Turn Off, Tune Out

The first quarter of 2021 comes to a close today, and as fast as time seems to fly, it’s been a long one. Take GameStop (GME). It may seem like months and months ago, but it wasn’t until late January that the stock started to go crazy as the ‘Reddit Rebellion’ launched and caused a mad scramble by hedge funds to cover any and all of their short positions. Think about it. In under three months, we’ve seen at least two large funds (Melvin Capital and Archegos), not to mention the collapse of supply chain finance giant Greensill Capital. Sometimes we go an entire year without blowups of this magnitude.

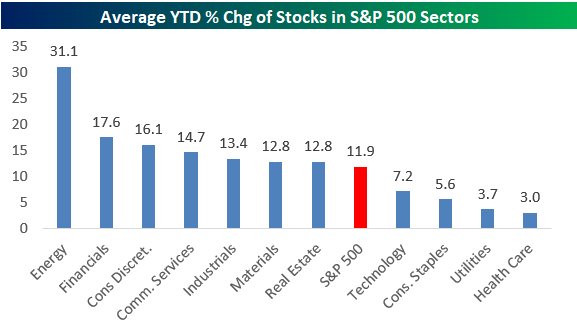

Despite the tumultuous headlines and market volatility along with the frustrating churn in the market lately, US equities are finishing off the quarter well. Stocks in the S&P 500 are up an average of 11.9% so far this year and grouped by sector they’re all averaging gains. Leading the way higher, stocks in the Energy sector stand apart from every other sector with an average gain of over 20%. After Energy, stocks in the Financials and Consumer Discretionary sectors are both up an average of over 15%. On the other side of the chart, sectors underperforming are generally defensive in nature with Health Care and Utilities both averaging YTD gains of less than 5%. One notable underperforming sector given its size is Technology. With an average gain of 7.2% YTD, stocks in the Technology sector are underperforming the broader market by more than 4.5 percentage points.

Given the underperformance of Technology YTD, we can’t help but remember some market ‘certainties’ over the years that never quite came to fruition. Remember after the initial surge off the lows coming out of the Credit Crisis in 2008 and 2009? While Financials were the best performing sector coming off the lows, the rally in the sector ran out of steam and stalled out. All we kept hearing at the time was that ‘the market couldn’t rally without the Financials’, but rally it did. Now, after Technology outperformed during COVID and through last Summer, the sector has stalled out, and we’re hearing the same phrase now as we did back then with the only difference being that Technology has replaced Financials as the sector that the market couldn’t rally without. Since September 2nd though, when we first started to see the ‘Big Shift’ in the market, the S&P 500 has nearly tripled the return of the Technology sector, and despite Tech’s underperformance, the S&P 500 has still managed double-digit percentage gains. When it comes to the old conventional wisdom of the market, investors would be best served by doing the opposite of Timothy Leary by ‘turning off’ and ‘tuning out’ all the noise.

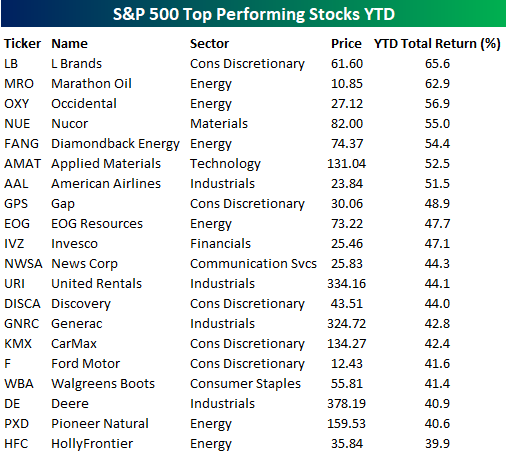

In the tables below, we list the top and bottom twenty performing S&P 500 stocks so far this year. Starting with the winners, L Brands (LB) and Marathon (MRO) are both already up over 60%, while another five stocks have rallied 50%+. With the exception of HollyFrontier (HFC), which is up 39.9%, every other one of the top 20 stocks is up over 40% – in just three months! What’s most notable about this table, though, isn’t what’s on it, but what isn’t. Technology has a larger number of components in the S&P 500 than any other sector, but only one stock from the sector – Applied Materials (AMAT) – made the list of top performers, and only one other besides AMAT (Hewlett Packard Enterprise) made the top 50.

At the other end of the spectrum, there are only 13 stocks in the S&P 500 that are down over 10% YTD, and the 20th worst-performing stock is down less than 9%. And while there was only little representation from the Technology sector on the list of biggest YTD winners above, there’s no shortage on the list of losers with eight of the twenty coming from that sector. It’s only been three months, but stretching back to early last September, the market has gotten along just fine without the help of Technology. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Charts We’re Watching

Bespoke’s Consumer Pulse Report — April 2021

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 3/31/21 – The Homestretch For Q1

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“End? No, the journey doesn’t end here.” – J.R.R. Tolkien

The first quarter is nearly in the books, but the year has only just begun, and with GameStop and Archegos already, it doesn’t look like 2021 will be a snoozer. Futures are inching higher this morning with the Nasdaq leading the way higher.

Economic data has generally been positive overnight with Chinese PMI and South Korean Industrial Production topping expectations, while inflation data in Europe remains relatively tame.

Read today’s Morning Lineup for a recap of all the major market news and events including a discussion of quarter-end trends, events in Brazil, a recap of international markets, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

For all the churning in the market lately, it sounds hard to believe that every sector in the S&P 500 is on pace to finish Q1 in the black for the year. Granted, the gains aren’t evenly distributed, but it’s still impressive to see every sector positive on the year. Leading the way higher, Energy’s (XLE) 31% surge tops the list, but the double-digit percentage gains from Financials (XLF) and Industrials (XLI) are nothing to scoff at. Defensive-oriented sectors are unsurprisingly at the bottom of the list as Health Care (XLV), Utilities (XLU), and Consumer Staples (XLP) are all up 3% or less.

The most surprising sector to some, though, is Technology (XLK) which is at the absolute bottom of the list and just barely hanging on to positive territory for the year with a gain of under 1%. XLK is the only sector below its 50-DMA, and while it’s indicated to open higher today, closing out the quarter above its 50-DMA is going to be tough.

Daily Sector Snapshot — 3/30/21

E.W. Scripps (SSP) Diverging From the Script of Media & Entertainment Stocks

Major media stocks caught up in the Archego margin call have found some respite today as Discovery (DISCA) and ViacomCBS (VIAC) both trade higher. Elsewhere in the Media and Entertainment industry, E.W. Scripps (SSP) came in at the top of our Stock Scores this week. Our Stock Scores ranks members of the S&P 1500 on their attractiveness based on a range of Fundamental, Technical, and Sentiment indicators. For access to our weekly Stock Scores screen, sign up here for access. SSP—which has a portfolio of local and national media outlets like TV stations and newspapers—came in this week with a perfect Technical score alongside high Fundamental and Sentiment scores.

At its multi-year highs earlier this month, E.W. Scripps (SSP) had broken out to multi-year highs before its sharp pullback in the second half of March which has brought the stock down around 20% from its closing high on March 12th. While that decline coincides with the big losses in VIAC and DISCA that resulted from prime brokers, who held positions equal to more than 5% of each company’s float, selling positions as hedge fund clients failed to meet margin calls on swap positions, in the case of SSP none of those same brokers like Credit Suisse or Morgan Stanley possess any significant stake. Additionally, the technical damage has not been quite as severe for SSP. Whereas the losses for VIAC or DISCA resulted in the stocks crashing through their 50-DMAs, SSP’s uptrend remains intact as it has so far managed to find support at its 50-DMA in the past week. SSP didn’t rally nearly as much as DISCA or VIAC, they haven’t dropped nearly as much either.

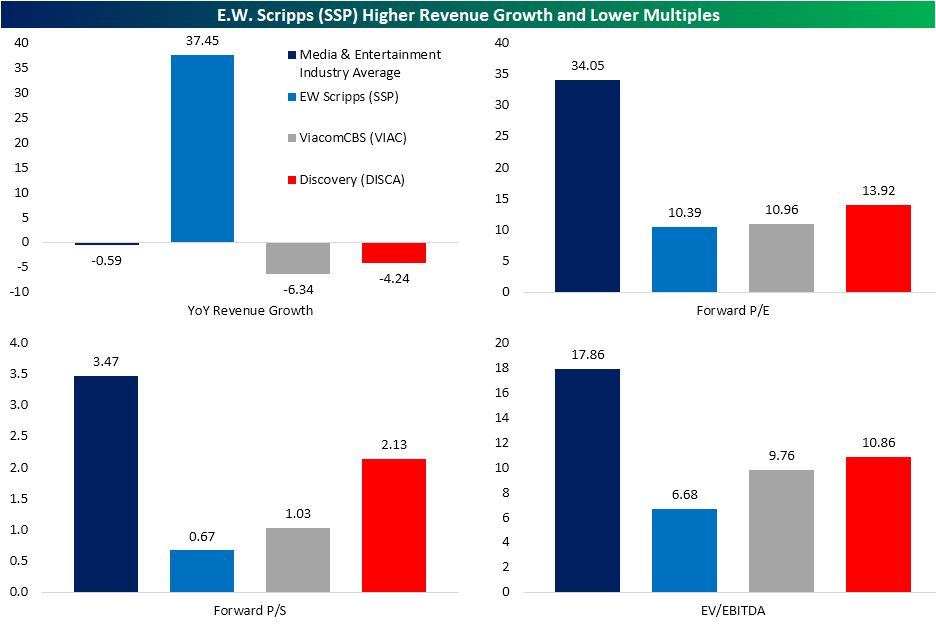

Not only is the technical picture positive, but an attractive valuation relative to its peers also played into EW Scripps’ high Stock Score this week. SSP showed much stronger revenue growth YoY, up 37.45% in 2020, when compared to the average for other stocks in the Media and Entertainment Industry. On top of that stronger revenue growth, SSP trades at a discount to the average stock in its industry on a forward P/E, P/S, and EV/EBITDA basis. Those are also more attractive valuations than VIAC and DISCA in spite of both of those stocks having seen their prices nearly cut in half recently. Respective of its own history, current valuations for SSP are also at the low end of the past decade’s range. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day – Consumer Confidence Finally Shows Up

Bespoke Stock Scores — 3/30/21

Bank and Broker CDS After Archegos

On Friday, we noted massive share price declines for a handful of US media names and Chinese education technology stocks. Further details of the saga were released over the weekend and into this week which we reviewed in greater detail in yesterday’s Morning Lineup. Included in that news were announcements that two of the prime brokers for Archegos Capital Management — Credit Suisse (CS) and Nomura Holdings (NMR) — could incur significant losses as a result of the liquidation event. As a result, the two stocks were down double-digit percentage points yesterday with further losses today.

Some US firms have also been reported as involved as prime brokers in the ordeal including Morgan Stanley (MS) and Goldman Sachs (GS). In spite of their involvement, credit default swap (CDS) spreads have risen recently but are not necessarily at worrying levels for the time being. As shown in the charts below, the only major US investment banks’ CDS spread that has reached a new six-month high has been Morgan Stanley (MS). Across these four banks, CDS spreads range from Bank of America’s (BAC) low of 52.49 bps to Goldman Sachs’ (GS) high of 63.9 bps.

From an even longer time horizon, the recent tick higher in CDS is hardly even noticeable, especially relative to where they stood exactly one year ago. Back then, other than GS, each of these CDS spreads peaked above 200 bps. Again, although they have begun trending slightly higher, current levels across these four names are all below the five-year average.

By far the biggest move in CDS has been for the bank that appears to be the most affected: Credit Suisse. As shown in the first chart below, CDS for Credit Suisse have spiked to new six-month highs. Even still, CDS are only trading just above 70 basis points, which is significantly lower than the reading in the mid-100s seen during the COVID Crash last year. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/30/21 – Gloomy Gold

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The window to the world can be covered by a newspaper.” – Stanislaw Jerzy Lec

It’s more of the same this morning as futures are modestly negative, but higher interest rates are acting as a weight on the Nasdaq and growth stocks in general. The economic calendar is relatively light, with a report on home prices coming out at 9 AM eastern and Consumer Confidence at 10 AM. Crude oil and gold are both down sharply, but bitcoin is higher. In political news, President Biden will speak on Infrastructure this afternoon. In terms of the latest COVID trends, national declines have been inching higher, but the key as we discuss in the Morning Lineup is that among populations that have been widely vaccinated, case counts have remained contained.

Read today’s Morning Lineup for a recap of all the major market news and events including a discussion of the move higher in rates, a recap of international markets, some strong survey related economic data out of Europe, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Gold just hasn’t been able to get out of its way this quarter. Despite concerns over inflation, the yellow metal has been weak as interest rates rise. This morning alone, gold is trading down over 1.5% after trading down over 1% yesterday and on the verge of testing its recent lows.

With the quarter coming to a close tomorrow, gold is on pace for a double-digit percentage decline this quarter, making it the worst quarter in nearly five years and just the tenth quarterly decline of more than 10% in the last 45 years.