Daily Sector Snapshot — 4/6/21

Bespoke Stock Scores — 4/6/21

Bespoke Matrix of Economic Indicators – 4/6/21

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Precious Metals Finding Support and Eyeing Breakouts

After a strong run in the first months of the pandemic, gold (GLD) has been in a downtrend since the summer erasing most of the past year’s move higher. While GLD is far from breaking its longer-term downtrend, the past few weeks have at least seen a bit more constructive price action with a potential double bottom forming. After trading deep into oversold territory in early March, GLD found at least a temporary bottom right around the lows of last sping’s range. Last Tuesday, there was another successful retest of those same support levels. Since then, GLD has pressed higher and is getting close to breaking out of the past few weeks’ consolidation range.

Elsewhere in the precious metals space, silver (SLV) has generally fared better over the past several months. While it hasn’t been pressing higher either, SLV has more or less been trending sideways since last summer’s high. Since late February, SLV had been heading back to the bottom end of its range, but like GLD, it recently found some support. SLV took a brief dip below its 200-DMA one week ago which snapped a streak of 217 consecutive closes above its long-term moving average; the third-longest on record since SLV began trading in 2006 as shown in the second chart below. That drop below did not last long though as SLV has since moved back above its 200-day. Now, it is sandwiched between its 200-DMA and 50-DMA; which it had previously failed to move above last month. Additionally, the move higher today is breaking the short-term downtrend that has been in place for most of 2021. Like gold, the overall longer-term picture for silver has a lot of room for improvement, but at least in the near term, there are some positives developing in the past week. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Breakout Basket

Bespoke’s Morning Lineup – 4/6/21 – All Quiet on the Market Front

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“How did you go bankrupt?”

“Two ways. Gradually, then suddenly.” – Ernest Hemingway, The Sun Also Rises

With little in the way of economic data today and earnings season not really kicking off until next week, it’s a quiet morning. Futures are modestly lower even as the 10-year yield is back below 1.7%. After being closed yesterday, European markets are back open this morning and making up for lost time by rallying in reaction to the strength in the US yesterday.

In SPAC news, NFTs may be the hot trend in the collectible space, but traditional baseball cards are the center of attention this morning as Topps has announced a deal to go public in a merger with Mudrick Capital. The deal for the maker of cards for baseball, most other major sports, and who can forget- Garbage Pail Kids- will be valued at $1.3 billion. You can also bet that at some point, they will be moving into the NFT space. Perhaps the most telling aspect of the SPAC environment these days is the fact that in an interview with Topps Chairman Micheal Eisner, he stressed that the company will be operating as a ‘real’ company.

Read today’s Morning Lineup for a recap of all the major market news and events including the latest Australian Central Bank decision, a recap of SENTIX investor sentiment surveys for April, US and international COVID trends as well as our series of charts tracking vaccinations, and much more.

The market may be quiet this morning, but there have already been plenty of fireworks to start the second quarter. While the two 1% gains came four calendar days apart, this is the first time that the S&P 500 has kicked off a new quarter with back-to-back 1%+ gains since Q2 2009! As shown in the table below, in the post-WWII period, there have only been seven other quarters that kicked off with back-to-back gains of at least 1%.

The table below shows the S&P 500’s performance in the week after each of those prior strong starts as well as its performance over the rest of the quarter. Over each of the time periods, the S&P 500 saw positive returns on both an average and median basis, and while the S&P 500 was up for the remainder of the quarter following each of the last four occurrences, in the three occurrences prior to 1987, it was down over the remainder of the quarter every time.

Daily Sector Snapshot — 4/5/21

Chart of the Day – Economic Data Consistently Positive

Another Record in Gun Background Checks

It seems to happen every month these days, so it shouldn’t come as much of a surprise that FBI background checks for the purchase of firearms hit a new record in March, rising by more than a million to 4,691,738. It used to be that background checks followed a relatively steady saw-tooth seasonal pattern where, as shown in the chart below, they would fall throughout the first half of the year, bottom out in mid-Summer, and then steadily rise throughout the second half of the year. That seasonal trend became less consistent in the early part of the last decade and has completely broken down in the last two years. Now, it seems that the monthly number of background checks goes in one direction – up!

Despite rising to new record highs, the pace of growth in background checks has started to slow down a bit. March’s growth rate was 25.4%, and while that is still an extremely rapid rate of increase, it’s at the low end of the range from the last year where the y/y change in checks peaked out at 79.2% last July in the midst of the nationwide protests around the country. Click here to view Bespoke’s premium membership options for our best research available.

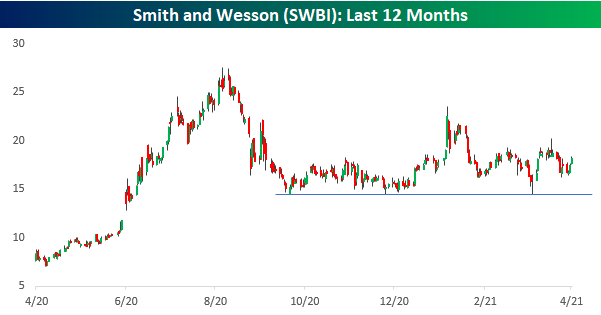

Just as the stock market and the economy don’t always move in lockstep with each other, the stocks of gun manufacturers don’t necessarily follow the path of gun background checks/sales. The charts below show the performance of the two largest publicly traded gun manufacturers over the last year – Sturm Ruger (RGR) and Smith and Wesson (SWBI). While background checks are at all-time highs, the prices of both stocks have corrected significantly from their highs last summer. After declines of 30%+ from peak to trough for both stocks, they have essentially been rangebound now for six months. However, while both stocks have been dead money, they haven’t broken down. In both cases, they have repeatedly bounced at support (~$60 for RGR and ~$15 for SWBI). As long as those levels continue to hold, they may be loaded with more than just blanks.

A Semi Snap Back

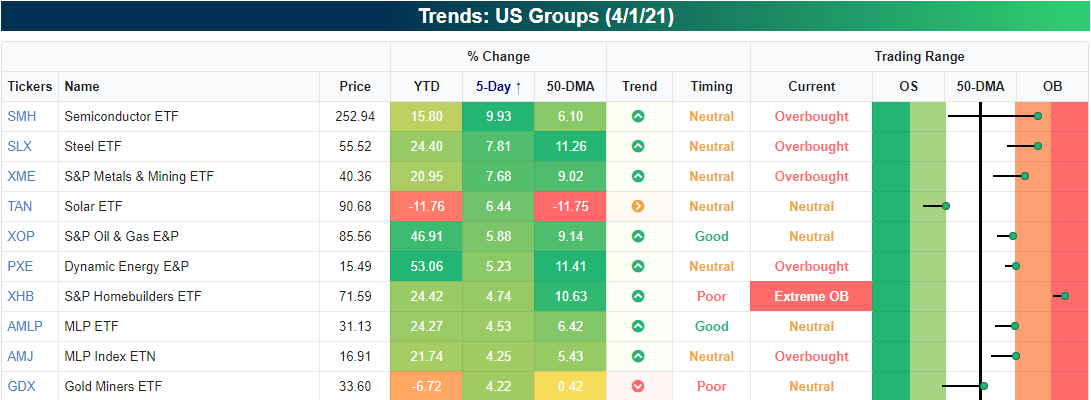

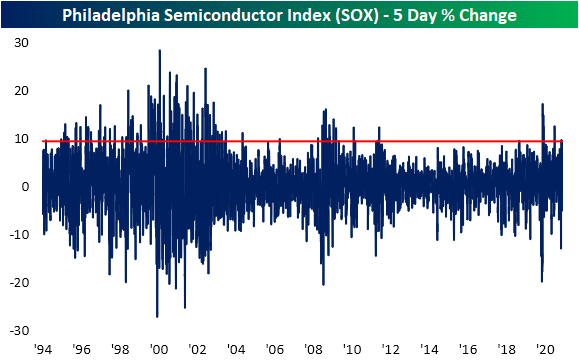

Headed into the long weekend, the Semiconductors (SMH) had been on a very impressive run over the prior five days. As shown in the snapshot of the US Groups screen in our Trend Analyzer, the group was the top performer (up just under 10%) in the five days ending last Thursday. That move brought it from well below its 50-DMA to deep into overbought territory.

While the Semiconductor ETF (SMH) is up again today, it is still over 1% below its highs from mid-February. Meanwhile, the Philadelphia Semiconductor Index (SOX) has already broken out to a new record intraday high this morning.

Today’s gain for the SOX adds to a 9.5% gain for the index last week. As shown in the chart below, that 9.5% rally is historically large, especially relative to the past several years. In fact, the five-day gain through Thursday’s close stands in the top 5% of all five-day runs for the index. While there was another occurrence as recently as the five days ending March 15th, moves of this size have been fairly uncommon in the past decade. Prior to the most recent and March occurrences, the only other recent instances were in November and the spring of last year. Prior to 2020, the past decade only saw a small handful of other instances of rallies in the 95th percentile or better. Conversely, the volatility of the Financial Crisis and the late 1990s and early 2000s led to more frequent clusters of top 5% moves.

In the charts below, we show the performance of the semiconductor index following rallies that rank in the top 5% of all 5-day changes without another occurrence in the prior two weeks. The results show that there’s typically a near-term cool-down period after such a sharp one-week rally. One and two weeks later have both tended to underperform the norm (by 42 bps and 90 bps respectively), averaging declines with positive returns less than half the time. While there has been some near-term weakness, one month and a quarter out have both tended towards outperformance. Click here to view Bespoke’s premium membership options for our best research available.