The Bespoke Report Newsletter – 4/1/21

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Bespoke’s Weekly Sector Snapshot — 4/1/21

Bespoke Market Calendar — April 2021

Please click the image below to view our April 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Sentiment Goes the Other Way of Price

The S&P 500 has risen around 2.5% to new record highs and crossing the 4,000 milestone in the past week. Despite this, optimism took a slight step back this week. The Investors Intelligence survey of newsletter writers released yesterday saw a lower share of respondents report as bullish; down from 57.4% last week to a three-week low of 54.4%. After coming in at the highest level in three months last week, the AAII’s sentiment survey also saw fewer respondents reporting as bullish. Last week, over half of respondents reported as bullish for the first time since November. Today, that reading has fallen to 45.8%. Despite the less optimistic tone, the 5.1 percentage point decline was the largest single-week drop in bullish sentiment since only the first week of March and the current level still stands in the top decile of the past five years. It is also over 7 percentage points higher than the historical average of 38%.

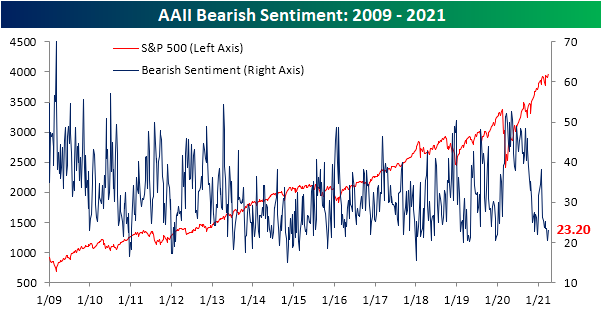

As bullish sentiment came in at a multi-month high last week, bearish sentiment fell to the lowest levels since December 2019. Bearish sentiment likewise saw a reversal this week as it rose 2.6 percentage points to 23.2%. Mirroring bullish sentiment, albeit off the low, the current level of bearish sentiment is still in the bottom 10% of readings of the past five years.

Those inverse moves in bullish and bearish sentiment have resulted in the bull-bear spread falling 2.7 points to 22.6. While that indicates a less optimistic tone than last week, the current reading shows that sentiment continues to largely favor the bulls. In fact, even after pulling back, the current reading sits in the top 5% of all weeks of the past 5 years.

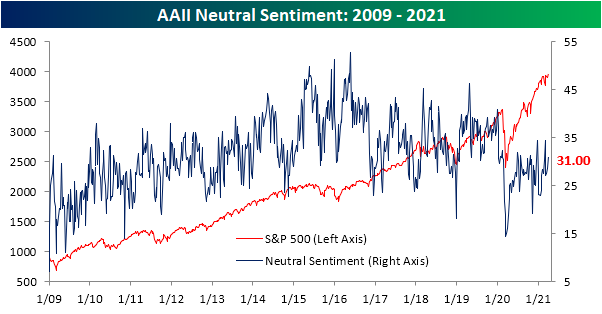

While fewer respondents reported as bullish this week, not all of those jumped ship to the bearish camp. Neutral sentiment picked up the difference rising 2.5 points to 31%. That is the first reading of over 30% and the highest since the first week of March when it had risen to 34.4%. While that is an elevated level relative to the past year in which sentiment has become more polarized between bullishness and bearishness, the current level of neutral sentiment is actually just below the historical average of 31.41%. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Brutal Quarter For Bonds Finally In The Rearview Mirror

Claims Miss Expectations But Sit Just Off Pandemic Lows

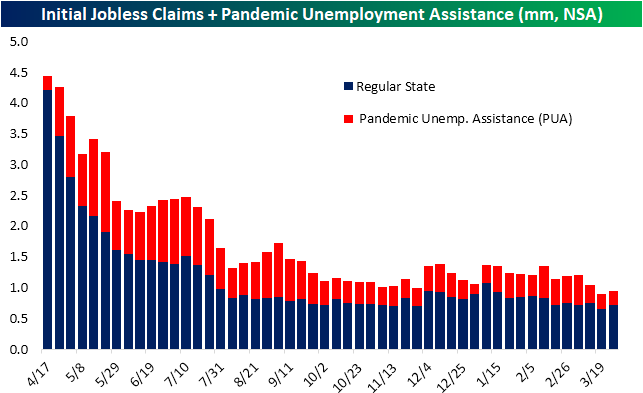

After coming in at a new low for the pandemic last week, a higher reading in initial jobless claims was expected this week with forecasts calling for a reading of 675K; up from a downward revision to 658K last week. Instead, claims rose by 61K to 719K. Although that is the biggest one-week increase since the second week of January when claims rose 123K, at 719K this week’s reading still managed to tie the last week of November for the second-lowest reading of the past year. Additionally, we would also note that this week is the first to reflect the annual revisions to the seasonal adjustment factors for both initial and continuing claims.

Unadjusted regular state claims were also higher rising from 651.2K last week to 714.4K. Again, this was the largest one-week increase since January. While regular state claims were weaker, Pandemic Unemployment Assistance (PUA) claims fell slightly to 237K. That sets a new low for the pandemic save for the first week that PUA claims debuted roughly one year ago and the first week of 2021 when there was the caveat that there were some lapses in claims as a result of the timing of the signing of the spending bill. Nonetheless, the larger uptick in regular state claims meant that, on a combined basis, claims did rise this week. Granted, at 951.4K total claims remained below 1 million in back-to-back weeks for the first time in the past year.

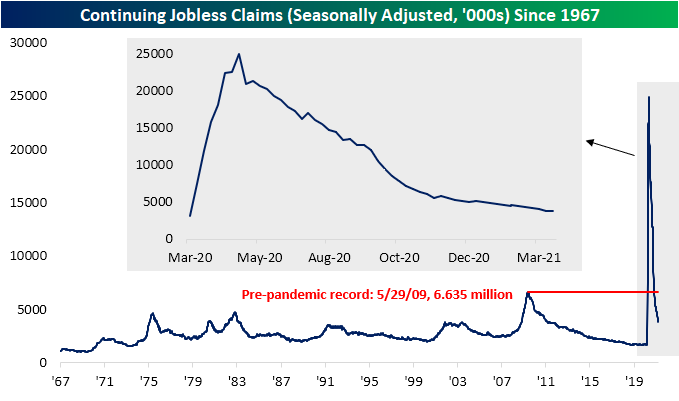

Like initial jobless claims, continuing claims also came in higher than expected (3.794 million vs. 3.75 million expected). While claims were above expectations, they did improve from last week’s reading of 3.87 million to set a new low for the pandemic. That also marked an eleventh consecutive week with lower continuing claims.

Factoring in all unemployment programs adds some lag to the data making the most recent data as of the week of March 12th. That week saw a broad decline across all programs as combined claims fell from 19.768 million to 18.247 million. The program that contributed the most to that decline was Pandemic Emergency Unemployment Compensation (PEUC) which fell by over 700K claims. That marks the program’s fourth-largest decline of the past year. Regular state and PUA claims also experienced significant declines.

Recently we have noted how a rising share of total claims belongs to programs like PEUC that extend benefits past the expiration of the regular benefit periods. For example, the previous week saw two of these programs, PEUC and Extended Benefits, account for 36.9% of all claims which was the highest level of the pandemic. That large decline in PEUC claims in the most recent week alongside a modest improvement in the Extended Benefits program resulted in that share declining by 1.1 percentage points. In other words, there is some evidence that there has been some improvement in the reading on people who are facing long-term unemployment. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 4/1/21 – A Fresh Start

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If the end doesn’t justify the means, what does?” – Robert Moses

One day after President Biden outlined his plans for infrastructure, we thought it fitting to turn to Robert Moses, the ruthless modern-day master of infrastructure, for today’s Quote of the Day. During the New Deal, when the Federal Government was looking for ‘shovel-ready’ projects, unlike most cities around the country that had ideas but no plans on how to implement them, Robert Moses was prepared and had both the ideas and the plans drawn up and ready to lay them out. As a result, New York City and the surrounding region received a large share of distributed funds. Ideas a good, but plans to implement them are just as, if not, even more important.

US futures are trading higher to kick off Q2 with Asia trading higher overnight and Europe also strong. Economic data from international markets has been strong as Manufacturing PMIs for the month of March continue to surge. The only US economic data so far today has been jobless claims, and on both an initial and continuing basis, the latest figures came in higher than expected.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of manufacturing economic data from around the world, a recap of international markets, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

The first quarter of 2021 was a positive one for US stocks, but the quarter, like the majority of days in it didn’t end on a positive note. The S&P 500 finished the day in positive territory, but a last-hour sell-off clipped those gains considerably. Wednesday’s pattern was a microcosm of the pattern all year, where stocks open higher, rally throughout the trading day, and then sell-off in the last hour and into the close. How weak has the last hour of the trading day been? Well, throughout Q1, despite the S&P 500 trading higher on 54% of all trading days, the last hour was only positive 31% of the time! Relative to all other hourly intervals throughout the trading day, the last hour has been, by far, the least consistent to the upside.

Daily Sector Snapshot — 3/31/21

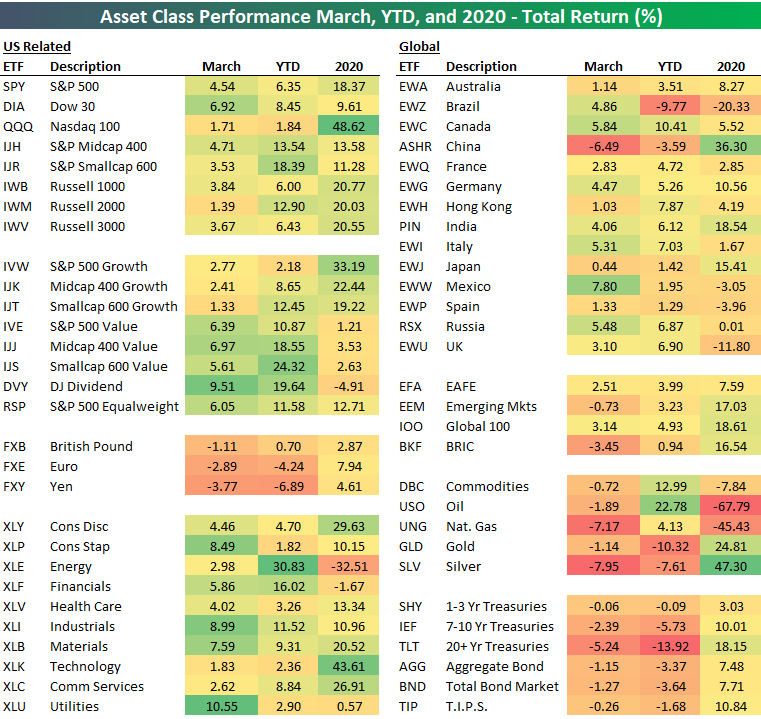

Asset Class Performance

The first quarter of 2021 came to a close on Wednesday, and while the first quarter of this year was not nearly as crazy as the first quarter of 2020, it was far from tranquil. Below we provide a snapshot of our ETF Asset Class Performance Matrix summarizing the total return of ETFs across the investment spectrum during the month of March, Q1, and for all of 2010.

Given the carnage we saw in some areas of the market recently, it may not seem that way but March was a very positive month for US equities across different styles and sectors. At the index level, the Dow led the way surging nearly 7%, but the S&P 500 was also very strong, gaining more than 4.5%. Large Cap Tech was an area of relative weakness, but even the Nasdaq 100 was up 1.71% (just about all of which came on the last trading day of the month). Continuing a trend that has been in place all year, value stocks left growth in the dust, more than doubling the gains of growth stocks during March. At the sector level, we saw both cyclicals and some defensives lead the way higher this month with Utilities rallying more than 10%, Industrials up 9%, Consumer Staples up 8.5%, and Materials up nearly 8%. While no sectors were down in March, Technology lagged the most by rallying ‘only’ 1.76%.

At the international level, it was a good month for North America as Mexico rallied 7.8% and Canada surged 5.8%. On the downside, the only country in the red for the month was China, which dropped 6.5%. What’s interesting to note about the performance of international markets is that like the US, a lot of areas that lagged in 2020 were leaders in March and vice versa for this year’s laggards.

While inflation has been a concern for investors lately, it’s interesting to note that all of the commodities in the matrix were down in March with Silver (SLV) and Natural Gas (UNG) falling the most. In the case of silver, while it was the second-best performing ETF in our matrix in 2020, it was the worst-performing ETF during the month of March.

Finally, fixed-income investors have had a rude awakening so far this year. While all of the fixed income-related ETFs saw positive returns in 2020, they’re all down so far in 2021. Long-term US Treasuries have been the biggest laggards as TLT is already down 13.9% YTD. So much for the ‘safety’ of Treasuries. Click here to view Bespoke’s premium membership options for our best research available.