Small Business Sentiment Slow to Come Back

After crashing following the election, optimism on the part of small businesses remains pretty beaten down, though there was finally an improvement in February. The NFIB’s Small Business Optimism Index was expected to see a 2 point rebound in the month of February, but the increase was even smaller as the index rose from 95 to just 95.8.

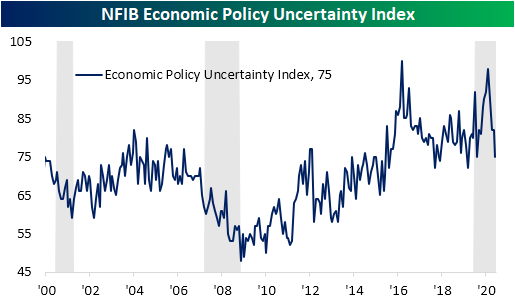

While small business sentiment is far from recovered, uncertainty has improved. After spiking to a near-record high of 98 headed around the election last fall, the index for Economic Policy Uncertainty has continued to fall dropping to 75 in February. That 7 point month-over-month decline stands in the bottom 5% of all monthly changes which brings the index to the lowest level since last April.

Breadth in the report was mostly positive with 10 of the 18 categories higher in February while another 3 went unchanged and the remaining 5 were lower. Although most categories saw an improvement, several readings remain at historically low levels. For example, the indices for Expect Economy to Improve and Expect Real Sales Higher were both in the 3rd percentile of all readings. Other indices also remain at the low end of their historical ranges such as Plans for Capital Outlays and Now is a Good Time to Expand.

Sales metrics generally improved although firms reported as less optimistic for the future. While sales expectations fell deeper into negative territory, small businesses reported higher nominal sales as that index rose 9 points from -7 to 2. That was in the top 5% of all monthly moves and the first positive reading since November. Additionally, the index for Actual Earnings Changes also improved rising 5 points to -11. Due to the strong pace of sales, a higher share of companies reported higher prices. That index rose 8 points to 25. That is the strongest reading for the index since August 2008.

In addition to stronger sales, lower inventory levels also played into those higher prices. The index of Inventory Satisfaction which measures how many firms report current inventory levels as “too low” was flat on the month in the top 1% of all readings. Despite this, fewer firms report plans to increase inventories. The index for Inventory Accumulation actually fell 2 points to the lowest level since May.

While small businesses do not appear to be making plans to increase inventories, they are investing in employment. The index for Hiring Plans rose slightly from 17 in January to 18 in February. Although that is off higher levels from earlier in the pandemic, it is well within the range of the past several years. Compensation Plans were also higher with the index gaining 2 points to 19. Even though firms appear to want to increase employment, they have yet to follow through with hiring. The index for Actual Employment Changes remains negative falling further to -3 in February. Meanwhile, the Compensation index went unchanged. The lack of actual increases to employment is not a demand problem but instead appears to be a labor supply problem. A record number reported job openings as hard to fill while 33% report either cost or quality of labor as the single most important problem for the business; up 5 percentage points from the prior month. That borrowed from firms reporting things like Taxes, Inflation, and “Other” as their biggest issues. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: New Highs Expanding

Bespoke Stock Scores — 3/9/21

Versatile Outperformers

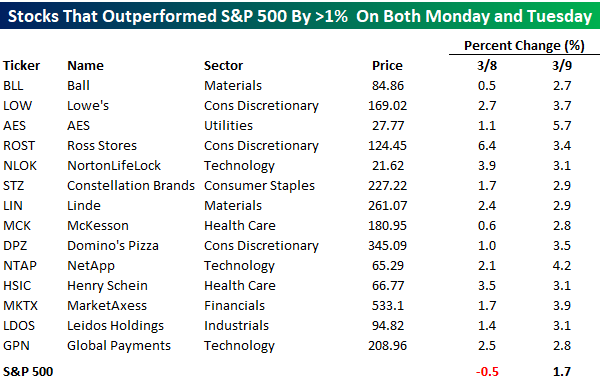

There’s still a lot of time left in the day, but the tone of the equity market has been much different today compared to Monday. Whereas Monday saw tech stocks get creamed while cyclical areas of the market rallied, today we’re seeing tech stocks rebound while cyclicals lag. To illustrate, within the entire S&P 500 there are just 14 stocks that have so far managed to outperform the index by at least one percentage point both yesterday and today. The table below lists each of those stocks, and looking through them, they aren’t the flashy, high-profile names that you always see discussed in the media. Who said boring is a bad thing? In terms of sector representation, there’s also no clear trend as eight of the eleven sectors are represented by the list of just fourteen names!

Below we show six-month price charts of each of the 14 names listed above from our Chart Scanner tool. Here again, no clear technical theme links the stocks together. While stocks like AES, Global Payments (GPN), McKesson (MCK), and Ross Stores (ROST) remain close to six-month highs, others like Ball (BLL), Domino’s (DPZ), and Market Axess (MKTX) aren’t far from six-month lows. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/9/21 – Diverging Markets

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“There are no facts, only interpretations.” – Friedrich Nietzsche

The Nasdaq is looking to brush the dust off its shoulders after a major beatdown in the high growth area of technology to kick off the week yesterday. S&P 500 futures are also up nearly one percent as the DJIA lags. For now, fixed income markets are cooperating as yields pull back, but we’ll see if these levels can hold throughout the trading day.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including revised OECD economic forecasts, trading in overseas markets, Japanese economic data, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Yesterday was another wild day in the stock market. Depending on your perspective and your benchmark, it was either a good day or a bad day. From the perspective of the DJIA, which was up 0.97%, the week didn’t start off all that bad, but for an investor who follows the Nasdaq, this week started off much differently with a decline of 2.4%.

That kind of divergence where the DJIA is up and the Nasdaq drops over 2% on the same day is pretty uncommon. The charts below show the performance of both indices going back to 1986, and in each one, we have included red dots to show all the occurrences where the DJIA was up and the Nasdaq was down over 2%.

In this span, every prior occurrence was confined to three separate periods. While there were two separate occurrences right after the 1987 crash, there wasn’t another until 1999, when there were three between April and June. After that, the frequency of occurrences really picked up as there were 23 in 2000 and another 7 in 2011. After that, the two indices went nearly another 20 years until July 2020 without any similar occurrences, and now this year, there have been two since 2/22.

Daily Sector Snapshot — 3/8/21

Tepper and Treasuries

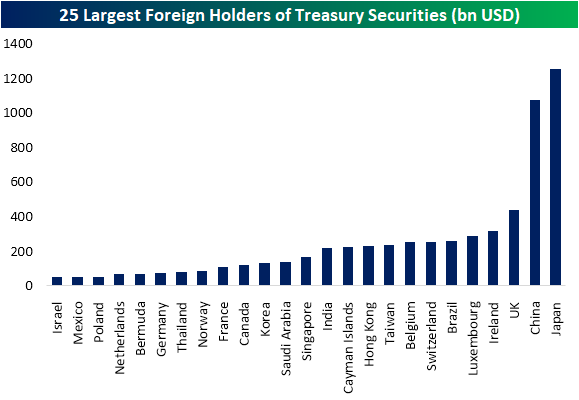

One catalyst being given credit to the generally positive performance equities today were bullish comments in a CNBC interview with Appaloosa Management’s David Tepper. Tepper stated that in his view “rates have temporarily made the most of the move” and ” “it’s very difficult to be bearish.” Tepper also stated a belief in the possibility of Japan stepping in as a buyer for US Treasuries following the recent rise in yields. As for why exactly Japan doing so would benefit Treasuries, it should be noted that Japan is the largest foreign holder of US Treasuries (per Treasury International Capital TIC data). As of December data (January data is set to be released next Monday, 3/15), Japan held $1.25 trillion in Treasury securities. The only other country that comes even close is China with $1.072 trillion in Treasury holdings. Behind those two, the UK is the next largest holder with not even half that amount: $440.6 billion.

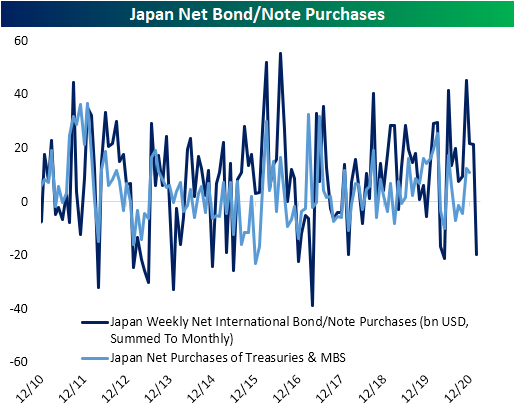

Using the same TIC data, from early 2015 through the end of 2019, Japan was a net seller of US Treasury and Federal Financing Bank securities. For most of 2020, that had changed with Japan becoming a net buyer though that waned towards the end of the year. The recent uptick in yields coincided with Japan returning to being a net seller.

While Japan has purchased fewer Treasuries, they have still been making up the difference as big buyers of MBS. According to the TIC data for December, positive flows of MBS purchases offset the decline in Treasury purchases. As for Japanese data with less of a delay, in the chart below we show weekly net purchases of all foreign bonds and notes in US dollar terms summed by month. As for this more high-frequency data, again, there has yet to be evidence that Japan is buying Treasuries. For the month of February, the country was a net seller of $19.6 billion in foreign bonds and notes. But Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Inflation Week

Bespoke’s Consumer Pulse Report — March 2021

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

How Long Can Dividends (DVY) Outperform Growth (VUG)?

Over the past few weeks, high growth names have turned into a pain trade with the Vanguard Growth ETF (VUG) having fallen 11% from its February 12th closing high to the intraday lows last Friday; with a small rally in the second half of Friday’s session which has continued today, the ETF is now down 7.16% since the 2/12 high. Meanwhile, in the same time frame, the iShares Select Dividend ETF (DVY) has risen 8.13% since its February 12th close, breaking out to new all-time highs both on Friday and again today

Looking at the screen of various styles of ETFs in our Trend Analyzer, the recent moves have brought VUG deep into oversold territory as of Friday’s close. Other growth-focused ETFs are similarly oversold. Meanwhile, the strong performance of dividend stocks has resulted in DVY alongside the S&P Dividend ETF (SDY) to be extremely overbought at more than two standard deviations above their respective 50-DMAs.

In the chart below, we show the ratio of the Dividend ETF (DVY) versus the Growth ETF (VUG). Times in which the line is declining indicate outperformance of growth while an upward trending line indicates outperformance of dividend stocks.

As could be expected given the different risk premiums of the two styles of these ETFs, growth stocks have seen fairly consistent outperformance in recent years. But more recently, the opposite has been the case, and in a big way. As shown in the second chart below, over the past month (21 trading days) the ratio of DVY to VUG has risen over 16%. In the history of the data going back to early 2004, the only period that has seen this line rise at a more rapid pace was in September 2008 when it rose by 25.46%. Looking at that instance, the outperformance of dividend stocks did not lead to any sort of a longer-term trend though. In fact, the ratio peaked only a couple of months later erasing the entirety of the move by early March 2009. Click here to view Bespoke’s premium membership options for our best research available.