 12th with 47 reports due that day. Looking back on Q4 earnings results, a massive number of companies reported triple plays. A triple play is when a company exceeds analyst forecasts on the top and bottom line while also raising guidance. Using data from our Earnings Explorer tool, 12.75% of all earnings reports were a triple play in the just-completed earnings season. Although that is down from a rate of 14.6% the previous quarter, no other quarter in the history of our data has seen as strong of a number of triple plays.

On a day that the broader market is also trading lower, even triple plays of the past 24 hours are not seeing the best reactions to earnings despite solid results. Since the closing bell yesterday, there have been three triple plays from Hewlett Packard Enterprise (HPE), Veeva Systemes (VEEV), and Ambarella (AMBA). Of these, only AMBA is trading in the green today.

Enterprise software company HPE reported a third triple play in a row last night beating EPS estimates by 11 cents while sales came in at $6.83 billion versus estimates of $6.75 billion. The company also guided higher. While the stock was at a new 52-week high at the open, so far this morning HPE has shifted lower and is now down 1.24% for an outside day. Granted, headed into earnings the stock was and continues to be overbought at around 1.5 standard deviations above its 50-DMA after a substantial run over the past few months. From lows last October through today’s decline, the stock has risen 74%.

Veeva Systems (VEEV) is a cloud-based software solutions company specializing in the life sciences industry. The company has consistently reported triple plays in the past with half of its 30 reports having been triple plays. It is the other triple play that is trading lower today currently down over 4% as of this writing. In addition to raised guidance, the company reported revenues up 27.4% year over year which was around $16 million above forecasts. The company also beat on the bottom line with EPS topping estimates by 15 cents. Unlike the still extended HPE, VEEV has been fluctuating around its 50-DMA in recent days with the sell-off on earnings today bringing the stock to the low end of that range. If the stock continues to head lower, interesting support levels to watch will be the 200-DMA and the lows from the fall.

Not every triple play is trading lower though. Semiconductor design company Ambarella (AMBA) is up around 7.5% after reporting EPS of $0.14 versus $0.08 expected and revenues about $4.5 million above estimates. Shortly after the open, the stock broke out to new highs surpassing the previous highs from mid-February. Since then though, it has pulled back and is now back down around 5% below those highs. Click here to view Bespoke’s premium membership options for our best research available.

Guns Still Flying Off the Shelves

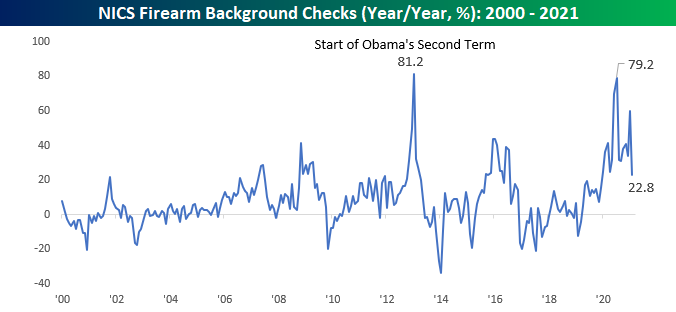

The latest data on firearm checks from the FBI for the month of February showed that while gun sales eased off from January’s record pace, by all accounts, the pace of gun sales is unlike anything seen prior to 2020. With a total of 3.44 million background checks during the month, February’s pace was down 20% versus January’s record pace. Even with the decline, though, February saw more background checks than all but six other months since 2000, and all of those six months were in the last twelve. For the month of February alone, background checks this year were higher than any other February on record by a margin of over 600K.

On a y/y basis, background checks were up over 22%, and while that’s a significant increase, it actually represents the lowest y/y increase since December 2019. Again, 2020 was a year unlike any other in the last twenty years in terms of Americans looking to buy guns.

With sales still near historically high levels but clearly slowing from the torrid pace of growth in 2020, the stocks of gun manufacturers (SWBI and RGR) have been in a bit of a holding pattern. Both stocks peaked in the middle of last year as protests and riots exploded around the country. They started to rally again after the election right up through early January. Interestingly, the closing high of the post-election rally in both stocks ended on the same day as the Capitol riots on 1/6, and since then both stocks have been drifting back into the ranges they traded in during the second half of 2020. For full access to our research and market commentary, start a two-week trial to our Bespoke Premium service.

B.I.G. Tips – Charts We’re Watching

Bespoke’s Morning Lineup – 3/3/21 – Put Up or Shut Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I went looking for trouble, and I found it.” – Charles Ponzi

Markets are looking to make an attempt to rebound from yesterday’s weakness, but the effort hasn’t been all that inspiring to this point as futures have erased more than half of their gains. If the inability of futures to hold on to their gains isn’t enough, today also marks the birthday of Charles Ponzi!

ADP Private Payrolls were just reported and missed expectations by nearly half (117K vs 225K). The big report of focus for the remainder of the day will be the ISM Services report at 10 AM.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, some earnings reports from the US and around the world, an update on Markit PMI readings for the Services sector, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

US equities opened higher yesterday but sold off from the opening bell right until the close in what can only be described as a disappointing session for bulls. Below we show intraday charts of the S&P 500 and Nasdaq over the last 15 trading days, and what you can also see in both charts is that their opening prints also coincided with downtrend lines that have been established from the index highs in mid-February. At this point, the burden of proof is on the bulls to break these downtrends. Based on where futures are trading now, neither of these trends will come into play at the opening bell, but if the markets can build on their early gains, a test could come into play. Stay tuned!

Daily Sector Snapshot — 3/2/21

B.I.G. Tips – Google Search Trends Revisited

Chart of the Day: Economic Indicator Diffusion Index on the Rebound

The Best and Worst Performing Stocks on Earnings

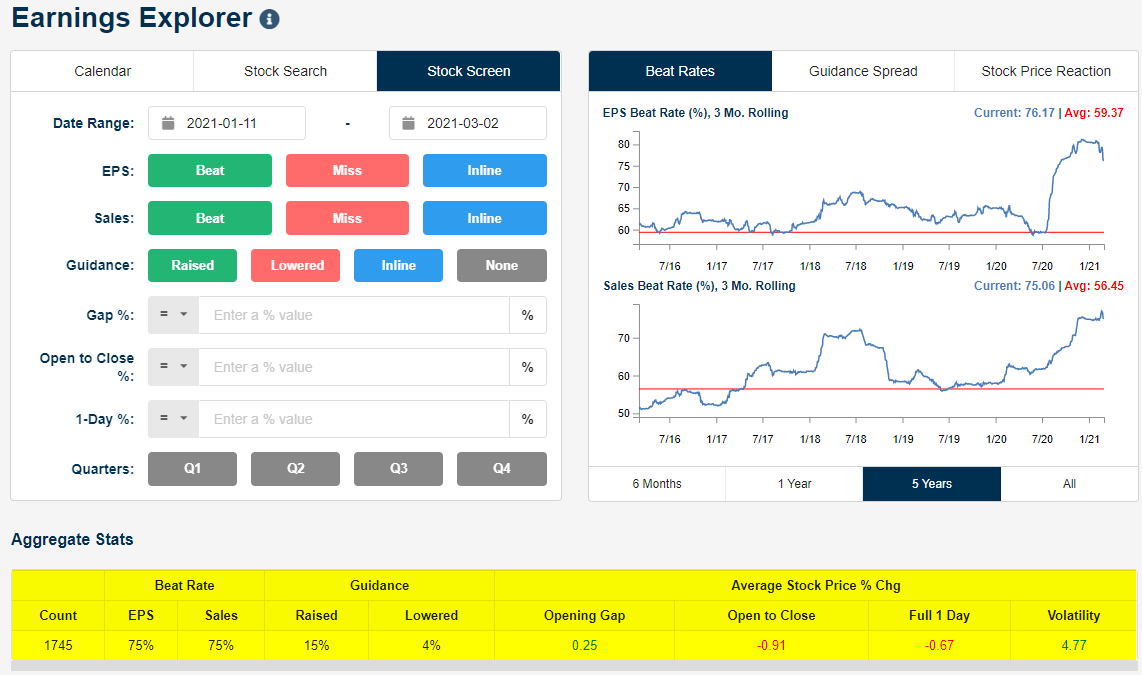

Our Earnings Explorer tool is a massive interactive database that contains historical information for thousands of companies and tens of thousands of quarterly earnings reports. You can start using the tool to hopefully trade more successfully around earnings with a two-week trial to our Bespoke Institutional package. Since mid-January when the most recent earnings season began, more than 1,700 companies have released their quarterly numbers. As shown in the snapshot from our Earnings Explorer page below, 75% of these companies beat consensus analyst EPS and sales estimates, while 15% raised forward guidance. On the negative side, just 4% of companies lowered guidance.

In terms of share price reactions to earnings reports, this season we saw the average stock open higher by 0.25% in reaction to its earnings report but then average a decline of 0.91% from the open to the close of trading. The gap higher of 0.25% and the open to close decline of 0.91% add up to a full-day decline of 0.67%. So even with relatively strong beat rates and positive guidance, investors have had a “sell the news” attitude over the last couple of months.

For those of you interested in individual stocks, below is a list of the 40 names that had the best one-day share-price reaction to earnings this season. You can use the “Stock Screen” page at our Earnings Explorer tool to generate lists just like the one below with a Bespoke Institutional membership. To make the cut, the stock had to gain at least 15% on its earnings reaction day like TAL Education (TAL), Digi International (DGII), NIC Inc (NIC), and Sonos (SONO) did. At the very top of the list is software company Teradata (TDC), which gained 37% on the day after reporting earnings on February 4th. Along with TDC, there were six additional companies that saw one-day gains of more than 30% in reaction to earnings this season. These six big winners were Glu Mobile (GLUU), RR Donnelley (RRD), Fisker (FSR), Bill.com (BILL), QuantumScape (QS), and PubMatic (PUBM).

The biggest stock to make the list was Netflix (NFLX) with a market cap of $243 billion and a one-day gain of 16.85%. That’s pretty good considering that the average stock to make the list has a market cap of just $12.8 billion. Other notables on the list include Canada Goose (GOOS), Hanesbrands (HBI), Groupon (GRPN), and Zillow (ZG).

Unfortunately, there were plenty of big losers this earnings season as well, and below is a list of the worst of the worst performers. The 40 stocks below all saw one-day drops of at least 14.9% on their recent earnings reaction days, with Ping Identity (PING) falling the most at -28%. Seven additional stocks fell more than 20% — MEDNAX (MD), Nautilus (NLS), Warrior Met Coal (HCC), TPI Composites (TPIC), SM Energy (SM), Zix Corp (ZIXI), and Twist Bioscience (TWST). Other notables on the list of big losers include Fastly (FSLY), Elastic (ESTC), Clarivate (CLVT), Harley-Davidson (HOG), Overstock.com (OSTK), and GoPro (GPRO). To dive deeper into our Earnings Explorer and access everything else Bespoke publishes throughout the trading week, start a two-week trial to our Bespoke Institutional package.